Welcome to the monthly update of our journey to financial independence, where we report on the progress of our FI tree, aka Freedom Fund. Our mangoes are almost ripe and we’re projecting to reach our goal by July 2017. This means that we’ll have enough investments to live off of without ever having to work again to pay for living expenses.

We’ll consider ourselves financially independent when our Freedom Fund is able to support our lifestyle indefinitely. Our Freedom Fund is comprised of mutual fund investments, short-term reserves, and a real estate property.

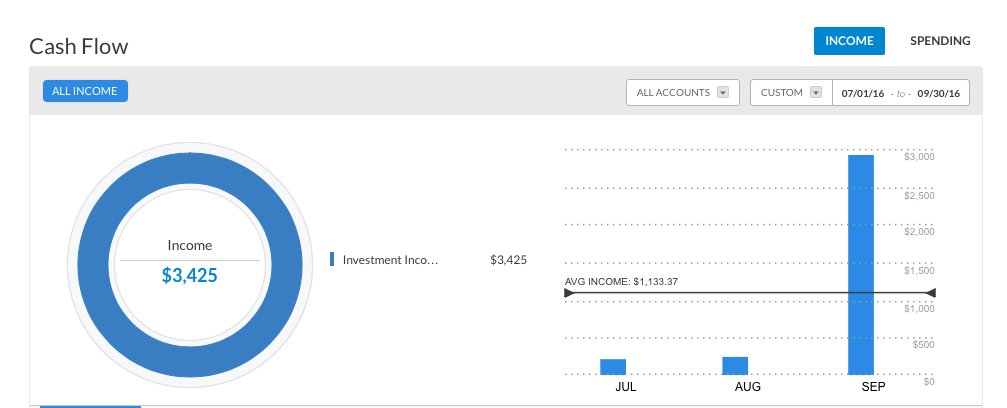

Quarterly Earnings Report

We look forward to the end of the quarter because we get to collect our dividends. These are the fruits of our labor. Our income for the quarter was $3,425. We earned $2,743 in the third quarter of 2015.

This represents a 25% increase over the previous year. Aside from our efforts to save, some of that increase can be attributed to a more aggressive asset allocation aligned with our long-term goals.

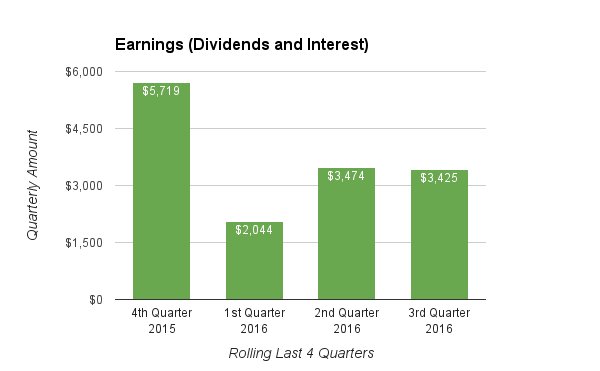

Our target dividend amount is $17,500 per year. Our total earnings for the previous four quarters were $14,662. (see graph below). We are $2,838 short of our dividend income target!

Freedom Fund Progress

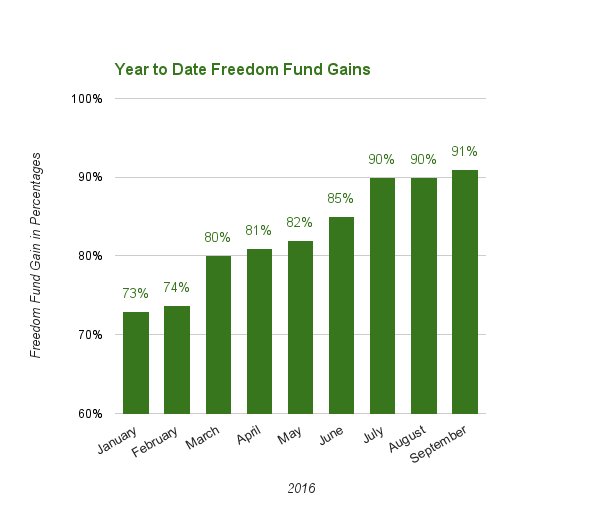

Percentage of Freedom Fund reached in September

In September, we had a high-spending month. Part of it was due to a Colorado trip we took. School taxes were also due for the rental property.

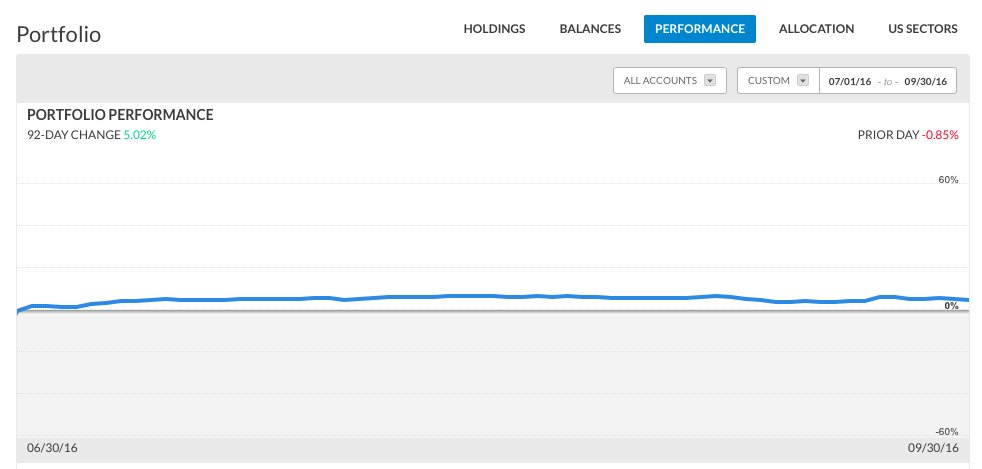

These factors prevented our net worth from increasing as usual. Our investments suffered another minor loss in the market for the month, but the quarter overall performance was satisfactory, returning 5%.

Our Freedom Fund increased to 91 percent from 90 percent the previous month. Our investments can cover up to $32,185 in annual expenses. That puts us $2,815 short of our $35,000 annual income goal!

Year-to-date gains

We’re nearing the end of our Freedom Fund savings journey. Given the prospect of lower market returns on the horizon, gaining that final 10% could be both exciting and challenging. We cannot predict or control market movements, but we can control our savings and investment decisions.

My biggest question right now is: if we enter a bear market and remain stuck in the ’90s, or even drop into the ’80s or even ’70s for an extended period of time, when do we stop contributing to the Freedom Fund and shift our focus to other financial goals, such as saving for big short-term purchases?

We’ll just have to wait and see what happens.

What were your monthly financial goals? Have you met them?

Risk disclosure: All investing involves risk, including the possible loss of principal. The material contained on this website is for discussion purposes only and should not be construed as financial advice.

To help answer the question you have, if the market drops to 70%, I think it would be prudent to continue investing as to allow you a security buffer or extra funds to allow you to give to charity / Family. Giving back should be just as important after reaching a great milestone. Also buying stocks on sale is icing on the cake. Good luck in the 4th quarter.

Yes, we’ll probably continue investing a little more than planned and just put some cash on the side once we have a retirement date. The cash on the side is not in fear of market drops but to cover short-term expenses that we’re planning for. I’ve never been in this situation, since the last time we had the recession I was paying off debt and changing my life behaviors. If there was a recession now, without any debt to pay off, I think we’d cut our discretionary expenses by a big chunk and invest even more than usual in the market.

As far as donations/contributions, we’re big on giving back and helping our parents so we’ll put some aside for that as well. It does make you feel good to be able to give back. Thanks for the comment and tip!