When most couples tie the knot, they often rush into buying a house. But our path to homeownership has been anything but conventional. For years, we’ve been strategically cutting expenses and embracing renting as a key part of our journey to financial independence (FI).

The Power of Affordable Renting

Tatiana’s post-college journey began with a tiny, quirky apartment that was far from perfect. It had a miniature bathroom, a kitchen with a patchwork of different wall styles, and no central air. But at $750 per month, including utilities, it was a steal that aligned perfectly with our financial goals.

I was initially hesitant about downsizing from my larger single home, but I quickly embraced the “less is more” philosophy. We even stayed in that small apartment for nearly a year after getting married, maximizing our savings potential.

In 2014, we decided to move closer to work. While our rent increased, the reduced commute made the higher cost worthwhile. This decision taught us an important lesson: sometimes spending a bit more can lead to greater overall savings and improved quality of life.

The $1,400 Wake-Up Call

Our journey to financial independence wasn’t always smooth sailing. When we first met, dining out was our weakness. Tatiana enjoyed daily lunch outings at work, while I, despite bringing lunch from home, was saddled with credit card debt and a mortgage.

The turning point came when we started seriously tracking our expenses using Mint. One month, we were shocked to discover we’d spent a whopping $1,400 on restaurants alone!

This eye-opening moment can’t be overstated. If you’re not tracking your expenses, I strongly encourage you to do so, even if just for a month. You might be surprised—or shocked—by what you find.

From Restaurant Junkies to Home Cooking Aficionados

Seeing that $1,400 figure was the push we needed to change our habits. We set a strict budget and gradually reduced our average monthly restaurant spending to under $300, not including alcohol (which we track separately).

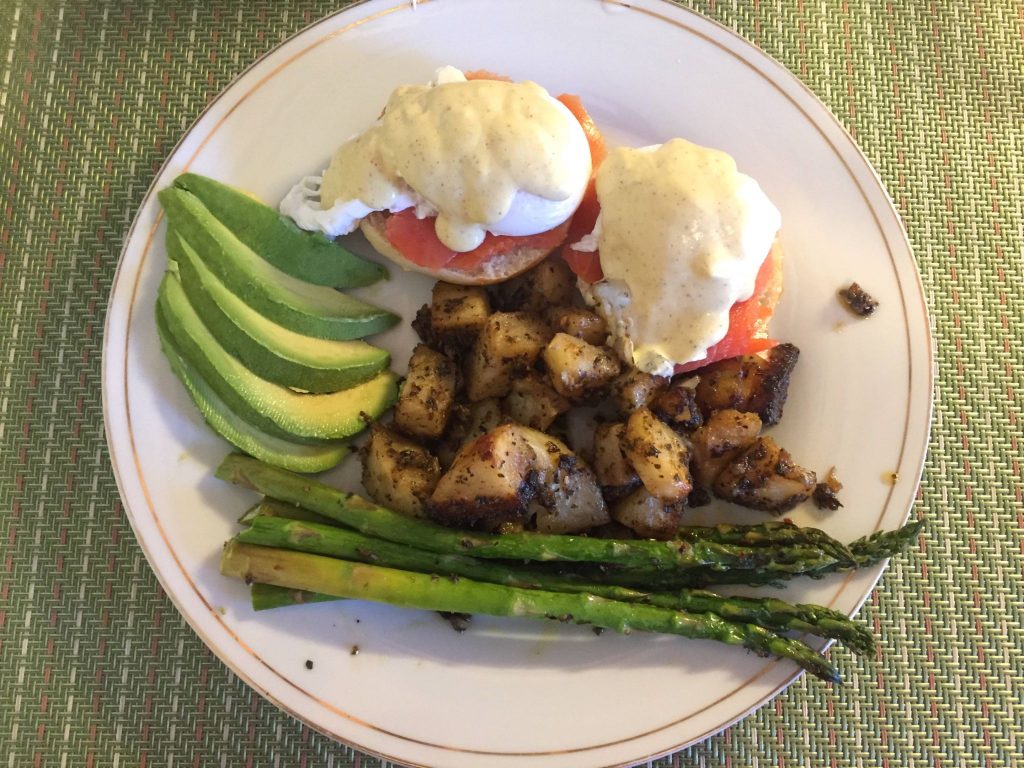

But our journey wasn’t just about cutting costs; it was about finding new joys and skills. I discovered a passion for recreating our favorite restaurant dishes at home, often improving upon them. Our weekend brunches transformed from $60 restaurant outings to $6 gourmet home-cooked meals, complete with organic ingredients and wild-caught salmon.

Tatiana became my biggest cheerleader in the kitchen, encouraging me to explore diverse, multicultural dishes. As we became more health-conscious and particular about ingredients, our home-cooked meals not only saved us money but also improved our overall well-being.

The Compound Effect of Smart Choices

By significantly reducing our dining out expenses and keeping our housing costs reasonable through renting, we were able to maximize our retirement account contributions and invest after-tax money towards our long-term goals. These investments are now generating capital gains and dividends that will support our early retirement lifestyle.

Our journey has been about more than just cutting costs; it’s been about aligning our spending with our values and long-term happiness. We challenged ourselves in various aspects of our lives, always focusing on what truly brought us joy.

The Renting Advantage

For us, renting while pursuing financial independence offered predictability. We avoided surprise expenses like home repairs or sudden increases in property taxes and insurance. Our fixed housing costs made budgeting straightforward and reliable.

However, we recognize that the rent vs. buy decision is highly dependent on individual circumstances and location. It’s crucial to run the numbers and consider what works best for your specific situation.

Looking Ahead: Our Next Chapter

As we approach early retirement (just two years away!), we’re excited about our next big goal: purchasing our first home outright. We envision a future where we’ll continue enjoying delicious home-cooked meals, perhaps even growing our own organic produce in a backyard garden.

Our journey to financial independence has taught us that by mindfully reducing expenses and aligning our spending with our values, we can create a life of freedom and fulfillment. It’s not about deprivation—it’s about making intentional choices that open up a world of opportunities.

What steps are you taking on your path to financial independence? If you’ve already reached FI, what strategies helped you get there? We’d love to hear your stories and insights in the comments below!

Further Resources

For more inspiration and insights on frugal living and the path to financial independence, check out these valuable resources:

- Frugalwoods – A blog focused on extreme frugality and homesteading as a path to financial independence.

- Monarch – The expense tracking tool we used to revolutionize our spending habits.

That is one of our biggest sins! We eat out a lot. Less now with a baby, but still more than I would like. I need you to talk to my hubby and get him to cook for at least 1 day of the week and then we are in business.LOL! I did however watch our eating out budget and was flabbergasted. That’s why we only allow ourselves to eat out now during the weekend, but I still would like that number to be lower. Here’s to hoping for small changes and big outcomes…

Hi! Yes, gotta get him in the kitchen. I agree on trying to get him in there at least once a week to build the habit. 🙂 Thanks for stopping by. Your baby is growing handsomely!

My wife and I found a nice big apartment in Florida and convinced her sister and a close friend of mine to move in with us. The apartment is a 3 bedroom and 2 1/2 bathroom with a rent of 895 plus utilities and internet. We are each paying less than $300/month and cooking at home more has reduced our food expenses as well. Since we are young and don’t have huge commitments right now, it’s working out pretty well. It’s like being in college again :). The only challenge is finding the right people to live with which for us was an easy challenge to overcome. Loved this post!

That’s awesome! Living like a college student after graduation will help you reach your financial goals a lot faster than if you were to give in to lifestyle inflation.

With your rent approach that means you’re saving about $600 a month in rent. Applause! You can pay off debt or invest it if you don’t have any and let that money compound. I’d do that for as long as possible. Nice rent hacking!