Welcome back to our quarterly update on how financial independence is fueling our journey to true happiness! In this edition of One Life To Live (OLTL), we’ll share our experiences, financial progress, and the steps we’re taking on our path to early retirement. Let’s dive in!

Exploration: New England Adventures

This quarter, we kept our travels relatively local but still managed to pack in some exciting experiences. After attending a friend’s wedding in Lancaster, PA, we embarked on a 14-day New England adventure. Our trip included:

- A work conference in New York City

- Family visits in Rhode Island

- A 5-day getaway to Cape Cod, Massachusetts

Here are some highlights from our Cape Cod experience:

- Indulging in a delicious lobster roll at Stewarts Seafood Restaurant

- Discovering the “best blueberry scone ever” at a cozy Provincetown cafe

- Exploring Provincetown’s Portuguese Square and the Pilgrim’s Monument

- Enjoying the sun at Race Point Beach

- Visiting the iconic Nauset Lighthouse

From the Chef’s Kitchen

While we love dining out, we also enjoy preparing meals at home. It’s a great way to eat healthily and save money. One of our favorite dishes this quarter was fettuccine alfredo with chicken and broccoli, made with gluten-free pasta and homemade Alfredo sauce.

Financial Progress: Building Our Wealth Ladder

Now, let’s dive into the numbers that showcase our progress towards financial independence.

Bare-Bones Expenses

For Q2 2018, our basic expenses totaled $4,448.19.

| Category | Quarter Amount | YTD Amount | Comments |

|---|---|---|---|

| Net Rent | $1,777.37 | $1,671.44 | YTD amount: We had a surplus in the first quarter and that’s why the YTD spent is less than the quarter amount. |

| Bills & Utilities | $509.79 | $1,020.10 | |

| Groceries | $1,236.95 | $2,751.20 | |

| Auto & Transportation | $619.98 | $1,110.59 | |

| Home Supplies | $304.10 | $660.53 | |

| Total | $4,448.19 | $7,213.86 |

One notable expense was a $350 repair on our 2007 Camry, which still beats having a monthly car payment!

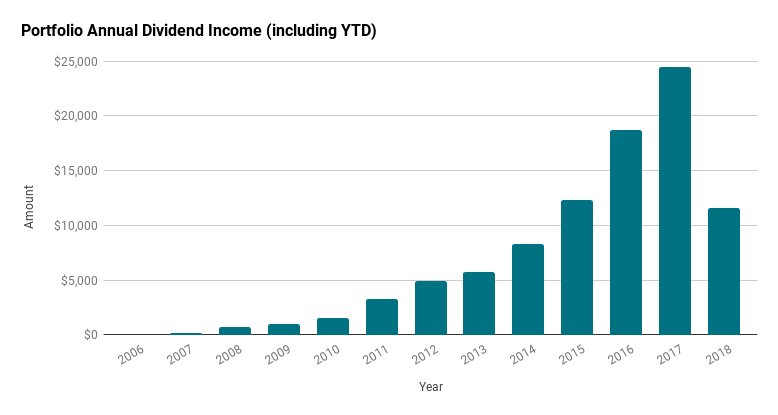

Passive Income Growth

Our dividend income continues to grow, reaching $5,954 this quarter—a 25% increase from last year. We’re particularly proud of how far we’ve come since our humble beginnings in 2006, when we were only receiving a few dollars in dividends each month.

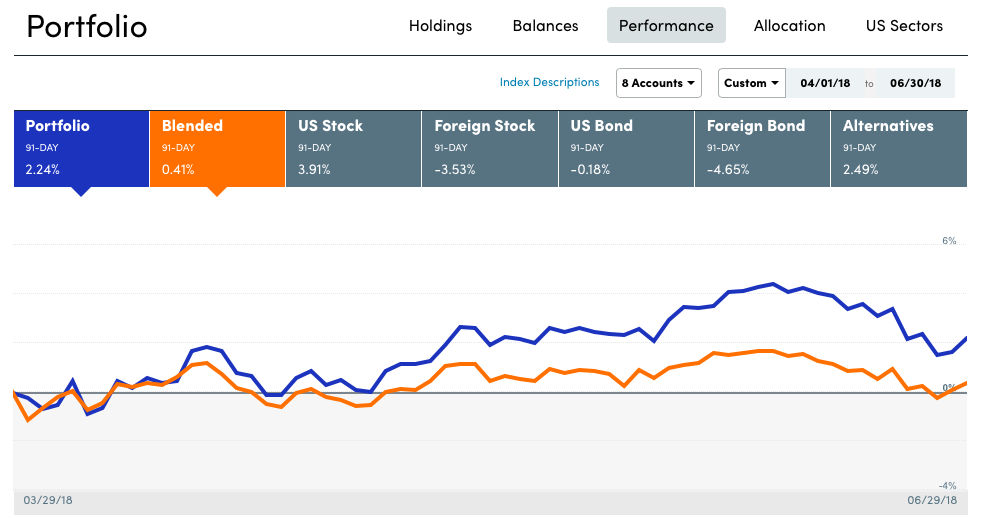

Freedom Fund Portfolio Performance

Our Freedom Fund Portfolio, which aims to provide income for the rest of our lives, saw a 2.24% return in Q2. Year-to-date, we’re relatively flat, but we’re prepared for potential periods of lower returns as predicted by some market experts.

Net Worth Update

While we don’t disclose exact figures, our net worth has seen significant growth since we started tracking it as a couple in 2014. It’s amazing to think that just a decade ago, one of us had a negative net worth on paper!

Road to Retirement

We’re on track with our early retirement plans and have already started decluttering in preparation for our next chapter. Our main financial goal now is to boost our brokerage account within the Freedom Fund, which will cover our expenses in the first five years of early retirement.

Final Thoughts

Our journey to financial independence is about more than just numbers. It’s about creating a life that aligns with our values and allows us to make the most of our one life to live. We hope our story inspires you to take control of your finances and work towards your own version of freedom.