Hey there, fellow financial freedom lovers! It’s time for our monthly Freedom Fund update, and boy, do we have some exciting news to share. We’re inching closer to our goal of financial independence, and we can almost taste the sweet nectar of early retirement!

The Big Picture: Where We Stand

As of September, our Freedom Fund sits at a whopping 90% of our target. Can you believe it? We’re so close we can practically hear the beach waves calling our names! Our investments can now cover $31,800 in annual expenses, leaving us just $3,200 short of our $35,000 annual income goal. Talk about progress!

Now, I know what you’re thinking—”But what about market fluctuations?” Well, here’s the scoop: August was a bit of a rollercoaster. Our market investments took a little dip, but thanks to our active income, we still managed to increase our net worth slightly. It’s like our Freedom Fund is doing the cha-cha—two steps forward, one step back, but always moving in the right direction!

The Journey So Far

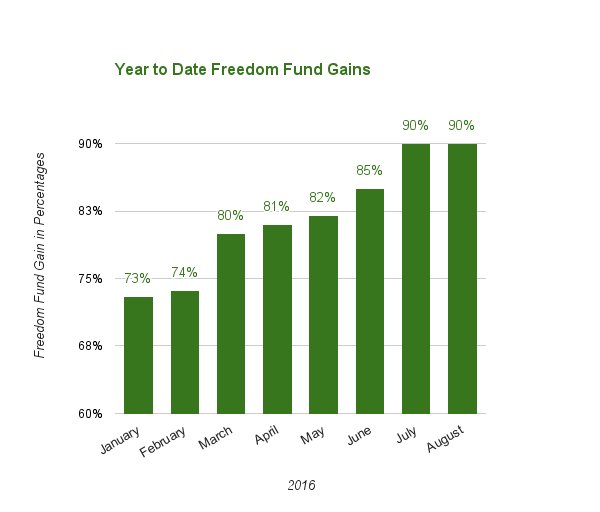

Let’s take a walk down memory lane, shall we? In just seven months, we’ve watched our year-to-date progress climb from 73% to 90%. It’s like watching our very own money tree grow (and who doesn’t love a good money tree?). Sure, there were moments when it felt like we were stuck in molasses—like that tiny bump from July to August—but that’s the nature of the beast, folks!

Investing is a lot like gardening. Sometimes you plant the seeds and water them faithfully, but it feels like nothing’s happening. Then suddenly, BAM! You’ve got a jungle in your backyard. Patience is key, my friends.

Breaking Down the Freedom Fund

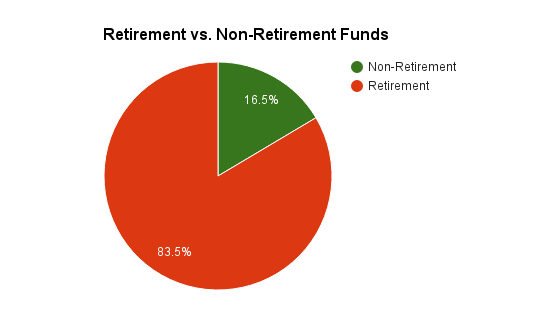

Now, let’s get into the nitty-gritty. Most of our Freedom Fund is tucked away in retirement accounts. But here’s the catch: we can’t touch those without penalties for five years after we retire early. So, we’re on a mission to beef up our non-retirement assets. It’s like we’re squirrels, gathering nuts for that first winter of early retirement!

Last month, we saw our non-retirement asset fraction increase by almost 2%. It’s not huge, but it’s progress, baby! We’re focused on pumping up those non-retirement accounts for the rest of the year. It’s all part of our master plan!

The Crystal Ball: Our Early Retirement Forecast

Here’s where it gets really exciting. We’ve been using Personal Capital’s Retirement Planner tool, and guess what? It’s giving us a big thumbs up! According to their predictions, our portfolio will support our retirement goals 82% of the time. That’s like getting a B- on our retirement report card—not too shabby!

Now, some people might hear “82%” and start sweating. But let me tell you, we’re doing a happy dance over here. Why? Because we’d rather take a 20% chance of needing a job in the future than a 100% guarantee of working until we’re in our 60s. No thank you!

Final Thoughts: Living Life on Our Terms

Here’s the deal: we’re not buying into the doom and gloom some people try to sell about early retirement. They say it’ll be bad for our health? Ha! We’ll be more active than ever. They claim we’ll struggle to maintain relationships? Please, we’ll have more time than ever for our loved ones!

We’re charting our own course, and the numbers are adding up beautifully. Sure, there’s always a bit of risk involved—that’s just how investing works. But we’re ready for this adventure, and we can’t wait to share more updates with you as we get closer to our goal.

Congrats on the progress! That’s a good point about health and relationships. I did expect to be more active, but had not anticipated how much my calendar would be filled by time spent with family and friends. When I was working we had to pick and choose which events we could spare time to attend. Now that I am done we have no excuses. Over the last few months I have connected many friends and family that I had not seen in a decade.

Hi MCK!

You’re a testament to this statement: Early retirement means that your time will be filled by reconnecting with family and friends. Thanks for stopping by!

Job well done!!!! Haters gonna hate. The whambulance is probably going off on you soon claiming you “cheated” or to explain out that this doesn’t happen to normal people — he did something”special” that doesn’t apply to the average joe.

Keep up the good work. Looking forward to the 100% celebration next summer!

Thanks LM! Yeah, I can not even begin to imagine what they’ll say. People will always talk no matter what you do so might as well do what makes you happy. 🙂

The market will probably keep the numbers interesting but as long as we continue investing and moving along with our plans we’ll be more than okay. Thanks for stopping by.