Greetings, my wonderful peeps! I hope those who are experiencing difficult winters are coping well. I advise them to relax with a hot beverage by the fire and remember that spring is coming soon.

We’re snowbirding in the south and will return home next month.

We’ve been out of corporate for nearly seven months. Early retirement is going well, and the joy of raising our daughter leaves us with little time to write, as evidenced by the frequency with which we post.

We managed to get this quarterly post out despite other life events taking precedence. We’re just going with the flow, knowing that parenting is our number one priority right now.

My passion for the blog is evolving

My interest in this blog is evolving now that we’re in the early stages of retirement.

That is exactly how it should be.

Our passion for things should evolve over time, just as our relationship with money does.

We want to live the dream rather than just keep dreaming it. It’s time to enjoy the fruits of our labor, and writing about things like savings rates, which are critical during the accumulation stage, no longer excite me as much.

That doesn’t mean we’ve lost interest in personal finance.

We’re simply in a different stage of life. We still talk about money, but I’m more interested in learning about withdrawal rates, capital preservation, and so on.

So our emphasis on personal finances has shifted, but the most important goal for us is still to enjoy the journey.

We always preached to enjoy the journey while on the path to FIRE, and we must do so even more now that we don’t have a 9 to 5 job.

We must enjoy the journey, even if it means missing out on writing on this blog for months at a time. That is perfectly acceptable.

We’ll write occasionally. There are some precious moments that we are unwilling to give up by spending more time on a computer. Those are the moments we live for.

We finally own our time

We finally own our time. Dividends and capital gains from our investments compensate us. And that sum is sufficient to cover our expenses.

Our spending is not extravagant, but it allows us to live a fantastic lifestyle. We live the lifestyle of someone earning around $100,000 per year, but on a much lower salary.

With that in mind, let’s examine our spending to see how it relates to our happiness.

One Life To Live is our quarterly recap on how financial independence plays an integral part in fueling our true happiness. We have one life to live, but are we making the best of it? Are we living in the most fulfilling way possible? We hope that our lifestyle answers those questions as we continue to optimize for happiness. Carpe Diem!

Exploration

Since we didn’t do a third-quarter post, let’s go over what we did after we left corporate.

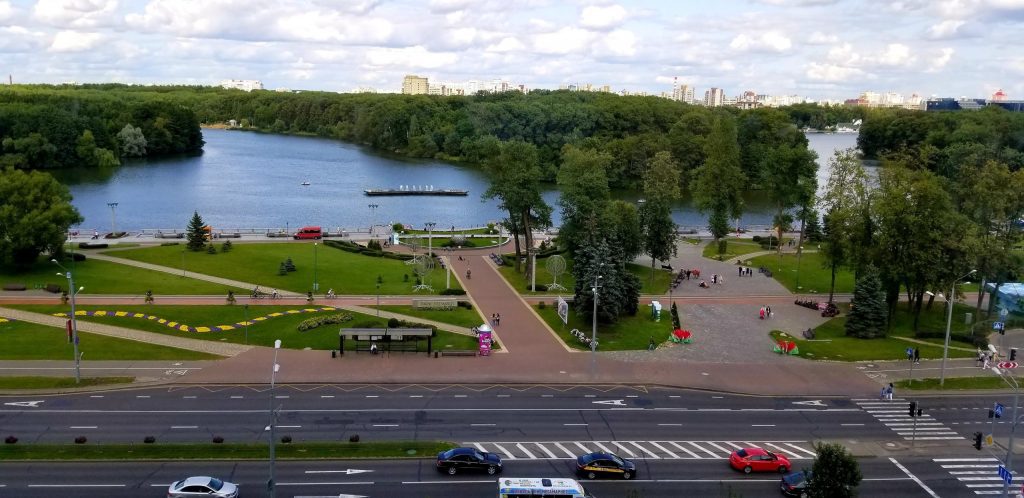

We boarded a plane a week after handing in our badges and spent 48 summer days in Europe.

Our first European stop was an overnight layover in Helsinki, Finland. Then we traveled to Minsk, Belarus, before spending time in Lithuania and Spain. In September, we returned to the United States.

Winter in Florida

Pennsylvania’s early fall weather was unusually warm. We weren’t in a hurry to leave, but as November arrived with colder temperatures, we knew it was time to head south.

For the second time, we drove to Florida. As Thanksgiving approached, we set out and stopped at the homes of friends and family along the way.

It took us over two weeks to get to our final December destination in Florida.

We wanted to be closer to the beach, so we rented a condo in Venice for $1,300 for our first month in Florida.

The condo was in great shape and it was only a 15-min walk to the beach and a 5-min drive to downtown Venice.

Now, for those who enjoy numbers, we’ll go over our fourth-quarter spending, portfolio income, and performance.

Passive income and expenses

The following is a streamlined spending report that takes very little time to produce, giving us more time to enjoy live. It fits with our theme of having only one life to live and making the most of it.

Expenses

Spending for the fourth quarter of 2019 (October – December)

This is the amount we spent in our first full quarter of early retirement!

Now that we’re retired, I’d like to concentrate on overall spending rather than the essential spending that we used to do for OLTL. Having said that, we show spending amounts for all categories.

| Category | Quarter Amount |

| Food & Dining | $4,070 |

| Travel | $1,711 |

| Health & Fitness | $1,007 |

| Gift & Donations | $910 |

| Bills & Utilities | $809 |

| Auto & Transport | $430 |

| Entertainment | $413 |

| Other | $292 |

| Total | $9,642 |

For the quarter, our average monthly spending was $3,214. This is in line with our projected annual spending of less than $40,000 a year during our first year of early retirement.

Health & Fitness

Other than health insurance costs, nothing stands out in terms of our spending. This is our first year without employer-sponsored health insurance.

We took a vacation abroad after leaving our corporate jobs and purchased travel insurance. There was only a brief gap in coverage between the time we left our jobs and the beginning of our trip. We didn’t mind because we had retroactive coverage for 60 days.

After returning from Europe, we enrolled in short-term health insurance to cover the gap between then and the time our insurance would kick in under the health exchange in January 2020.

During the fourth quarter, the cost of health insurance for a family of three was $188 per month. This type of coverage is extremely limited. You can only sign up for one year. If you are sick, you are disqualified and cannot apply. This is not good!

This concludes our fourth-quarter spending.

You can view our most recent annual spending post by clicking here.

Portfolio income

Dividends

December is always a good month for dividends. Since we invest in mutual funds and ETFs, the majority of our dividends are paid quarterly. And since we continued to invest while working, our dividends increased steadily.

We’re not adding any more money to the pot now that we’ve retired from corporate work. The pot, on the other hand, continues to grow as a result of compounding interest and market returns.

Our dividend income for the fourth quarter was $18,970. Now that we’re no longer employed by a financial firm, I believe we can be more open about how we invest.

VPMAX to the max!

The largest income distributions came from VPMAX, VITPS, VWILX, VBTLX, and VTPSX. Some of these, as you may have noticed, are managed funds.

We have a few managed funds in our portfolio and are not among those who say, “I’m 100% in VTSAX.”

When you first start investing, there’s nothing wrong with putting all of your money into VTSAX. However, as our portfolio grows in size, we seek greater diversification and capital preservation.

It makes complete sense. Someone with $1,000 will not consider investments in the same way that someone with $10,000, $100,000, or even a million will. As your investments grow, so should your investment knowledge.

Or do your investments grow as you become a more savvy investor?

We had the opportunity to attend a presentation by the VPMAX management team while working for Vanguard. We were pleased with their investment philosophy in addition to learning about their investment strategy.

They invest with a long-term mindset, which aligns well with our objectives. Stocks are held for long periods of time, often decades.

We’ve been investing in VPMAX through our 401(k)s for at least 9 years. VPMAX pays out dividends once a year.

The total dividend amount distributed in December was $9,494. This is one of the reasons why our December dividend payment is larger than usual.

This money is tax-deferred and cannot be withdrawn without penalty.

Freedom Fund Portfolio Returns

We currently have two goals for our entire portfolio:

- The Nuestra Casa Fund holds the funds for our future home in a warmer area, once we decide where to settle in time for our daughter’s schooling.

- The Freedom Fund provides the income needed to live life on our terms.

Freedom Fund Portfolio performance

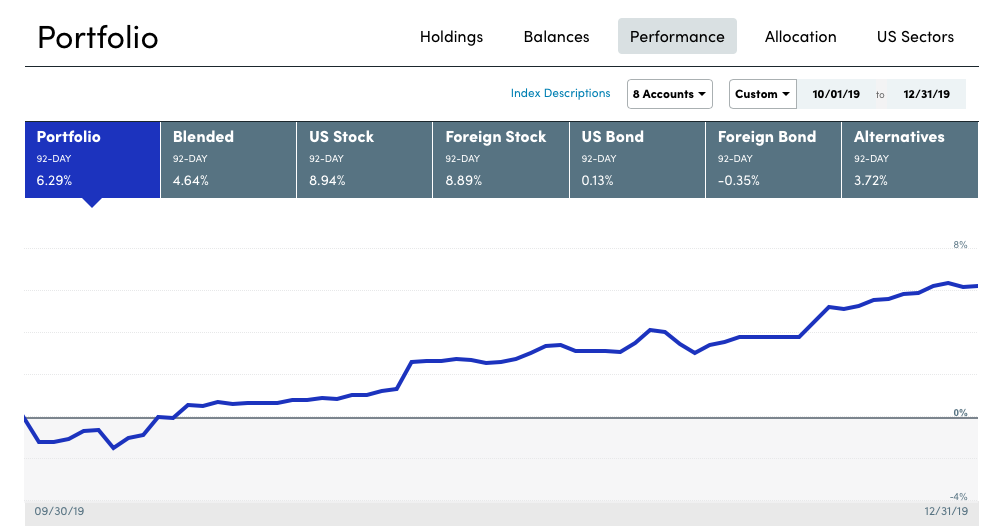

Our FF portfolio returned 6.29% for the fourth quarter.

Our portfolio is growing faster than we can spend in early retirement. That will not always be the case, but we are prepared for a downturn by maintaining a conservative.

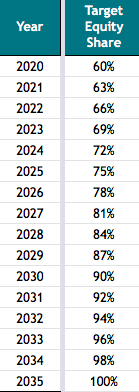

We decided to take an equity glide path (thank you, ERN!). Starting with a 60/40 allocation and gradually shifting to 90% equities in 10 years, with the option of going to 100% equities in 15 years.

We’ll reassess whether we should stop at 90% equities or go all in after ten years. It will be determined by the proportion of our net worth invested in equities and fixed income.

So much can and will change in 15 years. I’m confident we’ll come across additional investment opportunities along the way. We’re only getting started!

Net worth update

What makes up our net worth?

Only income-producing and real estate assets make the list.

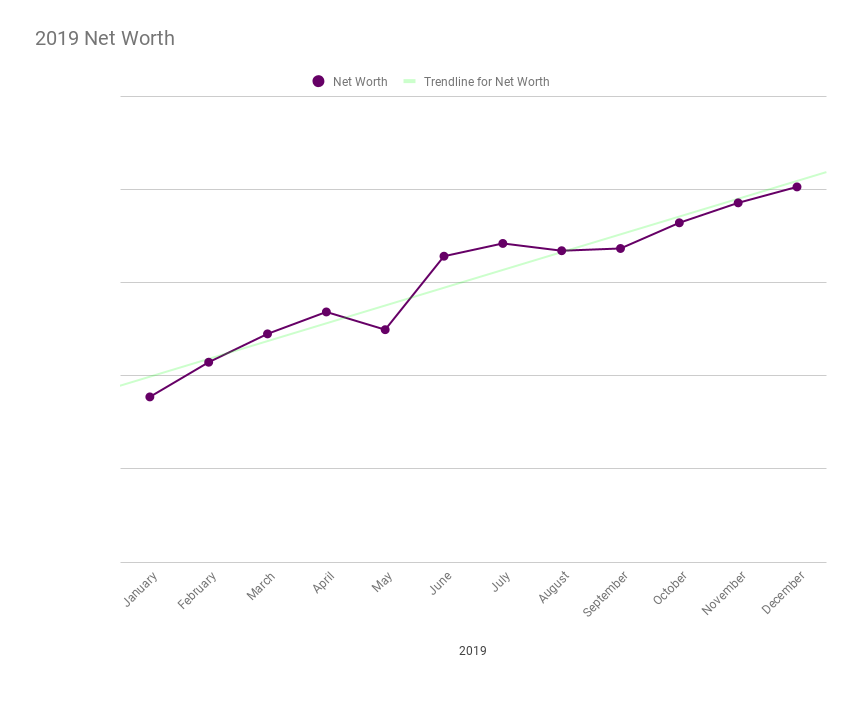

2019 net worth

Even after we stopped contributing to accounts, our net worth increased. We did not need to withdraw for expenses in 2019, so it will be interesting to see how future withdrawals and market returns affect our net worth.

That’s all for now, folks. I hope you’re on track with your finances and remember to live a little. Now we’re off to spend more time doing things we enjoy with our little girl. 🙂

Love it! Very insightful

Hi Jessya!

Thanks, I’m glad it provides you with a good insight into our early retirement lifestyle! 🙂