Welcome to part two of our post on bidding on the neighborhood zoo in an online auction. Last week, we introduced the story and what it took us to decide to join the bidding war online.

The lot we bid on has 5-1/2 acres of land. Part 1 of this 2-part series also showed you the auction results as the bid price approached $150,000.

Please read the first post if you’d like to learn more about the crucial factors that influenced our decision to place a bid on the lot. We left you hanging last week just as the bidding war between bidders A and C was heating up. That was not nice, huh?

Don’t you worry, you can finally see how the entire bidding went down. In summary of last week’s post, bidders B and D left the race a little early. Hopefully, that wasn’t one of us! How far were the remaining two bidders willing to take it?

Here’s a look at the entire bidding war.

| Bidder | Bid |

|---|---|

| Opening bid | $6,641.12 |

| A | $71,000.00 |

| B | $81,000.00 |

| A | $81,100.00 |

| C | $82,000.00 |

| A | $82,100.00 |

| D | $87,000.00 |

| A | $87,100.00 |

| B | $87,200.00 |

| A | $87,300.00 |

| C | $88,100.00 |

| A | $88,200.00 |

| B | $88,400.00 |

| A | $88,500.00 |

| D | $90,000.00 |

| A | $90,100.00 |

| D | $93,000.00 |

| A | $93,100.00 |

| C | $94,200.00 |

| A | $94,300.00 |

| D | $95,000.00 |

| A | $95,100.00 |

| C | $97,200.00 |

| A | $97,300.00 |

| B | $97,400.00 |

| A | $97,500.00 |

| D | $98,000.00 |

| A | $98,100.00 |

| C | $100,200.00 |

| A | $100,300.00 |

| D | $104,000.00 |

| A | $104,100.00 |

| C | $105,900.00 |

| A | $106,000.00 |

| D | $109,000.00 |

| A | $109,100.00 |

| D | $110,000.00 |

| A | $110,100.00 |

| C | $110,200.00 |

| A | $110,300.00 |

| D | $112,000.00 |

| A | $112,100.00 |

| C | $112,200.00 |

| A | $112,300.00 |

| D | $115,500.00 |

| A | $115,600.00 |

| C | $117,200.00 |

| A | $117,300.00 |

| D | $121,000.00 |

| A | $121,100.00 |

| C | $122,300.00 |

| A | $122,400.00 |

| D | $125,000.00 |

| A | $125,100.00 |

| D | $126,000.00 |

| A | $126,100.00 |

| C | $127,200.00 |

| A | $127,300.00 |

| C | $129,200.00 |

| A | $129,300.00 |

| C | $131,200.00 |

| A | $131,300.00 |

| D | $133,000.00 |

| A | $133,100.00 |

| C | $134,200.00 |

| A | $134,300.00 |

| C | $135,200.00 |

| A | $135,300.00 |

| C | $137,200.00 |

| A | $137,300.00 |

| C | $139,000.00 |

| A | $139,100.00 |

| C | $141,200.00 |

| A | $141,300.00 |

| C | $142,200.00 |

| A | $142,300.00 |

| C | $143,200.00 |

| A | $143,300.00 |

| C | $145,100.00 |

| A | $145,200.00 |

| C | $147,100.00 |

| A | $147,200.00 |

| C | $149,100.00 |

| A | $149,200.00 |

| C | $150,100.00 |

| A | $150,200.00 |

| C | $152,200.00 |

| A | $152,300.00 |

| C | $153,100.00 |

| A | $153,200.00 |

| C | $155,200.00 |

| A | $155,300.00 |

| C | $156,100.00 |

| A | $156,200.00 |

| C | $157,200.00 |

| A | $157,300.00 |

| C | $160,100.00 |

| A | $160,200.00 |

| C | $161,200.00 |

| A | $161,300.00 |

| C | $162,100.00 |

| A | $162,200.00 |

| C | $163,200.00 |

| A | $163,300.00 |

| C | $165,200.00 |

| A | $165,300.00 |

| C | $166,200.00 |

| A | $166,300.00 |

| Auction is over. |

After reaching $166,300, bidder C did not place another bid for a minute, and bidder A won the bid!

Is this a happy moment, or are we merely bystanders at this point?

So, did we win???

In terms of placing our bid, since this was our first time taking part in an online auction, we placed an autobid and the computer automatically bid in $100 increments. We also didn’t want any computer glitches to prevent us from bidding.

In fact, we were having connection issues that week, and when I woke up the morning of the auction, I had to unplug the router to reconnect to the internet. If that didn’t work, I was prepared to go to a cafe for WIFI so I wouldn’t miss the live bidding.

Can you tell which bidder we are by now? 🤨

So, ladies and gentlemen, after a week of intense research, preparation, and 23 nerve-racking minutes of online bidding, we are pleased to announce that we won the bid!

We did it!!!

Yes, we’ve now added 5-½ acres of a city lot to our real estate portfolio.

How much were we willing to pay?

Based on our conservative estimated value of $250,000, how much were we willing to pay for the lot?

The whole point of an auction is to get it for a ridiculously low price. We don’t intend to flip it, so we can afford to pay a higher price than someone looking to make a quick buck.

Since we’re very flexible on how we want to use this property, we were willing to pay $200,000, or 80% of the value we had in mind. So we let the system bid for us with a maximum bid of $200,000.

It’s been over a month, and we still can’t believe we own that lot.

Actual value

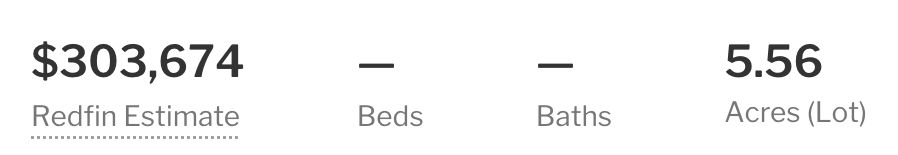

In lieu of a formal appraisal, I wanted to get a better idea of the value of the land. I had no idea Redfin could provide price estimates for vacant lots. It was a pleasant surprise when I found out you could get those estimates from them as well.

We rely on Redfin estimates for our monthly net worth updates on our real estate assets. I find that they are more accurate at estimating the value of our real estate assets than other applications.

So I entered our lot information, and the estimated value is $303,674 based on recent sales.

$303,674!

OMG, that’s a lot more than we expected. 🙀

The impact on our net worth

So we ended up paying 55% of the current market value of $303,674.

With this purchase, we’ve added $136,182 to our net worth!

$303,674 (actual value) – $167,492 (final price with fees) = $136,182 (equity)

Real estate has kept our net worth from plummeting as a result of stock and bond market declines. First, because we kept our rental property and purchased our home in 2020 to avoid being priced out of the market, and second, because we added this lot to our portfolio.

Real estate market is local

It’s amazing how things have worked out. We didn’t expect to make a purchase in such a short period of time, but opportunity favors the prepared. We’d been looking for real estate to buy for over a year, so when this deal came knocking, we were familiar with the local real estate market.

Since the real estate market is so local, knowing your market is critical. I can easily estimate the value, potential, and living conditions of properties in our area, but it’s much more difficult in an area I’m unfamiliar with.

The worst part about this area is finding homes on oversized lots. For instance, we wanted to find a house with an acre lot when we were looking to buy one here in Florida so that we could have a lovely garden and plant fruit trees. I looked through hundreds of listings and we only found one home with that much acreage in the heart of the city during that time. That house was overpriced, and it was in and out of the market several times, probably because it didn’t sell at a high price. Since the majority of the homes in this area are on 1/4-acre lots, we settled for a quarter-acre lot. Therefore, a 5-1/2 acre lot in the middle of the city is very uncommon.

Final thoughts

So now we own a new asset. More exciting projects are on the way as a result of this purchase. We’re going to branch out into new areas, such as residential construction. Although we did not go into detail about best and worst case scenarios, we did take some precautions to reduce risk.

I think that the worst-case scenario is that we decide to do nothing with it and sell it during a real estate market downturn. I don’t see the real estate market cooling by 45%, which is what we’d see in order to lose money if we had to sell quickly. I’m not saying that such a big downturn can’t happen, but by buying so low, we can protect ourselves from losses better.

Besides, it’s not so much that real estate is worth so much more than it was a few years ago as it is that inflation has devalued the dollar and other world currencies and made everything else much more expensive. This housing market has changed significantly compared to 15 years ago, when inflation was low. I can see prices stabilizing, but not to the extent of the 2008 housing crash.

Historical Inflation Rates: 2007-2021

| Year | Annual Average |

| 2007 | 2.8 |

| 2008 | 3.8 |

| 2009 | -0.4 |

| 2010 | 1.6 |

| 2011 | 3.2 |

| 2012 | 2.1 |

| 2013 | 1.5 |

| 2014 | 1.6 |

| 2015 | 0.1 |

| 2016 | 1.3 |

| 2017 | 2.1 |

| 2018 | 2.4 |

| 2019 | 1.8 |

| 2020 | 1.2 |

| 2021 | 4.7 |

| 2022 | Muy caliente! |

There are many best-case scenarios that we can pursue, and a few that we are willing to move forward with. One thing is certain: we are very pleased with the possibilities and are confident that we will profit from them all. But wait, we already made a profit at the point of purchase. Everything else is gravy. 😊

We have many plans for this property, which we will discuss as they progress. We are currently working with a lawyer to quiet the title. That process takes about three months, so by the end of the year, we should be ready to rock and roll!

We’ve met our goal of adding more land to our portfolio. Stay tuned for the next steps. Until next time, financial freedom warriors.

Congratulations on your purchase! This is an awesome accomplishment and huge step forward. What a win!

Thank you! Sometimes you just don’t know what might come your way by simply mowing your front lawn! 😉

Congratulations!!! Looking forward to seeing what you have planned for it!

Thank you! Yeah, it’s very exciting to see how it will unfold over the next few years.