Hola, mi gente! It’s been so long since we last wrote a post. All I can tell you is that we’ve been extremely busy, too busy to even write about one life to live. LOL.

It’s all good though. We spent the first half of the year getting ready for life after corporate work, and guess what?

We retired!

We retired from our corporate jobs at the ages of 33 and 44!

There is no going back now. We quit our jobs, and everything happened so quickly that we barely had time to think about it.

However, because we were certain of our decision, there wasn’t much to ponder.

Despite the fact that we haven’t published in a while, we’ve been more active on social media and in mainstream media. We were featured on a mainstream media financial news channel in April, and the majority of our peers learned about our FIRE plans before we retired.

Speaking of peers, we’ve got a few more readers from our work network. They want to follow our journey! Hooray and welcome! Friends, you can click to follow us on Twitter, our active social media channel.

I took June off to complete my paternity leave and returned on July 1st to give a three-week notice. The next day, Tatiana gave her notice, and it was epic!

We’ll go into more detail in another post, but we wanted to share the big news with you right away.

So, aside from early retirement, what has been going on in our lives?

We usually post One Life To Live quarterly, but we missed the first quarter, so we decided to do a special mid-year update.

With that in mind, let us scrutinize our spending and how it relates to our happiness.

One Life To Live is our quarterly recap on how financial independence plays an integral part in fueling our true happiness. We have one life to live, but are we making the best of it? Are we living in the most fulfilling way possible? We hope that our lifestyle answers those questions as we continue to optimize for happiness. Carpe Diem!

Exploration

Aside from returning from Florida in January and visiting Providence, RI in June, we didn’t travel much in the first half of the year. Why take limited vacations when a permanent vacation was right around the corner?

We moved to our rental property in June, and I spent the weekends leading up to the move renovating it while Tatiana took care of our daughter and packing/moving logistics.

You moved? What!!!!

We didn’t travel much in the first half of the year, aside from returning from Florida in January and visiting Providence, RI in June. Why take limited vacations when a permanent vacation was right around the corner?

We moved to our rental property in June, and I spent the weekends leading up to the move renovating it while Tatiana took care of our daughter and packing/moving logistics.

Have you relocated? What!!!!

Yes, we have decided to move to our paid-off rental property for the next 1-4 years until we find the ideal location for our dream home. To avoid harsh winters, we’ll snowbird until we can relocate permanently to a warmer climate.

As a result, trips were a few in the first half of the year, but that is changing now that we have retired.

From the chef’s kitchen

Cooking your own meals is an excellent way to eat healthily while also saving money. One significant advantage is that you can use higher-quality ingredients and know exactly what is going into your food.

We still cook many of our meals, but with the move and everything, we ordered a lot during the first quarter.

We also started grilling since we now have our own backyard and enjoy outdoor dining on our front porch. For our small backyard, we wanted a small charcoal grill, so we chose this Weber grill. We also purchased a rotisserie attachment.

Now, for those who enjoy numbers, we’ll go over our spending, portfolio income, and performance for the first half of the year.

Passive income and expenses

The following is a streamlined spending report that takes very little time to produce, giving us more time to enjoy living. It fits with our theme of having only one life to live and making the most of it.

Expenses

2019 Mid-Year Spending (Jan-Jun)

Now that we’re retired, I’d like to concentrate more on overall spending on a quarterly basis. Having said that, we are providing spending for all categories. This is how we spent the first six months of the year.

| Category | 1st Half of 2019 Amount |

| Home | $27,675 |

| Kids | $6,131 |

| Food & Dining | $5,670 |

| Gifts & Donations | $1,935 |

| Travel | $1,420 |

| Bills & Utilities | $1,335 |

| Auto & Transport | $1,223 |

| Health & Fitness | $949 |

| Other | $1,170 |

| Total | $47,508 |

Home repairs and improvements

So we spent more than $47k halfway through the year. This is an unusual year for us because we are retiring early. We don’t expect to spend as much money in the future. We spent a lot of money on home improvements, which we’ll go over shortly.

$16,283 of the $27,675 spent on the Home category went toward home improvements and a new roof. We made some upgrades to get the property ready for us to move in!

We installed new waterproof laminate flooring throughout the house and repainted the majority of the rooms. We installed granite countertops and a stone and glass backsplash to replace the old ones. Also, we added a nice powder room in the basement, which was previously just a toilet enclosed in plywood walls.

Most upgrades and repairs increased the equity by at least $20,000 because we did a lot of the work ourselves and hired cheap labor.

Finally, we get to enjoy a nice upgraded home for the next few years, and when the time comes to sell, we won’t have to do much work to get it on the market.

Rest of the expenses

Some expenses incurred during the first half of the year are also being eliminated or drastically reduced. For example, the $4,600 in rent we paid from January to May can now be put toward property taxes, annual maintenance costs, and insurance.

Moving costs were $1,500. We didn’t move very far (about 45 minutes), but we still hired movers. The days of us doing the heavy lifting are over.

Approximately $6,000 was spent on babysitting while Tatiana was back at work for five months. That monthly cost has now been eliminated.

Aside from those costs, there’s nothing out of the ordinary here.

But we saved money in other areas. We got new cell phone service providers and lowered our cost!

Now that we’ll be traveling for months at a time and will be using more Wi-Fi at home, we decided to look into our cell phone service options .

Mint Mobile for U.S

We eventually signed up for Mint Mobile and switched our phone numbers. We now pay $15 per line per month for unlimited texting, voice, and 4 GB of data per month.

If you’re interested, you can try it out and get $30 off your service by using this link. Since this is an affiliate link, we will receive a commission at no cost to you.

So far, we’re pleased with Mint Mobile’s service. They use T-Mobile towers, so we have service almost everywhere in the United States. The switch from our previous provider went smoothly. We’ve also had no problems with internet speed or dropped calls.

GoogleFI for international service

Another issue we had with phone service was that we had to get a new sim card for the Dominican Republic every time we visited.

I didn’t want to spend time doing that every time we visited a new country. To avoid this inconvenience, we enrolled in GoogleFI for international service.

GoogleFI is a pay-as-you-go service that is available in over 200 countries. We pay $20 per month for the GoogleFI line, which includes unlimited texting and voice calls in the United States.

We pay $10 per GB for the data we use. We’ve been in Europe for three weeks and have only used about half a GB because most places have Wi-Fi.

Depending on which country you are in, calls are charged per minute. In Belarus, for example, it is $0.20 per minute. When we have Wi-Fi, we use WhatsApp, Viber, or Skype because those minutes add up quickly.

So far, our experience with GoogleFI has been excellent. We’ve had service in most places, and they notify you when you arrive in a country that you’re covered.

When we return to the United States, we can pause the service for three months at a time and keep the number. This saves us a lot of time because we no longer have to worry about getting sim cards when we travel and we won’t leave money behind because we only pay for the data we use. This is a big win!

If you’re interested in checking out GoogleFI, use this link to get $20 off your service. Again, this is another affiliate link so we get a kickback, but rest assured, we only recommend a service we use or believe in.

With Mint Mobile and GoogleFI, we are getting much more out of our phone service and paying way less.

Previous phone service spending: $70/mo for two lines = $840/yr plus international charges.

New phone service with Mint Mobile: $30/mo for two lines = $360/yr plus international charges.

That leaves us with $480/yr to play with. We can spend that much on GoogleFI when we travel abroad and still be below our previous phone spending.

That sums up our spending for the first half of the year.

You can click here to see our latest annual spending.

Portfolio income

Dividends

I don’t know how much we received in dividends for the second quarter. We’re having trouble accessing our Vanguard accounts from abroad because we don’t have our U.S. text messages to verify the sign-in process. I wish we could verify via email like Personal Capital. Vanguard, hint, hint!

I need to call Vanguard and figure out how to get access to it, but I didn’t want to delay this post. After all, I’m not in a hurry to fix it. 🙂

We’ll include dividend income in the next OLTL post.

Freedom Fund Portfolio Returns

We currently have two goals for our entire portfolio:

- The Nuestra Casa Fund holds the funds for our future home, once we decide where to settle 2-4 years from now, in early retirement.

- The Freedom Fund provides the income needed to live life on our terms.

Our goal for asset allocation prior to retirement is an allocation of 75% stocks (including REITs) and 25% bonds/cash in the FF Portfolio, which coincides with having the money we’ll need during the first 5 years of early retirement in bonds and cash. We met our allocation goal.

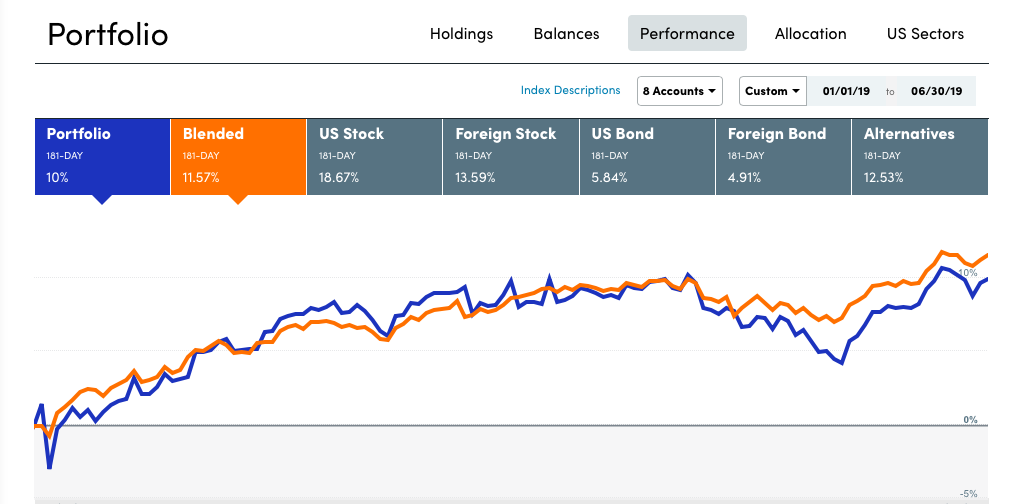

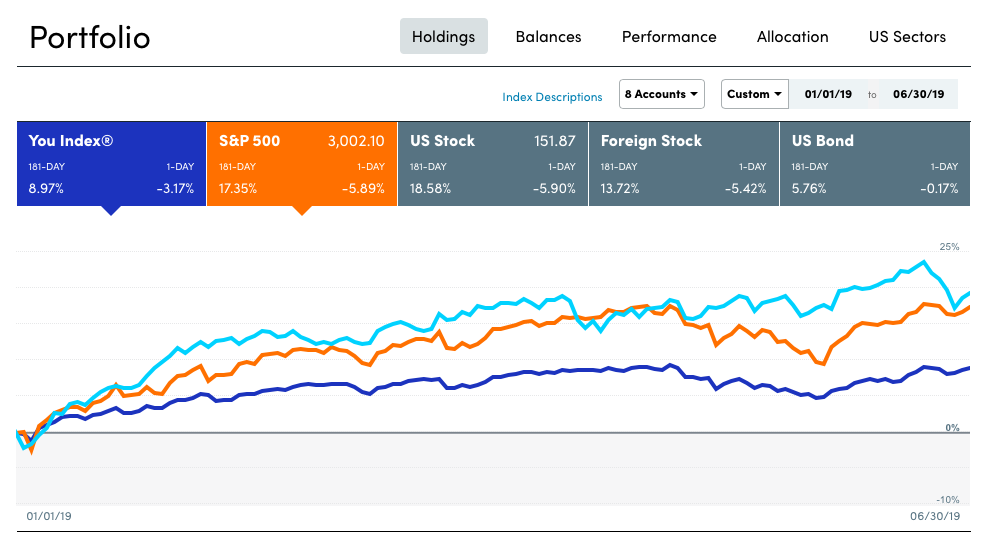

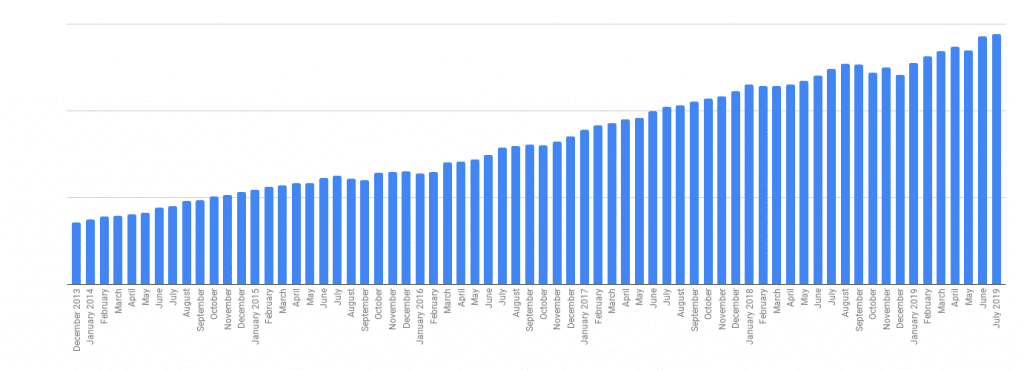

Freedom Fund Portfolio performance

For the first half of the year, our FF portfolio returned 10%. Since we hold bonds and cash, our returns are about 8-9 percent lower than the S&P 500.

We need fixed income. We are retired now. You know?

REITs

You know what else is doing well in our portfolio?

Our REITs holdings!

From January to June, our VGSLX shares returned 19.29 %! They currently account for 7.6% of our portfolio, and we keep them in Roth accounts due to their inefficiency with regard to taxes. Through a 401(k)-traditional IRA conversion, we hope to increase it to 10% of our FF portfolio as an alternative to stocks and bonds.

Net worth update

What makes up our net worth?

Only income-producing and real estate assets make the list.

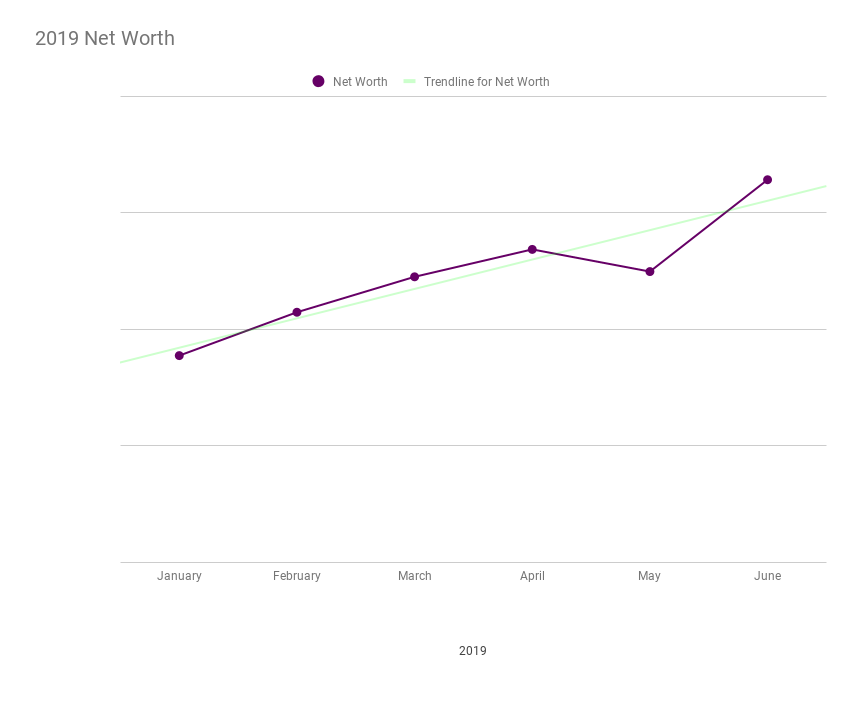

2019 net worth

Our net worth increased during the first four months of the year, but then fell in May. By June, we were back on track. We weren’t expecting much growth in our net worth this year, so this was a pleasant surprise.

Net worth over time / Our ladder to wealth

Since we reached our FIRE date, how did we do as far as meeting our number?

When we first sat down to calculate our FI number earlier this decade, we set a goal of slightly more than a million dollars for our net worth of income-producing assets. We reduced our target for a lean FI and achieved it in 2017.

We were ready to call it quits and retire from our corporate jobs at the time, but we wanted to have a child first. We had some difficult times before our lovely daughter was born.

Her birth a year ago started the countdown! We wanted to spend the majority of the first year stationary because babies do better in a stable environment during that time.

According to the timeline, the best time for us to retire would be in July 2019, after we’d received our company bonus for the previous calendar year.

And we did retire!

Our net worth had now surpassed our original FI figure. I should be overjoyed, but we proceed with caution in this early retirement stage for several reasons:

- We’re retiring at the end of the world’s longest bull market, and if an extended bear market follows, the chances of depleting our funds increase.

- The healthcare system in the United States remains a disaster, with skyrocketing costs.

- Since the market is overvalued, withdrawing 4% from our retirement accounts does not feel safe for a 60-year retirement.

- Since the majority of our funds are in retirement accounts, we must make the money in the brokerage account last as long as possible.

We have put in place a few safeguards that will allow us to thrive because the last thing we want to do is return to mandatory work.

The bear market is inevitable. We’re not sure when, but we’re preparing as if it’s already here. We intend to withdraw less than 4% of our funds. We can stay in our current home for the next four years, giving us financial flexibility.

We’re traveling for now and have travel insurance, but we do plan to have health insurance when we return to the U.S.

To sum it up, we’re not going to spend money as if the fountain can’t go dry. Caution and flexibility will be the name of the game, especially in the first few years.

What else is happening?

We’re still trying to establish a routine for ourselves in early retirement. We’re having a great time without the stress of a 9-5 job and taking things one day at a time.

And, most importantly, we’ll be there to witness our little one take her first steps on her own, which should happen any day now. There will be so many firsts with her that we will get to experience. That alone makes it all worthwhile. Until next time!

This is all so exciting! Congratulations!! With a such a young kid, it feels like you pulled the plug at the right time for the right reasons. I couldn’t be happier for you – or more jealous!

Hola!!! 🙂

It definitely feels like the right moment to do this. We’ll be around her when she needs us the most and wants to be around us. 😉

Thank you for stopping by!

Congratulations!

I’d love to know more about the numbers and how much your investment portfolio spits out to cover your expenses. We found with having a kid that our expenses are going on, so we are actively trying to boost our passive retirement portfolio by another $50,000 a year. But I don’t think we’ll get there for another three years.

Have your phone you needed to have more or make more once your child was born?

Sam

Thanks Sam!

Our entire portfolio’s income, including the funds to buy a house that are in money market account, was $40,568 last year. We own our current home outright. It was a rental property, but we decided to move in for now since we still need to decide where we want to live by the time our little one needs to attend school.

We were aiming for a spending budget of $40k a year with a paid-off home. Given our previous dividend income I feel strongly about being able to live off the dividends without tapping into investment gains.

We’re in the process of analyzing how much we should keep in the house fund given that a) we don’t see ourselves moving within the next 3 years and b) we have about $120k of home equity that we can use towards the future purchase. This gives us more flexibility with cash in early retirement as most of our money is in retirement accounts that can be touched until traditional retirement age.

As far as kid spending. It hasn’t been that bad for us. We expected to pay for a babysitter this year but now we’re home and don’t need it. Baby now eats mostly from what we cook and she gets lots of present from friends and family so we don’t spend much on her.

We planned our early retirement with a couple of kids in mind, and we also plan to live in areas with a lower cost of living than west coast.

Thanks for commenting, buddy!

Cool! Everything should work out!

Jubilado!

Jubilation!

A sincere congratulations to both of you. Enjoy!

-PoF

Thank you, sir! Congratulations to you as well on your early retirement and new home purchase. We might cross path on our travels.

Great Post 🙂

Financial goal I accomplished this year: downpayment for my first apartment and a savings I am proud of! With the help of two(and third is still a baby) very helpful people

Thanks Jessya! I’m glad you were able to meet those goals! 🙂 I can’t wait to see your story continue to unfold.