One Life To Live is our quarterly update on how financial independence plays an integral part in fueling our true happiness. We all have one life to live, but are we making the best of it? Are we living in the richest way possible? We hope that our lifestyle answers those questions as we continue to optimize for happiness. Carpe Diem!

Welcome sexy souls,

It’s time for our 4th quarter recap! I feel like the last months of 2017 just came and went. We laid low during the last months of the year and only took a trip to Florida. Now we’re already in February. That’s how fast life goes, so the more reason to make it worthwhile.

Adventures

Sarasota, FL

While we explored several cities in the Tampa area, Sarasota was the highlight of our most recent trip to Florida.

Why?

Because we’re contemplating that area as our early retirement home. We liked what we saw so far and are thinking of first renting in the area after leaving PA.

Have you been to Sarasota? What do you think of the area?

Passive income and expenses

The following is a streamlined report that takes very little time to produce, therefore, giving us time back to get back to living our lives. It stays within our theme of having one life to live and maximizing our time for happiness. What’s included in these reports? At the end of the day, people need food, shelter, mobility, the ability to pay the bills and take care of debt payments. So, these are the expenses that we concentrate on.

Bare-bones expenses

Bare-bones spending for Q4-2017

This is how we spent money on the most basic needs during the fourth quarter.

Main Category | Quarter Amount | 2017 Monthly Average | Comments |

| *Net Rent | $637.41 | $447.24 | |

| Bills & Utilities | $465.09 | $163.82 | |

| Debt Payments | $0 | $0 | |

| Groceries | $1,490.71 | $519.42 | |

| Auto & Transportation | $241.65 | $248.64 | |

| Home Supplies | $162.14 | $62.08 | |

Total | $2,997 | $1,441.19 | Total spent on these in 2017 = $17,294 |

That sums up our bare-bone spending for last quarter. So we stayed below $18k for the year – nothing surprising there. Groceries tend to be higher than what many in the FIRE community spend and we’ll talk more about that on the upcoming annual spending post. You can click here to see our latest annual spending post.

Passive income

Dividends

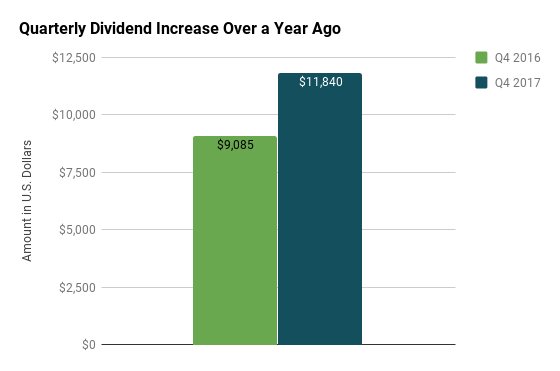

The fourth quarter is the best quarter for dividends. It’s the Christmas gift that keeps on giving! We received $11,840 in dividend income for the fourth quarter. That’s a 30% increase from a year ago. Of course, dividends are just one part of the equation as we like to concentrate on the total returns of our investments.

Passive Income Main Categories

Main Category | Quarter Amount | 2017 Monthly Average |

| Dividends | $11,840 | $2,036 |

| Capital Gains | $0 | $788 |

Total | $11,840 | $2,824 |

Portfolio Returns

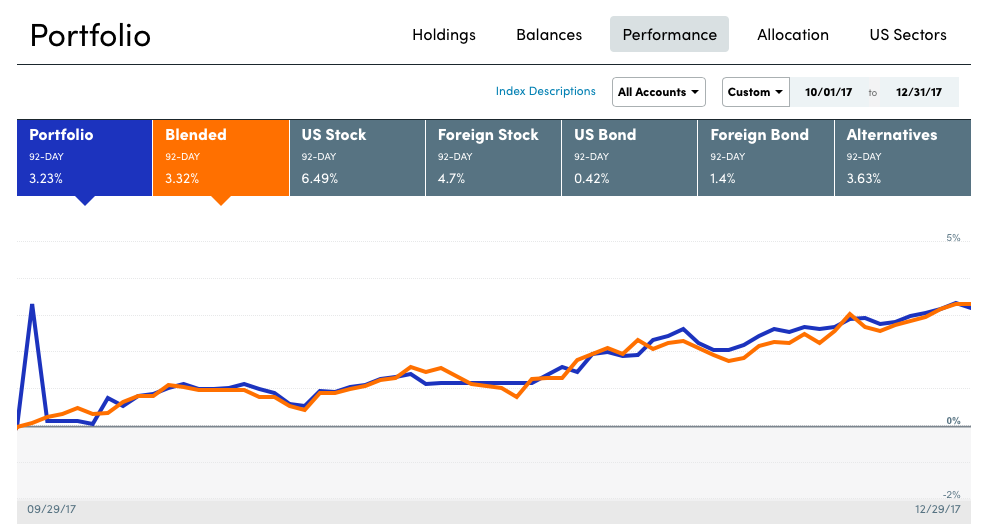

Our entire portfolio, including the house funds (NCF), which are heavily invested in bonds, returned 3.23% for the quarter. We’ll continue to trail the U.S. Stock Market index by a few points. This will change once we settle on a property after retirement and get rid of a big chunk of bonds.

Road to retirement

We recently posted a recap on our FIRE plans. Things are going well and we’re on way to retire by 2020. Man, there’s a long list of to-do’s before we get there, so we’ll be busy by this spring as we start to get rid of stuff.

From the chef’s kitchen

Cooking your own meals is a great way to eat healthy and save money. A great advantage is that you can cook with better ingredients and know what’s going into your food.

Here are some of the dishes we cooked last quarter.

What’s next?

We’d probably make a trip to VA in March for a concert and a little getaway.

Money-wise, we’re in the process of front-loading retirement accounts.

As far as upcoming posts from Enchumbao, I have no idea of what’s coming. This is as organic as it gets. 🙂 We’ll see what we get inspired to write about. Hasta luego and thanks for reading.