Almost four years into early retirement, I still find myself in awe when reviewing our portfolio income statements. The transition from earning a paycheck to living off investment income felt surreal at first. “Is this for real?” I would wonder, watching money flow into our accounts with minimal effort on our part. Today, I want to share our authentic experience with portfolio income in early retirement, including both the victories and the challenges we’ve faced along the way.

Our Journey to Portfolio Income

When we achieved financial independence in February 2017, we made the decision to continue working for another two years and five months. We finally called it quits eleven months after our daughter Yuna was born, prioritizing family time over additional financial cushioning. Looking back, it was one of the best decisions we’ve ever made.

Our commitment to financial independence is reflected in our growing savings rate over the years. When we first started tracking our savings in 2012, we were setting aside about 45% of our income. Through intentional lifestyle choices and increased financial awareness, we steadily increased this percentage year after year. By 2018-2019, we were consistently saving around 80% of our income. This dramatic increase wasn’t achieved through deprivation, but rather through questioning our spending habits and aligning our expenses with our values. The chart below shows our savings rate progression:

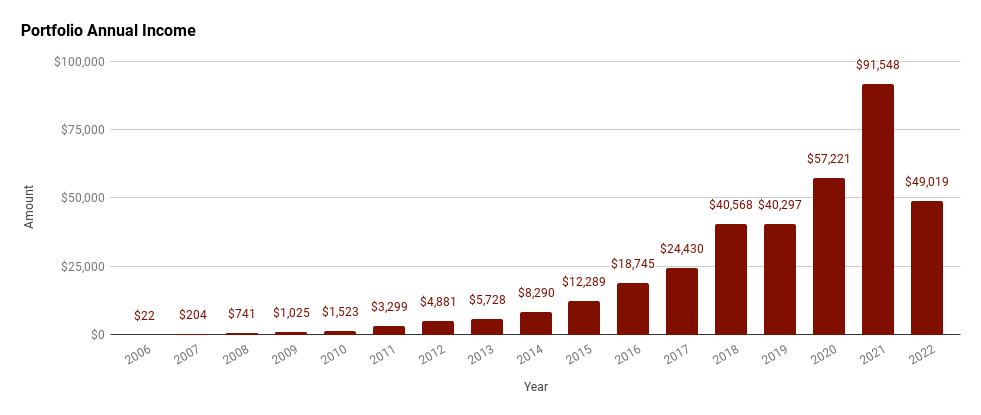

Let me be transparent about our portfolio income journey. In my first year of saving (2006), my dividend income was a mere $22. Yes, you read that right: twenty-two dollars. By 2022, our annual portfolio income had grown to $49,019, including both dividends and capital gains. This growth didn’t happen overnight; it took years of consistent saving and strategic investing.

Breaking Down Our Current Portfolio Income

Our Freedom Fund generates income through three main channels: dividends, interest, and capital gains. Here’s how our income has performed over the past three years:

| Year | Amount |

|---|---|

| 2020 | $57,221 |

| 2021 | $91,548 |

| 2022 | $49,019 |

What’s particularly interesting is the breakdown between dividends and capital gains. In 2022, we received:

- Dividends: $15,443

- Capital Gains: $33,576

- Total: $49,019

This mix of income sources provides some stability while allowing for growth. We’ve intentionally structured our portfolio to balance current income needs with long-term sustainability.

Our Withdrawal Strategy: Beyond the 4% Rule

| Withdrawal Strategy Based on the 4% Rule | ||

|---|---|---|

| Year | Amount | Inflation |

| 2020 | $48,587 | 1.23% |

| 2021 | $49,186 | 4.70% |

| 2022 | $51,497 | 6.5% |

| Total | $149,270 | |

While many in the FIRE community follow the famous 4% rule, we’ve opted for a more conservative CAPE-based withdrawal strategy. This approach typically results in withdrawals closer to 3.25% of our portfolio value, adjusted annually for inflation. Our actual withdrawals have averaged $37,667 annually over the past three years–significantly less than what a 4% rule would suggest.

| Breaking Down Our Withdrawal Rate Options | ||||

|---|---|---|---|---|

| Year | 4% SWR | 3.25% SWR | CAPE-Based SWR | Actual Withdrawal |

| 2020 | $48,587 | $39,477 | $37,818 | $39,499 |

| 2021 | $49,186 | $39,964 | $41,414 | $32,400 |

| 2022 | $51,497 | $41,841 | $41,402 | $41,102 |

| Total | $149,270 | $121,282 | $120,634 | $113,001 |

| Annual AVE | $49,757 | $40,427 | $40,211 | $37,667 |

The reality of early retirement withdrawal strategies is more nuanced than most articles suggest. We’ve discovered that having multiple income streams (including rental property income) provides crucial flexibility. This has allowed us to be more conservative with our portfolio withdrawals during these early years.

Managing Early Retirement Challenges

One significant challenge we face is that most of our funds are in retirement accounts, inaccessible without penalty until age 59½. We’re managing this through careful Roth conversion strategies and maintaining a balance between taxable and tax-advantaged accounts.

Some might question whether we should have saved more in taxable accounts rather than maxing out our 401(k)s. However, considering we were in the 22-25% tax bracket while working and are now in the 10% bracket, the tax arbitrage has worked in our favor, even accounting for potential early withdrawal penalties.

Lessons Learned and Looking Forward

After three years of early retirement, here are our key insights:

- Portfolio income can be more stable than expected, but flexibility is crucial

- A conservative withdrawal rate provides peace of mind

- Tax planning is as important as investment returns

- The psychological transition from saving to spending takes time

- Family time is worth more than an extra year of savings

Looking ahead to 2023, we’re projecting dividend income of around $25,501 before any capital gains distributions. While this might seem low compared to our withdrawal needs, our strategy of reinvesting excess income from previous years provides a valuable buffer.

| Year | Dividends | Capital Gains | Total Income | Withdrawal | Reinvested |

|---|---|---|---|---|---|

| 2020 | $8,221 | $49,000 | $57,221 | $39,499 | $17,722 |

| 2021 | $9,788 | $81,760 | $91,548 | $32,400 | $59,148 |

| 2022 | $15,443 | $33,576 | $49,019 | $41,102 | $7,917 |

| Total | $33,452 | $164,336 | $197,788 | $113,001 | $84,787 |

Making Your Own Path to Financial Independence

Remember, your journey to financial independence will be unique. While our numbers and strategies might not match your situation exactly, the principles remain the same: consistent saving, strategic investing, and thoughtful withdrawal planning.

For those still on the path to financial independence:

- Don’t be discouraged by small initial investment income

- Focus on your savings rate rather than investment returns

- Consider how different account types (taxable vs. retirement) will affect your early retirement strategy

- Plan for flexibility in your withdrawal strategy

For those already retired early:

- Regular review and adjustment of withdrawal strategies is crucial

- Consider multiple income streams to provide flexibility

- Keep tax efficiency in mind when planning withdrawals

- Don’t forget to enjoy the freedom you’ve worked so hard to achieve

Final Thoughts

Our journey into early retirement has validated many of our key financial decisions along the way. The choice to maximize our tax-advantaged accounts, despite early withdrawal considerations, has proven to be strategically sound. Our conservative CAPE-based withdrawal strategy has been particularly valuable, providing peace of mind during periods of market volatility that might otherwise have caused significant stress. The habit of living below our means during our working years wasn’t just about saving money—it created crucial flexibility that we now enjoy in retirement. Perhaps most importantly, our decision to build multiple income streams, including our rental property, has given us valuable options for managing our financial needs.

Remember that perfection can be the enemy of progress when planning for early retirement. We’ve learned that you don’t need to have every potential future challenge solved before making the leap. Our experience has shown that it’s perfectly viable to retire with most of your savings in retirement accounts—the tax implications and access challenges can be navigated successfully. With proper planning, market volatility becomes less intimidating, and the psychological benefits of early retirement often far outweigh any minor financial optimizations you might have missed.

Looking ahead, we certainly face our share of challenges—managing Roth conversions, addressing healthcare costs, and making periodic adjustments to our strategy. However, we’ve come to view these as good problems to have. They represent the challenges of freedom rather than the constraints of traditional employment.

Could we have optimized our portfolio further or accumulated more in taxable accounts? Perhaps. But no amount of additional savings could replace the memories we’ve created or the privilege of being present for our children’s formative years. Financial independence isn’t ultimately about crafting the perfect portfolio—it’s about having enough confidence in your plan to choose time over money. The goal should be to build a strong financial foundation that allows you to invest in what truly matters to you.

Thanks for sharing! Love how in depth in details your article was. I started investing early in my twenties. Without the knowledge I have now, I made the mistake of liquidating my 401K during the 2008 recession. It was a mistake, the penalties alone was terrible. I gained the confidence to start investing again 5 years later. This time I have a better job and I am able to Max out my 401k and IRA. Even seeing the loss I took during the pandemic, I didn’t panic this time and kept investing. Working my way to FIRE is the goal!

Anny

You’re very welcome. Sometimes it’s hard to put it all out there but if that can help others to save and continue on their journey to FIRE, I’m all up for it!

Good job on acknowledging your investment mistakes and no longer panicking in a downturn. You’re still young and have time to FIRE and enjoy more out of life. Keep it up! 🙂