When you realize you haven’t had a good relationship with money for the majority of your life, it can be a rude awakening. You may be deeply in debt, and adding it all up in a spreadsheet may reveal a small or even negative net worth, with little equity or assets to show for it. The truth can make you want to vomit.

That’s exactly how I felt seven years ago: lots of red ink and very little black ink. I wasn’t broke at the time, but I was living paycheck to paycheck and was weeks away from financial ruin. When I first laid out all of my finances, there were many money blunders and very few wins to show for it.

In 2017, I have a completely different story to tell. I’m no longer seeing red ink. Our most popular colors are now black and green! However, getting to this point required a lot of hard work, discipline, and a fantastic partner.

A little reflection reveals that just one year of wise money management can make a significant difference in anyone’s finances. Money did not fail us last year because we are no longer bad at it.

At any point in our lives, we have a choice: we can either follow the herd and live a lifestyle fueled by debt, or we can pursue the less traveled path of financial independence. We chose the less traveled path that will lead us to financial independence and a simple, happy life.

We have an easy choice because we understand what it means to be financially independent and how that translates to having more time. Our investing strategy is largely automated and based on an asset allocation that meets our needs. Money comes in and out in various ways, and it came to us in unexpected ways last year.

Let’s take a look at the steps we took in 2016 to ensure we stayed on track to achieve FIRE.

Financial successes

1. Found money in the trash

You didn’t see that coming, I know! We didn’t go around trash-picking for money. That would be a waste of our time, and who literally throws money away? Unless they leave it on a meal tray!

I went to trash my avocado peel after eating lunch in my building’s cafeteria, and there they were: three $1 bills waiting for me to pull them and keep them in circulation. At first, I thought I was being watched by a hidden camera, but these dollars had been abandoned. We parted ways a few weeks later when they were tipped to a waitress at our favorite vegan buffet restaurant.

2. Maxed out our 401(k)s

Yes, we did it again, folks. Last year, we were able to front-load our accounts. A good lesson from the wealthy is that minimizing taxes should be a priority in order to amass wealth. It’s simple: the less we pay in taxes up front, the longer our investments can grow.

3. Maxed out our Roth IRAs

Prior to last year, we didn’t have Roth accounts because we wanted to build up our taxable accounts because retirement was less than a decade away. We would have started investing through this vehicle sooner if we had known years ago that we could withdraw our contributions at any time without penalty.

So we opened Roths last year and were able to contribute for 2015 and 2016 because we did it before the tax deadline.

4. Met our dividend goal

We had reached our dividend goal of $17,000 by the end of the year, with a total of $18,130. Of course, the majority of these dividends are coming from our retirement accounts, which means we won’t be able to touch them until we’re much older, but a dividend is a dividend regardless of where it comes from.

5. Invested a nice chunk of dinero in our brokerage accounts

We invested in our taxable account because we are nearing early retirement. This money will assist us in covering the first five years of our early retirement. The plan is to cash out the dividends and use the capital gains to help offset our living expenses in retirement.

6. Discovered trash a la carte

Trash a la carte…it appears that adding “a la carte” to any word makes it more fancy. We saved money by doing trash collection a la carte. We discovered last year that we could pay $4 per trash bin rather than sign up for the quarterly unlimited trash plan with weekly pickup

We recycle a lot of our waste and don’t have a lot of trash, so we only fill up one trash can per month during the winter.

However, we intend to have it collected more frequently in the summer to avoid breeding maggots. We’re swimming in extra trash dough because recycling pick-up is free every week. We will save at least $120 per year as a result of this.

7. Accumulated some serious points in travel hacking

Tatiana is doing an excellent job of earning us travel hacking points. We accumulated 315,000 points last year through airline and hotel credit card sign-up bonuses and have already used some of them to save money on hotels.

Last year, we were able to take advantage of three free hotel stays with points for a total of six nights. For those three stays, the total cost is estimated to be $1,025 USD.

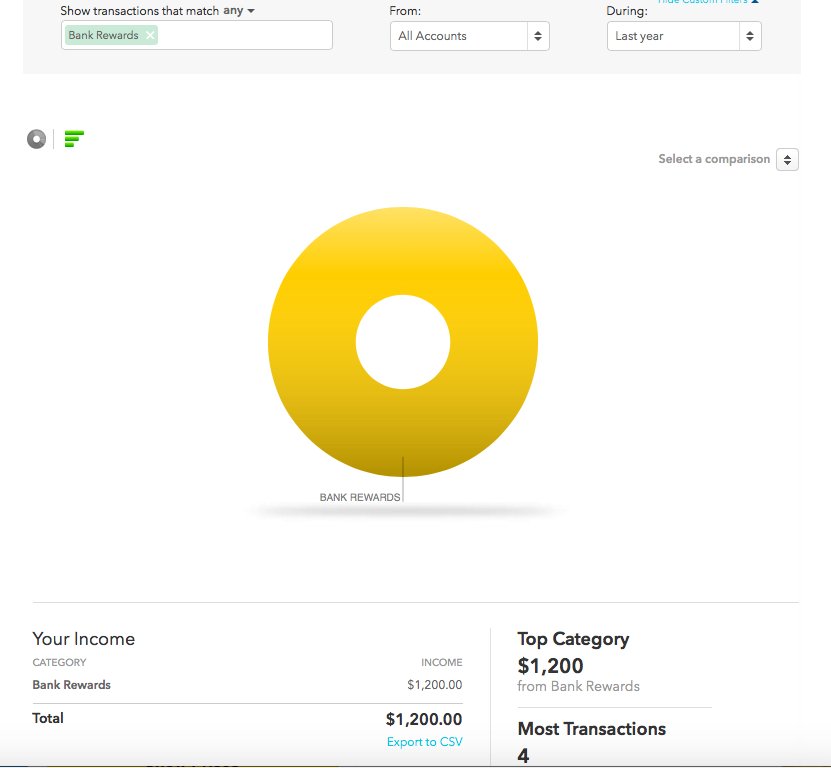

8. Earned some money by trying out new banks

I appreciate it when banks make attractive offers to try out their services. Last year, we signed up for four accounts and earned $1,200 in bonuses.

That’s a nice sum of money considering it took us less than 15 minutes to sign up online and another half hour to close the account if we had to go into a branch. We ended up keeping one account because it was easier to deposit cash and they have branches all over the country.

That money is now invested in a high-dividend yield ETF, which pays us 3% in dividends annually while also growing at a nice rate, as the fund is up 20% from a year ago. Caching, caching, caching…

9. Increased our Freedom Fund by 24%

We still can’t believe we made it this far. We nearly achieved financial independence last year, well ahead of schedule. It feels incredible, but it is the result of a very simple formula: spend less and invest the surplus. We don’t have to spend money just because it comes our way.

It all starts with eliminating a few unnecessary expenses, and then it’s just a matter of letting the money grow on its own.

10. Did some tax-loss harvesting

Tax-loss harvesting is still a new concept for us. We tried it last year and took a $1,800 long-term capital loss by switching from an international fund to a similar fund. That figure will be used to offset other income gains.

11. Took advantages of other cash rebates

I’m terrible at following all of the steps required to get more discounts on items when shopping. Tatiana comes in handy here because she knows which links to click to save us money even before we enter a website.

We received $53 in cash back from Ebates last year. Hey, it’s more than the money I found in the trash. And no one looks at you funny for it like they would if you stuck your hand in the garbage can. 🙂

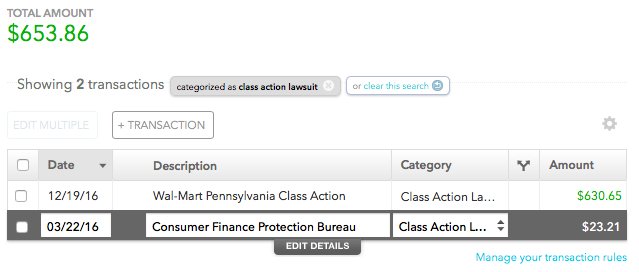

12. Won some class action lawsuits. Who knew?

Nothing beats receiving checks in the mail for lawsuits that you won without actively participating in.

When I first moved to Pennsylvania in 2005, I needed a temporary job to pay the bills while I looked for a full-time permanent position. So I applied to a few retailers ahead of the holiday season and ended up with a part-time job at Sam’s Club.

When the going gets tough, I’m not afraid to apply for lower-level positions. After all, the money you don’t make today will not be made tomorrow. Tomorrow’s money is brand new money.

As a result, I accepted the position at the customer service desk, despite the fact that my resume screamed: “excessive qualifications!!! Don’t hire him; he’ll leave as soon as the next opportunity arises.”

My sales pitch for discounting my resume qualifications was that I was inspired by Sam Walton’s entrepreneurship and wanted to advance within the company. I basically told the hiring manager what she wanted to hear in order to get the job.

To make a long story short, I worked there for less than a year before landing my current position at Vanguard. However, a Pennsylvania overtime hours without breaks lawsuit was filed against the retailer, and a check for $630.65 arrived a few days before Christmas last year!

Greeeaaat! That was a nice unexpected gift that helped us reach our financial independence goal.

We also received a check for $23.21 for a Consumer Financial Protection Bureau class-action lawsuit. I’m not sure who was sued; what matters is that we were compensated! It was either a major wireless carrier or a mortgage company, I believe. I’m perplexed because we’ve received settlements from both.

(March 1, 2017 Update: The wireless carrier check was discovered under another category. It cost $38.16. Our total reward now stands at $692.02.)

Financial failures

13. Spent too much on alcohol

Last year, we spent more on alcohol than we anticipated. It was only slightly more than we spent the previous year, but the fact that we intended to spend less and failed to do so irritates us. The total amount spent on alcohol was $1,726.

According to our expectations, that was far too much. We have a no-alcohol challenge this year. Thus far, so good!

Almost failures

Credit card late fee

Tatiana failed to hit the submit button after scheduling a payment, so we were charged a credit card late fee and interest. Keep in mind that playing the credit card rewards game can be dangerous. That’s why I delegated it to her.

In any case, we called, explained the situation, and requested reimbursement.

They waived the fees as a one-time courtesy. You shall receive if you ask!

Important note about late payments: late payments are only reported to credit bureaus if they are 30 days or more past due. So the fact that the payment arrived a few days later had no impact on our credit scores.

Library late fee

The day after a book was due, our library was closed. We chose to return it the night before it opened because you have all day to return it, essentially until they open the next day.

They attempted to charge a late fee but agreed to waive it after I explained my reasoning. I know it seems silly to try to get that waived, but we don’t like being charged unfairly. Okay, we don’t like paying late fees at all!

A 3-step action plan you can implement today!

We hope you can take something away from our successes and failures. If you have more money flaws than strengths, here’s a quick plan you can implement right away to improve your financial situation.

- Keep track of your spending. I cannot stress this enough. Keeping track of your expenses is critical to improving your financial situation. How will you manage your finances if you don’t know where you’re going? It will make you aware of any unnecessary spending in your life. Keep track of every dollar that enters and exits your accounts. Mint and Personal Capital are both free online software tools that are simple to use and easily automated once your financial accounts are linked.

- Define what makes you truly happy. Analyze what has brought you happiness in your life. You’ll be surprised to learn that what gives real meaning to your life doesn’t require a lot of money.

- Take appropriate action based on your findings. Eliminate wasteful spending, improve your lifestyle, and pursue your true happiness wholeheartedly.

Closing thoughts

Given that our only failure was that we were nice and tipsy at times, that was a fantastic financial year.

If we had to grade ourselves, we could give ourselves a 12 out of 13 or an A-. Given all of the heavy-duty goals we accomplished, that sounds like the grading of a tough and heartless college professor.

Let’s give ourselves an A! Yeah!

We couldn’t have achieved most of these accomplishments without putting in the necessary effort, and that effort is paying off handsomely.

You’re probably aware of how much I enjoy quotes, so I’d like to conclude with this motivating quote from the real Wolf of Wall Street: “The only thing standing between you and your goal is the bullshit story you keep telling yourself as to why you can’t achieve it.” ― Jordan Belfort