Welcome back to our monthly Freedom Fund update! As we dive into autumn 2016, I’m excited to share our progress, challenges, and some personal reflections on our journey towards financial independence.

The Big Picture: Our 2017 Goal

We’re still aiming for July 2017—that’s when we hope to have enough investments to support our lifestyle indefinitely. Here’s where we stand:

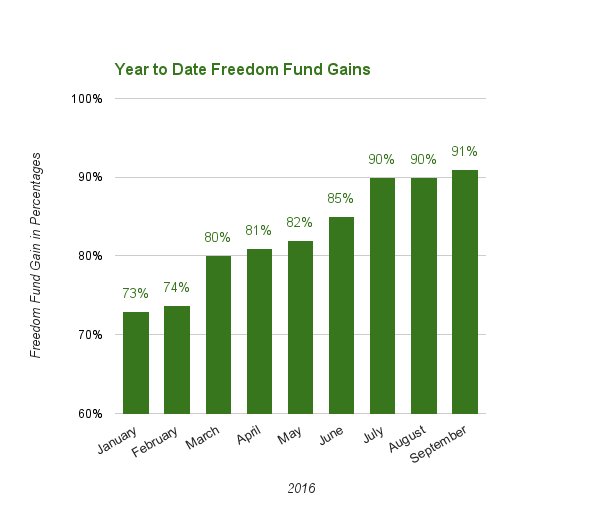

- Freedom Fund Progress: 91% (up from 90% last month)

- Annual Expense Coverage: $32,185 (just $2,815 short of our $35,000 goal!)

Quarterly Earnings: A Reason to Celebrate

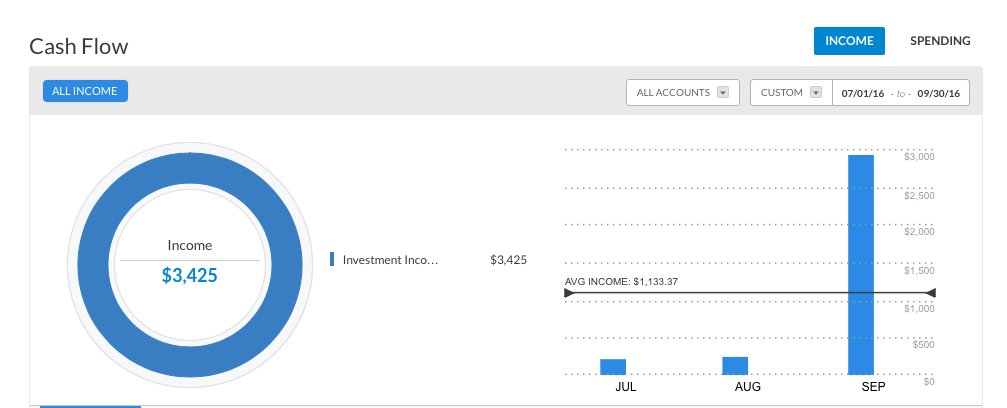

Q3 always brings a spark of excitement as we tally up our dividends. Here’s the breakdown:

- Q3 2016 Income: $3,425

- Q3 2015 Income: $2,743

- Year-over-Year Increase: 25%

This growth isn’t just numbers on a page. It represents countless decisions to save, invest wisely, and stay the course. We’ve also fine-tuned our asset allocation to better align with our long-term vision, which has paid off nicely.

Our target dividend amount is $17,500 per year. Total earnings for the previous four quarters were $14,662, leaving us $2,838 short of our dividend income target. Progress feels tangible!

The Balancing Act: Life Happens

September threw us a few curveballs:

- Colorado Adventure: We took a much-needed trip to the Rockies. While it dented our savings, the memories were priceless.

- Rental Property Taxes: Our annual school tax bill for the rental came due. A necessary expense, but always a bit painful.

- Market Fluctuations: We saw a slight dip in our investments this month, but the overall quarter performance was solid at 5% returns.

Looking Ahead: The Final Stretch

As we enter Q4 2016, I can’t help but feel a mix of excitement and nervousness. We’re so close to our goal, but the financial landscape is always uncertain. A few thoughts keep swirling in my mind:

- The Bear Market Question: What if we hit a prolonged downturn? At what point do we pivot from aggressive saving to other financial priorities?

- Redefining “Freedom”: As we near our target, I’m realizing that true financial independence is as much a mindset as it is a number.

- Short-Term vs. Long-Term: If we enter a bear market and remain stuck in the 90% range (or even drop lower) for an extended period, when do we shift focus to other financial goals like saving for big short-term purchases?

Your Turn

I’d love to hear from you! What were your financial goals for September? Did you meet them? How do you balance long-term goals with short-term enjoyment?

Remember, wherever you are in your financial journey, every step forward is worth celebrating. Here’s to making progress, learning from setbacks, and supporting each other along the way.

Until next month, keep saving and dreaming big!

To help answer the question you have, if the market drops to 70%, I think it would be prudent to continue investing as to allow you a security buffer or extra funds to allow you to give to charity / Family. Giving back should be just as important after reaching a great milestone. Also buying stocks on sale is icing on the cake. Good luck in the 4th quarter.

Yes, we’ll probably continue investing a little more than planned and just put some cash on the side once we have a retirement date. The cash on the side is not in fear of market drops but to cover short-term expenses that we’re planning for. I’ve never been in this situation, since the last time we had the recession I was paying off debt and changing my life behaviors. If there was a recession now, without any debt to pay off, I think we’d cut our discretionary expenses by a big chunk and invest even more than usual in the market.

As far as donations/contributions, we’re big on giving back and helping our parents so we’ll put some aside for that as well. It does make you feel good to be able to give back. Thanks for the comment and tip!