When I hear that people need to spend more than $100,000 a year to be happy, I wonder where their happiness comes from. The more fulfilling our lives are that require fewer material possessions, the happier we are.

We traveled, ate well, danced, and spent a lot of time with family, friends, and each other last year. We were living, and we were living well!

And how do we get to travel so much?

Priorities and choices we make

It all comes down to priorities and the choices we make. If we succumb to peer pressure and feel the need to impress others, we will struggle regardless of our income.

To give you a better picture of our finances, we’re a working couple with middle-class salaries and no children. We are also very good savers. We can live with much less and still be happy. When we splurge, we usually do so on experiences rather than materialistic possessions.

Our formula for happiness

You may be wondering why we chose to make our expenses public. We want to demonstrate that the majority of Americans can live happy lives on much less. That you can reduce your spending, reduce your stress, and be happier overall.

Financially, 2015 was a fantastic year for us. We always say that our expenses should reflect our values and bring us true happiness, and we have done so yet again.

We are aware of our spending because it represents our life energy. One of the primary goals of conscious spending is to achieve financial independence as soon as possible without sacrificing the present.

Our formula for happiness is to live in the present while keeping an eye on the future. After all, how can you shoot in the right direction if you don’t have a target to aim for? Knowing how your money is spent is one way to accomplish this.

Let’s take a look at how we spent our money last year.

Our expenses were divided into three categories: essential, discretionary, and gifts/donations.

What has changed since the 2014 spending report?

To simplify the report, we combined the costs for fuel and insurance on both cars, and we also added a column with our expenses from the previous year.

What remained constant?

We were too lazy to sell the second car, a 2003 Suzuki Aereo, but we’re determined to do so this year!

People, let’s get some comments going at the end of the post. We’d be delighted to hear from you!

Essential Expenses

| Category | 2015 | 2014 | Comments |

| Net Rent | $2,798 | $3,585 | Heat, water, lawn mowing, snow removal, and all repairs are included.:) We subsidize it with the proceeds from our rental property: $13,800 (annual rent) – $11,002 (net rental income) = $2,798 |

| Internet | $520 | $475 | We’re loving our Verizon deal of $29 per month! The total cost for 2015 is higher because it includes a one-time new modem charge. |

| Electricity | $634 | $127 | First full year paying for electricity. |

| Trash | $206 | $41 | First full year paying for trash. |

| Groceries | $5,205 | $3,860 | Ouch! There has been an increase because we are cooking more at home now. Also, what Russian household does not consume Caviar? That Caviar has to be had at least once a year around New Years. Enough with the excuses; let’s try harder this year! |

| Home Supplies | $781 | $878 | We also started using non-toxic personal care products, which can be more expensive. |

| Mobile Phones | $840 | $861 | Cricket offers two prepaid plans for $70 per month. It comes with unlimited minutes, texting, and 2.5 gigabytes of data. |

| Auto Insurances | $1,039 | $1,248 | Insurance on two used cars (2007 Toyota Camry & 2003 Suzuki Aerio). |

| Auto Fuel | $844 | $1,703 | It’s much lower than in 2014 now that we live 2 miles from work! |

| Services & Parts, Registrations, Other | $304 | $340 | When the commute to work is so short, few repairs are required. |

| Total | $13,171 | $13,118 | This is just a slight increase from last year’s spending in the essential category. |

In 2015, we spent $13,171. That is 33 percent of our total spending on essential goods and services.

Homeownership vs. Renting

In the personal finance community, the debate over whether to rent or buy is never-ending. Depending on your circumstances, one may be more advantageous than the other. You only need to do the math.

For several reasons, having a rental property rather than owning a home is more advantageous to us right now, mobility being one of them.

Renting is not a waste of money as long as you invest the remainder of the income that could have gone towards a mortgage and the costs of home maintenance.

Paula Pant at Afford Anything has a great article comparing both: Renting is Throwing Money Away… Right?

Discretionary Expenses

| Category | 2015 | 2014 | Comments |

| Health Insurance | $1,066 | $780 | Employer-sponsored – for both |

| Dental Insurance | $312 | $208 | Employer-sponsored – for both |

| Renter’s/Umbrella Insurance | $196 | $246 | Those NY bridges are so expensive!!! |

| Toll Fees | $275 | $303 | |

| Parking | $49 | $47 | |

| Public Transportation | $157 | $48 | |

| Dry Cleaning | $69 | $61 | |

| Shipping/Office supplies | $37 | $90 | |

| Alcohol & Bars | $1,547 | $1,843 | We ended up cutting back a bit. 2016 is all about reducing toxins in our lives, so we should see a reduction in alcohol consumption as well. |

| Coffee Shops | $117 | $190 | |

| Restaurants | $2,920 | $4,527 | Living in the suburbs or the boonies has its advantages, such as being less tempted to visit our favorite restaurants in the city. While grocery prices increased for the year, restaurant prices decreased. |

| Lunch at Work | $530 | $840 | |

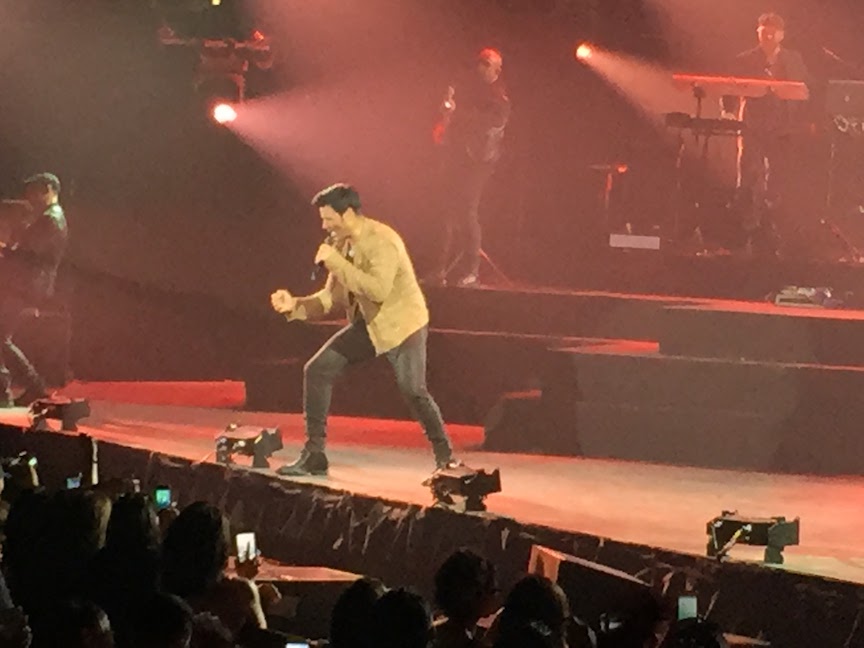

| Entertainment | $914 | $1,062 | We went to a few concerts, shows, and movie theaters, and we have Netflix and Dramafever subscriptions for streaming. |

| Education | $0 | $2 | That’s not bad for lots of book reading! We love that local library! |

| Fees, Interest & Bank Charges | $0 | $0 | |

| Health & Fitness | $935 | $421 | It includes work gym membership. |

| Home Furnishings | $852 | $3,132 | |

| Personal Care | $689 | $908 | |

| Pets | $447 | $206 | Tatiana’s insistence on higher-quality cat food for Pushok will keep us working longer than necessary! |

| Shopping | $1,528 | $2,287 | It includes $209 for a car stereo and installation kit on the Camry, which we installed ourselves. |

| Travel | $6,269 | $6,548 | We did no exotic travel during the year. We visited the Dominican Republic and Florida several times. This year, we’re interested in travel hacking. |

| Total | $18,909 | $23,749 |

Last year, we spent $18,909 on discretionary spending. That equates to 46% of our total spending. Although these expenses were not required, the majority of them added to our happiness.

The return on extra purchases diminishes over time and can cause more stress than anything else. There may be many ‘wants’ in this category that people mistake for ‘needs.’ The important thing to remember here is to avoid spending money you don’t have.

Entertainment

We love Latin music concerts and have seen two this year: Chayanne’s En Todo Estare Tour and Ricky Martin’s One World Tour, which is now making its way to Latin America.

Both concerts were held at Atlantic City’s Boardwalk Hall. In comparison to larger venues such as Madison Square Garden, the venue is medium-sized and very cozy. We only sat down for a slow jam during Ricky’s concert and danced the rest of the time. Wisin opened the show before joining Ricky on stage for Adrenalina (sube la adrenalina!).

Fees, Interest and Bank Charges

There were no interest charges here. We live debt free and intend to stay that way.

In 2015, our total living expenses (essential and discretionary) were $32,080.

Gifts and Donations

This one means a lot to us. Last year, we gave away $8,802 in gifts, or 21% of our total expenses. We’re grateful to be at a point in our lives where we can make a difference by helping others.

Nobody gets anywhere on their own. We got here because others helped us along the way. Our parents made significant sacrifices in order for us to receive an education. A large portion of this money will be used to help them, with the remainder going to charitable causes and a few thoughtful gifts to friends and family.

Thankfully, we were able to convince everyone to forego excessive gift exchanges for birthdays and holidays in favor of spending time with our loved ones.

Drum roll, please… our new projected FI date!

When we released our first annual spending report in March 2015, our projected FI date was March 2019. Our new FI date is November 2018, according to our new projections. Yay! We’re doing better than expected and hoping to get there sooner.

The stock market can delay or advance our FI date, but it cannot delay our early retirement plans because we are not investing in the market the reserves that we will require immediately after early retirement.

Nice breakdown! I was just working on our numbers, and it looks like our spending is pretty close to yours. Though we don’t have subsidized housing 😉

LOL. Including the rental income as part of that equation makes it feel worthwhile when I get a call to repair something at someone else’s apartment instead of mine!

I can’t wait to see your numbers. Thanks for stopping by.

Great article! Thanks for the share. Now we will have to strive to reach that amount as well 🙂

Hi,

The key is to track your spending. You’ll be eventually get to a “happy number” as you become aware of where your money is being spent. Thanks for reading!

117% increase for el azaroso.. forget about Social Security and COLA increases, that welfare cat lives the high life in the Enchumbao household XD.

But seriously now, thanks for sharing. This is all very encouraging to all of us on the FI pursuit to compare notes and see how we are doing!

Wow, I didn’t even realize what a huge increase that was! That conniving azaroso already eats better than me. Watch him hint at getting medicaid next year!

You’re welcome. It’s a fun post to put together because as we put down every line item, it makes us really analyze them. By the time we’re ready to pull the plug on the 9to5s we’ll be able to predict with extreme accuracy how the spending will go. Thanks for commenting!