I recently returned from a few days in Rhode Island with my father and family. We ate together, drank coffee, had great conversations, sat outside to enjoy the nice weather, and watched the neighbors literally burn thousands of dollars in fireworks on July 4th.

We never had to leave the property to watch them; we just sat in the backyard and drank wine while the beautiful show in the sky continued. I cherish the time we spent together.

It was a very relaxing five-day vacation, and I wish I could have stayed longer, but that would have meant rearranging some commitments.

Furthermore, I had already committed to coming to work the next day and had planned the rest of the week around the fact that I would be returning to Pennsylvania on July 5th.

Those frustrations reminded me of why we’re doing this. Why do we save and invest the majority of our hard-earned money rather than spending it on a lavish lifestyle that includes first-class travel, luxury vehicles, fine dining, luxurious vacations, and bigger houses?

Why do we choose to live a lifestyle that some may perceive as “accumulating money” and living in “deprivation”?

Why not enjoy it right now? Since you can’t take it with you when you die.

It has never been about the money

The truth is that our journey has never been about amassing wealth for the sake of amassing wealth. It goes far beyond that, and those who think in these terms completely miss the point. They don’t understand, and may never understand, why we’ve chosen this path.

This journey is about breaking the bonds of debt slavery so that when we wake up in the morning, we have the option to refuse the predetermined lifestyle that has already been set for us. It’s about making the cubicle environment a choice rather than a necessity, about being yourself, and having a variety of options.

Most importantly, this journey is about living a life that is breathtaking, awe-inspiring, magnificent, wonderful, amazing, stunning, impressive, and truly happy without the need to impress anyone but ourselves.

Stop drooling over it.

To get there, you must first purchase the most valuable commodity on the planet: time! Having complete control is essential for fully enjoying this journey.

There are some things in life that you will never be able to fully control, such as family issues, death, illness, and weather disasters, but then there is financial freedom!

Financial freedom solves many problems

When you have financial freedom and problems arise, you can simply pull out your wallet and solve the problem. It’s a fabulous state of mind. To afford such a lifestyle, we are looking to achieve financial independence with a portfolio built to last.

I’ve always said that financial independence means different things to different people, like different strokes for different folks. I’ve even used the term synonymously with financial freedom.

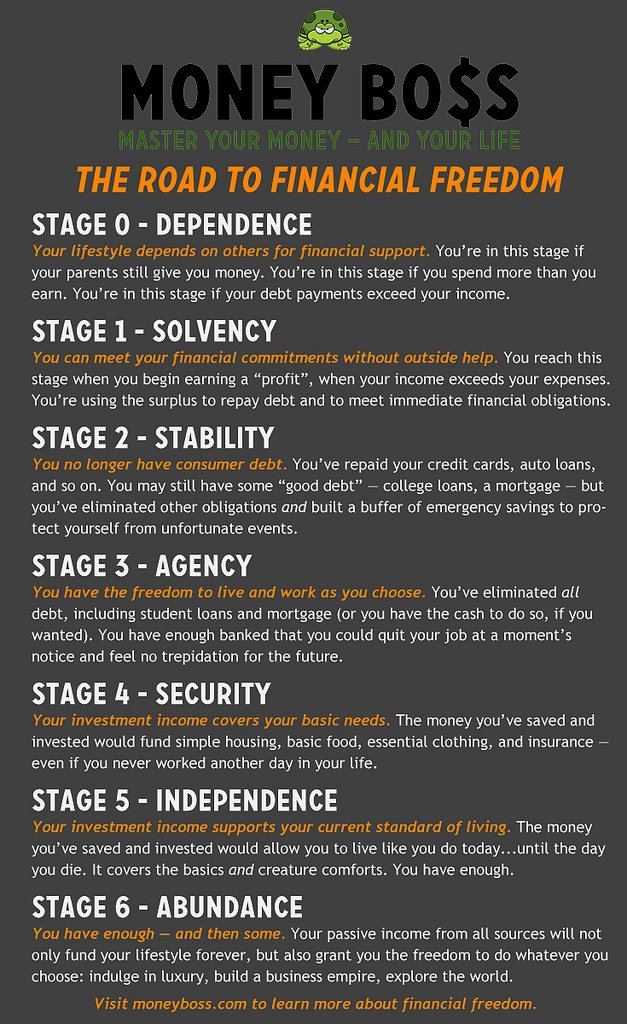

That was my interpretation until I read J.D. Roth’s article about the Six Stages of Financial Freedom. J.D. is financially independent, but he recalls that his life was a disaster 12 years ago. He had more than $35,000 in consumer debt and was living paycheck to paycheck.

In the article, J.D. explains the various stages of financial freedom and provides us with the following useful chart:

Independence, according to J.D. Roth, is one of the final stages of financial freedom, followed by abundance. We’ve been going through this financial freedom process stage by stage in our quest for financial independence, with no clear road map but a desire to change what wasn’t working for us.

The lifestyle we envision

We envision a lifestyle that makes us feel good every day—one that is well-lived and immersed in true happiness. To accomplish this, we committed to living debt-free and cutting any unnecessary spending. Everything else began to fall into place after that.

I hope the chart is useful to those of you who are just beginning your journey to financial freedom. It’s an effective guide that teaches you the fundamentals of financial freedom.

Ultimately, financial freedom is about having options. The more stages you complete, the more and better your options will be.

We are currently in Stage 4. We have achieved financial security and have been on the FI path since we began blogging. For us, financial independence is just around the corner! We are no longer constrained by debt, and we have more options than ever before! It’s a thrilling adventure.

Get off the treadmill ideas

If you haven’t noticed, Tatiana has returned to the Motherland of Belarus, after an 18-year absence. She’s been sharing some amazing photos from her trip, and I can’t wait to hear more about it.

I went to Rhode Island to spend the Fourth of July while she was away. It was an excellent opportunity to see my father, who is visiting the United States and has extended his stay. If Tatiana and I returned to our routines and felt the desire to quit our jobs and live off of our investments, we could choose from the following options:

- We could sell the rental property, invest the proceeds in our stock and bond portfolio, and live off of our Freedom Fund. Our Freedom Fund currently provides a safe withdrawal rate of $29,000 per year.

- We could withdraw some funds from the market, start a business, and relocate. If we so desire, this could help us achieve independence and abundance. We could do this in a place where the weather is pleasant all year.

- Last but not least, when Tatiana returns, she may have more great ideas. Returning to work after such a long European vacation will be jarring for her. She might not show up to work again if I mention any quit now ideas!:) Besides, she’s never short of creative ideas. I’m confident she can come up with solutions I haven’t considered.

These are just quick ideas; we can get more elaborate. You saw nowhere in our options that we had to work to pay off our debts. I’ve been there, and I’m done! The Solvency stage has long passed.

Final thoughts

I’m sure your path to financial freedom looks different than ours. It is critical that you visualize the life you want to live, paint your journey, and know where you want to stop and say, “I have had enough. I have options. This is what I seek in life. The rest is pointless nonsense. At this point, I can stop accumulating and cash in on my options. I make the decisions and am in charge of my financial future.”

Yes indeed. The few that get it and get to enjoy life outside of the cubicle build lifetime memories.

Oh the woes of not having enough time, even when you are making good money. Time is such a precious commodity and not worth giving it up for a 9-5 for 50 years of your life. I think your mindset is what makes people eligible for FI. Not everyone wants to live within their means and sacrifice to accumulate money and then live life in their own terms. But the few that do get the point that it’s not the material possessions, it’s the memories built away from the paycheck that really count.

You have made some awesome progress. Independence is great and the idea of abundance sounds nice too! I see you have traveled a good bit, is there a particular place you plan to live abroad?

Thanks Mr. CK!

Tanya is the bigger traveler as she just got back from a 20-day trip to Belarus. I’m just getting started. 🙂 We’re planning to live in Punta Cana and make the DR our base during our first years of early retirement but we’re keeping things flexible so that we can change plans if we feel the need to. It’s not like we need to rush and move to a more permanent place right away so we’re also playing with the idea of traveling the world during our first year of ER, staying in one continent months at a time. This might include doing the Caribbean, Latin America, Asia and Europe. Thanks for reading and commenting.

We are in “Agency” and love it! Nothing like waking up in the morning and knowing you don’t owe anyone anything, and that all moneys that used to go to payments now go to a mutual fund, which in turn SENDS YOU interest 🙂

Congratulations. That’s impressive. Most people get stuck in Stability because they keep on spending as if they were in the Abundance stage.