Things are getting real. We’re getting close to our early retirement year!

And as we move closer to our target, we continue to shift our assets to meet our future needs. When it comes to investing, our goal is to keep things simple and we try not to ask too much from our retirement assets: Only to pay for our living expenses, forever. The money works for us so that we can fully concentrate on things that we care about.

We’ve been writing about our asset allocation since we started blogging and it’s just amazing how much happens in one year. One thing is for sure, we keep moving forward and taking gigantic steps. For every year that we work, we’re adding another 4-5 years of living expenses to our assets, without accounting for future returns.

However, as our life plans change, so does our asset allocation. Our asset allocation reflects our goals and by knowing that there’s a purpose behind our decisions, we feel comfortable no matter where the market is heading.

As we approach early retirement, some of the questions that come to mind when it comes to asset allocation are…

- How would we deal with a sequence of returns risk?

- How many years of our portfolio would we keep in cash and bonds?

I believe we already have answers to these questions.

Definition of a sequence of returns risk

Since most of us here are not investment geeks, let’s get some definitions out in the open. A sequence of returns risk is when you start withdrawing from your portfolio and receive lower or negative returns during your first years of retirement. The biggest risk with this is that you could run out of money prematurely. ChooseFI has an excellent podcast with Big ERN explaining a sequence of returns risk and how to manage it.

We’re concerned about a sequence of returns risk because we’re still at the tail of the bull market. We just don’t know how long that tail is and we’re not trying to guess. If we are patient enough to stick to this deadline, we have two more years before we retire, and we might be facing a correction or the beginning of a bear market by then.

Who knows? Maybe the bull market will continue beyond that. I don’t really care because we’re covered. We certainly don’t lose sleep over this. As a matter of fact, nothing keeps me up at night. The excitement just wakes me up too early! Nothing excites me more than getting up and having the first hour or two to ourselves.

A common-sense approach to our asset allocation

I approach our asset allocation with common sense. For example, our rule is that we don’t put money in the market that we need within five years. That been said, our allocation needs to include five years of living expenses in bonds/cash.

Another figure that we’re keeping in bonds/cash is the money that we’ll be using three years from now to buy a house, aka Nuestra Casa Fund.

We feel comfortable keeping no more than five years in bonds because we can stretch our money further in bad times for the following reasons:

- We don’t have any debt.

- Our plan is to have a paid-off house. Mortgage? No, thank you! Big ERN also plans on not having a mortgage in early retirement, so we’re in good company. 😉

- There’s a huge gap between our essential and discretionary expenses. Cutting spending when necessary won’t be disastrous to our lives.

- We know how to make money and can find meaningful work if we want to reduce our future withdrawals even further.

All of these will also help us address sequence of returns risk.

Side note: I asked two coworkers that are retiring next year if they knew what sequence of returns risk means and they didn’t have a clue. Are we, future FIRE people, too worried about stuff like this? I guess we worry more because we are more knowledgeable about investments than the average. As a result, we want to have all of our i’s dotted and t’s crossed.

I also realize that things will be just fine, so we’ll take the plunge when the time comes. Why worry about carrying so many parachutes when, in the end, we only need two working ones?

Our entire investment portfolio allocation

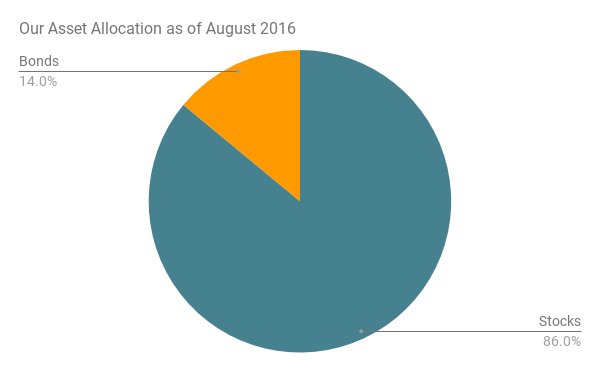

The past: last year’s asset allocation

This is where we stood as of August 2016, that time when we baked the perfect pie and ate it! That pie was so good that it’s gone now. Since then, I’ve learned that there’s no such thing as a perfect asset allocation, just like there’s no such thing as a perfect life. As goals evolve, or circumstances change, so does our long-term asset allocation. We can’t just set an allocation and hope that it will be appropriate for us for years to come.

We had very little in bonds as of August 2016 because we weren’t saving for the house yet. We also thought that there would be a market correction by now. For us now, fear trumps greed, so we’ve become less greedy. Since there hasn’t been a correction and stocks seem to be expensive by most metrics, we decided to make the savings for the house our first priority with our after-tax income.

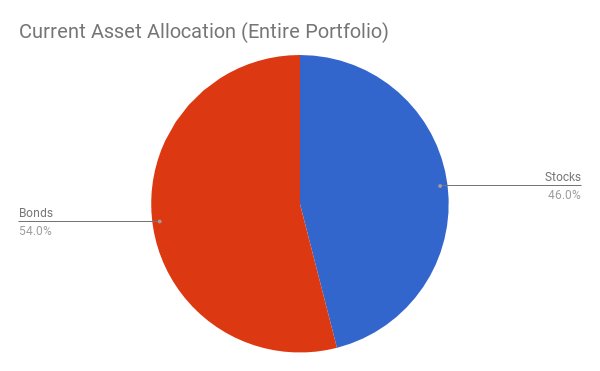

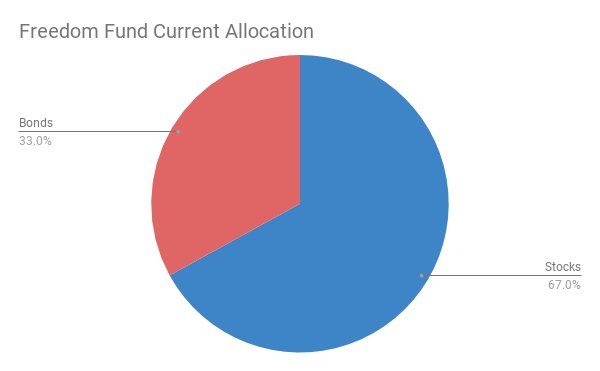

The present: our current asset allocation

This is where we stand as of October 2017.

Our percentage of bonds is higher than we want it to be, but the dollar amount is just about right for our goal. We’ve been buying bonds to save for the house. We also shifted to a more conservative asset allocation over the summer to equate five years of living expenses in bonds/cash, as if we were to retire today. Because, who knows? We might feel bold enough to retire today.

What can I say? Thirty-two-year-old wifey is itching to retire at any point now and travel the world for months at a time. I keep adding fuel to that FIRE! 😉

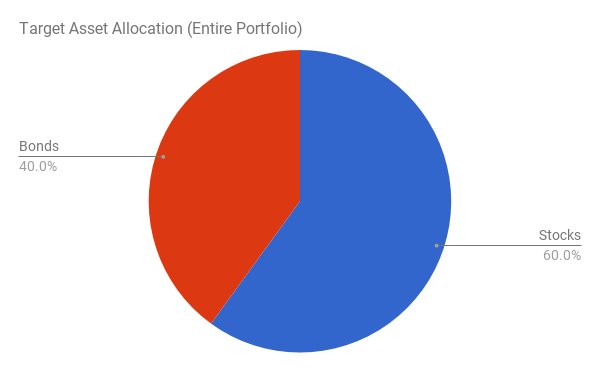

The future: our target asset allocation

Since we want to have five years of living expenses and the house funds in bonds and cash, our entire portfolio target asset allocation coincidentally comes out to a 60/40 allocation between both asset classes.

Our asset allocation should look something like this two years from now as we continue to invest more in stock funds.

This is a high-level explanation of our allocation. For simplicity, stocks include alternatives, such as REITs, and bonds include cash. You can click here to review investing portfolio allocation models. Rental property is not included in these calculations.

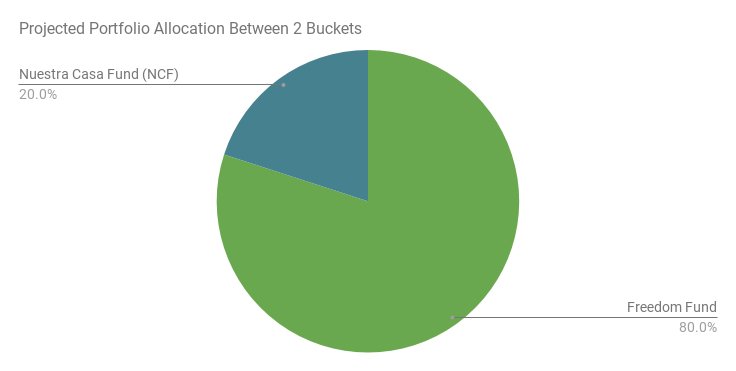

A breakdown of our investment portfolio

The investment portfolio we just described is composed of two buckets: the Freedom Fund and the Nuestra Casa Fund.

Bucket 1 – The Freedom Fund (80% projected portfolio allocation)

The Freedom Fund will cover our living expenses (essential and discretionary) in retirement. We’re keeping a minimum of five years of living expenses in bonds/cash and the rest in stocks. We’re still debating how much to keep in cash, maybe a year? I think that we can be leaner since we have cash in the NCF and can use it in case of a big emergency. This would be a last resort, but it’s good to know that it’s available to us.

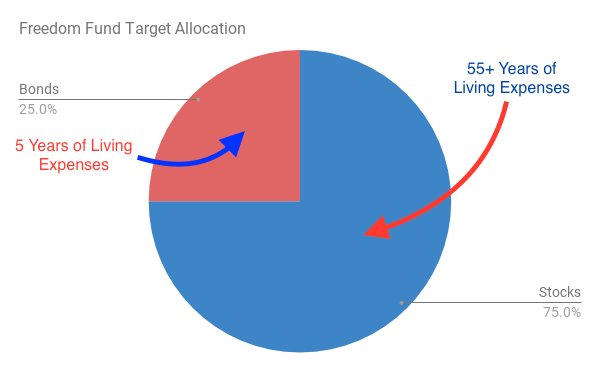

Freedom Fund target asset allocation

Five years of living expenses equates to 25% bonds/cash in our Freedom Fund portfolio.

Freedom Fund current asset allocation

We’ll continue to max out our retirement accounts until we retire. Since we have the number of bonds we need, any new contributions to the 401(k)s are now going to stock funds. This should slowly bring up the stock funds ratio to 75%. Future investments will have decades to grow, so we’re not concerned about the impact of current market valuations.

Freedom Fund asset class allocation

| Freedom Fund Asset Class Allocation | ||

|---|---|---|

| Class | Current Allocation | Target Allocation |

| Cash | 8% | 5% |

| International Bonds | 3% | 4% |

| U.S. Bonds | 22% | 16% |

| International Stocks | 19% | 20% |

| U.S. Stocks | 43% | 45% |

| Alternatives (REITs, Other) | 5% | 10% |

Cash

Our goal is to have 1-2 years of living expenses in cash. I’m leaning towards having one for the reasons mentioned earlier in the article.

International exposure

We feel very positive about the strength of U.S. companies, but we also like to invest in other great companies outside of the U.S., like Nestle, Samsung, Toyota, Honda, Canon, and America Movil, just to name a few.

Telecommunication services continue to grow exponentially in markets like Latin America as they’re not as saturated as in the U.S. The world still needs more internet, and companies like Samsung and America Movil are teaming up to provide services to these growing markets. America Movil is a venture of Carlos Slim. We want a piece of that!

For diversification purposes, we try to keep 30% of our stock exposure and 20% of our bond exposure to international.

U.S. stocks allocation

We’ll gradually increase our U.S. stock allocation over the next two years.

REITs

We’re slowly building up our REITs allocation by buying them in our Roth IRAs annually during the first quarter. That’s our best available investment vehicle for REITs so that we don’t get taxed on the dividends as ordinary income. Our goal is to reach a 10% allocation. With only two more years to buy, we’re not going to reach the desired 10% allocation.

How can we reach the 10% allocation? After we retire, we can convert part of our 401(k)s into IRAs and will be able to buy more REITs then. We’ll invest the money in stocks until that time comes.

Bucket 2 – The Nuestra Casa Fund (20% projected portfolio allocation)

These are the funds to purchase our home. We allocate this bucket to bonds and cash. The allocation for the NCF is 80% bonds and 20% cash. We talked more about that here.

After we’re done saving for the house, hopefully by the end of next summer, we’ll continue to cushion our Freedom Fund. Even though we reached FI, we’d like to have more funds in our taxable account to comfortably bridge the gap until we can access our 401(k)s without penalties. We could have more funds available by getting a mortgage, but that’s not an option that we want to pursue.

Our long-term approach

We continue to move full steam ahead by investing in both portfolio buckets. We plan to always keep five years of living expenses in bonds/cash which will be close to a 75/25 allocation of stocks and bonds in our Freedom Fund at the time of retirement.

Our long-term approach is for moderate growth. We’ll continue to grow our portfolio, but also seek to preserve capital.

I left the rental property out of this report, but we plan on selling it in the future and adding the proceeds to the Freedom Fund. Why sell? My biggest reason is that I’ve been managing this property since 2004 and I’m ready to take a break on that front. And yes, we could get a property manager, but I want to be free from all the hustle that comes with that as well.

I’m shooting for complete freedom from active income activities. 🙂 We’re going for what makes us truly happy. After early retirement, it will no longer be about making more money. Heck, I don’t even think it’s about making more money right now. Our mindsets are quickly evolving and it’s becoming more and more about optimizing our happiness.

Risk disclosure: All investing involves risk, including the possible loss of principal. The material contained on this website is for discussion purposes only and should not be misconstrued as financial advice.

It’s always interesting to see what other people are doing with their investments! We just checked our allocation the other day and we’re coming in at around 20% bonds and 80% stocks. I think we’re happy with that for now.

I keep thinking about picking up a place to rent or flip, but I’m enjoying doing all the fun stuff too much to try making more money. Stocks and bonds are much easier to maintain 🙂

80/20 sounds like a good allocation for your situation. I think that after we retire and access our situation we’ll get closer to an 80/20 from a 75/25 (not including house funds).

I’ve been managing the property for so long that I want to know how it feels to not have the responsibility. RE is not 100% passive unless you hire a property manager. It hasn’t been that bad for us lately but every now and then you get the leak from hell that no matter how much you fix it, keeps coming back!

I’d like to try RE crowdfunding sites in the future but will wait until there’s a shakeout so that we can invest with solid companies. That’s at least 2-3 years down the line though. Thanks for stopping by!