Welcome to our quarterly update on how financial independence is fueling our pursuit of true happiness. We’re six months into early retirement, and we’re excited to share our experiences, insights, and financial updates with you.

The Evolution of Our FIRE Journey

Embracing a New Chapter

It’s been nearly seven months since we left the corporate world, and we’re loving every moment of early retirement. Our focus has shifted from accumulating wealth to enjoying the fruits of our labor, with raising our daughter, Yuna, taking center stage.

Changing Priorities

Our passion for personal finance hasn’t waned, but it has evolved. Instead of fixating on savings rates, we’re now more interested in topics like withdrawal strategies and capital preservation. This shift reflects our new stage in life and our commitment to enjoying the journey.

Our Recent Adventures

European Escapade

We kicked off our retirement with a 48-day summer adventure in Europe. Here are some highlights:

- An overnight layover in Helsinki, Finland

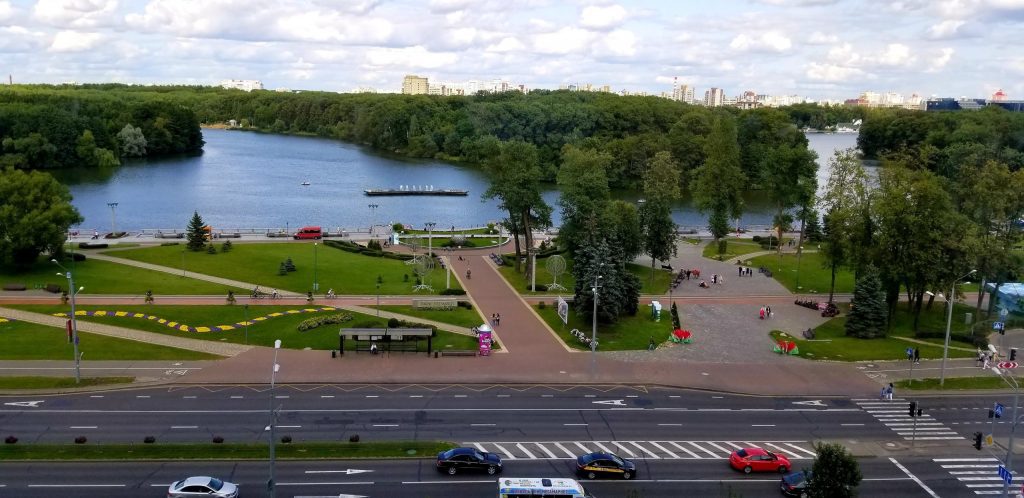

- Exploring Minsk, Belarus

- Discovering the charms of Lithuania

- Soaking up the culture in Spain

Snowbirding in Florida

As Pennsylvania’s fall turned chilly, we embarked on a leisurely road trip to Florida. We’re currently enjoying the sunshine state, having rented a condo in Venice for $1,300 for our first month.

Financial Update: Q4 2019

Expenses Breakdown

Here’s a snapshot of our spending for October through December 2019:

| Category | Amount |

|---|---|

| Food & Dining | $4,070 |

| Travel | $1,711 |

| Health & Fitness | $1,007 |

| Gift & Donations | $910 |

| Bills & Utilities | $809 |

| Auto & Transport | $430 |

| Entertainment | $413 |

| Other | $292 |

| Total | $9,642 |

Our average monthly spending was $3,214, aligning with our projected annual spending of less than $40,000 for our first year of early retirement.

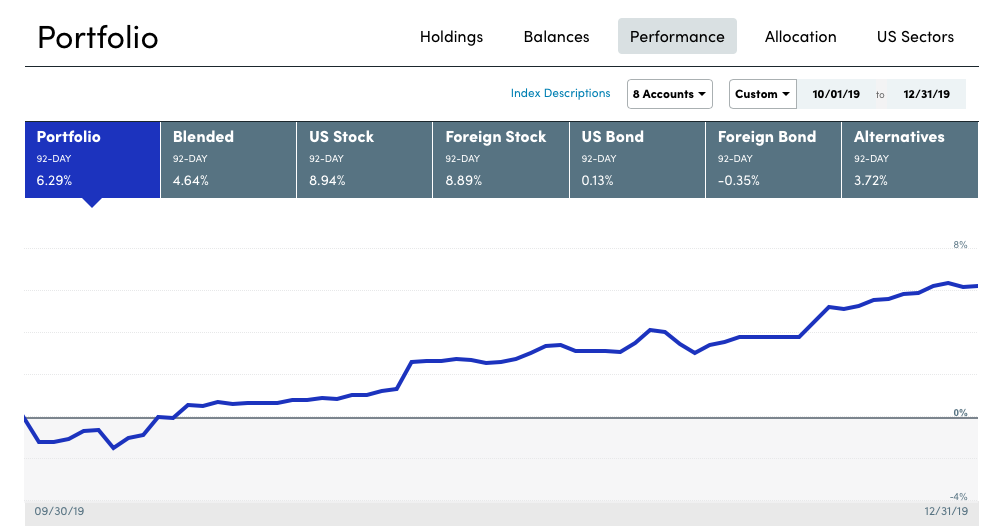

Portfolio Income and Performance

- Q4 Dividend Income: $18,970

- Freedom Fund Portfolio Q4 Return: 6.29%

Our portfolio is currently outpacing our spending, but we’re prepared for potential market downturns with a conservative allocation strategy.

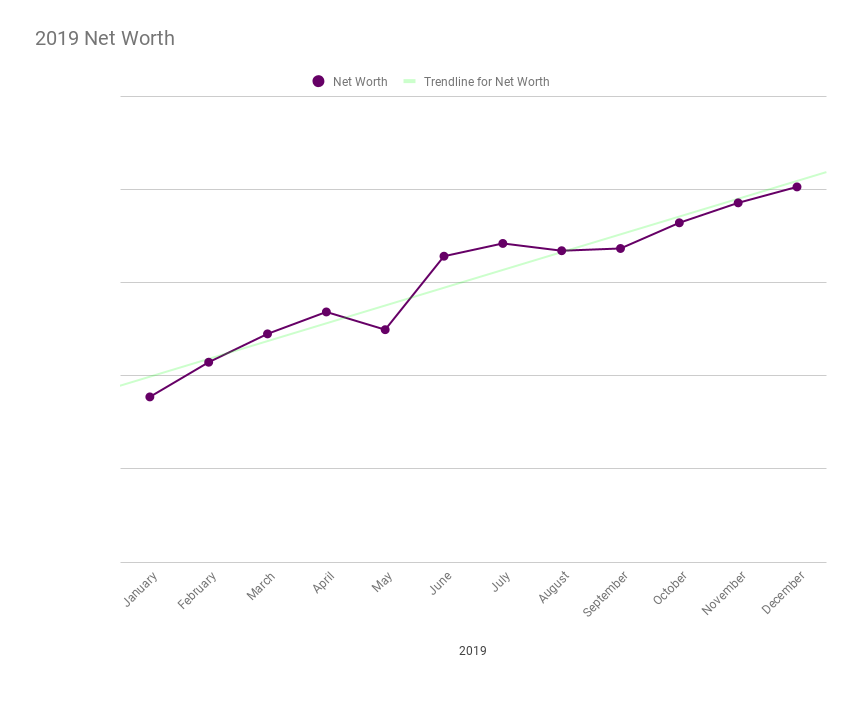

Net Worth Update

Our net worth continues to grow, even without new contributions. We’re excited to see how future withdrawals and market returns will impact our financial picture.

Reflecting on Our Journey

Early retirement has given us the gift of time—time to explore, to grow, and to cherish moments with our daughter. While we may not write as frequently, we’re living the dream we’ve worked so hard to achieve.

We encourage you to find your own balance between planning for the future and savoring the present. Remember, we have one life to live—let’s make it count!

What are your thoughts on early retirement? Have you reached your FIRE goals, or are you still on the journey? Share your experiences in the comments below!

Stay tuned for more updates on our FIRE adventure. Until next time, keep optimizing for happiness!

Love it! Very insightful

Hi Jessya!

Thanks, I’m glad it provides you with a good insight into our early retirement lifestyle! 🙂