When my wife and I first calculated our path to financial independence (FI), we estimated we’d reach our goal in early 2020. Little did we know that this simple act of tracking our net worth would become one of the most crucial steps on our journey to early retirement.

Our Story: From Financial Stress to Freedom

Before discovering the FIRE (Financial Independence, Retire Early) movement, I was drowning in debt while my wife was debt-free. Despite this disparity, we shared a common goal: achieving financial independence. This alignment made it easier for me to tackle my debt and for us to become a united force in our quest for financial freedom.

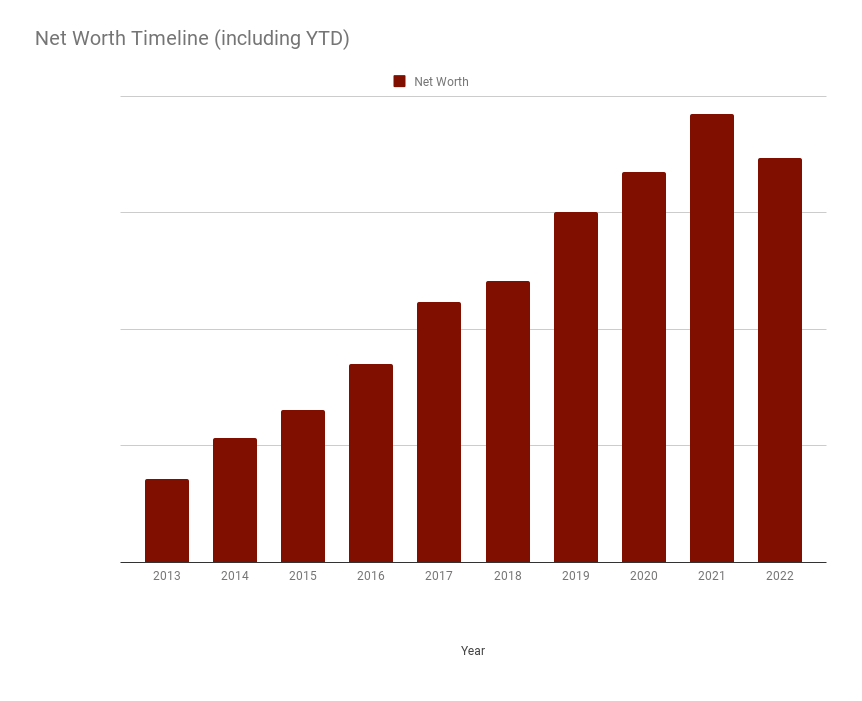

We started tracking our net worth diligently in 2013, the year before we got married. At first, we didn’t have much, but we were determined to grow our wealth. We paid off our car, cut down our spending, and invested as much as we could into our retirement plans.

The Power of Tracking: Our Monthly Ritual

Every month, I would sit down and update our numbers. It was exhilarating to see how close we were getting to our goal of owning our time. This regular check-in kept us motivated and accountable.

Even now, in early retirement, we continue this practice. It’s not just about watching our money grow; it’s a window into the financial world. When I see a decrease in our net worth, it prompts me to investigate:

- Is the stock market entering a bear or bull phase?

- Is the housing market starting to cool?

This awareness helps us make informed decisions about our finances without getting caught up in the daily noise of mainstream media.

Why Net Worth Matters (And How to Calculate It)

Your net worth is simply your assets (savings, investments, property, etc.) minus your liabilities (debt, loans, credit cards, etc.). The formula is:

Assets minus Liabilities = Net Worth

For example:

- If you have a $350,000 house with a $280,000 mortgage, your net worth is $70,000.

- If you have a $23,000 car with a $25,000 loan, $80,000 in student loans, $10,000 in credit card debt, and $20,000 in the bank, your net worth is -$72,000.

Tracking this number over time can help you:

- Get a snapshot of your financial health

- Set realistic financial goals

- Measure your progress

- Stay motivated on your financial journey

The Importance of Diversification: Our Real-Life Example

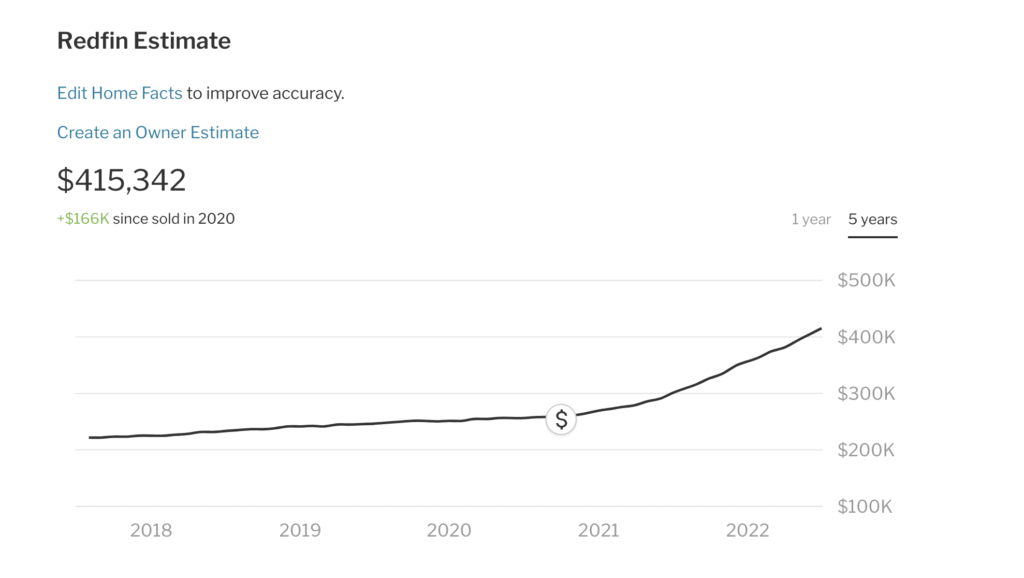

Not all assets rise or fall simultaneously, which is why diversification is crucial. For instance, we purchased our home in 2020. Despite the stock market’s recent downturn, our home’s value has increased by $166,000 since we bought it. This, along with our rental property value, has prevented our net worth from plummeting.

By the time home prices begin to cool, the stock market might recover, or another asset class might rise. That’s the beauty of diversification—it helps smooth out the bumps in your financial journey.

Starting Your Net Worth Tracking Journey

If you’re not already tracking your net worth, we strongly encourage you to start today. Here are some options:

- Use automated tools like Monarch

- Create a simple spreadsheet if you prefer a more hands-on approach

Remember, the key is consistency. Whether you choose to update monthly or quarterly, stick to your schedule.

Closing Thoughts

The Impact on Our Marriage

One of the main reasons people divorce is financial problems. Money is a top marriage stressor. By tracking our net worth together, my wife and I have stayed on the same financial page throughout our journey. It’s helped us set common goals, celebrate our victories, and face challenges as a team.

Our journey from debt to early retirement wasn’t always easy, but tracking our net worth made it clearer and more achievable. It’s not just about the numbers—it’s about the freedom, security, and peace of mind that come with financial awareness and control.