Hey there, fellow freedom seekers! It’s time for our monthly financial independence update, and boy, do we have some exciting news to share. Our Freedom Fund—our ticket to a life of choice and purpose—is blossoming like never before.

Remember that mango tree analogy we’ve been using? Well, our mangoes are so close to ripening that we can almost taste the sweet flavor of financial freedom. We’re now at 90% of our goal, which means we’re actually a couple of months ahead of schedule. Can you believe it? July 2017 is our target date, and it’s looking more achievable than ever!

But let’s not count our mangoes before they’re picked. The market can be as unpredictable as a summer storm, so we’re keeping our eyes on the long-term forecast. Speaking of which, let’s dive into the numbers that have us doing a little happy dance.

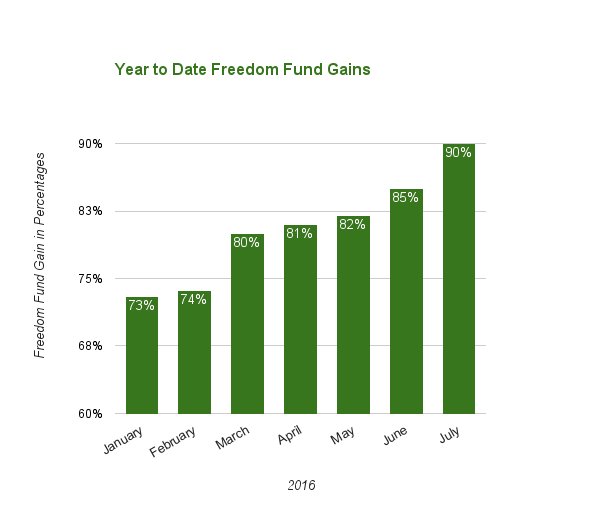

Our Year-to-Date Progress

In just seven months, we’ve seen our progress shoot up from 73% to 90%. It’s like our Freedom Fund tree got a mega dose of fertilizer! This growth is incredibly motivating, but we’re not letting it go to our heads. We know that slow and steady wins the race.

Breaking Down Our Freedom Fund

Now, here’s where it gets a bit technical, but stick with me. Most of our assets are tucked away in retirement accounts. It’s great for tax benefits, but it does mean we need to be clever about accessing our funds before we hit that magic number of 59½.

Our secret weapon? The Roth IRA Conversion Ladder. It sounds complicated, but it’s basically a strategy to access our retirement funds penalty-free. We’re also building up our non-retirement assets to cover those first five years of early retirement. It’s all about balance and planning ahead.

Performance and Investment Mix

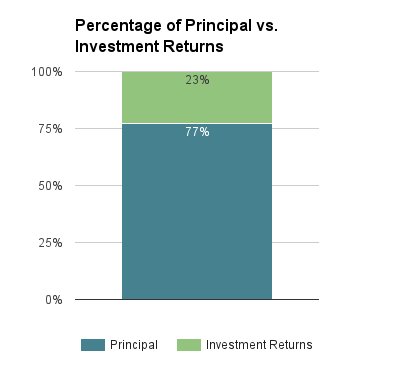

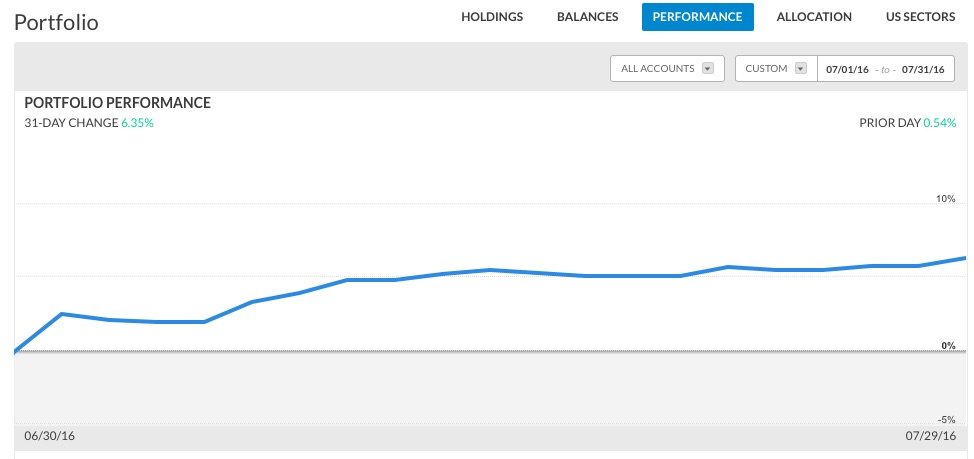

Last month was particularly kind to us, with the market gifting us a 6.35% gain. It’s moments like these that make all the budgeting and saving worthwhile. But here’s a cool fact: even if the market took a 20% nosedive right now (knock on wood), we’d still be in the green. Why? Because 23% of our balance is pure investment returns. Time in the market really is our best friend.

We’ve started using Personal Capital’s free tools to track our progress, and I’ve got to say, those colorful graphs make number-crunching almost fun. Almost.

Learning and Growing

This journey has taught us so much. We’ve learned to focus on asset allocation rather than trying to time the market. We’ve discovered the power of staying invested and the peace of mind that comes from a solid, long-term strategy.

Every month, as we crunch these numbers and update our charts, we’re reminded of why we started this journey. It’s not just about the money—it’s about creating a life where we have the freedom to choose how we spend our days.

So, how about you? What financial goals are you working towards? Have you hit any milestones recently? Remember, every step forward, no matter how small, is progress. Keep nurturing your own freedom fund, and before you know it, you’ll be picking your own financial mangoes!

Until next month, keep growing and stay focused on your path to freedom!

Risk disclosure: All investing involves risk, including the possible loss of principal. The material contained on this website is for discussion purposes only and should not be construed as financial advice.

Wow! This is awesome! Congrats on reaching another milestone! It’s so motivating to follow graphs of your progress, isn’t it?

I also love that you guys explained how you will convert your non-retirement assets. That was a question we struggled to find an answer to in this world of very late retirements. As a result we did what you are doing now- built up the non-retirement fund to avoid early penalties and fees, because who likes those, right?

Great work and keep it up!

Hi! Thank you. It sure is motivating and I like that the blog provides me with a reason to track the progress via different charts. Yes, we gotta do our best to avoid those fees!!! It’s amazing how little people know about the loop holes available. I found out about it a few years ago as well. Thanks for dropping by!