Hello to everyone. What a first quarter we’ve had!

The general consensus is that we are in the midst of a pandemic. People are scared. They are concerned about their health and their jobs… It’s complete chaos.

Some are even concerned about our financial situation.

“How are the FIRE folks dealing with this situation?” “Are they already looking for jobsk?”

These are the kinds of statements you’ll come across online. Some seem to be waiting for our FIRE plans to fail.

We’re doing just fine here in Florida, snowbirding. Except for the quarantines that are preventing us from returning home, life goes on as usual for us.

Now, I’m not going to sugarcoat it and say we’re not concerned. We are concerned that more people will die. We are concerned about those who are unable to support their families because they are unable to work. We’re worried about other people.

However, the last thing on our minds is worrying about money, but since this site is about happiness and financial independence, we must address these issues.

2019 marked the end of the longest bull market in history. We knew the end was near, but we didn’t know when or how.

We were promised a roller coaster ride, but no one told us we were going to ride the drop tower!

In a matter of days, we lost 30% of our stock fund portfolio.

Fortunately, we were prepared for this situation. We’ve been preparing for it for three years by becoming more cautious. We entered early retirement with a conservative 60/40 (stocks/bonds) allocation.

In addition, we withdrew 3.25 percent of our portfolio for 2020. That covers our projected annual spending.

We can easily forecast our spending because we’ve been doing it for years.

Previous years of spending

We started blogging in 2015 and have been publicly reporting our spending since then. The following are links to previous spending posts:

That’s six years of expense reporting, not counting 2019.

But how long have we been keeping track of our spending?

We started tracking it about a decade ago. Tracking our spending was critical to achieving financial independence. It made us realize how we were wasting our money and not maximizing it for true happiness.

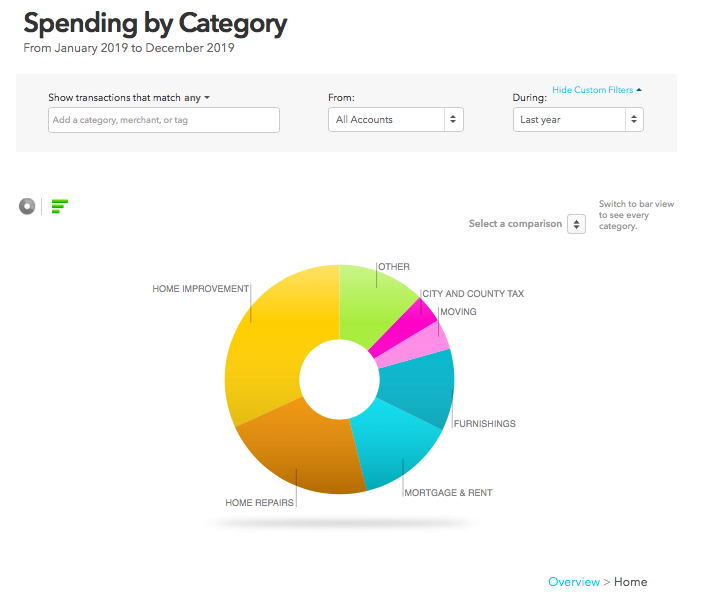

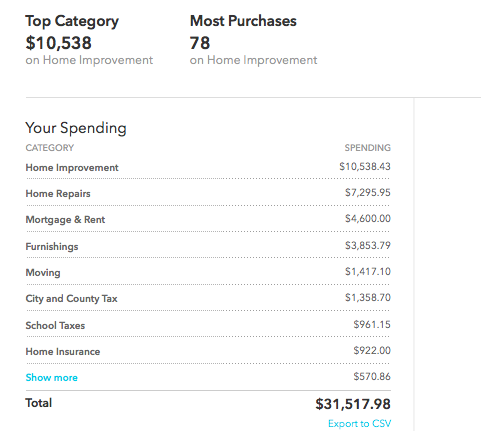

2019 spending, by category

To keep things simple, we’re focusing on the major categories and grouping them all together in one table.

When we first started tracking spending, it was critical for us to distinguish between essential and discretionary spending.

Why?

We gained an advantage by tracking it. It provided critical information such as how much money we needed to live on, what we could cut from our spending, and so on…

Nowadays, the vast majority of our spending is discretionary. We have no debt (not even mortgage debt), so we have more freedom to spend how we want.

Let’s take a look at how we spent our money last year:

| Category | Annual | Monthly |

| Home | $31,518 | $2,626 |

| Food & Dining | $12,914 | $1,076 |

| Travel | $8,063 | $672 |

| Gifts & Donations | $4,049 | $337 |

| Kids | $3,728 | $311 |

| Bills & Utilities | $3,175 | $265 |

| Auto & Transport | $3,066 | $256 |

| Health & Fitness | $2,698 | $225 |

| Shopping | $1,255 | $105 |

| Entertainment | $719 | $60 |

| Other | $381 | $32 |

| Total | $71,566 | $5,965 |

Home

Last year, we spent more than usual.

Rather than investing more in our taxable accounts, we decided to spend the money on much-needed home repairs and remodeling. This increased spending was anticipated, so it comes as no surprise.

2019 was a year of transition for us. We rented for $4,600 over the first five months of the year. During that time, I spent weekends driving to the property to make repairs, while Tatiana stayed at home caring for our daughter.

We moved into the property in June, a month before retiring, and commuted to work for 45 minutes using a combination of remote/office workdays.

We spent nearly $18,000 on home repairs and improvements. The majority of these costs were for upgrades. That was a wise decision because we won’t have to make any upgrades once we’re ready to sell the house and relocate south. And we get to enjoy them for the duration of our stay.

It was also good timing because if we had put that money into the stock market, it would have vanished. Now that the property has been mostly renovated, it is ready to sell at any time.

When the market is overpriced, it is a good time to diversify, pay off debt, and make home repairs.

Photos of repairs before and after

Kitchen upgrades

Flooring

Powder room remodeling

The powder room in the basement also got an upgrade.

New roof install

Ceiling and wall repairs

Making of a smarter home

Garage opener replacement

The garage opener replacement broke during the summer. A company wanted $250 to install it so I ended up doing it myself and learned a new skill.

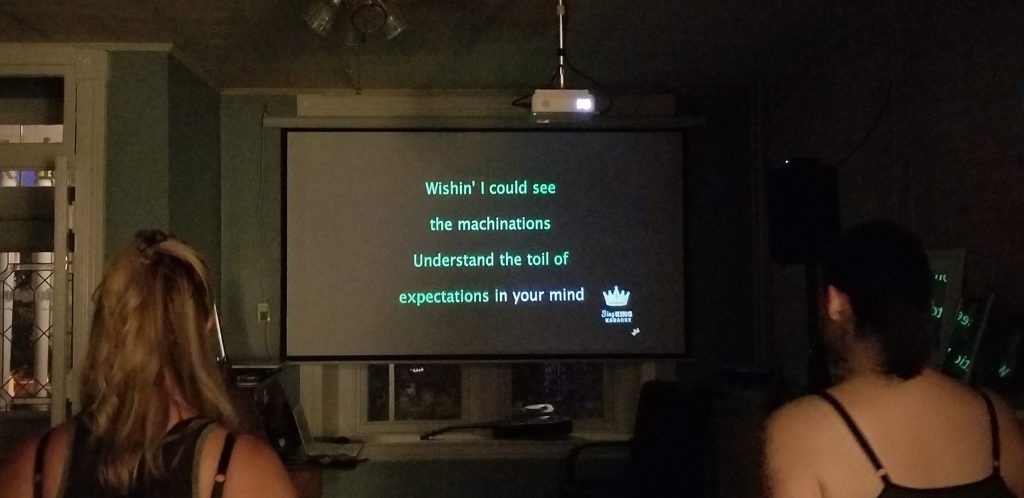

Enjoying our home

It took some work to get us to the point of being able to fully enjoy our home. We still have a few minor projects to finish up when we go back but nothing compared to what we’ve done so far.

Food & Dining

We cook a lot at home, but we also buy good food, which isn’t cheap. You’ll have to pay a lot more if you want wild-caught salmon rather than farmed-raised salmon from China.

We used to buy salmon from Aldi but stopped when we realized it was coming from China.

We don’t limit ourselves when it comes to good food, but because we spend so little on other things, our overall budget balances out.

Travel

We traveled without time constraints for the first time in 2019. We spent about three weeks in Florida at the beginning of the year. Then we drove back to Florida in late November after spending nearly two months in Europe.

We kept our travel costs to $8,000 by using reward points for flights and hotels.

Kids

We received a $2,000 child tax credit, which we applied directly to our child spending, bringing it down to $3,278. We spent a lot of money on this because we hired a babysitter while we were working. She was amazing! :*

Auto & Transport

We’re still driving our 2007 Camry. We had to make some repairs, but it’s still alive and well. It is driving us to Florida for the second time!

We typically spend $3,000 per year on auto expenses.

What’s not included in the spending report

- I

- Income tax is excluded.

- We also exclude blog expenses because they are minor. We do not break even on them. For the time being, this is just a hobby.

- We have no debt, so there is no interest to show for any outstanding balances.

Final thoughts on 2019

In terms of spending, there were no major surprises for us in 2019.

If you have any questions or need more information about any of our spending categories, please leave a comment below.

Could we cut back?

Sure, sure…

Why, though?

We could spend less on food and dining out, but we don’t feel obligated to. We also eat out less frequently, but when we do, we choose restaurants that serve high-quality food. As a result, we spend more money per visit.

Chipotle is our fast-food restaurant.

We are okay with spending more on this category because being FI is about having choices and spending more where it matters to you. Health and food go hand in hand.

Cut the fat where there’s a lack of happiness and spend more on what really matters.

A look ahead

We are fine with spending more on this category because being FI is all about having options and spending more where it matters. Food and health go hand in hand.

Cut the fat where there is a lack of happiness and spend more on what is truly important.