Welcome to the monthly update of our house fund goal, Nuestra Casa Fund (NCF). Our NCF goal is to save enough before we retire early, to fully fund our home purchase.

We’ll measure our progress by providing a monthly update against our benchmark. Our number one rule: Never, nunca, touch this money unless it’s for the house.

We’ll achieve our goal by continuing to work at our full-time jobs. As far as investing, our plan of action is to continue maxing out retirement accounts, while saving for the house and fulfilling the rest of the buckets we deem necessary to retire early.

Change is in the air

One big decision that we made after we returned from the DR in June was that we’ll be staying in the U.S. after retirement. We’ll travel for months at a time internationally, but we want to be based here. (At least, that’s the current thinking.)

Where in the U.S. do we want to settle?

We don’t know yet and we’ll continue to explore at our leisure. One thing for sure is that we want to be able to grow some tropical fruits and veggies, hence, we see no freezing temperatures in our horizon. 😉

Timeline

We’re projecting to retire in about two years and plan to buy a house about a year after we retire.

Here are three actions we took in the Nuestra Casa Fund last month:

- We increased the target amount that we need to save.

- We allocated more funds to the account.

- And we added bond funds to our goal.

Where we stood as of last month

If you recall from last month, we almost reached half of our goal. We had 49% of our funds saved.

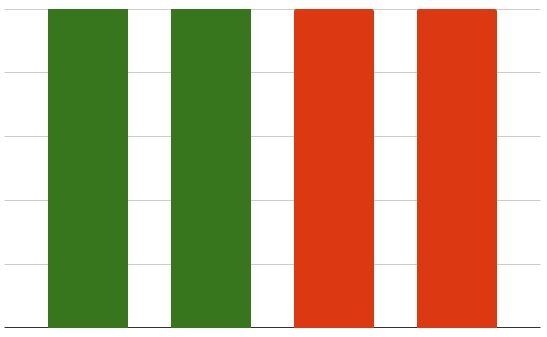

Let’s illustrate what that looks like. The 4 bars below represent all the money that we originally planned to save for the home purchase.

As you can see from the chart above, we needed 4 bars to buy our home. The green represents what we accumulated and the red is what we still needed to save.

Increasing the house purchase target amount

As we continue to search homes online to get an idea of where the real estate market is heading, we realize that we might need a bigger budget to get what we want. That been said, we’ve decided to increase our NCF target amount.

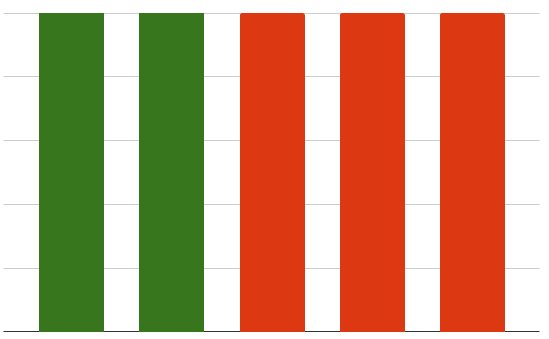

We’re increasing our budget by 25% of our current goal, which means that we need to add another bar.

Ouch! Too much red now. 🙁 Sounds like it’s time to add more working years to our lives.

Good bye, early retirement. Our plan failed.

Not so fast!

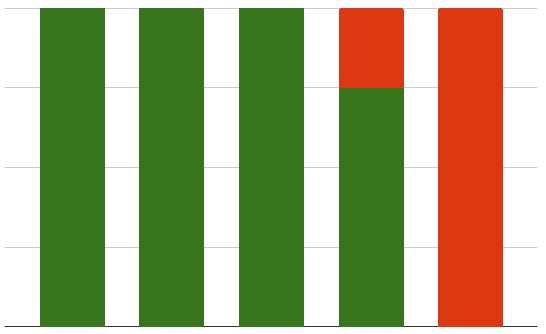

Our timeline will not increase because we are increasing our budget. This year we sold some small caps and high-dividend yield funds in our taxable account. The main reason is that we want to have a more conservative asset allocation and be ready to retire today if we desire. We allocated this money to the NCF. We also had some money in bond funds which we added to this goal as well.

Our progress with the extra funds

With the money we added from our taxable account, we had enough to cover almost two bars! We have met 75% of our new goal by adding these funds.

Investing for the long term pays off

We, as in Tatiana, started investing in the taxable account ten years ago. So some of this money has been working hard for us for at least that long and can go take a little break until we decide where to live.

Given our overall gains in the market since we started investing, you can say that a big chunk of our future home purchase will be funded with gains from the market!

So we’ve increased our target amount, but our investments came to the rescue.

Taking more risks with a portion of the assets

With keeping the timeline flexible, the next question that comes to mind is:

How do we keep inflation from eroding our funds?

I’m okay with having money that we’ll definitely use in a couple of years sitting in a bank account, but if we want to not worry about having to buy in a rush for fear of inflation, then we need to have that money at least keeping up with it.

If the funds are making at least a 3% return, then I won’t feel the obligation to buy a house right after we retire. I’ll be okay with us taking our sweet time finding the right place.

If we were just saving the 20% down payment for a house, we would keep it all in cash. That’s the wise thing to do. Our case is no different from someone trying to save the down payment for a house except that we’re going for 100% self-funding. We have some flexibility and can add a little risk so that our savings can at least keep up with inflation.

A month ago we worried that these funds wouldn’t keep up with inflation since we kept them in a high-yield savings account. That has changed. Since we’re increasing the target amount, we’re going to take a little risk. We can do this because we have options, many options, and flexibility is key to a successful early retirement.

Our new NCF target asset allocation

Since we’ve decided to add some bond funds into the mix, our new target asset allocation for the NCF is 80% bonds and 20% cash versus 100% cash before.

“But bonds are soooo boring!” Well, stocks are way too exciting for this goal. We know that bond funds decrease in value when interest rates go up, but we also know that stocks lose a lot more value when we face a correction or enter a bear market. I’m not saying that we’re about to enter one, but we’re accessing our risk and preparing for various scenarios since we’re so close to retirement.

In times like these we ask ourselves: how much risk are we willing to take on a humongous short-term goal?

Do we invest it in the market knowing that we want this money to be available three years from now? Hell, no.

Imagine if we get greedy and decide to put this money in stock funds now because we want better returns, and the market crashes 2-3 years from now? Our home purchase would have to wait and that could be a very long wait if the market goes through a long recovery period. We don’t want to be in a situation where we have to wait for years once we’re ready to settle in our home. So, why take unnecessary risks?

Also, the new funds that we sold this year already made money for us during this bull market. Our dollars are coming home to safety, just in time to help us achieve our goal of buying our first home. It’s a win, win, win, all around.

Now, let’s see how much we were able to add to the NCF last month.

October NCF Update

Since we allocated more funds to our goal, we’ve shortened the timeline! We expect to meet our goal by August 2018. That’s right, folks, we’re not about to drag this out. We’ll concentrate on getting there by mid-summer.

Below are our September results along with a year-to-date update.

| Year-to-date NCF Update | |||

| Month | Percent of Goal Met | Benchmark | Percent Increase towards 100% |

| January 2017 | 23.9% | 23.9% | This is when we started tracking this goal. |

| February | 25.1% | 26.5% | 1.2% |

| March | 28.5% | 29.2% | 3.4% |

| April | 28.8% | 31.8% | 0.3% |

| May | 30.2% | 34.5% | 1.4% |

| June | 39.1% | 37.1% | 8.9% |

| July | 46.1% | 39.8% | 7% |

| August | 49.1% | 42.4% | 3% |

| September (new target) | 78% | 77.2% | 28.9% |

| October | 79.3% | ||

| November | 81.4% | ||

| December | 83.6% |

Last month we saw an increase of 28.9% towards our march to 100% of funding our goal. We’ve now saved 78% of the funds for our future home purchase. Sweet!

Since we increased our target, we had to reset the benchmark to reflect the change.

We feel confident we can meet our goal by our new target date.

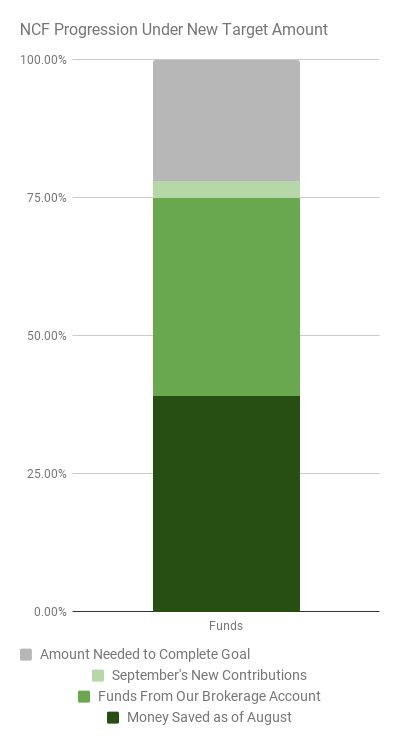

NCF progression under new target amount

So, we threw a whole bunch of numbers your way and while we try to be as clear as possible, it can get confusing, so let’s try to break it down some more.

1. Money saved as of August 2017

Under our new target amount, the money saved as of August (49.1%) became 39% of our new goal amount. If we didn’t have the extra funds in the brokerage account, we would’ve needed to lengthen the timeline.

2. Funds from our brokerage account

This is the amount from the stock funds we sold this year and bond funds we already had in the brokerage account. Since we’re close to retirement, we started to shift to a more conservative asset allocation. We sold some small and mid-caps at the beginning of the year and some high-dividend yield growth funds during the summer.

This money was part of our Freedom Fund. We reached our FI target back in January 2017 but continued to save in our 401(k)s and Roths so the Freedom Fund keeps getting fat. Since we continue to save in pre-tax accounts, we’ll have more than our initial FI target by the time we retire. The proceeds, along with the bond funds, took us all the way to 75% of our new goal.

3. September’s new contributions

Before we added our savings for last month, we were at 75% of our goal. Our September savings added 3% to our fund. We now have 78% of the funds needed.

4. Amount needed to complete goal

We need 22% to accomplish our goal and project to complete it by August 2018.

Final thoughts

By increasing our target, we ensure that we have more than enough to cover our future purchase. We’ll also be more relaxed with our timeline knowing that our NCF has a better chance of staying above inflation. We don’t want to lose to inflation, but we also want most of our principal to be available when we need it.

Our current NCF asset allocation is set to our target allocation of 80% bonds and 20% cash.

That’s it for now, folks. We’re satisfied with these changes and look forward to having a cappuccino in our own backyard in the future. 😉 After all, it’s all about creating awesome experiences with the people we love.