As we wind down another year of our financial independence journey, a significant change is taking place in how we manage our money. With Mint’s unexpected closure, we’ve found ourselves exploring new horizons, ultimately leading us to Monarch Money–a platform that’s revolutionizing how we track our post-FIRE finances.

The End of an Era

Since 2010, Mint has been our constant companion in budgeting and expense tracking. While Empower (formerly Personal Capital) continues to handle our investment analysis beautifully, Mint’s impending closure left a crucial gap in our day-to-day financial management. This void needed filling, and quickly.

Why Monarch Money Won Us Over

After careful consideration, we’ve transitioned to Monarch Money, and the experience has been transformative. As a platform developed by one of Mint’s original team members, Monarch feels like the natural evolution we’ve been waiting for. The interface is intuitive and clean, making financial management feel less like a chore and more like a strategic tool for maintaining our financial independence.

What truly sets Monarch apart is its family-friendly approach. Each family member gets their own login, eliminating those awkward shared-account moments. The platform’s transaction delegation feature has been a game-changer for our household–now we can easily assign specific transactions for our partner to review, making financial management truly collaborative.

Beyond Basic Budgeting

The platform’s commitment to continuous improvement has been impressive. Since joining in November, we’ve witnessed regular updates and new features, including a beta version of their Reports functionality that rivals what we loved about Mint. This new feature allows us to create custom charts based on categories, groups, accounts, and tags—essential for maintaining the detailed financial awareness that helped us achieve FIRE.

Our Post-FIRE Savings Journey

One of Monarch’s most exciting features for the FIRE community is its savings rate calculations. Unlike basic budgeting tools, Monarch automatically factors in investment income, dividends, and appreciation alongside traditional income sources—crucial for those of us in the post-FIRE phase. Even though we left traditional employment in July 2019, tracking our savings rate has revealed fascinating insights about our post-FIRE financial health:

Post-FIRE Savings Rate Evolution

| Year | Savings Rate | Visualization |

|---|---|---|

| 2020 | 11.2% | |

| 2021 | 25.7% | |

| 2022 | 0% | |

| 2023 | 27.7% |

Post-FIRE savings rates showing continued financial growth even after traditional employment

These numbers tell a powerful story: even in retirement, our money continues working harder than we do, often generating more than we spend. It’s a testament to the sustainable nature of our FIRE strategy.

Making the Switch

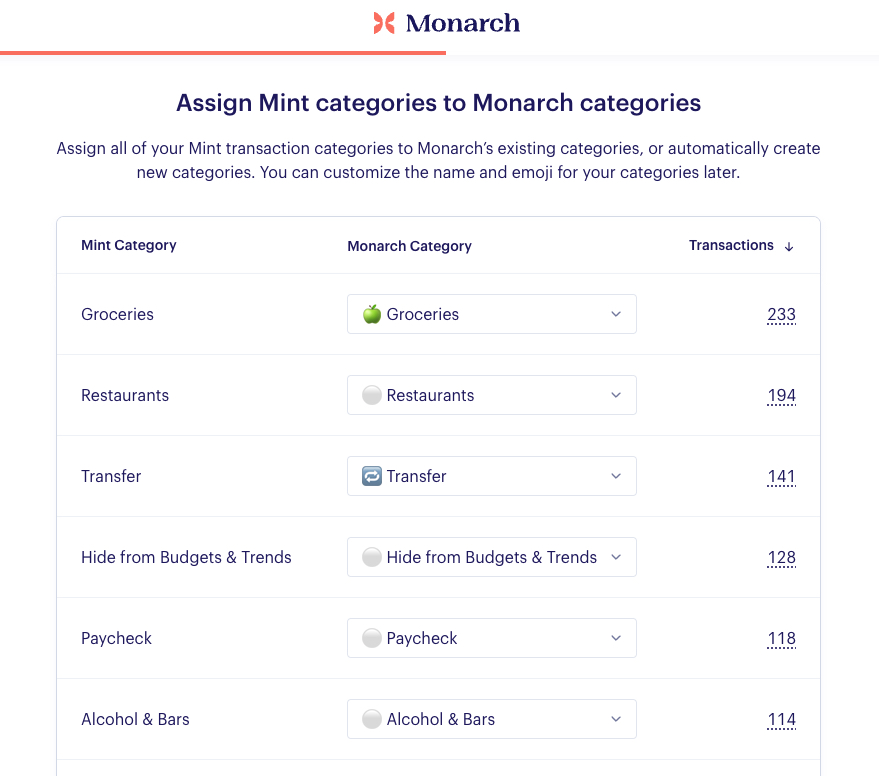

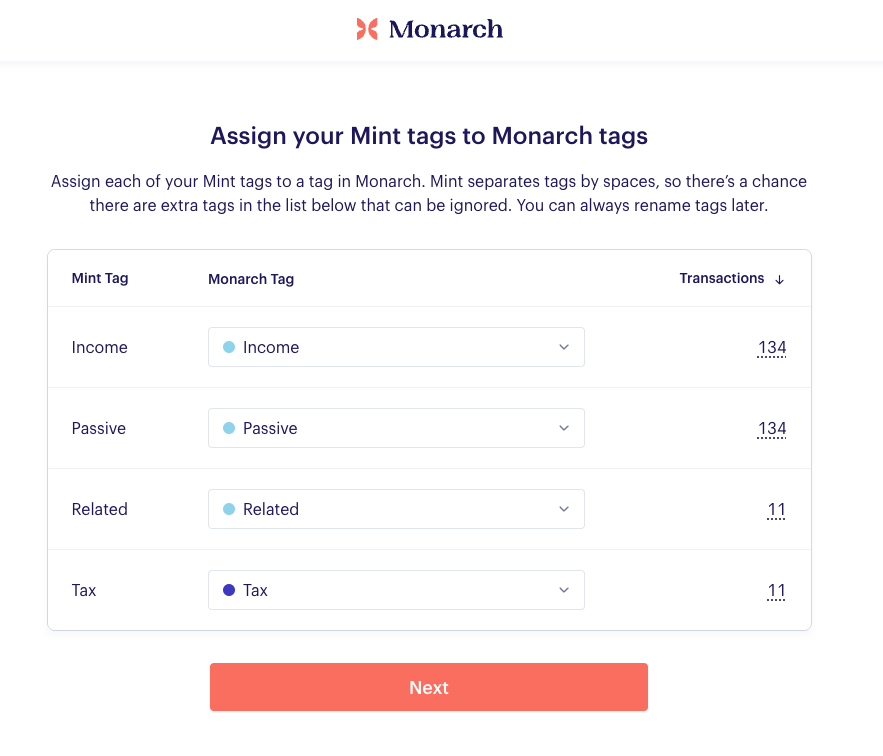

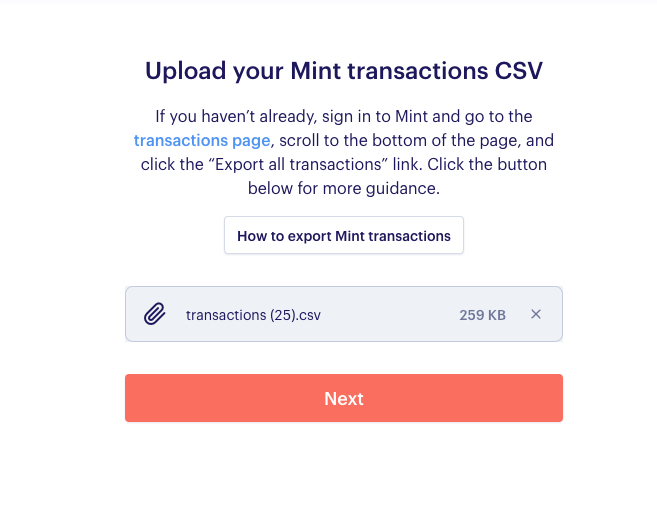

Transitioning years of financial data seemed daunting, but Monarch made it manageable. We successfully transferred over 32,000 transactions, taking a methodical approach by uploading year by year in CSV format. While the process took about 23 hours, the attention to detail was worth it for maintaining accurate historical records.

The only current limitation we’ve encountered is the lack of investment account transaction tracking, though Monarch has communicated this feature is in development. For now, we’re managing with manual uploads during dividend periods.

Looking Forward

For those considering the switch from Mint, Monarch offers a comprehensive transition guide. While the $99 annual fee might give some pause, we’ve found the value proposition compelling—especially considering the responsive customer support and continuous platform improvements.

Ready to take control of your post-Mint financial future? Try Monarch Money with our referral link for a free month trial. Join us in this new chapter of financial management, where your money works as smartly as you do.