Ever notice how personal finance articles often claim you need a six-figure income to be happy? Well, I’m José, and together with my wife Tatiana, we’re here to challenge that notion. In 2015, we spent just $40,882 and had one of our most fulfilling years yet. We traveled, danced at concerts, enjoyed amazing meals, and spent precious time with family and friends. Today, we’re pulling back the curtain on our finances to show you exactly how we did it.

Why We’re Sharing Our Numbers

Transparency in personal finance is rare, but we believe it’s crucial. Too often, we see friends and colleagues trapped in the cycle of earning more but never feeling financially secure. By sharing our detailed expenses, we hope to demonstrate that living well doesn’t require an extravagant income. It’s about intentional choices and aligning your spending with your values.

Our Approach to Money and Happiness

As a middle-class couple without children, we recognize our situation might be different from yours. However, our core philosophy can apply to anyone: view your expenses as life energy and make every dollar count toward your happiness. We’ve learned that true contentment rarely comes from material possessions. Instead, we focus on experiences, relationships, and building a secure future without sacrificing the present.

This mindset has transformed how we handle money. We’re not extreme minimalists or frugal to the point of discomfort. Instead, we practice what we call “conscious spending”—being m mindful about where our money goes and ensuring it aligns with our values and long-term goals.

Breaking Down Our Expenses

We categorize our spending into three main areas: essential, discretionary, and gifts/donations. Let’s take a closer look at each:

Essential Expenses: $13,171 (33% of total spending)

| Category | Amount | Description |

|---|---|---|

| Housing | $2,798 | We’re currently renting, which works well for our lifestyle. Our net rent (after rental income) was just $2,798 for the year. |

| Groceries | $5,205 | We splurge on good food, including the occasional caviar for New Year’s! |

| Transportation | $2,187 | We live close to work, which significantly reduced our fuel costs. |

| Utilities and Services | $2,981 | This covers internet, electricity, trash, and mobile phones. |

| Total | $13,171 |

Housing is typically the biggest expense for most families, but we’ve found a creative solution. Through our rental property income, we’ve managed to reduce our net rent to just $2,798 for the year. The property provides $13,800 in annual rent, leaving us with remarkably low housing costs after expenses.

Our grocery bill came to $5,205, which might seem high for two people. But here’s where our values come into play—we believe in eating well and cooking at home. Yes, we splurge on items like caviar for New Year’s (we’re half Russian, after all!), but we’ve found that quality ingredients and home-cooked meals actually save money compared to frequent dining out.

Transportation costs totaled $2,187, significantly lower than previous years. A key decision we made was moving closer to work—we’re now just two miles away. This choice has cascading benefits: lower fuel costs, reduced vehicle maintenance, and more free time from shorter commutes.

Utilities and services ran us $2,981 for the year. This includes internet ($520), electricity ($634), trash service ($206), and mobile phones ($840). We’ve found sweet spots in each category—like our Cricket wireless plan that gives us both unlimited minutes and generous data for $70 monthly.

Discretionary Expenses: $18,909 (46% of total spending)

| Category | Amount | Description |

|---|---|---|

| Travel | $6,269 | We visited the Dominican Republic and Florida multiple times. |

| Dining Out | $2,920 | Moving to the suburbs helped us cut back on restaurant spending. |

| Alcohol & Bars | $1,547 | We’re aiming to reduce this in 2016 as part of our goal to minimize toxins in our lives. |

| Entertainment | $914 | We enjoyed concerts, shows, and movie nights. |

| Shopping | $1,528 | This included some home improvements and personal items. |

| Health & Fitness | $935 | Includes our work gym membership. |

| Home Furnishings | $852 | We invested in making our living space comfortable. |

| Personal Care | $689 | We’ve started using more non-toxic products, which can be pricier. |

| Health Insurance | $1,066 | Employer-sponsored for both of us. |

| Dental Insurance | $312 | Also employer-sponsored for both. |

| Pets | $447 | Tatiana insists on high-quality food for our cat, Pushok! |

| Transportation-related | $481 | Includes tolls, parking, and public transportation. |

| Other | $949 | Covers various small expenses like coffee shops, dry cleaning, and renter’s insurance. |

| Total | $18,909 |

This category reveals the most about our lifestyle and priorities. Travel took the biggest slice at $6,269, covering multiple trips to the Dominican Republic and Florida. We’re not luxury travelers; we look for deals, use rewards points when possible, and focus on experiences rather than fancy accommodations. For 2016, we’re diving into travel hacking to stretch these dollars even further.

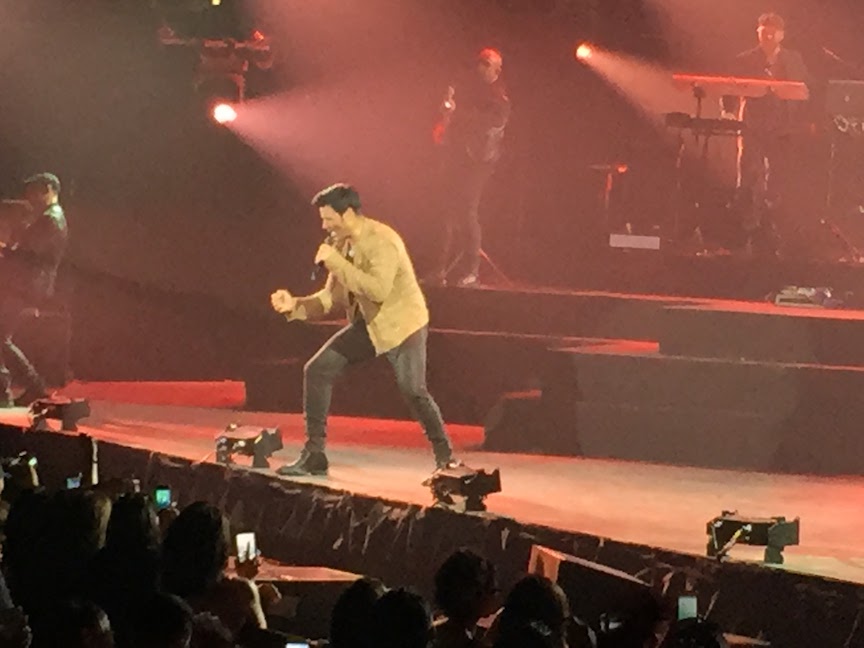

Entertainment and dining form another significant portion of our discretionary spending. We spent $2,920 on restaurants, $1,547 on alcohol and bars, and $914 on entertainment like concerts and shows. Moving to the suburbs naturally reduced our restaurant spending—fewer temptations!—but we still make room for experiences we truly value. For instance, we attended Chayanne’s En Todo Estare Tour and Ricky Martin’s One World Tour at Atlantic City’s Boardwalk Hall. These concerts were unforgettable nights of dancing and joy—exactly the kind of experiences we prioritize.

Health and wellness is another priority, reflected in our spending. We invested $935 in health and fitness, including gym memberships. Personal care ran us $689, with a focus on non-toxic products. While these items cost more, we view them as investments in our health.

Home furnishings ($852) and shopping ($1,528) show restraint compared to previous years. We’re thoughtful about what we bring into our home, ensuring purchases serve a purpose and add value to our lives. Even Pushok, our cat, gets the good stuff—we spent $447 on quality pet care because, as Tatiana insists, our furry family member deserves the best!

Insurance costs, including health ($1,066) and dental ($312), are manageable thanks to employer-sponsored plans. We also maintain renter’s insurance ($196) because peace of mind is worth the small annual cost.

Gifts and Donations: $8,802 (21% of total spending)

This category makes us particularly proud. We dedicated $8,802 to gifts and donations, representing 21% of our total expenses. This isn’t just about charity; it’s about gratitude and recognition of those who helped us along our journey. A significant portion goes to supporting our parents, who sacrificed so much to ensure we received good educations. The rest is split between charitable causes and thoughtful gifts for friends and family.

We’ve actually convinced our loved ones to skip excessive gift exchanges during holidays and birthdays. Instead, we focus on spending quality time together, which has made celebrations more meaningful and less stressful.

Looking Ahead: Our Path to Financial Independence

Tracking our expenses this carefully serves a bigger purpose—we’re working toward financial independence. When we first shared our spending report in March 2015, we projected reaching financial independence in March 2019. Thanks to our conscious spending and solid investing strategy, we’ve moved that date up to November 2018!

While market fluctuations might shift this timeline, we’re not overly concerned. We maintain separate reserves for our early retirement needs, ensuring market volatility won’t derail our plans. This approach gives us confidence in our future while allowing us to enjoy the present

Living Well with Less: Key Takeaways

- Housing Flexibility: Renting isn’t “throwing money away” if you invest the savings wisely. Our rental property strategy has significantly reduced our housing costs while building equity.

- Location Matters: Moving closer to work cut our transportation costs dramatically while improving our quality of life.

- Intentional Splurging: We spend freely on experiences that matter to us (travel, concerts, quality food) while minimizing expenses that don’t align with our values.

- Health Investment: We don’t skimp on health-related expenses, viewing them as investments in our future well-being.

- Giving Back: Financial success enables generosity, which brings its own rewards and satisfaction.

Your Journey to Financial Freedom

We share these details not to brag or suggest everyone should copy our approach, but to spark ideas and show what’s possible. Financial freedom isn’t about deprivation; it’s about making intentional choices that align with your values and goals.

The path to financial freedom isn’t about having the highest income or living like a monk. It’s about being intentional with your resources and ensuring your spending reflects what truly matters to you. Here’s to making every dollar count on the road to financial independence!

Nice breakdown! I was just working on our numbers, and it looks like our spending is pretty close to yours. Though we don’t have subsidized housing 😉

LOL. Including the rental income as part of that equation makes it feel worthwhile when I get a call to repair something at someone else’s apartment instead of mine!

I can’t wait to see your numbers. Thanks for stopping by.

Great article! Thanks for the share. Now we will have to strive to reach that amount as well 🙂

Hi,

The key is to track your spending. You’ll be eventually get to a “happy number” as you become aware of where your money is being spent. Thanks for reading!

117% increase for el azaroso.. forget about Social Security and COLA increases, that welfare cat lives the high life in the Enchumbao household XD.

But seriously now, thanks for sharing. This is all very encouraging to all of us on the FI pursuit to compare notes and see how we are doing!

Wow, I didn’t even realize what a huge increase that was! That conniving azaroso already eats better than me. Watch him hint at getting medicaid next year!

You’re welcome. It’s a fun post to put together because as we put down every line item, it makes us really analyze them. By the time we’re ready to pull the plug on the 9to5s we’ll be able to predict with extreme accuracy how the spending will go. Thanks for commenting!