This post contains affiliate links.

Helloooooo! How are things going for you in the new year? I hope we’re all doing well and are ready to rock. We’re finally getting more sleep in our household after the birth of Lina.

We get to start the new year with a brand new human being who is getting chubbier by the minute, as well as new financial goals that can enrich our lives indefinitely. Let’s talk about money, shall we?

We had a very busy fourth quarter of 2022, so we didn’t get to post monthly spending reports for November and December. In this post, we’re tracking the spending for those two months as part of the annual report.

We haven’t done an annual spending report for the blog in at least three years. Even after we retired, we continued to track our spending because it is one of the most important financial steps we can take to stay on top of our finances.

Looking back at last year’s expenses gives us the opportunity to see if our spending made us happier or if we simply wasted money. Wasted money equals wasted energy, which we try not to do. That being said, let’s see how we spent our money in 2022.

2022 category spending

To produce this report, we used the categories from our Mint spending trends, beginning with the category where we spent the most.

Home

The home category accounted for more than a quarter of our total spending.

Our property taxes increased significantly last year. We paid $2,922 when we first moved in in 2020, and $4,789 last year!

Sarasota County, why are you becoming so expensive?

In two years, our taxes have increased by 63%! When you buy a house, taxes usually go up the following year, but we weren’t expecting them to go up so much the third year.

Furthermore, when we bought our house, we also took out a $125,000 mortgage with a 2.99% interest rate. We paid $3,614 in interest, or should I say our rental property paid for this expense? 🙂

Home repairs include a $1,000 payment to a sub-par roofer, whom I will not name, to tarp our roof while we settle the roof damage cost with the insurance company. At the very least, our house is habitable, but we will need to replace the roof before the hurricane season begins in June.

For tools, I purchased a chainsaw and a couple of tools to cut the limbs and branches of trees damaged by Hurricane Ian. In an emergency, a chainsaw is useful to have on hand. You never know when you’ll need to cut a tree or help a neighbor with a fallen tree on their property.

The remainder is typical home spending.

Total spent on home: $16,726.83

| Home Subcategories | Spending |

|---|---|

| Property Taxes | $4,789.03 |

| Loan Interest | $3,614.45 |

| Lawn & Garden | $2,197.54 |

| Furnishings | $1,617.58 |

| Repairs | $1,265.76 |

| Maintenance | $816.06 |

| Supplies | $781.60 |

| Home Insurance | $746.00 |

| Tools | $531.67 |

| Umbrella Policy | $323.00 |

| Data Storage | $44.14 |

| Total | $16,726.83 |

Food & dining

As we all know, food prices continue to rise, with no end in sight for inflation. However, we continued to visit our favorite restaurants, albeit on a less frequent basis.

Total spent on food: $14,817.98

| Food & Dining Subcategories | Spending |

|---|---|

| Groceries | $10,538.59 |

| Restaurants | $3,566.66 |

| Alcohol & Bars | $712.73 |

| Total | $14,817.98 |

How inflation is impacting our food spending

The benefit of tracking our spending is that we can compare and contrast things like inflationary changes and our spending habits over time. So let’s examine food spending over the last four years to see how things stand with regard to inflation.

| Food Costs Over a Four-Year Period | 2019 | 2020 | 2021 | 2022 |

|---|---|---|---|---|

| Groceries | $8,990.71 | $11,010.41 | $9,743.24 | $10,538.59 |

| Restaurants | $2,628.39 | $2,713.46 | $4,637.25 | *$4,696.33 |

| Total | $11,619.10 | $13,723.87 | $14,380.49 | $15,324.92 |

| Our Percent Increase or Decrease | N/A | 18.1% | 4.7% | 6.6% |

| U.S. Food Inflation Percent Increase or Decrease | 1.8% | 3.9% | 6.3% | 10.6% |

* The year 2022 includes dining while traveling, which results in additional spending of $1,129.67. This spending does not fall under the food and dining category. We classify “dining while traveling” as travel. We began categorizing in this manner so that we could differentiate between eating out in our area and eating out on vacation, whether it was a short or long trip. It also helps to keep our local restaurant budget more consistent. I’ve incorporated it for the sake of this exercise.

So what can we conclude from four years of food spending data?

2019 was our year of hybrid work/early retirement. We traveled extensively, including a two-month trip to Europe. We didn’t spend a lot of money in Eastern Europe because the food was reasonably priced.

2020 was a year of transition for us. We spent a portion of it in Florida, where we vacationed for the first three months of the year. We couldn’t buy in bulk because we wouldn’t be around for long. We returned to Pennsylvania in the early spring. Then, in October, we relocated to Florida.

Grocery spending

Groceries are slightly more expensive in our area than they were in Pennsylvania. Perhaps it has something to do with having more affordable grocery store options in PA. We spent less money shopping in Pennsylvania because there is a wider selection of ethnic stores. As a result, the years 2021 and 2022 better reflect our food spending trends in our new home.

A few words about our grocery bill. We mostly buy organic, grass-fed, wild-caught, and pasture-raised food. We try to avoid artificial and fake foods.

A year and a half ago, we paid about $4 per dozen for pasture-raised eggs. They’re now about $7-8 a dozen. We try to get them on sale, but this year, like everyone else, we’re paying much more. We prefer certain egg brands, but we are not exclusive to any, so as long as it is of good quality, we will buy whatever is on sale. We believe that eating cheap, low-quality food to save money will be more expensive and painful in the long run.

Maybe next year we’ll be able to build our chicken coop. We put that project on hold for a variety of reasons, but we do intend to raise chickens for egg production.

Let’s take a deeper dive into our grocery merchants.

| Our 2022 Top 10 Grocery Stores | |

|---|---|

| Merchant | Spending |

| Publix | $4,319.71 |

| BJ’s Wholesale Club | $4,151.80 |

| Aldi | $433.06 |

| Amazon | $332.22 |

| Wal-Mart | $205.41 |

| Vitacost | $181.34 |

| International Food Store | $170.00 |

| Home Goods | $160.99 |

| Whole Foods | $157.75 |

| Sam’s Club | $94.33 |

80% of our food shopping dollars go to Publix and BJs.

Publix is where we do most of our grocery shopping, and by buying in large quantities and taking advantage of their BOGO (buy one, get one free) specials, we were able to lower grocery costs by 2021. We also invested in a freezer in 2022 to guarantee that we have enough Irish butter to feed the entire neighborhood. Hahaha. Seriously, though, Kerrygold butter is out of this world.

The majority of the shopping we do at Publix is for discounted or free-with-purchase items, which helps to fight inflation.

BJ’s is a great place to get bulk discounts. We prefer it over Sam’s Club because they have a large selection of organic items in our area.

Restaurant spending

In 2021, our restaurant expenditures soared by 71 percent! After the mask requirements were lifted in most locations outside of our city, we traveled within FL and ate out more. Dining in the US can quickly add up compared to traveling abroad. The rest is most likely inflation.

| Restaurant Spending | 2019 | 2020 | 2021 | 2022 |

|---|---|---|---|---|

| Restaurants | $2,628.39 | $2,713.46 | $4,637.25 | $4,696.33 |

| Percent Increase or Decrease | N/A | 3.2% | 70.9% | 1.27% |

We spent nearly the same amount in 2022 as we did in 2021. However, we were more cautious in 2022 and visited less as we saw the prices skyrocket. For example, we reduced our sushi consumption by lowering our take-out orders from FUGU Hibachi & Sushi from $1,078 in 2021 to $348 in 2022.

Aside from grocery merchants, I was curious to see which restaurants were our top ten in terms of money spent, so I pulled the data below from Mint.

| Our 2022 Top 10 Restaurants | |

|---|---|

| Merchant | Spending |

| FUGU Hibachi & Sushi | $348.08 |

| Island Organics | $307.25 |

| Tijuana Flats | $244.96 |

| Panera Bread | $220.33 |

| Chick-fil-A (our guilty pleasure) | $184.00 |

| Healthy Pho | $176.36 |

| K & K (Ukranian) Bakery | $154.75 |

| First Watch | $145.95 |

| Star Thai Sushi | $130.27 |

| Chipotle | $120.64 |

This year, I believe we will be even more price-conscious and determined to keep our food budget the same or even lower than in 2022. Eating out is becoming outrageously expensive. There is always room for improvement, and I believe we can do better. In fact, I’m committed to cutting back on restaurant expenses this year. We’ll provide better numbers next year!

Americans still have a lot of savings from the plandemic days, and it will take until 2024 for the purse to run dry, according to the CEO of J.P. Morgan.

For prices to return to normal, the inevitable has to happen. Demand must be significantly reduced before the rest of the effects can be felt. We’re determined to help reduce demand this year.

This took some time to put together, and I need to get back to other pressing matters, such as our baby. Speaking of babies, let’s move on to talk about the birth cost of our second child.

Health & fitness

The child birthing experience

Due to the birth of our beautiful child, we spent far more than usual in this category last year. We knew how wonderful it was to work with midwives after having Yuna, but Tatiana wanted to avoid the “car ride with contractions” experience this time (which is one of the worst parts, ask any mama who’s been there). So we planned a home birth with Lifesong Midfery Care. This team’s prenatal and postpartum care was amazing, and they are extremely caring, but, unfortunately, we were unable to have our ideal home birth experience with them.

Tatiana’s blood pressure was high near the end of the pregnancy, peaking in week 39. Due to the potential risks and complications, we decided to go to the hospital to check for preeclampsia and give birth there, per our midwife’s advice.

Due to the extremely high blood pressure, the hospital doctor suggested having the baby the same day even though there was no preeclampsia. We were able to naturally initiate the process without the use of pharmaceuticals. Lina was born two days ahead of the “guess date,” so she was fully developed.

We were disappointed that we couldn’t have a home birth, but we understood that we all wanted the best for mom and baby, so we were fine with the hospital birth.

We chose Sarasota Memorial Hospital in Venice, FL, for the birth on the advice of the midwife. Everything went smoothly, and the doctor and nurses were extremely accommodating to our needs. We had an excellent overall experience.

We paid around $6,000 for the home birth midwifery services, a global fee they charge, which is included in the prenatal – postpartum care subcategory below. Unfortunately, most insurance companies in the United States do not cover home births, which is unfair. The only difference between a birth center and a home birth is that the birth takes place at your home rather than in a “hotel room” at a birth center. All of the prenatal appointments took place at the office.

We hope that as more people discover, or rediscover, the beauty and benefits of home births, there will be more consumer pressure to include this option as a covered treatment.

In addition to the midwifery costs, we’re still waiting for the hospital bill, the co-pays for which will be another $6–8k.

Tatiana also saw a chiropractor who specializes in using Webster techniques to treat pregnant women. Tatiana sought prenatal care from Momma Bear Chiropractic‘s Dr. Jenny. That would cost around $650. We have to say that continuing to adjust her during the final months of her pregnancy and preparing her for labor was totally worth it. She was able to avoid most of the third trimester’s discomforts and prepare her pelvic floor for a smooth delivery. She’ll also be returning for postpartum care, which is essential for long-term health after childbirth.

Lastly, Lina had a severe tongue tie, and our health team recommended surgery. A chiropractic adjustment can usually relieve a mild tongue tie, but Dr. Jenny said it was too severe. Her health insurance has yet to kick in, so we’re still waiting. We didn’t want to wait because she is breastfed and needs to latch properly, so we paid $500 in cash and had the surgery. It was a quick laser surgery that only took a few seconds.

Total health & fitness category spending: $12,632.39

| Health & Fitness Subcategories | Spending |

|---|---|

| Prenatal – Postpartum Care (includes midwifery, chiropractic and acupuncture care) | $7,866.51 |

| Vitamins and Supplements | $880.22 |

| Health Insurance | $865.86 |

| Pediatrician | $590.00 |

| Dental Insurance | $470.14 |

| Dentist | $468.00 |

| Pharmacy | $370.09 |

| Therapeutic Massage | $370.00 |

| Doctor | $270.00 |

| Gym | $235.00 |

| Acupuncture | $170.00 |

| Essential Oils | $48.57 |

| Chiropractor | $28.00 |

| Total | $12,632.39 |

Bills & utilities

We’re now moving on to lower spending categories. The only unusual aspect of these bills was the $400 charge to flush the septic tank. Instead of city sewer, we have a septic tank. This is great for the time being because we don’t have to pay for water sewer disposal for our garden water usage.

Although this may change in the coming years as the city plans to run sewer throughout the entire city of North Port. The hurricane’s damage could slow down the process. We’ll see what happens.

As far as smartphones are concerned, we still have our two lines with Mint Mobile. The plan costs $15 per month plus tax for one line. This includes unlimited talk and text, 4 GB of data, and nationwide coverage. The service works well in our area, and we’ve renewed for a third year.

Other features of the plan are:

If you want to save money on your cell phone bill, you can use my referral code to get $15 off! If you sign up, I’ll get a referral bonus at no extra cost to you.

Total spent on bills & utilities: $3,807.37

| Bills & Utilities Subcategories | Spending |

|---|---|

| Electric | $1,377.53 |

| Water | $626.78 |

| Internet | $599.97 |

| Mobile Phone | $414.71 |

| Sewer | $400.00 |

| Home Security System | $388.38 |

| Total | $3,807.37 |

Shopping

Although we are not frequent shoppers, we do purchase high-quality shoes and clothing. Wifey learned about the benefits of organic cotton clothing and arch support sandals, which are not cheap even when on sale.

I keep telling her that we didn’t budget for organic cotton clothes when we were planning our retirement, but she says that once you’ve gone organic, it’s difficult to go back to pesticide-laden clothing.

Last year we also had to replace our laptop and my phone.

We still spent half as much on clothing as we did the previous year, which is an improvement. Early on, we had to replace the majority of our wardrobe after moving to Florida and leaving corporate jobs. We now mostly dress casually and frequently wear shorts and flip flops.

Total spent on shopping: $3,370.36

| Shopping Subcategories | Spending |

|---|---|

| Electronics & Software | $1,613.91 |

| Clothing | $1,523.71 |

| Other | $232.74 |

| Total | $3,370.36 |

Travel

We did not travel abroad as a family because we were expecting. In the summer, we flew to Rhode Island. We didn’t spend much money on flights because we took advantage of the points we had available.

In October, I also took Yuna to the Dominican Republic. In addition to spending time with Abuelo, we spent three nights at a resort in Puerto Plata at her request. She recalled our trip there in 2021 and expressed a desire to go back. However, without Mommy there, it wasn’t the same.

Aside from those two trips, we took a few day trips in Florida. We enjoy living in Florida because we can drive for half an hour to a new city and go on vacation without spending a lot of money. We are within 45 minutes of Venice, Punta Gorda, Boca Grande, and Siesta Key. People pay to vacation in these locations, and we can do so at a very low cost.

That’s really about it for travel. We didn’t spend a lot of money, but we had a lot of fun and made wonderful memories.

Total spent on travel: $3,290.87

| Travel Subcategories | Spending |

|---|---|

| Hotel | $1,332.55 |

| Dining | $1,129.67 |

| Parking & transport | $394.60 |

| Air Travel | $211.49 |

| Rental Car & Taxi | $128.87 |

| Travel insurance | $52.92 |

| Activities | $24.96 |

| Phone and Data Abroad | $15.81 |

| Total | $3,290.87 |

Auto & transportation

This year, we spent $323 more on gas than the previous one. Auto insurance cost has been rising as well, possibly due to inflation.

I hope I’m not jinxing us by saying this, but we didn’t need to repair our 2007 Toyota Camry. Wow, I believe this is the first time in a long time that we have gone an entire year without needing to make any repairs.

Now, I must confess that I am itching to replace the car and be done with the search. I’m not always looking, but we’ve been waiting for better deals. We’ve been talking about replacing our car for more than a year.

At the very least, our car has not caused us any major problems, so we can continue to wait and save money on a car payment.

We may not have to wait much longer because we want to upgrade our vehicle and go on road trips once Lina is ready to hit the road. That could happen by the summer.

When Yuna was almost five months old, we took her on a lengthy road trip from Pennsylvania to Florida for the first time, and she did great. Lina appears to be fine so far and will be on the road early as well. In terms of behavior, there are numerous parallels between the two. We’ll see how she does once we cross that bridge.

Overall, we spent $117 less on auto than we did the previous year.

Total spent on transportation: $2,712.34

| Auto & Transportation Subcategory | Spending |

|---|---|

| Gas & Fuel | $1,368.71 |

| Auto Insurance | $1,200.00 |

| Service & Parts | $64.38 |

| Auto Registration | $36.10 |

| Parking | $23.15 |

| Toll Fees | $20.00 |

| Total | $2,712.34 |

So those are the areas we wanted to emphasize. Here is the complete 2022 spending chart.

Drum roll, please…..

2022 spending

| 2022 Spending by Category | Spending |

|---|---|

| Home | $16,726.83 |

| Food & Dining | $14,817.98 |

| Health & Fitness | $12,632.39 |

| Bills & Utilities | $3,807.37 |

| Shopping | $3,370.36 |

| Travel | $3,290.87 |

| Auto & Transport | $2,712.34 |

| Gifts & Donations | $2,055.03 |

| Entertainment | $676.40 |

| Other | $613.72 |

| Total | $60,703.29 |

In total, we spent $60,703 last year. Some expenses are not recurring, and we should expect to see decreases in some categories, such as health.

Essential and discretionary expenses

$60,703 is a little more than we expected to spend this early in our retirement from corporate, but it makes sense given the circumstances.

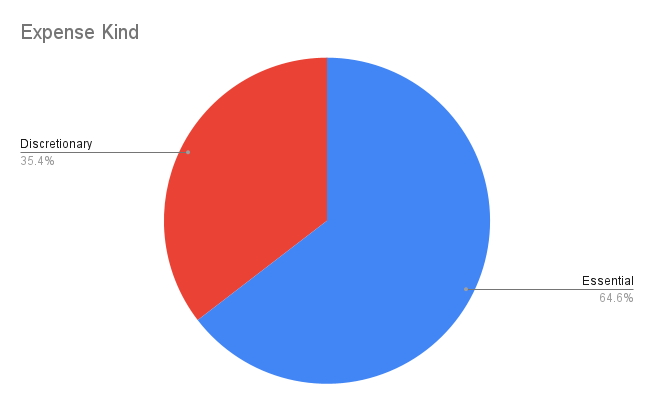

Nonetheless, I was curious as to how much of our spending in 2022 would be discretionary versus essential. To accomplish this, I made a list of what we consider discretionary spending and subtracted the amount from our actual spending.

| Total expenses | $60,703 | Note | |

| Deduct discretionary expenses | – $21,507 | Travel, auto, shopping, restaurants, alcohol, other miscellaneous | |

| Essential expenses | $39,196 | ||

| Deduct pregnancy-related expenses | – $9,247 | Prenatal care, vitamins, tie tongue surgery for Lina | |

| Absolute minimum needed for 2023 | $29,949 |

35% of our spending is considered discretionary. So, after deducting all discretionary spending, we have $39,196 in essential spending. I even classified auto expenses as discretionary because we don’t need a car to get to a job. We’re unemployed! 🙂 A car is a nice treat for us.

We are not expecting another child this year.

What about a future one? Wifey, are you ready for more fun?

Who knows what the future holds? LOL.

We’re left with nearly $30k in essential spending after deducting baby-related expenses.

This means that if we are extremely strapped for cash as a result of a prolonged market crash or Armageddon, we can tighten our belts and get by by cutting our spending in half. And we can still afford good food and caviar on New Year’s Eve.

But…

Let’s be real. Have I ever tried to limit my spending to only paying for necessities?

Never. Neither during nor after my college years. Not during my working years, and certainly not afterwards. So I’d probably look for ways to make more money.

Do you know what’s so lovely about this exercise?

To know how much money we’d need from our portfolio to pay the bills and how much more we’d need to have fun. That’s all!

I prefer to see things in terms of abundance. I like tracking our pennies to see where our money goes, but I don’t like having to count pennies to figure out which bills need to be paid. That can be very stressful and no fun at all.

Final thoughts

As we examine our spending, we also consider our income and cash flow, and you may have questions like the ones below if you want to achieve FI and retire from a corporate job.

How did we manage to spend so much when we withdraw less from the portfolio? What can we anticipate withdrawing from our portfolio?

Did we go in debt this year?

Is our lifestyle unaffordable?

How do we manage our cash flow?

As we get through a series of financial posts coming up, we’ll discuss these numbers in more detail.

Since we left our jobs, no year of spending has looked the same for us. One thing is certain: we would not change a single thing in order to save more money. The freedom we gain from owning our time and spending it as a family is more valuable than any money we could have earned by working more years. So far, so good. 🙂

Until next time, financial freedom lovers.