Most of us can agree that a portfolio with a few funds is an effective path to wealth. Investment fees are also important, and the lower your expense ratios, the more profit you keep.

With that in mind, we try to limit our portfolio to as few funds as possible while also keeping costs down. We love Vanguard funds for this reason. At a low cost, Vanguard offers some of the world’s most competitive funds.

Among those funds, my favorite mutual fund is the Vanguard PRIMECAP Fund Admiral Shares (VPMAX). We’ve been invested in this fund in our 401(k)s since we started our FI journey.

Why is it my favorite mutual fund? For many reasons that we’ll get to.

First, I’d like to compare VPMAX to another fund, which is where we would have invested if VPMAX wasn’t an option.

VTSAX – the FIRE community darling

If there are two funds that we’ve been holding forever, it’s probably Vanguard Total Stock Market Index Fund Admiral Shares (VTSAX) and VPMAX. So I want to do an analysis to see how these two great funds compare against each other.

Why compare these two funds?

For starters, there are many good reasons why VTSAX or VTI, the exchange-traded fund (ETF) component, is the favorite of the FIRE community. Second, as previously stated, VTSAX would be our go-to fund if VPMAX was unavailable.

By no means am I attempting to discredit one fund over the other; despite their differences, both focus on long-term investing in top-tier businesses.

Just to clarify, I’m not a financial advisor. I’m just an investor trying to do an analysis based on data to draw my own conclusions about our investment decisions. This is for entertainment purposes only. Consult a professional if you need help with your investments.

One of the things I like about blogging is that it forces you to do more research on certain topics to be able to find answers, research that I wouldn’t do otherwise. By the end of this post, I hope to be able to confidently answer the following questions: Did we make the right decision by continuing to invest in this fund? Should this fund remain an important part of our asset allocation? Is this fund a good addition to a well-diversified portfolio?

Okay, then! Now that we’ve cleared that up, let’s get started with the fund comparison.

Returns

The first step will be to compare the returns for VPMAX and VTSAX. Vanguard has that information readily available, so there’s no need to go digging for it.

| Performance | VPMAX | VTSAX |

|---|---|---|

| YTD (as of 6/30/2022) | -17.54% | -21.38% |

| 1-year | -14.63% | -14.24% |

| 3-year | 10.03% | 9.63% |

| 5-year | 10.84% | 10.52% |

| 10-year | 14.64% | 12.51% |

| Since inception | 10.37% (11/12/2001) | 7.20% (11/13/2000) |

| Data as of 6/30/2022. | Source: Vanguard |

Since inception, VPMAX has provided better returns than VTSAX. This is how far back we can compare the performance of both of these funds. However, the inception years are different.

VPMAX was launched a year after VTSAX. How did this affect the overall performance?

In a span of 22 years, I’m sure an extremely good or bad year can make a difference in returns. How did the S&P 500 perform from 11/13/2000 to 11/12/2001?

Looking at the S&P 500 returns, the market was clearly down that year. As a result, including that year in the comparison would be an unfair advantage to VPMAX.

So forget about that year and let’s compare both funds from 2002 (their first full year of operation) to 2022.

Link to calculations.

By comparing returns in Portfolio Visualizer, if you had invested $10,000 in VPMAX in 2002 and reinvested dividends, you would have received $72,357 today versus $54,569 if you had invested in VTSAX. That’s a difference of $17,788!

I know, I know, hindsight is 20/20, but we’ve been investing in this fund for a while, so one point is to see how we did versus putting all of our money in VTSAX.

It’s nice to know that some of our investments were profitable. It helps to mitigate blunders in other investments. I’ve made investment mistakes, and the good news is that I’ve learned from them.

“You only have to do a few things right in your life as long as you don’t do too many things wrong,” Warren Buffett says.

VPMAX has also outperformed VTSAX in the worst years, which is encouraging. It not only outperforms in good years but also takes a smaller hit in bad years. Therefore, providing some downside protection during bad times. It’s not significant enough to drop VTSAX for VPMAX but it’s good to know that during bad times, they’re more cautious.

Our personal rate of return

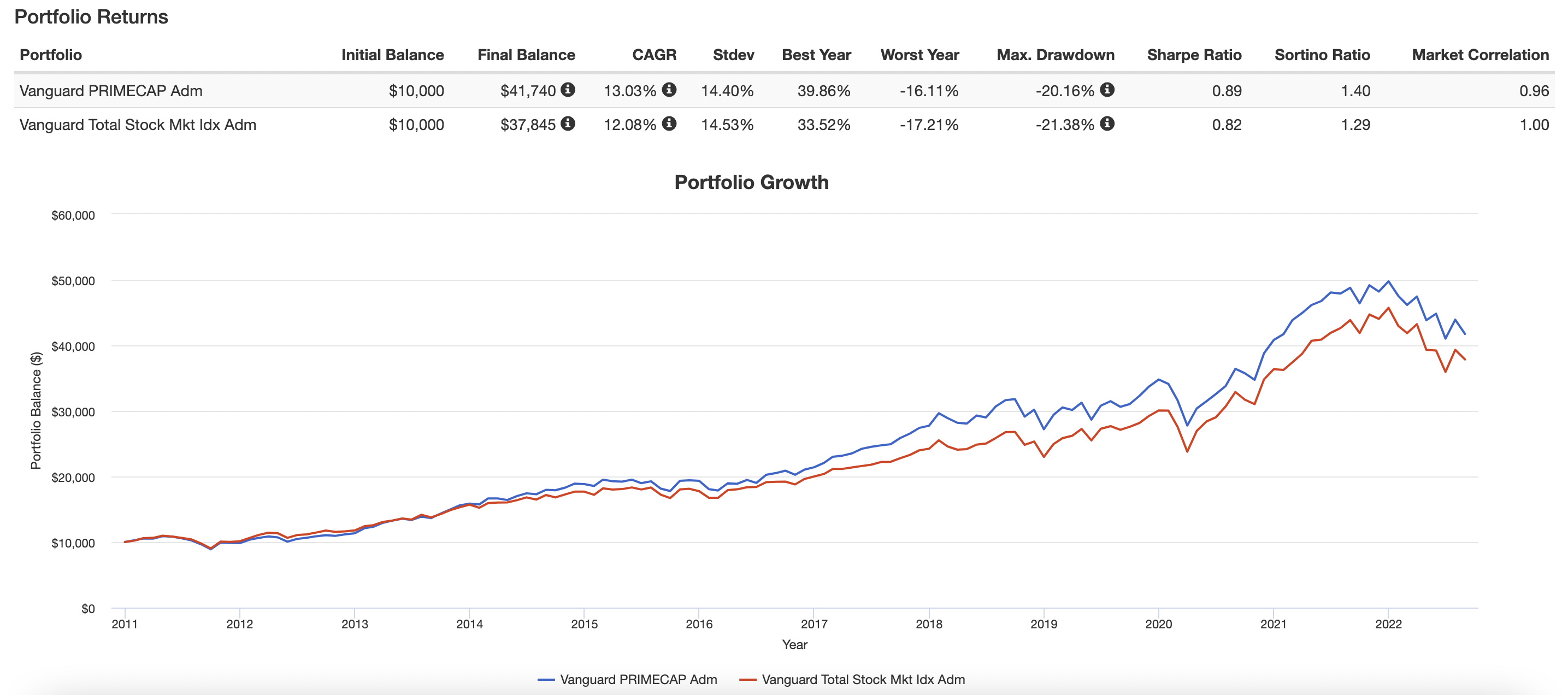

We started investing in this fund somewhere in 2011. Let’ see where investing $10,000 in both funds would have take us since 2011.

Link to calculations

This is getting personal now. Hahaha. During the time we’ve been investing in VPMAX, our personal rate of return has outperformed that of VTSAX. If we started investing $10,000 in VPMAX in 2011 instead of VTSAX, we would have made $41,740 instead of $37,845.

Consider the fact that we did dollar cost averaging on a biweekly basis. This is more difficult to calculate and find exact performance data in our Vanguard accounts because we’ve done 401(k) to traditional IRA exchanges and Roth conversions.

The one thing we track in a spreadsheet is our overall portfolio annual returns. By the end of the year, I add the following information to a spreadsheet for each of our accounts, based on Vanguard reporting format:

| Beginning balance |

| Purchases & Withdrawals |

| Investment returns |

| Ending balance |

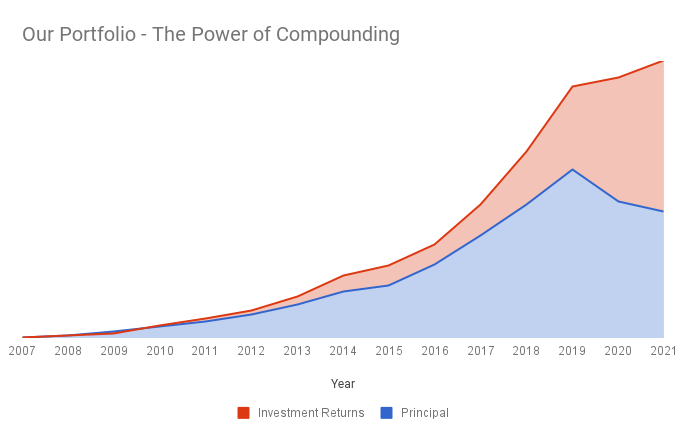

After aggregating annual data for all accounts, I can generate a variety of charts that help paint a complete picture of how our investments are performing. We have enough data dating back to 2006, when I first started investing. Tatiana was hired in 2007, fresh out of college, and she began saving at that time.

We stopped adding principal to our portfolio after we retired in 2019. Now the portfolio is doing all the heavy lifting for us, as you can see in the chart below.

This chart also includes the money we had set aside to buy a house. We made larger withdrawals in 2020 and 2021 to fund 50% of the purchase and some home upgrades.

Every year, our principal portion of our investments shrinks. Although our balance continues to grow.

VPMAX’s benchmark

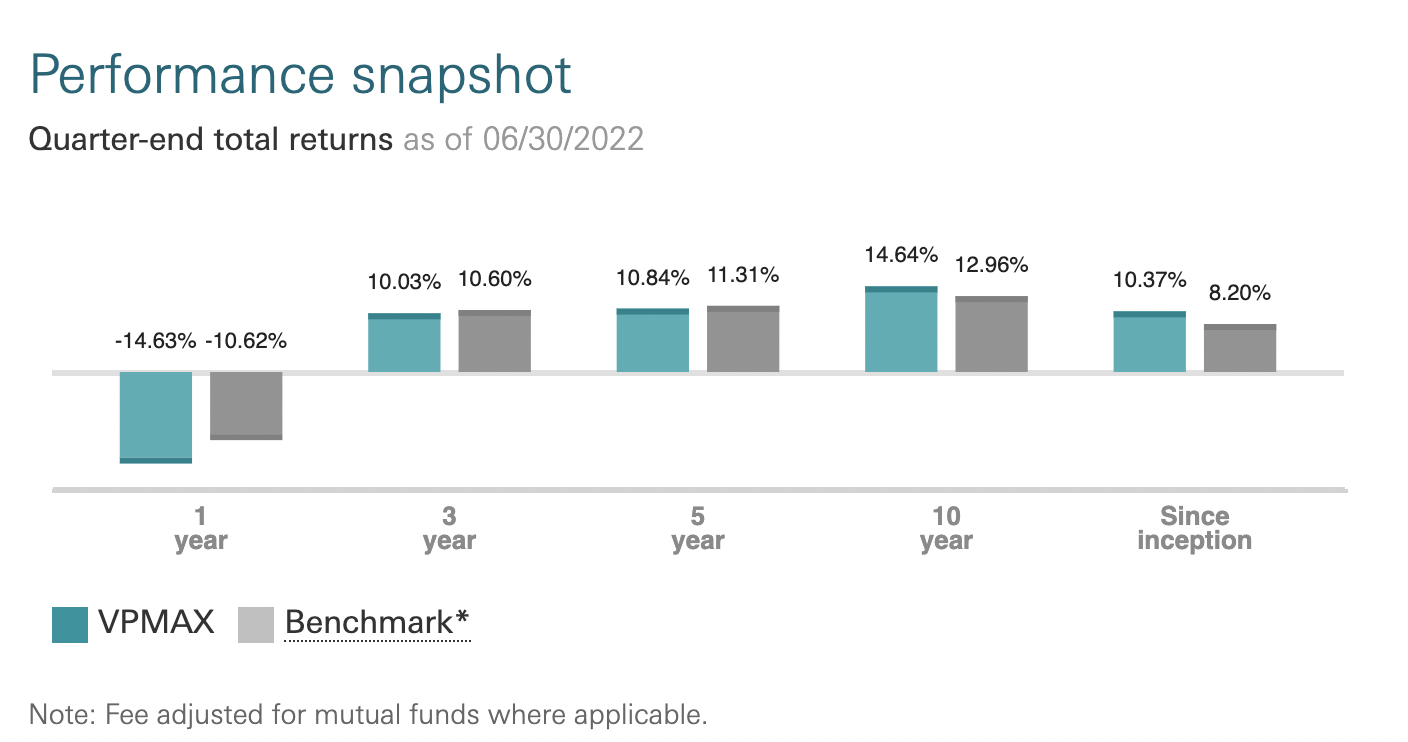

I want to go further and compare VPMAX’s performance against its benchmark, the S&P 500 Index. It should be close to VTSAX’s performance. The data is as of 06/30/2022.

According to the chart, VPMAX underperformed the benchmark in the short term but outperformed it in the long term. We invest for the long term, so I’m always more interested in the fund’s long-term performance.

We’re done, guys. Let’s wrap this up. We have a winning fund in our hands.

Not so fast!

How much does it cost compared to VTSAX?

Expense ratio

You may have guessed that VTSAX is an index fund and VPMAX is an actively managed fund by now. In a nutshell, an index fund mimics the market, whereas an actively managed fund attempts to outperform the market. Fees are a major reason why index funds outperform their active fund counterparts.

Vanguard’s actively managed funds, on the other hand, have very low expense ratios, making them very competitive. Over the last decade, 86% of Vanguard’s actively managed funds outperformed their peer group averages.

The expense ratio for VTSAX is 0.04% and VPMAX is 0.31%. The fund’s returns already include the expense ratio and other fees.

To balance the total expense ratios, we have mostly index funds. Outside of Vanguard, the high fees for actively managed funds in other institutions are not worth it to us. If you’re considering an active fund, pay close attention to the fees involved and how that affects investment returns. Most of the time, the index fund is the best option.

Portfolio information

Allocation across market caps

Large-cap companies have a market capitalization of $10 billion and greater. Mid-cap have a capitalization between $2 and $10 billion and small-caps have between $300 million and $2 billion.

Large-cap companies grow more slowly than mid- and small-cap companies, but they are less risky. In investing, the greater the risk, the greater the potential loss or reward.

Consider a start-up versus a more established company. A start-up may not have much cash on hand, but the business has greater potential for growth, whereas an established company may have a large share of the market and cash on hand to buy out smaller companies. Smaller businesses are much more likely to fail in bad times, whereas established businesses have more room to cut costs to stay in business.

Let’s take a look at how the allocation of large-, mid-, and small-cap stocks differs between the two funds.

VPMAX invests more in large-cap companies than VTSAX. The distinction is insignificant. Where they differ is that VPMAX invests significantly more in mid-cap companies and significantly less in small-cap companies than VTSAX.

Sectors

They are 11 sectors in the stock market:

- Communications Services

- Consumer Discretionary

- Consumer Staples

- Energy

- Financials

- Healthcare

- Industrials

- Materials

- Real Estate

- Technology

- Utilities

Aside from real estate, we do not invest in a single sector fund. A sector could be out of favor for a long time, and I don’t want to waste time guessing which sector will be in favor. So I’d rather invest in several sectors at once and spend time with my family.

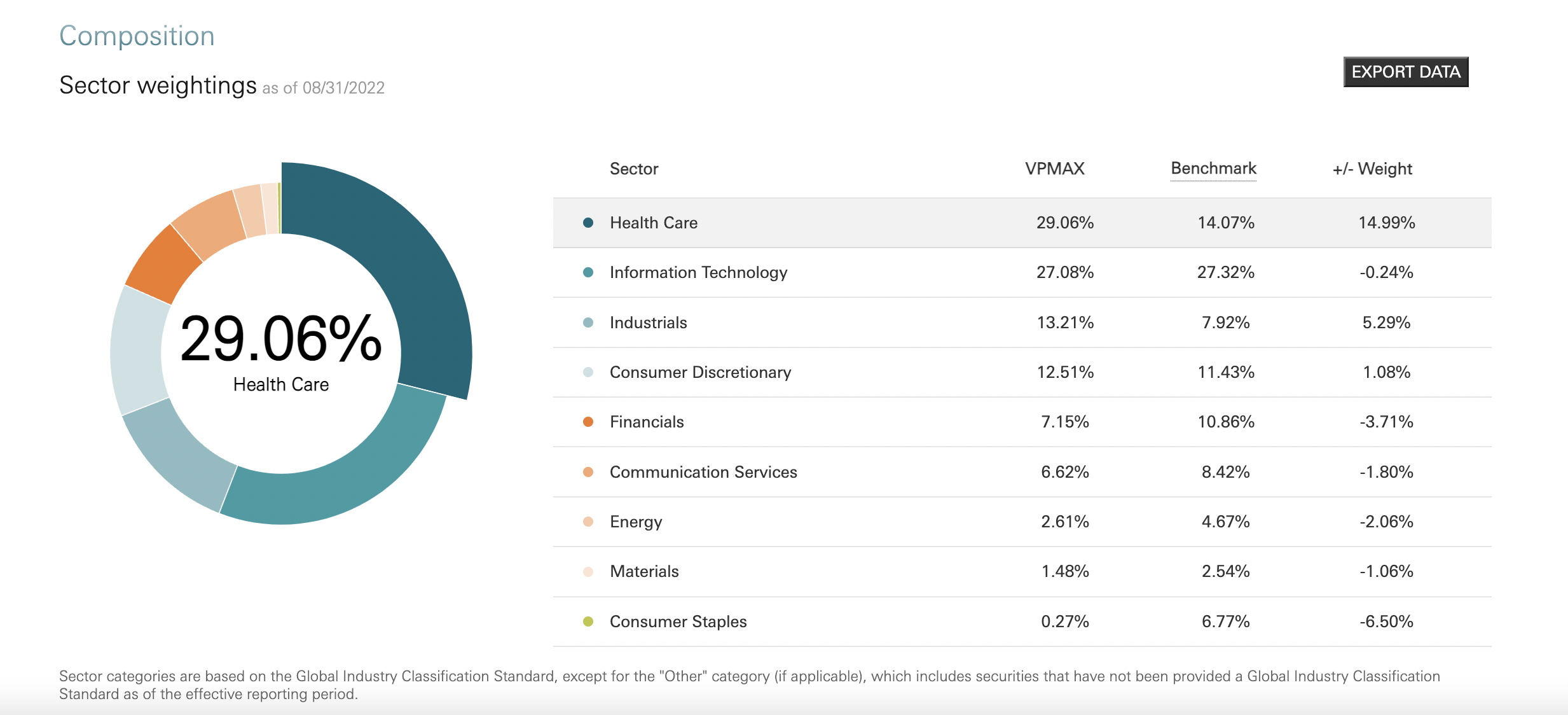

The majority of diverse funds and ETFs invest in all or several sectors. VPMAX is more concentrated in a few sectors than VTSAX. Let’s see how they stack up.

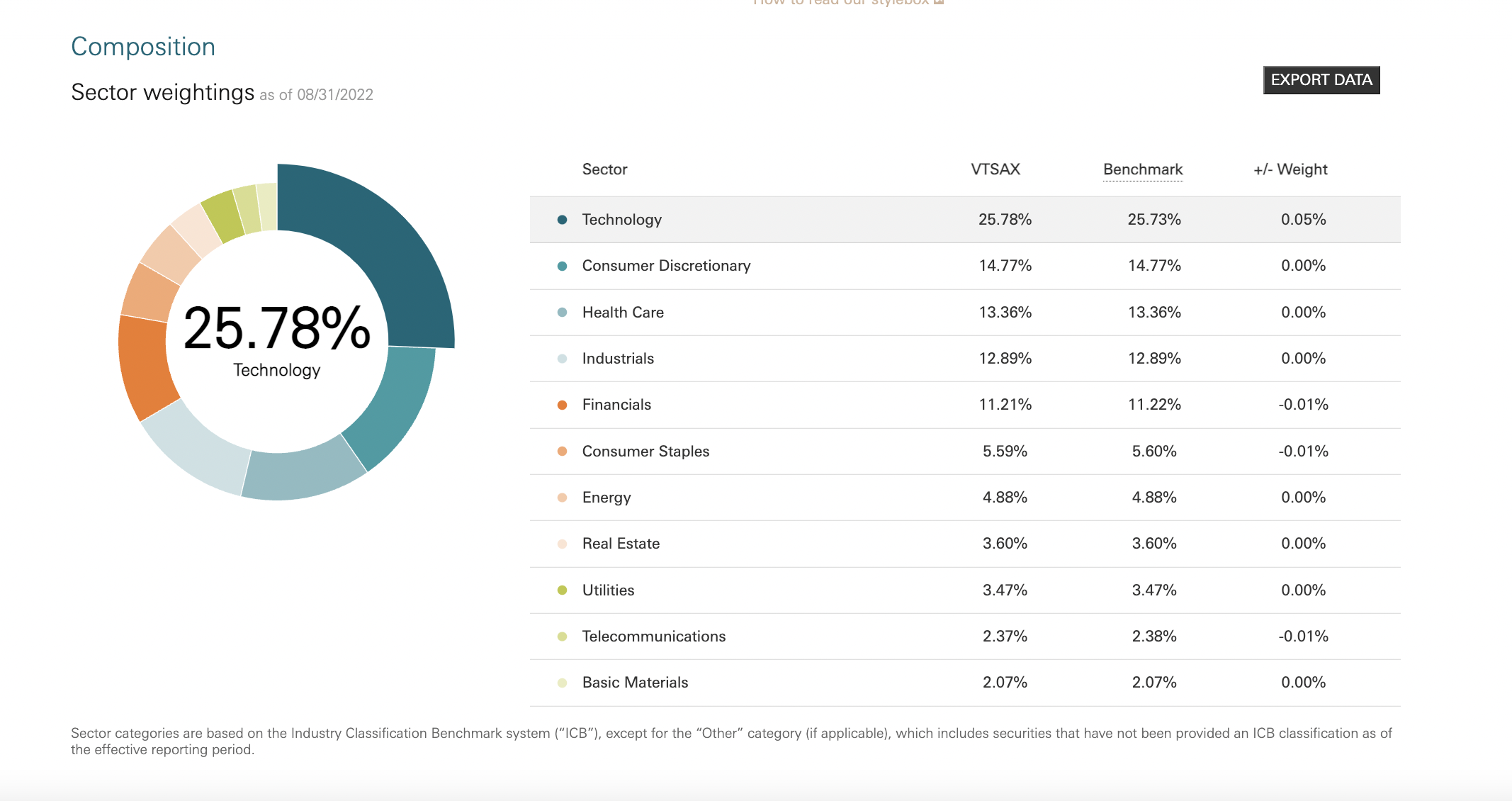

VPMAX composition

VTSAX composition

The sector labels between the two are slightly different on the Vanguard site but let’s assume they mean the same thing. Healthcare and technology account for 56% of VPMAX composition and 39% of VTSAX composition.

VPMAX invests in 9 industries. It does not invest in the real estate or utilities sectors.

VTSAX invest in all 11 sectors since is an index fund that mirrors the stock market.

What I like about VPMAX is that it has a few managers who make rational decisions on which industries and companies to invest in rather than just throwing money at a company because it’s popular regardless of its ethical standards, long-term perspective or management style.

Speaking of companies, which ones are the cream of the crop in both of these funds?

Top ten companies in each fund

While conducting this research, I was pleasantly surprised not to come across some companies that we dislike in VPMAX. VPMAX invest in 170 companies versus VTSAX holding 4,026 companies.

“Only 170 companies! OMG! You need more diversification!”

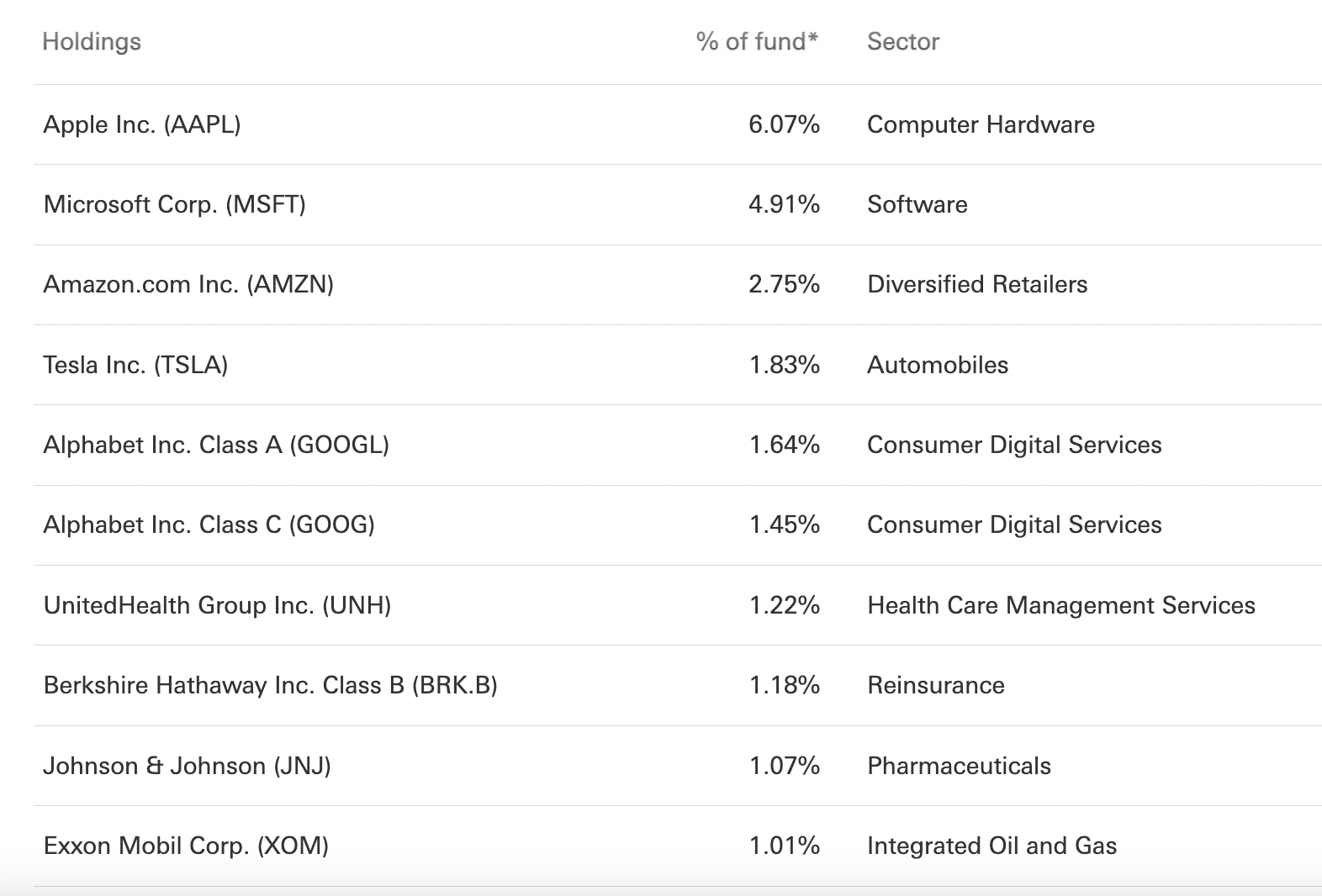

Top 10 holdings in VPMAX

Top 10 holdings in VTSAX

170 companies is still a large number of companies in which to invest. We also invest in VTSAX and a few other funds, so we’re well-diversified. However, if we only invested in VPMAX, I’d be totally comfortable with that amount. It would take me a long time to put together a diverse portfolio of 170 great companies. Instead of stock picking, I hire professionals to do it for me at a low cost. 😉

I was pleasantly surprised not to find Pfizer or Moderna in VPMAX! If you ask me, or my wife, or many of our friends and family, we wouldn’t invest in those two companies. Who would want to invest their hard-earned dollars with a convicted felon who continues to prioritize profits over people’s health?

So I’m relieved that the VPMAX management didn’t think they were worthy of the fund. I’d rather invest in Lilly, the top holding company in VPMAX. Lilly also reminds me of a beautiful dog that a friend of mine owned, so there’s a positive connotation there.

Turnover rate

When evaluating a mutual fund, it is critical to consider the turnover rate. The turnover rate is the percentage of the mutual fund’s holdings that have changed in the previous year. A high turnover rate mutual fund raises costs for its investors.

For example, a mutual fund manager who seeks short-term high returns and frequently trades in and out of stocks will result in a higher portfolio turnover rate.

Because VPMAX has a long-term perspective, its turnover rate is 5% versus 4% for VTSAX. As a result, it is far more “passive” than other actively-managed mutual funds in the industry. I love that!

A turnover ratio of 5% indicates that the fund’s holdings have changed by 5% since the previous year.

This is where the Vanguard ownership structure is most visible. Vanguard is owned by the funds, and the people own the funds. They are not attempting to profit for a third party.

However, in an institution where profit for shareholders, not clients, is the primary motivator, a portfolio manager of an actively managed fund may shuffle a client’s portfolio frequently in order to generate trading commissions, resulting in a higher turnover ratio.

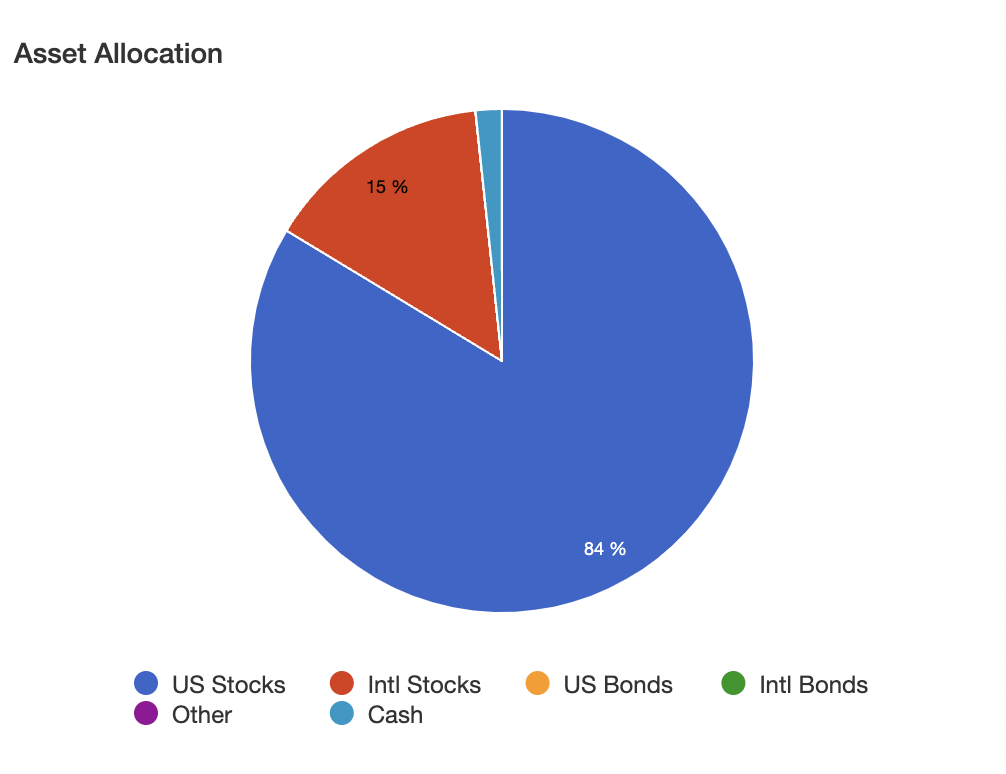

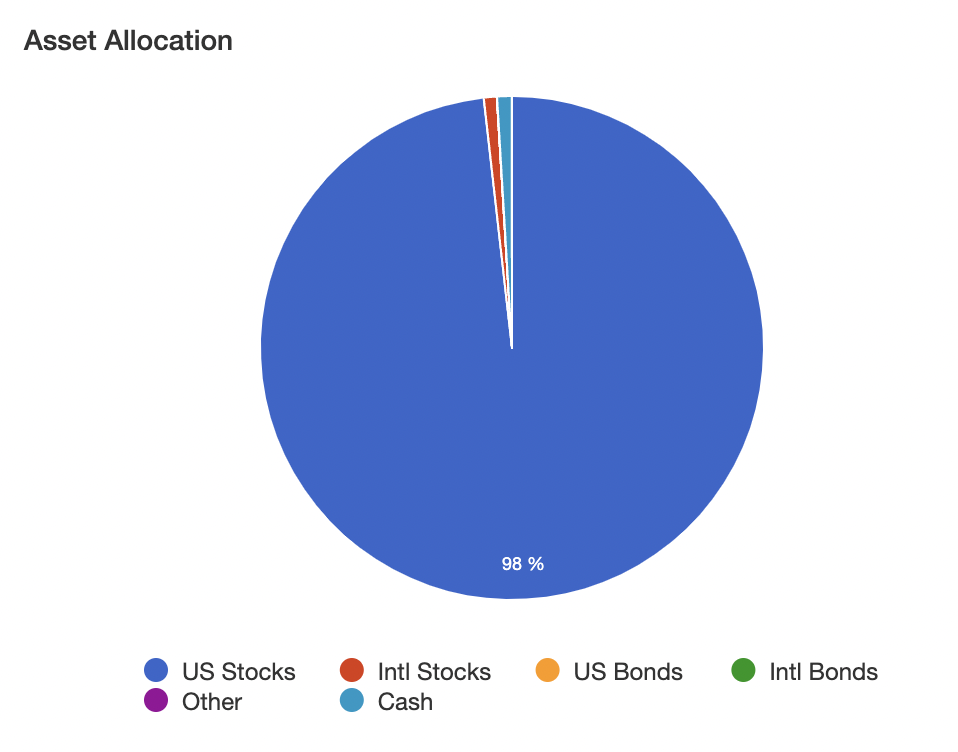

International exposure

Another advantage of VPMAX over VTSAX is that it has a higher allocation to international markets. VPMAX has a 15% allocation, while VTSAX has less than 1%. So our portfolio already has some international exposure without the need for an international mutual fund.

Portfolio income

Dividends

VPMAX pays dividends once a year in December, whereas VTSAX pays them quarterly. VPMAX has a dividend yield of 1.42% versus 1.54% for VTSAX. There isn’t much of a difference.

Capital gains

The chart below shows a significant difference in income distribution between the two funds, despite the fact that dividend distribution is similar. This is due to the fact that VPMAX distributes capital gains in December. For this reason, this fund should be held in a tax-sheltered account. It’s ideal in a traditional IRA, but it would cause tax complications at the end of the year in a taxable account.

What I like about having the fund distribute the gains is that we’ll be able to use our gains to cover our spending in traditional retirement without having to sell any shares. So we won’t have to break our heads over when to sell the fund. Many people find it difficult to sell their assets.

For the time being, our capital gains distributions and dividends are reinvested as soon as they are made available.

VPMAX is closed. Can I still invest in it?

Unfortunately, with a few exceptions, for those who might want to include this fund in their portfolio, the fund has been closed to new investors for years.

Why would a fund manager close a fund to new investors?

“The biggest reason why a mutual fund company will decide to close its fund’s doors is that the fund’s strategy is being threatened by the fund’s size.”

Investopedia

The manager might do this to protect existing shareholders from a fund’s stagnant or declining performance.

However, if you are a Vanguard Flagship client, you can invest in the fund with a $25,000 annual limit. A flagship client is an individual or household with at least $1 million in invested assets. So millionaires can dollar-cost average into the fund.

VPMAX was offered in our 401(k) plans while we were working at Vanguard. We never exchange it for another fund because it’s hard to rebuild the position with a $25,000 annual limit.

If you’re just getting started, investing in VTI, VOO, or an S&P 500 index ETF equivalent is probably the best way to go. VPMAX could provide you with something to look forward to once you become a millionaire. 😉

Final thoughts

Prior to leaving our corporate jobs, we went to a presentation by the fund advisors of VPMAX and were impressed by the management approach, the research that goes into new investments, and how they manage it with a long-term perspective. They provide diversification of thought by having multiple portfolio managers independently manage a portion of the fund.

As a result, VPMAX comprises 28% of our portfolio (as of 9/19/2022), making it our biggest mutual fund investment.

Did we make the right decision by continuing to invest in this fund?

Yes, yes and yes! As far as performance goes, we’ve done well by having this fund as part of our portfolio.

However, there’s the caveat that it’s an actively managed fund, and that’s frowned upon by many. The good news is that it has a low turnover ratio that is comparable to index funds.

Although beating the index isn’t my only goal, it’s comforting to know that this is one of the few actively managed funds that outperforms the index over time.

By choosing this fund, this is as close as we get to stock-picking without stock-picking. The only thing I want to pick is fruits from our backyard.

Four to five professionals are picking out the best investments for us instead of me having to stock-pick. I can’t compete with four chefs in the kitchen, no matter how good my cooking is!

Should this fund remain an important part of our asset allocation?

VPMAX is the type of fund that I would be happy to hold for more than ten years. Wait a minute, we’ve already had it for ten years, and I’m looking forward to many more decades of long-term investing with this fund in our portfolio. I feel strongly that we’ll be holding on to this fund for a much longer time and it will continue to be a major investment in our asset allocation.

Of course, past performance does not guarantee future results. The next ten years of investing will almost certainly not look like the previous ten, but the fundamentals of investing remain constant.

Is this fund a good addition to a well-diversified portfolio?

For all of the aforementioned reasons, I believe that someone with flagship status would benefit from adding this fund to their portfolio. I’d consider it if I didn’t have it in the portfolio.

This was fun! I’m glad I did this in-depth comparison because it revealed even more facts about this wonderful fund that we have.

When it comes to investing there are different vehicles to wealth. Make sure you’re comfortable and understand what you invest in. And, don’t forget the number one investing rule: don’t lose money. Until next time!

Which mutual fund or exchange-traded fund (ETF) is your favorite and why? Why do you think VPMAX outperforms VTSAX?

The information in this post is for entertainment purposes only and is not intended to be, and should not be interpreted or construed as, financial advice. We are not financial advisors, nor do we claim to be. This information is not a substitute for financial advice from a professional who is familiar with the facts and circumstances of your specific situation.

[…] José with Crucial Wealth, a former Vanguard employee, challenges our beloved VTSAX. Why I Prefer VPMAX over VTSAX. […]

I love the detailed comparison, and I’m impressed that VPMAX managed to outperform even with that increased international exposure. The increased mid-cap allocation may be a contributor. As you point out, the tax-inefficiency suggests that you only own this (and other actively managed funds) in a tax-advantaged account.

Great post, and it’s always good to challenge conventional wisdom.

Cheers!

-PoF

I agree that the mid-cap allocation may have contributed to outperformance. Thank you for your valuable insight!