This post contains affiliate links, which means that if you click on one of them and sign up for a rewards program, we will receive a commission at no extra cost to you.

It’s no coincidence that I’m writing this in late March. Some of you may still be experiencing hangover symptoms such as headaches, nausea, and uncontrollable bodily shakes.

No, I’m not talking about a hangover from overindulging during the December holidays.

I’m talking about the aftereffects of spending too much time shopping with other stressed-out people, exchanging gifts with your close circle, and then going back in January to return a bunch of them for store credit and other goodies.

As you may have read on our blog, we did away with the holiday shopping zombie tradition a few years ago. Instead, we aim to spend quality time with our friends and family during the holiday season.

We invite you to join our stress-free holiday season club and experience how magical the season can be without more stuff.

Holiday shopping aside, we still need to make some regular purchases throughout the year in categories such as shopping, supplies, dining, and travel. Our hard-earned money is a reflection of the time we gave up to obtain it, so we hustle to make every dollar stretch further and get more value for our out money. Correction, I hustle to find the best deals and keep an eye on José to make sure he doesn’t go rogue and buy something without prescreening it for optimal discounts first.

Here are 5 tips we follow for saving on everyday purchases we make

1. Discounted gift cards

Gift cards have become quite a popular gift choice for many givers, however, the recipients don’t always need or want what they get. In those cases, they are willing to sell the gift card value to you and me at a discount. As the demand for such exchange services rose, many websites popped up to be the middle man and earn a bit. Once I heard about this concept, I did some research and narrowed down my purchases to the top two sites: Cardpool and Raise.

Cardpool

The reason I like Cardpool is because this site doesn’t charge fees for the buyer and it has a “WishList” capability. Essentially, you can check off all the retailers you have an interest in, and they send you a daily customized summary of the ones they have gift cards available for.

Raise

I primarily use Raise to compare and contrast with Cardpool offers and because they have a handy search capability for retailers with multiple stores under the umbrella company. For example, I often shop at TJ Maxx, and they are owned by the same group as Marshalls and Home Goods. This means that you can use any of the gift cards at any store. Therefore, I like using Raise to see at a glance which one it makes more sense to buy.

A sea of options

There is also Gift Card Granny to compare sales across gift card sites, which comes in handy. And, I recently started using Card Cash as well. The point is there are many sites, so if you spend a few minutes checking out your options, it pays. Literally. 🙂

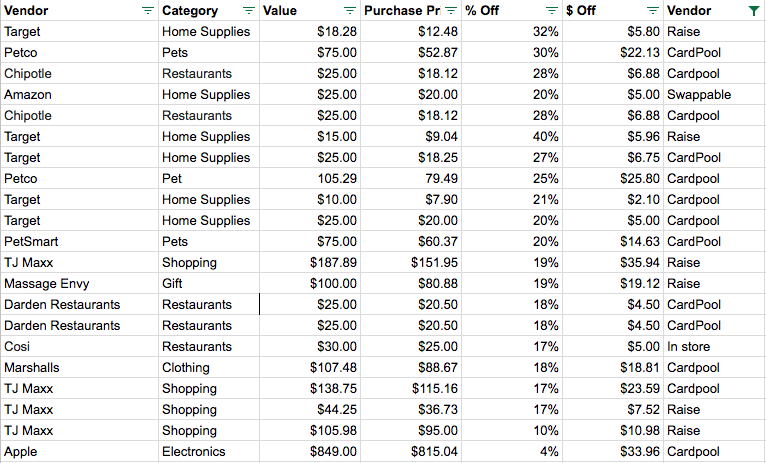

Examples of our discounts

As you can see, the discounts vary. Our biggest discount so far was 30% on a pet store gift card. (The big discounts on Target were actually inflated because we applied some $5 referral bonus codes to those. Normally, Target discounts range between 4-7%)

Lucky Pushok gets premium quality food and litter now for less than the crappy stuff I had him on before I did my research on pet supplies. José is happy that his budget didn’t increase when the quality of the products did. I love it when both of my men are happy. 🙂

Other tips for discount gift card purchases

- There are peak times for buying cards when you won’t get as much of a discount. I usually expect to see an inflow of gift cards for sale in January, once people decide which holiday gift cards to keep versus sell. Don’t make rash decisions. You can always keep an eye on price trends and hold off your purchase until a better deal comes up.

- Be sure to check what type of gift card you are buying: online only, in-store only, or mobile. They have different restrictions.

- Since I only buy gift cards, I prescreened these sites from the buyer’s point of view. If you are interested in selling gift cards, I encourage you to do more research on which sites are best for that.

- There are some gift cards that are sold by regular people versus by the retailer. If you see a bunch of gift cards available for the same percentage off, then chances are it’s a retailer sale. If you only see a few gift cards, it’s likely private sales. The retailer sales come in handy when you need to buy gift cards in bulk for a bigger purchase. I did this with Apple when I needed enough gift cards to buy a new phone this year.

- Plan ahead for gift cards you need, especially the physical ones that need to be shipped to you. If you frequent some retailers, then it may make sense to always have a gift card for them.

- Keep a record of the gift cards you bought and whether you used them, so you don’t forget about the value you have available. I also keep track of how I spent them, so I can categorize expenses in Mint appropriately.

- Cardpool and Raise have referral programs, which give you $5 towards your next purchase if someone you refer signs up and makes a purchase. If you want to sign up, feel free to use our referral links above and you’ll get $5 off your first order and so will we. Then, send your link to your friends and family to pay the $5 off forward and get $5 for your future purchases. Everyone wins. 🙂

2. Ebates and Mr.Rebates

We only learned about these babies last year and so glad we did. Essentially, when you make online purchases, you go to ebates.com or mrrebates.com, search for your retailer of choice, and see if they offer a cash rebate by going through either site. I use these two sites to compare and contract where the rebate offers are better.

The rebates post electronically and, on a periodic basis, you get a check with whatever you earned (automatic on Ebates; need to request on Mr.Rebates). No strings attached, just cash back. You are basically just using their cookies to get to your online shopping destination.

The percentage in cash back varies for each retailer over time, but I have saved up to 12% on some retailers.

Ebates also has a referral program. Use our referral link here to sign up and get $10 off your first purchase of $25 or more within 90 days of becoming a member, and then forward your referral link to friends and family to pay it forward and get referral credit.

Mr.Rebates also has a referral program. You can sign up using our referral link, and then forward to your circle. Then, each time your referral gets cashback, you get a bonus equal to 20% of their rebate. It feels a lot like a pyramid scheme, except it’s not, since there is no catch. I prefer to call it referral royalties. 🙂

3. Online shopping malls

If you have a credit card or are a member of a frequent flyer or hotel program, then chances are that at least one of those companies has an online shopping mall. Essentially, it’s just a middle man referral space where you go to earn points for your purchases at online retail sites. It’s the same concept as Ebates, only instead of cash back, you get points towards the airline, hotel, or credit card rewards.

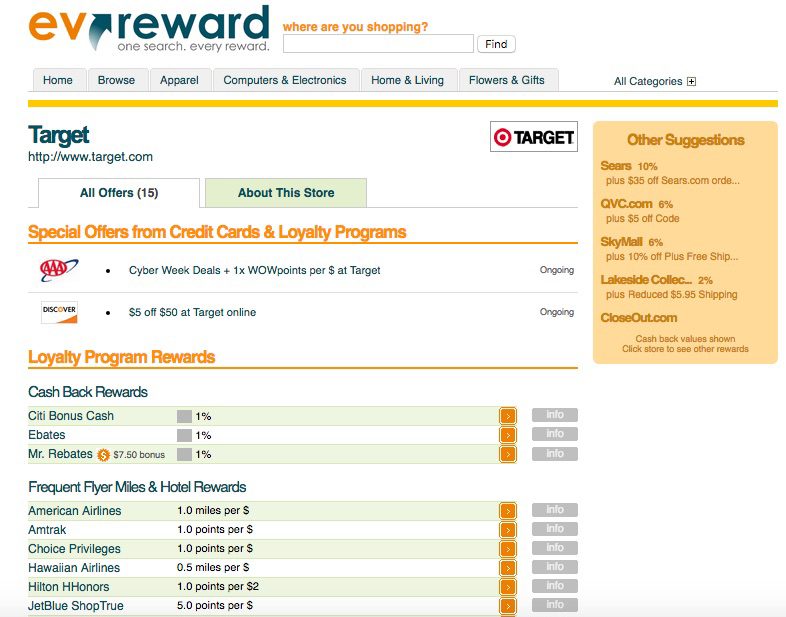

The points earned per dollar spent vary by the intermediary, so I like to compare and contrast before I make the purchase. I recently learned about a great site that shows your rewards per intermediary at a glance: ev reward. All you have to do is search for the retailer of choice, and you’ll see an aggregate of all the offers out there.

Time is money, so getting rewards and discounts in less time is a bonus in itself.

4. Dining out points

Similar to the online malls, most of the big airlines and hotel chains have a dining reward program where you can earn points towards the frequent flyer program by registering for a dining program. When you sign up, you can link all your credit cards to your account, and whenever you dine at a participating restaurant, you’ll get points towards your account. The nice thing is that this happens automatically, so you only need to spend a few minutes up front signing up and saving your card numbers.

Bonus points tip: The nice thing is that you usually get a chunk of points as a sign-up bonus, and then earn points per dollar spent at participating restaurants. If any of your points are about to expire, this will help renew the “last activity date” and reset the clock.

Pro tip: Note that you can’t register the same credit card for two different programs to prevent double-dipping. For example, if you have one credit card registered for your Hilton dining program, you have to use another one for your Southwest account. Of course, initially, I spread the cards across all the programs to get the sign-up bonuses for each. Later on, I consolidated them under one program for ease of monitoring.

5. Credit card points & promotions

Last, but not least, if you use credit cards to make your purchases, be sure to use the optimal one depending on the retailer. Some cards have a flat reward percentage, while others rotates bonus categories or have special promotions. For example, if I am about to pay for a hotel online, I will use whatever card has the best reward percentage for the travel category.

The only limitation here is that if you’re going through a credit card online shopping mall, you’ll have to use that company’s credit card to get the points.

Use Wallaby to help you swipe the right card

When you are shopping in physical stores, instead of online, Wallaby is a nice mobile app to remind you which credit card is offering the best rewards in each category. For example, when you are inside a restaurant and open the app, it’ll tell you which of your cards to use to pay the bill.

It’s pretty easy to set up the account. You don’t have to enter the credit card numbers for your cards. You only need to enter which credit cards you have.

Double and triple-dipping

While some of these tips can only be applied one at a time, I love double and tripple-dipping when I can.

Let’s look at an example.

- I want to book a hotel for $100 on Hotels.com. Instead of just going directly to the site, I check Evrewards.com and find that Ebates.com has the highest reward for Hotels.com at 6% back, which equals a $6. I go to Ebates.com, search for Hotels.com, and go through their site to Hotels.com. (Gotta love those cookies!)

- Once redirected from Ebates.com, I log into my Hotels.com account to ensure I’ll get the credit for the night towards a future free night, valued at 10%, which is $10 here.

- Lastly, I check my credit cards and use the one that gives me 2% in rewards for travel, which is $2 in this case.

Now, let’s do the math:

While I pay $100 for the hotel, I am getting cash back/rewards equivalent to $6 + $10 + $2 = $18. That’s 18% off the listed price.

That is what I call a damn good deal!

What’s the catch?

If you want to take advantage of these saving techniques, you will have to spend some time upfront setting up the accounts for these services. Thereafter, you must be willing to spend time and be thoughtful about each purchase.

Time-saving tip: I bookmark these sites together in my browser, so that I can easily access each one.

At the end of the day, remember that time is money. Don’t waste too much time doing all of this if you are making a small purchase. Some of these techniques really pay off on big-ticket items, but the savings are negligible on small purchases.

Lastly, before you buy, make sure your purchase is within your budget. A discounted gift card is still a bad purchase if your budget doesn’t allow for it. And even if you have money outside of your budget, don’t hoard gift cards that you won’t need for a while, as the amount you save on them could be less than what you could earn on that money if you invest it instead.