When it comes to saving for financial independence, the portfolio income might not look like much at first. Some retirement savers may not even know how to find the income section in their statements, if they even look at them at all. People simply don’t initially give retirement savings much thought. However, if those investments begin to increase in value, it can be very fascinating. As we’ll show in this post, you can create sizeable passive income streams that can sustain your lifestyle indefinitely with a little bit of effort and a lot of patience.

Join us as we discuss our own journey to financial independence and the strategies we’re using to fund most of our spending with our portfolio income. By providing you with a transparent view into our portfolio income, we’ll share the strategies we’re using, the challenges we face, and the lessons we are learning along the way. From saving aggressively, to investing in index funds, to calculating our personal savings rate, we’ll provide you with actionable tips to start building your own passive income empire today.

Calculating Your Savings Rate

How We Achieved a High Savings Rate

I’m still in awe when I look at our portfolio income, almost four years after we quit our jobs. As we transitioned from working to financial independence, I couldn’t help but ask myself, “Is this for real?” Is it possible for us to receive this much money annually into our accounts with no effort on our part?

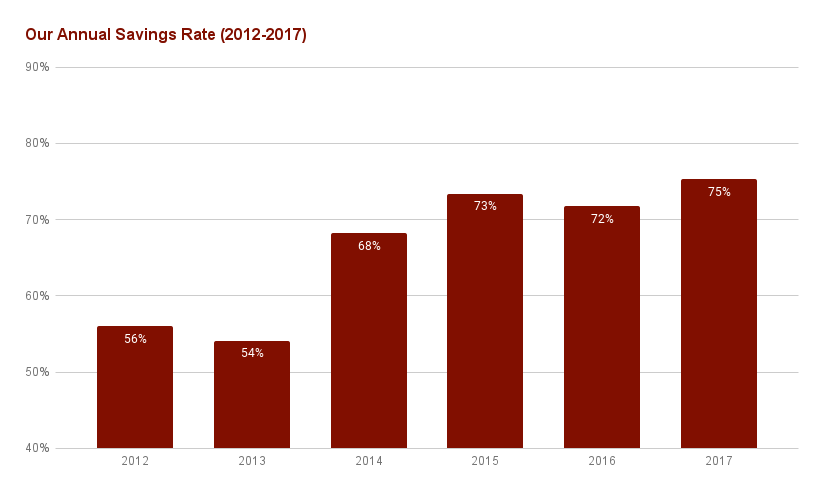

When we achieved financial independence in February of 2017, we continued to work for another two years and five months. We called it quits eleven months after Yuna, our first daughter, was born. During those working years, we were saving aggressively. As we all know, a high savings rate is crucial to achieving financial independence, so we constantly looked for ways to lower our expenses and increase our savings.

As we got better with money, our retirement accounts got fatter. By 2018, our savings rate was consistently in the 70s, and we were no longer recording this data.

How to Calculate Your Personal Savings Rate

As we continued to lower our spending, we were able to achieve a high savings rate. It was not difficult to adjust to living with less once we realized that true happiness does not come from spending more money. We recommend calculating your personal savings rate and determining how much you are currently saving towards your financial independence goal. From there, make any necessary adjustments to increase your savings rate.

Our Primary Goal of Saving Enough to Fund Our Living Expenses

Our primary goal was to save enough to fund our living expenses from our Freedom Fund Portfolio. Along with our rental property, we also intended to increase our portfolio by funding the maximum amount possible in our 401(k), Roth, and taxable accounts. To accomplish this, we invested primarily in index funds, which are a great way to diversify your investment portfolio and offer a low-cost way to get exposure to a wide variety of stocks and bonds.

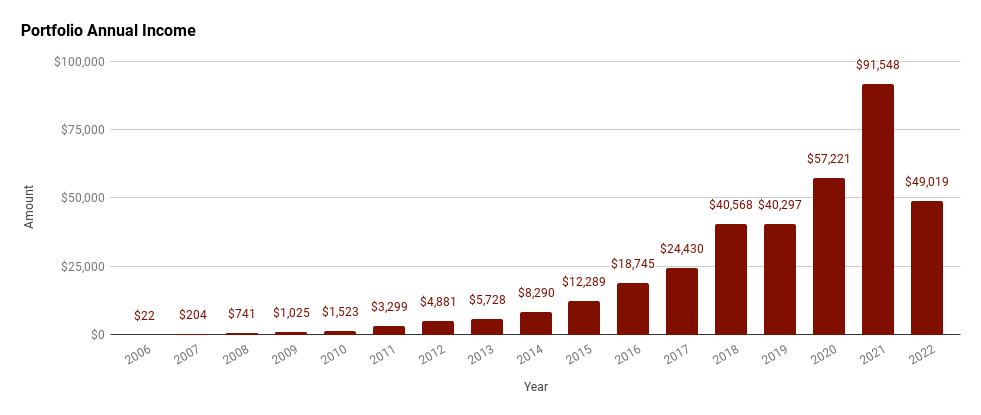

In the beginning, in the first year that I started saving, in 2006, my dividend income was only $22. However, the next year, Tatiana started working and saving as well. Although we didn’t know each other back then, our passive income continued to increase in our respective accounts over the years, even after we stopped working.

After leaving our jobs, we have been extremely busy with life, so I haven’t had time to carefully examine our portfolio income. Last year, however, I was more focused on trying to find investments for our self-directed IRA (SDIRA). We found a couple, and now we’re moving on to more exciting endeavors in our lives. Now that we don’t work for a living, we depend mostly on passive income.

Our Freedom Fund Portfolio Income Sources: Dividends, Interest, and Capital Gains

In terms of our Freedom Fund, we receive income in the form of dividends, interest, and capital gains. When analyzing a fund, we prefer to focus on the overall fund returns, but we also think that capital gains and dividend income are equally important. Understanding the different types of income returns is crucial. It’s important to note that while capital gains and income returns are both treated as income and are subject to the appropriate taxes, capital returns are simply your own money that you invested returning to you.

The majority of our funds distribute dividends quarterly, with the exception of a small number of funds that do so annually in December. As far as capital gains distribution is concerned, the funds send us our share of gains annually. We hold VPMAX, which is one of the funds that distributes capital gains annually.

One thing we like about holding this fund is that by having the fund distribute capital gains, we don’t have to sell shares to get more income distributed, which takes away the concern about when to sell. Selling is hard when all you’ve been doing is accumulating assets. A group of fund managers makes that decision on our behalf, and we choose whether to keep the cash on hand to pay for current expenses or reinvest it in line with our asset allocation. It’s another tool in our arsenal to rebalance. Even though they occasionally sell some of the fund’s underlying assets, we still hold the same number of VPMAX shares.

Freedom Fund Portfolio Annual Income Over the Years

Don’t Let a Small Income Figure Discourage You from Investing

If you’re just starting out on your financial independence path, don’t get discouraged by a lower figure in portfolio income. Even though I contributed to my 401(k) for half of the year, I only saw $22 in income during my first year in 2006. Tatiana began working in 2007, and we earned a combined $204 during that time. In the third year, that number more than tripled, and it then continued to rise.

A Change in Focus: Saving for Financial Independence

Around 2011, we realized there was an alternative to a 9–5 job, and we started to focus more on investing to achieve FIRE. I was debt-free and working toward maxing out my 401(k) by the end of 2013. Tatiana didn’t have any debt and was already maxing it out.

We then started maxing out our Roth IRAs in 2015, a year after our marriage.

The Impact of Capital Gains: A Jump in Income

In 2018, we see a big jump in our chart from $24,430 (the previous year) to $40,568. The reason for this is that we started including capital gains in the calculations in 2018. Previously, we only focused on disclosing dividend income in our portfolio income reports for this blog. It’s too cumbersome and time-consuming to try to go back in time to add those numbers.

We did keep track of the investment returns during those years, from 2006 through 2022, on a spreadsheet. We’ve only had four years of negative returns: 2008, 2015 (by less than $1,000), 2018, and 2022. Four out of sixteeen years in the red is not bad at all. Of course, we performed well with the help of the longest bull market in history.

The longest bull market in history was a stretch of about 11 years that began in 2009, during our initial period of accumulation and immediately following the financial crisis, and continued until 2020. The government pumped some serious dough into the economy, and the market continued to rise as a result.

Going back to capital gains distribution, in 2018, we started to record capital gains from funds like VPMAX. VPMAX distributed some major gains in 2021. Fortunately, these gains are in tax-deferred and Roth accounts, so no taxes are paid at the time of distribution inside the plan.

Can Our Spending be Funded by Income Alone?

With a sizeable income being distributed over the past three years since we’ve been retired, this begs the question: Can our spending or annual withdrawal amount be funded by our income alone? Would we need to sell and eat into our principal, or can we stay within our income limit to fund our withdrawal?

One reason I say the withdrawal amount is because the rental property funds a portion of our spending, so we don’t depend solely on the Freedom Fund Portfolio for our total spending.

Fortunately, we already have three years of retirement income and withdrawal data to try to answer these questions.

Our Approach to Calculating Withdrawal Amount

Freedom Fund Portfolio Income Over the Past 3 Years

If we were to follow the 4% rule, the answer might be no, as you’ll see below. But if it’s according to our CAPE-based withdrawal formula, which is close to a 3.25% withdrawal, we might have a chance to withdraw based on income alone.

Let’s look at the income over the past three years since that’s when we retired.

| Freedom Fund Portfolio Income Over the Past 3 Years | |

|---|---|

| Year | Amount |

| 2020 | $57,221 |

| 2021 | $91,548 |

| 2022 | $49,019 |

Based on these numbers, the average annual income for the past three years is $65,929. However, I wouldn’t bank on that. I don’t want to assume that that would be the average annual income going forward and start spending away.

Additional Data for Determining Withdrawal Amount

What other data can we use to help answer our question?

Hmmm, what if we look deeper into the 2021–22 income and separate the dividends from the capital gains? These calculations were made to estimate our 2022 portfolio income distribution, so they are easily accessible.

Since dividends are more predictable, it can help us decipher how much income we’d have during years where there might not be capital gains distribution.

| Freedom Fund Portfolio Income (2 Years) | ||

|---|---|---|

| Source of Income | 2021 | 2022 |

| Dividends | $9,788 | $15,443 |

| Capital Gains | $81,760 | $33,576 |

| Total | $91,548 | $49,019 |

Oh my, that doesn’t look like a lot of money in dividends. That’s even less in dividends than what we got prior to 2017. A few things could account for that. We have more invested in funds that have a lower dividend yield but greater overall returns. Also, we had some money parked in cash while we were looking for real estate investments in our SDIRA. On top of it all, the dividend yields are becoming more attractive since interest rates are increasing, so this number should increase.

Our Projection for Dividend Income in 2023

The dividend income for this year should look better, as we reinvested a big chunk of that cash since we’re done looking for real estate opportunities for now. Also, our cash is being rewarded with a higher interest rate. It’s great, but not so great when inflation hovers around 6–7%.

What would our income look like for 2023 based on our current yield without capital gains?

In order to estimate the income amount, we’ll need to find the dividend yield for each of our funds and multiply by the dollar amount we own.

The yield is displayed in the Vanguard fund profile, if you have Vanguard funds.

As of January 23, 2023, the projected dividend yield for us is $25,501. This number fluctuates as soon as our screens are refreshed.

Playing out a 10-Year Income Scenario: The Importance of Continually Analyzing and Adapting Our Strategies for Long-Term Sustainability

I want to play with what could be a bad-case scenario for us. What if, for the next seven years, we don’t receive any more capital gains and only receive $25,501 in dividends, with inflation factored in at 3% annually?

What would that income look like?

| 10-Year Income Scenario (without additional capital gains) | ||

|---|---|---|

| Year | Total Income | Notes |

| 2020 | $57,221 | Includes cap gains |

| 2021 | $91,548 | Includes cap gains |

| 2022 | $49,019 | Includes cap gains |

| 2023 | $25,501 | First year without cap gains |

| 2024 | $26,284 | Without cap gains and adjusted for 3% inflation |

| 2025 | $27,123 | Same as above |

| 2026 | $28,023 | Same as above |

| 2027 | $28,985 | Same as above |

| 2028 | $30,000 | Same as above |

| 2029 | $31,074 | Same as above |

| Total | $394,788 | |

| Annual AVE | $39,478 | |

If we assume that we would get no capital gains for the next seven years, which is unlikely, our average annual income would be $39,478 for the first 10 years of early retirement. That’s a far cry from the $65,929 for the three-year average we mentioned earlier.

Has there been a period where the market hasn’t produced capital gains seven years in a row? I’m too lazy to look it up but maybe someone can chime in on that in the comments.

I am hopeful that we will get some capital gains in the next seven years, but this is just an exercise. We want to see how cautious we should be with our annual withdrawal strategy and if it can be supported by income alone. We don’t live in a spreadsheet, and numbers do vary from year to year.

Withdrawal Strategies

Our CAPE-Based Withdrawal Formula

We discussed how we calculate how much money to withdraw from the Freedom Fund Portfolio annually earlier in this blog post. I won’t get into specifics, but you can read the post below for more details.

We based our withdrawal on a CAPE-based withdrawal strategy. A CAPE-based withdrawal strategy is a way to figure out how much money you can take out of your investments. It’s based on something called the CAPE ratio, which looks at how much the stock market is worth compared to how much money companies are making.

The idea is that if the market is worth a lot compared to how much money companies are making, it’s probably not a good time to take money out of your investments, so we might take a smaller percentage. But if the market is worth less compared to how much money companies are making, it’s probably a good time to take money out, so we might take out a bigger percentage. This way, you can make sure you’re not taking too much money out when the market is in a bubble and not leaving too much money in when the market is doing well.

Understanding the 4% Rule

We prefer this approach to simply withdrawing 4% of investments annually, also known as the 4% rule, without taking market conditions into account.

The 4% rule is a guideline that helps people plan how much money they can safely take out of their savings during retirement. The idea is that if you withdraw 4% of your savings the first year of retirement, and then adjust for inflation each following year, you should be able to make your money last for at least 30 years.

So, if you have saved $650,000, you could take out $26,000 (4%) in the first year of retirement and then increase that amount each year to keep up with inflation. This is a general rule of thumb, and it’s important to consider your own personal circumstances, such as your expected lifespan, spending habits, and other sources of income, when creating a retirement plan. I plan to live forever, so this should last us that much. Hahaha…

Based on our Freedom Fund Portfolio amount, this is what our withdrawal would’ve looked like during the first three years of early retirement if we were to follow the 4% rule.

| Withdrawal Strategy Based on the 4% Rule | ||

|---|---|---|

| Year | Amount | Inflation |

| 2020 | $48,587 | 1.23% |

| 2021 | $49,186 | 4.70% |

| 2022 | $51,497 | 6.5% |

| Total | $149,270 | |

Withdrawal Strategy Based on Different Rates

Our CAPE-based withdrawal strategy figures come closer to a 3.25% rule, but they vary according to the market value. Instead of the 4% rate, we’d withdraw 3.25%, adjusted for inflation on an annual basis, under the 3.25% rule.

| Withdrawal Strategy Based on Different Rates | ||||

|---|---|---|---|---|

| Year | 4% SWR | 3.25% SWR | CAPE-Based SWR | Actual Withdrawal |

| 2020 | $48,587 | $39,477 | $37,818 | $39,499 |

| 2021 | $49,186 | $39,964 | $41,414 | $32,400 |

| 2022 | $51,497 | $41,841 | $41,402 | $41,102 |

| Total | $149,270 | $121,282 | $120,634 | $113,001 |

| Annual AVE | $49,757 | $40,427 | $40,211 | $37,667 |

I’ve created a spreadsheet that auto-populates most of these numbers. I just need to annually input portfolio balance, inflation rate, and CAPE ratio, and it does the rest.

Going back to our previous calculations for a bad-case scenario of not getting capital gains for the next seven years and receiving an average annual income of $39,478. So far, our CAPE-based withdrawal has resulted in an average annual withdrawal of $40,211, which is slightly higher than $39,478. However, we’ve been withdrawing a little less than the suggested amount on average ($37,667).

Analysis of Income vs Actual Withdrawal Amount

What conclusions can we draw from this?

For one, we’ve left some income on the table—$28,262 annually, to be exact—which will continue to grow over the years.

| Income vs. Actual Withdrawal Amount | ||

|---|---|---|

| Year | Income | Actual Withdrawal |

| 2020 | $57,221 | $39,499 |

| 2021 | $91,548 | $32,400 |

| 2022 | $49,019 | $41,102 |

| Total | $197,788 | $113,001 |

| Annual AVE | $65,929 | $37,667 |

$65,929 (income) – $37,667 (actual withdrawal) = $28,662 (annual cushion)

Second, we can easily stick to withdrawing 3.25% annually, inflation adjusted, and still come close to living off of the income alone. For someone who wants to keep this calculation as straightforward as possible, this seems like a good idea.

So far, we’ve been able to live off of the Freedom Fund portfolio income alone without touching principal. We have created a safety net to help us get through the coming years. If we continue leaving around $10k in the account per year, for every four years of withdrawals, we’re leaving one invested. When you compare our withdrawals to a 4% SWR, we are sort of leaving 20% of the money invested.

Depending on our unique situations, we might have to withdraw significantly more in some years, but this gives us a good starting point.

Looking Forward to 2023 Withdrawals

Since we’ve come this far, let’s take a peek at the withdrawal estimates for this year, based on portfolio balance, a CAPE ratio of 27.96, and a 2022 inflation rate of 6.5%.

| 2023 Suggested Withdrawal Rates | ||

|---|---|---|

| 4% SWR | 3.25% SWR | CAPE-Based SWR |

| $54,844 | $44,561 | $44,078 |

Wow. We have a difference of over $10k between the 4% and the other two withdrawal rates. If everything goes as planned, we’ll withdraw around $44k from our portfolio this year. Let’s see what the future holds, as we want to keep withdrawals as low as possible for the reasons listed below.

Penalties are a biatch!

Most Funds are in Retirement Accounts

One significant barrier prevents us from easily withdrawing money: we aren’t old enough to do so without incurring penalties. We are still young; I’m like 25 at heart, and who knows how the laws may evolve in the years to come? Right now, you need to be 59-1/2 to be able to withdraw money from an IRA penalty-free. That number could be 65 by the time we get there.

Most of our funds are in retirement accounts. This is something that most people who FIRE have to deal with. One way to get money out sooner is by doing Roth conversions and waiting another five years to withdraw that principal. To avoid the 10% early withdrawal penalty, you must also calculate how much of your income you can convert each year to a Roth account. This is in addition to the challenging dance required to secure affordable health insurance without the help of your employer. It’s a cash flow issue that we face every year until we get to traditional retirement age. Nevertheless, I would rather handle this than get up and commute five days a week to a corporate job. This way is still much more fun and rewarding.

Our Taxable Account is Running Dry

We’ve been draining our taxable brokerage account. For cash flow purposes, we tap into the taxable account in the Freedom Fund Portfolio to fund our expenses. After reading this post, my wife questioned if there was anything we should have done differently. Should we have invested more of our savings in taxable accounts as opposed to 401(k)s? My answer to that is no.

We did the right thing and here’s why. When we were working we were in the 22–25% tax bracket. I rather have saved on the taxes back then, let the money grow tax-free for all these years and risk paying a 10% tax (penalty) later. We are currently in the 10% tax bracket. We’ve paid no taxes for the past two years and counting. If we need to access pre-tax accounts, we’ll most likely have to pay 10% total in taxes out of pocket to do so. I’m willing to take that risk.

In a subsequent post, we’ll go over how we manage our cash flow and expand on the role that the Roth conversions play in that process. We’ll figure it out, but if we want to avoid having to pay an early withdrawal penalty, we’ll need to start using some new tactics soon. I love me some challenges, so I’m not worried about this. Some problems like these are really good to have.

Final Thoughts

Should We Have Done Things Differently?

We have provided a transparent look into our Freedom Fund portfolio income. We also discussed how dividends, interest, and capital gains are different and how we balance the need for income with the need to maintain or grow our portfolio.

With a few scenarios, we were able to determine that while the 4% rule would not be practical if we wanted to solely rely on income distributions, a withdrawal rate of roughly 3.25% based on our CAPE withdrawal formula might be feasible. With a little bit of effort and a lot of patience, you too can achieve significant passive income streams that can fund your living expenses without having to lift a finger.

Should we have done things differently in terms of taxable versus 401(k) savings? Should we have continued to work, maybe one more year, to save more money in taxable accounts? No, no, no. 🙂

We’re very glad we quit when we did. Everything worked out perfectly. Should we have worked in an office for more years and missed the first baby’s moments? Hell no. No amount of money could buy us more happiness than being present and witnessing our children’s first steps. Notice the first time they smile and try to express themselves. Being there to raise them properly has been the most rewarding and best investment of our time.

When your 4-year-old asks to make a toast before meals, you know you’re doing something right. She’s really getting good at it. We see this type of behavior every day, so we’re used to it, but it hits us when others visit and compliment us on how well we’re raising our children.

Make What You Want of Your Journey But Keep Moving

The journey to financial independence and early retirement are unique to each of us. Just remember, it’s not a sprint; it’s a marathon. So, lace up your running shoes, grab a sports drink, and let’s go on this journey together! And if you ever feel like giving up, just remember that the finish line is getting closer every day.

Take the first step towards building your own passive income empire by calculating your personal savings rate and setting a goal for your early retirement.

We hope you enjoyed this post. We want to leave with you a reminder that we’re on Twitter and would love for you to join us! We’re having a lot of fun in that space! Follow us at Crucial Wealth for real-time updates and engaging content. See you there!

Thanks for sharing! Love how in depth in details your article was. I started investing early in my twenties. Without the knowledge I have now, I made the mistake of liquidating my 401K during the 2008 recession. It was a mistake, the penalties alone was terrible. I gained the confidence to start investing again 5 years later. This time I have a better job and I am able to Max out my 401k and IRA. Even seeing the loss I took during the pandemic, I didn’t panic this time and kept investing. Working my way to FIRE is the goal!

Anny

You’re very welcome. Sometimes it’s hard to put it all out there but if that can help others to save and continue on their journey to FIRE, I’m all up for it!

Good job on acknowledging your investment mistakes and no longer panicking in a downturn. You’re still young and have time to FIRE and enjoy more out of life. Keep it up! 🙂