The path that we’re taking to homeownership is an unusual one since most couples buy a house right after marriage. We’ve been cutting down expenses for many years and renting made sense on our path to financial independence.

As a matter of fact, Tatiana has always rented. Her journey after college started with renting a small apartment that was not even up to code. It had a tiny bathroom, a small kitchen with four different kinds of walls, and no central air, but it did the trick.

Her place was small compared to my previous home. What mattered the most is that her living arrangements allowed her to be happy and free. I was digging the “less is more” concept, and gladly gave up my big single home. Her $750 rent $750 covered electric, gas, and trash.

We were paying such low rent that we decided to stay in the apartment for almost another year after marriage. Then, in 2014 we decided to move because we got tired of the commute and found a place very close to work that made a higher rent more palatable.

Tatiana never had any debt, so getting on the FI path after we became big believers of early retirement was just a matter of prioritizing how we were spending our money.

We started shifting priorities by looking at our dining out expenses. We used to spend a lot on dining out when we first met. On top of that, Tatiana used to go out for lunch at work every day. And that adds up over time, especially if you’re having high-quality meals at sit-down restaurants, instead of fast food joints.

I, on the other hand, was always a packer, but a packer with debt. I brought lunch to work every day. However, my credit card debt and house mortgage interest at the time were probably more than what Tatiana spent eating out while renting a cheap apartment.

Tracking expenses was a major eye-opener

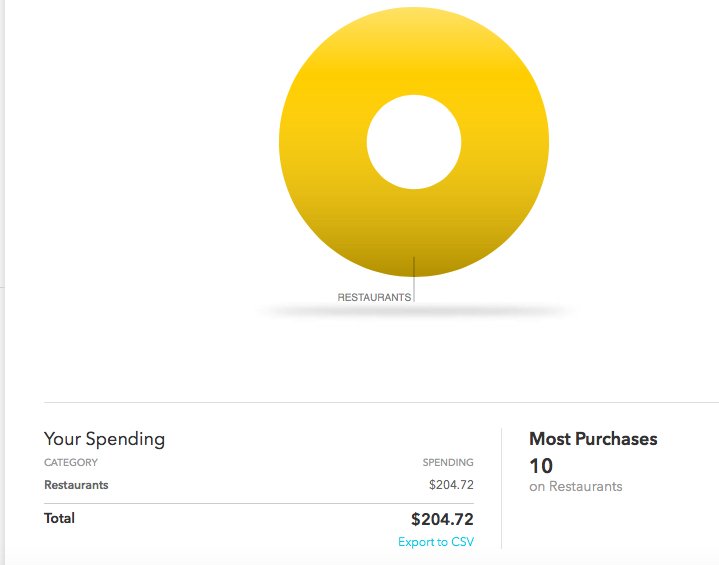

I started using Mint in 2010, but I never took the task of tracking and reviewing my expenses until a year later. That’s when I encouraged Tatiana to open an account as well. At that point, we seriously started tracking our expenses and realized that, on the previous month, we spent about $1,400 eating out!

Madre mia! $1,400 in one month! That was insane and a record month for restaurant spending–not the kind of record you want to hold.

This is why I recommend tracking your expenses at least for a month. There’s nothing more eye-opening than seeing how you’re spending your money. Tatiana’s jaw dropped when she saw that, and, as much as she enjoyed dining out, she was ready to set a budget.

We spend peanuts now compared to that time. Our average monthly spending in restaurants is now less than $300, not including alcohol. We usually split the alcohol from restaurant spending to keep a separate tab on our alcohol spending.

How we got to the point of spending $1,400 in one month on restaurants

I didn’t use to eat out much before meeting Tatiana. So, I joined her on her restaurant journey because it was more fun than just living to pay bills. I was also going through a tough time in my life, therefore, eating out and trying new places served as a good distraction.

I was tired of seeing my money only go to bills. Besides, it’s a lot more enjoyable to spend your money on experiences than on things, but you can also overdo it if priorities are not in order. I admit to overdoing it and corrected my mistake.

Something good came out of it, really…

One good thing did come out of my fancy dining out experience: I tried new dishes and learned how to make them at home and, according to wifey, often even better than at the source. So, I took that as a culinary experience that led to an improved chef at home.

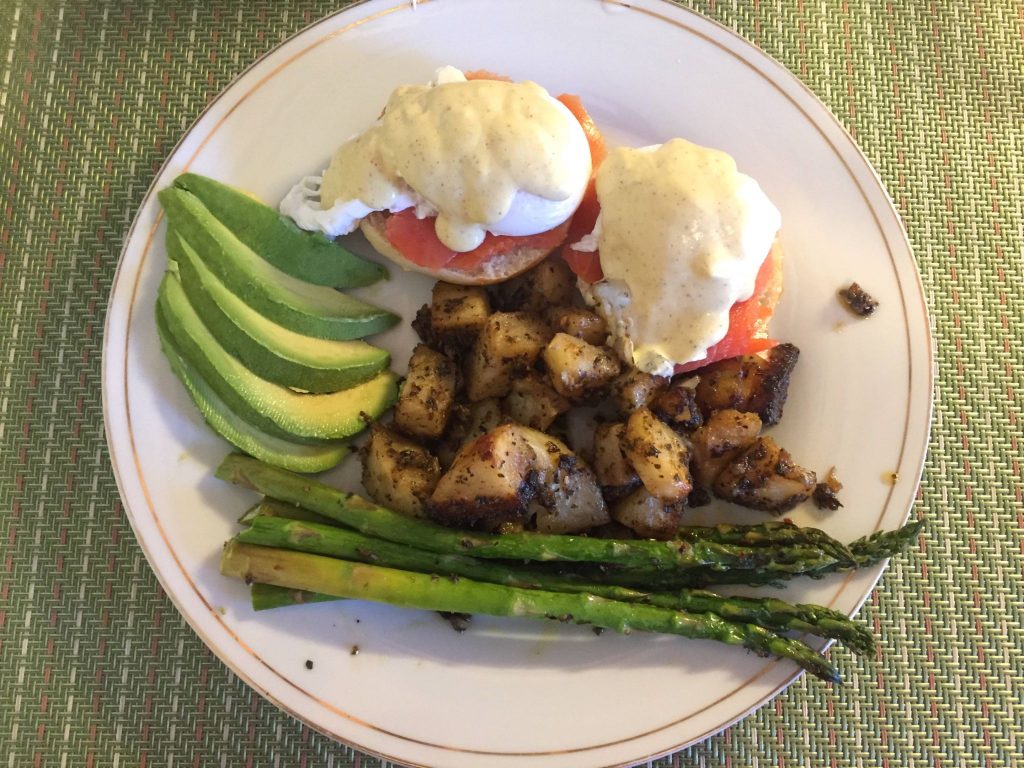

One staple dish in our home now is smoked salmon eggs benedict with home fries. We used to order this dish at one of our favorite brunch places and, after a couple of mimosas, the bill would come close to $60, of which $40 were the main dishes. So, one Sunday morning I tried making the dish, based on how it tasted and a few recipes that I found online, and it was a hit with Tatiana. Plus we use premium organic ingredients: eggs, potatoes, yogurt, home-made bread, and wild-caught smoked salmon. All for a grand total of about $6 for two people!

Over time, I made it even better for our taste buds: we incorporated baked asparagus, avocado, and more spices on the side. Yum! I’m not trying to brag here. This is based on her and her friends’ feedback that had brunch at our place. After trying that dish and other brunch recipes, we stopped going out for brunch and that cut down our dining out expenses easily by $150-$200 a month.

Tatiana was not aware that I could cook until we were already dating, so I know that she didn’t choose me based primarily on my cooking skills. She enjoyed the meals at home and instead of eating out at work every day, she also started packing lunch. She became the number one fan of my meals. With her encouragement, I continued to cook a variety of multicultural dishes.

As we became more conscious about ingredients and more dissatisfied with the restaurants’ few organic options and flavors, that couldn’t compete with my sazón, we continued to cook more and more at home. This was indeed a major financial win for us because it brought our expenses way down. Perhaps even more importantly, we improved our health by eating home-cooked meals more.

Improvement is the name of the game

Cutting down on dining expenses and keeping rent at a reasonable rate is how we were able to max out our retirement accounts and invest our after-tax money for our long-term goals. Now our investments are producing capital gains and dividends that will provide for our living expenses in retirement.

I’m glad that we were able to learn from each other. Tatiana became a lunch packer instead of a frequent diner, and I became a conscious renter instead of a big house owner trapped by a mortgage. By joining forces we became a lean machine. We challenged ourselves in other categories as well and focused on what brought us true happiness.

Another plus to renting while trying to reach financial independence was that with renting there were no surprise spending on repairs, tax, or insurance increases. We had a set budget with a fixed housing cost. Renting instead of buying worked for us, but we understand that housing plays out differently according to the area. It’s very circumstantial, so it’s wise to do the math and see what works in each scenario.

Decreasing expenses is what helped us increase our savings rate. We’re now about two years away from early retirement, with a major goal of fully funding the purchase of our first home.

We want to continue to enjoy tasty home-cooked meals and plan to start a garden that will provide organic produce for our kitchen all year round. That’s the beauty of buying back out time–we can grow some food in the back yard.

That is one of our biggest sins! We eat out a lot. Less now with a baby, but still more than I would like. I need you to talk to my hubby and get him to cook for at least 1 day of the week and then we are in business.LOL! I did however watch our eating out budget and was flabbergasted. That’s why we only allow ourselves to eat out now during the weekend, but I still would like that number to be lower. Here’s to hoping for small changes and big outcomes…

Hi! Yes, gotta get him in the kitchen. I agree on trying to get him in there at least once a week to build the habit. 🙂 Thanks for stopping by. Your baby is growing handsomely!

My wife and I found a nice big apartment in Florida and convinced her sister and a close friend of mine to move in with us. The apartment is a 3 bedroom and 2 1/2 bathroom with a rent of 895 plus utilities and internet. We are each paying less than $300/month and cooking at home more has reduced our food expenses as well. Since we are young and don’t have huge commitments right now, it’s working out pretty well. It’s like being in college again :). The only challenge is finding the right people to live with which for us was an easy challenge to overcome. Loved this post!

That’s awesome! Living like a college student after graduation will help you reach your financial goals a lot faster than if you were to give in to lifestyle inflation.

With your rent approach that means you’re saving about $600 a month in rent. Applause! You can pay off debt or invest it if you don’t have any and let that money compound. I’d do that for as long as possible. Nice rent hacking!