I’ve noticed some confusion in the FI community about what should be included in your personal savings rate calculations, so I thought I’d go over how to calculate your personal savings rate.

This is an important number for people who want to retire early because it determines how many more years you will need to work to be able to retire. Of course, the higher your savings rate, the sooner you’ll be able to escape the rat race.

Let us begin by defining the term. According to Investopedia, a savings rate is the amount of money deducted from one’s disposable personal income, expressed as a percentage or ratio, to set aside as a nest egg or for retirement.

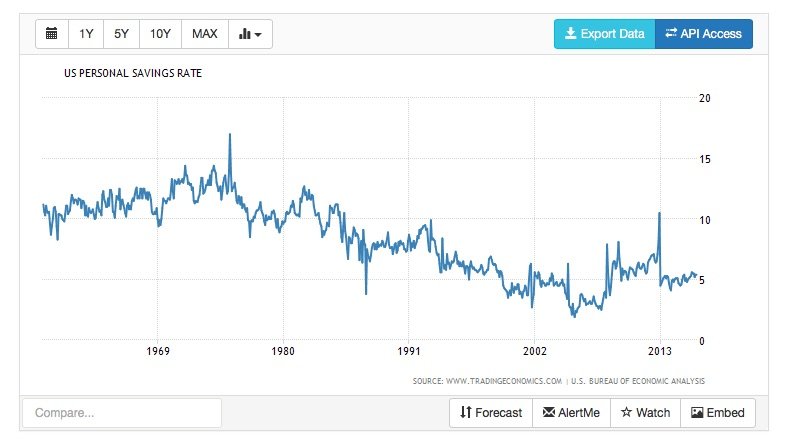

The U.S. Personal Savings Rate

For the past few years, the personal savings rate in the United States has been hovering around 5%. That means that we have been saving 5 percent of our disposable income as a group. It’s no surprise that Americans are poorly prepared for retirement. If you save at that rate, you’ll barely be able to afford retirement unless you make it a priority.

I was one of those sad statistics before I joined the FIRE movement. I assumed that working for a corporation until my sixties was the only way to go, and that retirement would be a 30-year ordeal in which all you had to save was a small percentage of your salary.

Then I woke up, realized that the prescribed lifestyle was a shambles, and resolved to take charge and get out of debt. We can say that after paying off all of my debts and joining Tatiana in becoming extreme savers, we will be able to retire within a couple of years.

We started tracking our personal savings rate two years ago and have come a long way since then. Without any deprivation, we saved 67 percent of our income in 2015. We live a fulfilling life that revolves around spending quality time with loved ones, taking inexpensive vacations, and engaging in hobbies that don’t deplete our savings.

When it comes to saving, our readers are a different breed than the general population. Many of them are avid personal finance readers of other blogs, and it’s not uncommon to hear people on the path to early retirement with savings rates ranging from 25% to 75%. Now let’s see how we can calculate our own savings rate.

How to calculate your personal savings rate

- List and total all sources of income, including salary, employer 401(k) contributions, rental income, dividends from retirement and non-retirement accounts, interest, government benefits, and any other income.

- To calculate your net income, subtract the tax you paid from your gross income.

- Add up all of your annual savings, including both employee and employer 401(k) contributions.

- Divide your total savings by your net income and multiply by 100. This is your savings rate.

For example, Martha is a single woman who earns $60,000 per year. Her employer contributed $3,000 to her 401(k) in 2015, a 5% match of her salary. She also has a rental property that brings in profits of $4,000 per year. She received $1,200 in dividends from her investments and $50 in interest from a high-yield savings account. Her “gross income” totaled $68,250.

$60,000 + $3,000 + $4,000 + $1,200 + $50 = $68,250.

Dividends and rental income are taxed differently than salary income, but for the sake of simplicity, assume Martha paid $14,000 in taxes. Since she had maxed out her 401(k) contributions, she was in a lower tax bracket. Her take-home pay was $54,250.

$68,250 – $14,000 = $54,250.

Martha contributed the maximum amount of $18,000 to her 401(k), and her employer contributed $3,000 as well (this contribution goes directly to her retirement savings).

She also invested $1,100 into index funds in her brokerage account and deposited $500 into high-yield savings accounts. She reduced the principal on her rental property mortgage by $2,900.

Martha also reinvested her $1,200 dividends and kept her $50 interest in her savings account. The remainder of her funds were spent. Her total savings amounted to $26,750.

$18,000 + $3,000 + $1,100 + $500 + $2,900 + $1,200 + $50 = $26,750

Martha’s personal savings rate was $26,750/$54,250 x 100 = 49.3%. Martha appears to be a viable marriage candidate. Who would want to marry her? Have you found your Martha yet?

With a savings rate of 49% – 50%, Martha will be able to retire early in her career. Assuming 2015 is her first year of saving, she could easily retire in 17 years assuming a 5% annual ROI and a 4% withdrawal rate. You can do your own calculations by using the Networthify retirement calculator.

A note about mortgage principal payments: I wouldn’t include principal payments on a home as part of the savings rate unless I plan on selling the house after retirement and renting instead, because these savings will not provide income. Once the house is paid off, it will only reduce my debt and eliminate a current expense.

Final thoughts

If your savings rate is low, consider reducing your spending or increasing your income to boost it. If you’re living above your means, you have a lot of room for improvement, and it makes more sense to cut spending to get there, because once you eliminate/reduce expenses, you don’t have to save to maintain it in the future.

Begin by reducing your biggest monthly expenses, such as food, housing, and transportation. Reduce your eating out budget; cut the cable; eliminate one vehicle or take public transportation; increase your heat tolerance to save energy; get a prepaid phone plan; move closer to work; and find unusual ways to earn more money.

The savings rate in America is laughably small. If it weren’t for Social Security, everyone would be working until they dropped dead. Great breakdown of the math behind calculating savings rates. I wish more people would take heed!

Hi Moola –

Yes, Social Security has been a lifesaver for many. Thanks for complimenting the numbers – it means a lot coming from a finance guy like you. 🙂