July has been a month of reflection and recalibration for our FIRE journey. As we update you on our Nuestra Casa Fund (NCF) progress, we have some big news to share that's shaking up our plans. NCF Update: A Big Jump Forward First, let's dive into the numbers. This month, we've seen our biggest jump yet in our NCF, reaching 39.1% of our goal. That's an 8.9% increase from last month, putting us ahead of schedule. Our mid-year bonuses gave us a nice boost, but it's important to remember that these windfalls won't happen every month. Year-to-date NCF UpdateMonthPercent of Goal MetBenchmark (the goal we set)Percent Increase towards 100%January 23.9%23.9% Started tracking this goal.February 25.1%26.5%&nbs

José

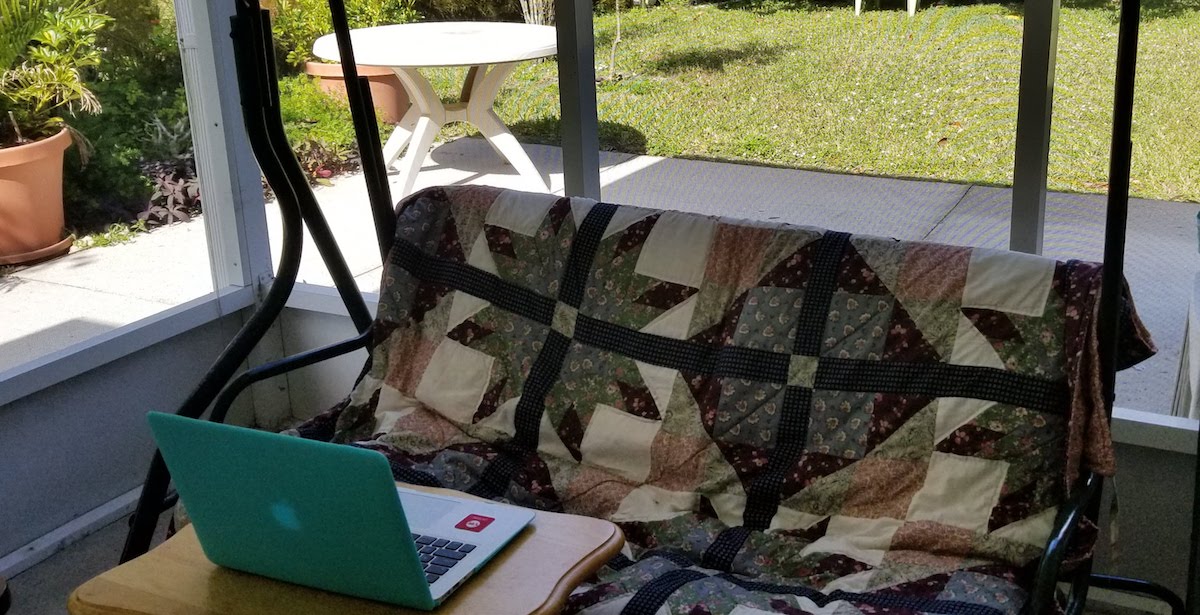

José concluded his distinguished 13-year career at Vanguard at age 44, stepping away from corporate life to embrace an early retirement. As a project manager, he expertly orchestrated the creation and delivery of educational materials—both digital and print—for 401(k) participants, ensuring resources reached millions of investors. Today, he embraces life's simpler pleasures: quality time with family, pursuit of passion projects, discovery of new adventures, and leisurely meals in his garden oasis.

View all posts by José →

Well that is good you figured out you don’t want to live in PC pre-ER. Would have been a bummer to move there and then figure that out. Of course, I am sure good experiences/memories would have come from it.

that’s great this month put you ahead of schedule. Much enjoying your blog. 🙂

Hi –

Yes, that would’ve been a bummer. I’m glad that we kind of “test drove” the area before we made a move. Our plan was to rent for a year after we retire and see how we felt about staying long term, to keep us from buying in a rush. After all, selling a property abroad it’s not as easy as in The States. So no retiring there for us but we do look forward to long vacations in Punta Cana with no strings attached.

I’m glad you’re enjoying the blog. It’s always great to get feedback from our readers. Thank you for commenting.