Everyone who owns stocks has probably seen a nice, quick increase in their net worth recently. When many people thought the market could only go down after the Dow Jones reached the symbolic 20,000, it went on to set another record high of 21,000 in a very short period of time.

Market timers are likely perplexed and may make incorrect decisions as a result of the euphoria. Greed is in the air.

We are not magicians and do not claim to know what the market will do. Nonetheless, when we have new funds to invest, we know exactly what to do. We have a magic wand known as “net worth allocation.”

Our net worth allocation serves as a gauge for greed and fear because it prevents us from buying too much of one asset when it is high and not enough when it is low.

Knowing what to do with your money based on logic rather than emotions is a great way to avoid making bad decisions. Sticking to our budget prevents irrational behavior.

We’re in it for the long term

We’re in it for the long haul.

Is the market going to rise by another 5,000 points before collapsing?

We have no idea and don’t care.

Is it going to crash to 16,000 points in the next couple of years?

We have no idea and don’t care.

What is it that we are concerned about?

We are only concerned with how much risk we should be taking. We are concerned about the proper allocation of our assets.

Net worth progress

When bad financial news comes our way, we can counteract it by looking at how far we’ve come. Our investments have risen steadily over time.

They survived the Great Recession despite their small size at the time. Then, because we didn’t panic during the recession, they grew exponentially. We continued to buy low and reaped the benefits of the market’s subsequent rise.

What is our current net worth?

That equates to…. hmmm… You were duped! We’re not ready to reveal any figures.

Brave are those souls that…

We’re not the brave souls who reveal their net worth on RockStar Finance’s net worth tracker.

There are some eye-opening figures in there.

Amber and Danny Masters of Red Two Green have a net worth of negative $532,000. That is not a typo; it is a negative! They incurred significant student loan debt.

With a net worth of $5 million, James Dahle, another blogger known as The White Coat Investor, has the highest net worth on the list. So we’re somewhere between those two bloggers, but a long way from the white coat guy. 🙂

Net worth percentage change

Getting back to our percentage tracking. I created a spreadsheet in 2014 to track our net worth, which facilitated in the reporting of our Freedom Fund updates.

We’ve been making adjustments as needed, and by simply tracking net worth every month, we can automatically populate a plethora of data.

For example, since October of 2016, our net worth has increased by 14 percent in just four months. We attribute a large portion of those gains to the stock market rally.

These increases seem surreal at times as we continue with our early retirement plan.

Our net worth is made up of assets that generate income. Some dollars work harder than others, but they are all designed to provide us with a comfortable lifestyle.

We completed the bucket that will sustain our lifestyles indefinitely when we became financially independent in January of 2017.

The portion of our net worth that we are now growing with new funds will be used to either buy or build our home. If we buy/build a duplex and rent out one unit, the house will undoubtedly become an income-producing investment as well.

From the tracking spreadsheet, here’s an example of how the last 12 months looked for us.

| Net Worth Percentage Change – Past 12 Months | |

|---|---|

| Month | Percent Change |

| March 2016 | 9% |

| April | .5% |

| May | 1.9% |

| June | 3.5% |

| July | 5.6% |

| August | 1% |

| September | 1.2% |

| October | -.5% |

| November | 2.7% |

| December | 3.3% |

| January 2017 | 4.6% |

| February | 2.9% |

Percent change by year

We also project our net worth increase for the following year based on expected income plus a cumulative 7% return on investments. Here’s how the previous three years looked.

| Net Worth Change – Past 3 Years | ||

|---|---|---|

| Year | Estimated Percentage Change | Actual Percentage Change |

| 2014 | 33% | 49% |

| 2015 | 37% | 23% |

| 2016 | 32% | 31% |

It’s incredible how the numbers turned out. We predicted a 33 percent increase in net worth for 2014, based on previous annual income and an expected return of 7% on our investments, and received a 49 percent increase.

The additional boost was due to a combination of lower household spending and some stock market growth.

In 2015, we predicted a 37% increase but received a 23% increase instead.

In terms of stock returns, 2015 was a flat year for us. That year, our stock and bond portfolio returned a negative $843.

For 2016, our estimates were fairly close; we were only 1% off at 31% of actual growth. The market performed well for us last year.

Net worth increase in 3 years

According to the chart below, we increased our net worth by 139% over the last three calendar years. The figures were off by less than a percentage point of the total cumulative estimated increase.

The table below should be read as follows: We estimated that our net worth would increase by 33% from 2013 to 2014, 83% from 2013 to 2015, and so on.

| Cumulative Net Worth Increase – Past 3 Years | ||

|---|---|---|

| Year | Cumulative Estimated Percentage Increase | Cumulative Actual Percentage Increase |

| 2014 | 33% | 49% |

| 2015 | 83% | 83% |

| 2016 | 140.72% | 139.47% |

How in the world did we pull this off?

Here’s the gist of it: To start with a clean slate, I paid off all of my debts prior to our marriage, with the exception of the mortgage on the investment property.

We kept things simple after we married, budgeted together, and kept track of our expenses.

We stayed in Tatiana’s old rented apartment, which wasn’t even up to code, for an extra year instead of moving into a bigger place right away or buying a house.

We didn’t let lifestyle inflation derail our saving habits.

It was also critical to our success that we did not incur any additional debt.

We invested any surplus, cut unnecessary expenses that didn’t add value to our happiness, downsized to one car, and relocated extremely close to work, all while the investments grew.

This is happening against the backdrop of a bull market. The next bear market will reduce a portion of our net worth.

A real estate slump could also have an impact on our net worth.

Our bond funds will most likely lose value as interest rates rise.

However, while some investments are likely to fall, others are likely to rise. There is no need to panic; simply stay the course.

After all, investing is all about taking risks in order to reap rewards. The key to successful investing is to take calculated risks.

All investments are subject to price fluctuations

Every investment, including your home, fluctuates in value almost every day. Just because the value of your home drops doesn’t mean you’ll rush out and sell it at a loss. The same is true for the stock market.

Imagine your home’s value being displayed on a screen every day, along with the values of other homes around the world.

Would you sell your house the next day if you saw it decrease in price?

That is highly unlikely.

A personality like Raul Gastador might consider it, but you and I know that your house will still provide shelter for you and your family, the lawn will still grow every spring, and watching a movie by the fireplace will be as cozy and enjoyable as it was the night before.

The same is true for stocks.

Even if the price falls and you incur an unrealized loss, you still own the same number of shares in the company and will receive dividends.

Downturns in the stock market are temporary potholes along the way for long-term investors like us, and an opportunity to buy more.

We’ll still make it to our destination. We don’t give them much thought, and we’ll explain why in a moment.

It’s reassuring that our net worth increase calculations were so close after only three years of tracking. This means that our methods of calculating these were decent.

The next three years could and probably will look very different.

Let’s look at which assets comprise our net worth and how we try to mitigate risks.

Net worth allocation

A friend of mine recently asked me, “How do you protect yourself from a stock market crash?”

I believe he was thinking more along the lines of when should we sell to avoid losses rather than riding it out.

The simple answer is that we do not sell to try to time the market, but rather invest based on how much risk we are willing to take.

When we have new money to invest, we look at our net worth allocation to see which assets are underweight and purchase accordingly.

We don’t think to ourselves, “Hmmm, the market is up big time. Let’s sell and sit on the sidelines until it settles down, then reinvest and make more money than the ‘fools’ who use a buy-and-hold strategy.”

People who sat on the sidelines 4-6 years ago, believing that the market had already had a good run, are probably kicking themselves for not staying the course.

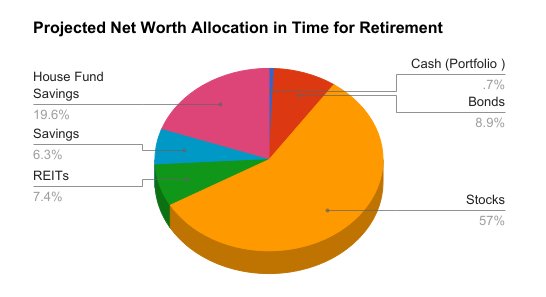

The chart below represents our current asset allocation. This portfolio already generates over $18,000 in dividends per year.

The chart below depicts our desired allocation prior to retirement.

This allocation is merely a guideline and is subject to change. If our plans change along the way, we’ll rethink our allocation mix.

Assets in our net worth allocation

Bonds

Our current bond allocation is more than 12%, but we want to reduce it to 9% by the time we retire.

We’re still in the accumulating stage, so being overweight isn’t a big deal, and our current allocation percentage will decrease as we invest more in other asset types.

Stocks

Based on our intended net worth allocation, we should allocate approximately 57 percent of our assets to stocks.

It is not 90 percent in good times and 30 percent in bad times, as some market timers prefer.

We haven’t invested in stock funds since late last year because our allocation shows that it has been growing aggressively on its own while we have been growing other investments.

This is why the net worth increased much faster than expected in the last four months. We’ll start buying again once stocks account for less than 57 percent of our net worth.

We haven’t had a major correction in ages, and a bear market is becoming more likely as time passes, so our current stock allocation is likely to change.

At that point, we’ll review our net worth allocation and rebalance as needed.

REITs

By the time we retire, we hope to have allocated approximately 7% of our net worth to REITs.

We have some REITs in our brokerage account, but we mostly buy them in Roth IRAs to avoid paying taxes on the distributions, so we’re restricted by the IRS’s annual contribution limit.

The next time we buy REITs will be in January 2018, unless they outperform other assets in the portfolio in the same way that stocks are doing right now.

Investment Property

We have an investment property that yields nice returns. We’re thinking about selling it after retirement.

House Fund Savings

The House Fund Savings is a new asset category that we began saving for last year. We’ve reached the point where we need to start aggressively saving for a house.

We intend to travel to places such as the Dominican Republic (my birth country) more often and, if possible, make it our home for the first leg of our retirement.

This money is kept in a risk-free account.

We’ve been renting for a while now, and if we don’t feel that buying a house is the best option at some point, we’ll reconsider our strategy.

We have options, and it will be useful to conduct a pulse check after retirement to ensure that we are still making the best decision.

Savings

This asset is the first to appear on the Projected Net Worth Allocation Chart.

The money will be transferred to this bucket after we sell the rental property (R.E. – Investment Property asset).

We intend to put about 6% of our net worth into this fund. This sum will cover the first three years of retirement living expenses as well as funds to purchase a car.

Final thoughts

One of my favorite aspects of blogging is that by explaining a topic or our plan of action, we ensure that all of our i’s and t’s are crossed. Everyone who is pursuing a life goal should blog about it. It clarifies and makes your goals more attainable.

Our net worth has grown over the last three years as a result of sound investment principles and an aggressive saving strategy without deprivation, driven by a strong desire to break free from the shackles of needing jobs to pay the bills and become financially free.

This desire helped us become more in tune with ourselves and define what truly brings happiness into our lives.

To achieve financial independence, you do not need to spend time working on complicated charts and spreadsheets. This kind of pointless nerdiness is simply what I enjoy working on.

All you need to do is get out of debt, optimize your spending, and invest the remaining cash. That simple is the path to wealth.

Hey thats a good return on net worth. If you focus, reinvest, and save a big portion of income FI is just around the corner. Why are you willing to sell a profitable rental in retirement? As the cash flow will help you not tap into the principle of your investments.

Yeah, that rental property has proven to be a hell of a good investment after all. I initially purchased it for $70k and invested about another $17K to turn it into a 2-apartment house and get a gross income of $1,350 a month.

One issue is that we’d need to get a reliable property manager and I’m not sure I want to deal with that headache after moving much further away. But it is a nice cash flow, we’ll revisit it next year and see if we want to give it a try with a property manager. Maybe we try a property manager while we’re here to see if it works out. I just don’t have faith in finding reliable people in the area. Good point!

I was horrified by the half a mill net worth that couple has. It would give me a heart attack for sure. It just validates my theory that you should always do a cost benefit analysis on everything you do or buy even if it means education. Congrats on increasing your “nest egg” steadily, diversifying your investments and readjusting your allocation based on your needs. We have a little more agressive portfolio than you for our retirement accounts with less than 5% in bonds because our 401ks may not even be touched during retirement. We plan to fund it with a combination of pension ( old school) , savings, dividends on non- retirement accounts and income from rental property. Of course, we also plan on living in a lower cost country for a couple years right away, letting our “nest egg” grow even more before needing to touch it. I estimate we would actually be able to save more than we do now in the first two years of retirement just by moving to a cheaper country. Isn’t that crazy?

Hi Jana –

Thanks! Since we reached our numbers much earlier than expected and are still predicting to work until 2019 we’re going to end up with a bigger portfolio so the bond allocation is really the extra money that is accumulating. (there are days like today when I do lose corporate patience and rethink this) That amount is about 6 years of basic living expenses. We’ve been investing part of it in a high-yield corporate bond fund so it’s providing a nice monthly income.

Living in a place with a lower cost of living definitely makes a big difference. That’s a great idea to let your investments grow while you travel. That’s one of the reasons why we plan to move after we retire. We can live like kings on a lower budget without decreasing the quality of life elsewhere. Thanks for stopping by!

Thanks Julie!

That’s the right mindset – adjust your investments according to your plans and not just because of market swings.

Good luck on selling your house! Not sure how the real estate market looks in your area but it’s looking better in PA than last year. Hope it’s the same for you. Thanks for stopping by.

I love your worry-free approach to managing your net worth and congrats on the crazy year-over-year increases. We’re still on the road to FI but we have a similar philosophy to you. We’ve switched more to cash recently but not because of the market – because we want a cash buffer as we prepare to sell our house.

Wow, congrats! Especially 2015 was a tough year with essentially flat equity returns. Our net worth growth has definitely slowed down in 2014/15/16, compared to 2011/12/13! Well, even in a flat year we’d get growth from additional savings, but it’s getting a smaller and smaller percentage once the portfolio grows.

Also totally agree with the “don’t time the market” attitude. It’s best to keep making the regular contributions, rain or shine. Some of my best investments were the ones I made when everybody else panicked and sold. 🙂

Good luck in 2017!

Thanks! I think we reached our peak percentage growth per year in 2015. We’re approaching your stage of 2014 where our salaries won’t move the dial as much. With a 7% return on our investments, we estimate our net worth to grow by another 25% this year from last year. Thanks for commenting.