Welcome to the monthly update of our house fund goal, Nuestra Casa Fund (NCF). Our NCF goal is to save enough to fully fund our home purchase before we retire early. We’ll measure our progress by providing a monthly update against our benchmark. Our number one rule: Never, nunca, touch this money unless it’s for the house.

We’ll achieve our goal by continuing to work at our full-time jobs. As far as investing, our plan of action is to continue maxing out retirement accounts, while saving for the house and fulfilling the rest of the buckets we deem necessary to retire early.

The following announcement changes everything!

My father always says: “It’s for the wise to change their minds.” That saying always stuck with me. There’s nothing wrong with changing your mind. I even see a dose of sanity in those who do. When you’re planning for FIRE, the beauty of it is that you have options.

So why not take advantage of them?

Last month we took an almost three-week vacation and headed to the DR. We spent two of those weeks in Punta Cana. We’ve been exploring this area since last year because we strongly considered moving there after retirement and even wrote about it. Of course, we were going to keep our options open until we were 100% sure that it could become our home for a while.

Moving to another country and leaving everything behind is a bold move. My wife and I did it as children with our respective families when we emigrated to the U.S., but even bolder is leaving the U.S. to move elsewhere. Once you’re accustomed to the U.S. lifestyle, it might be hard to get used to being without a certain level of comfort. We knew this and it wasn’t the deal-breaker for us.

So, we had to do our homework if we were to make such a move. With that in mind, we’ve been taking notes and seeing what life might be like in Punta Cana for us.

After we ended our trip, my wife and I came to the realization that we no longer want to move to Punta Cana. It’s a great vacation spot for us, but it wouldn’t satisfy our needs in the long-term. I think this merits a post of its own, so be on the lookout for a post on why we decided to ditch Punta Cana as our early retirement home and are considering staying in the U.S.

To have U.S. as our base?

This changes almost everything. Punta Cana offers a lower cost of living than the U.S. If we want to stay here, we’ll have higher expenses, health care being one of them.

Would we still be able to adjust our living expenses to meet our withdrawal rate in early retirement?

Would we need to save more, work longer, or work a side hustle in early retirement if we want to continue with the same lifestyle?

Are we discovering holes in our plan?

I don’t have the answer to any of these yet.

Questions keep popping up as we near early retirement and that’s all TBD. We are currently doing research to figure out where we may move within the U.S., and what the budget adjustments would have to be made. Be on the lookout for that upcoming post as well. For now, let’s see how much we were able to add to the NCF last month.

NCF July Update

Below are our June results along with the year-to-date update. Last month we saw an increase of 8.9% towards our march to 100% of funding our goal. We’ve now saved 39.1% of the funds for our future home purchase.

| Year-to-date NCF Update | |||

| Month | Percent of Goal Met | Benchmark (the goal we set) | Percent Increase towards 100% |

| January | 23.9% | 23.9% | Started tracking this goal. |

| February | 25.1% | 26.5% | 1.2% |

| March | 28.5% | 29.2% | 3.4% |

| April | 28.8% | 31.8% | 0.3% |

| May | 30.2% | 34.5% | 1.4% |

| June | 39.1% | 37.1% | 8.9% |

This has been the biggest jump since we started tracking this goal. It puts us ahead of schedule by a bit. And that’s great because no one likes being behind. At least not you and I! Yay! During some months, our number will be higher, but there might be months when we’ll be behind as some annual expenses take priority.

NCF Contributions

A good thing about building passive income streams before buying your dream home is that your passive income streams can help you reach your goal of buying your dream home, but your dream home would definitely not contribute to building your passive income streams. Homeownership can drain your pockets with unexpected expenses.

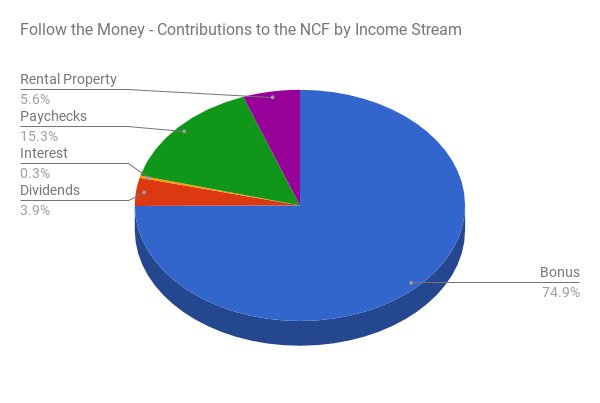

Besides getting a paycheck, we enjoy the fruits of our money in the form of dividends, interest, and rental income. The rental property income represents net income after monthly expenses are taken out.

Since we’re about two years away from retirement, we’re not reinvesting the dividends from the taxable account and are using this money to fund our short-term goals. We also shifted our asset allocation to be more conservative, since we’re close to retiring. From here until retirement, we want to keep our stock exposure to no more than 50% of our net worth. When it comes to the money in our taxable accounts, we’re into capital preservation mode and keeping it low risk, baby!

We also received mid-year bonuses that are tied to how well we’re doing by our clients and how our company is performing. My bonus was direct deposited to the checking account and didn’t hit the savings account in time for reporting, but Tatiana’s did, and it’s showing as part of the contributions. So we get a nice bump and that should keep us ahead of schedule for this quarter.

What concerns me is that it took us almost six months to hit our benchmark. So are we going to be able to hit the mark after the extra bump from the bonuses wears off?

Net worth allocation between the Freedom Fund and Nuestra Casa Fund

If you recall from our previous FI updates, the Freedom Fund will cover our expenses in retirement. We project a net worth allocation of 85/15 by the time we retire. The Freedom Fund would comprise 85% of the allocation, while the Nuestra Casa Fund would make up the rest.

| Allocation between FF and NCF | ||

| Month | FF | NCF |

| May | 93.7% | 6.3% |

| June | 92% | 8% |

| Goal ratio (%): 85/15 |

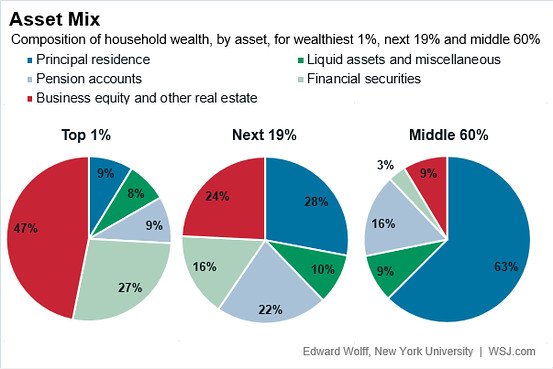

One way to interpret this chart is how much of our net worth do we want to allocate to our principal residence? By the time we’re ready to retire, we’re projecting that 15% of it will be allocated to our home.

That puts our net worth allocation model in good standing according to a Wall Street Journal article: How to Save Like the Rich and the Upper Middle Class (Hint: It’s Not With Your House). The article is from 2014, but the message still applies today: The rich don’t have most of their net worth tied up to a home as the middle class does. That article reminded me why we should aim to make our home a small percentage of our net worth.

That’s it for now, folks! Exciting times coming as we hope to kick butt in the second half of the year. We just need to save some serious money for a few more years to reach our goal and figure out if there any holes in the early retirement plan.

Well that is good you figured out you don’t want to live in PC pre-ER. Would have been a bummer to move there and then figure that out. Of course, I am sure good experiences/memories would have come from it.

that’s great this month put you ahead of schedule. Much enjoying your blog. 🙂

Hi –

Yes, that would’ve been a bummer. I’m glad that we kind of “test drove” the area before we made a move. Our plan was to rent for a year after we retire and see how we felt about staying long term, to keep us from buying in a rush. After all, selling a property abroad it’s not as easy as in The States. So no retiring there for us but we do look forward to long vacations in Punta Cana with no strings attached.

I’m glad you’re enjoying the blog. It’s always great to get feedback from our readers. Thank you for commenting.