We’re excited to introduce a new quarterly feature on our blog: “One Life To Live.” This section will explore how financial independence plays an integral role in fueling our happiness and how we’re optimizing our lifestyle to make the most of the one life we have to live.

In these updates, we’ll share our progress towards Financial Independence and Retire Early (FIRE), including our passive income growth, essential expenses, and how we’re balancing our financial goals with living life to the fullest. For our numbers-loving readers, you’ll find high-level updates on our main passive income streams and essential expenses. We’ll explore how our income would cover these expenses if we were already retired, giving us a glimpse into our post-FIRE life.

For those more interested in our lifestyle journey, we’ll provide updates on our recent adventures, challenges, goals, and the fun stuff that makes life worth living. We hope that by sharing our experiences, we can inspire others to find their own path to financial independence and a life well lived.

So, without further ado, let’s dive into our Q2 2017 update and see how we’re progressing on our FIRE journey while making the most of every day.

Passive Income Progress

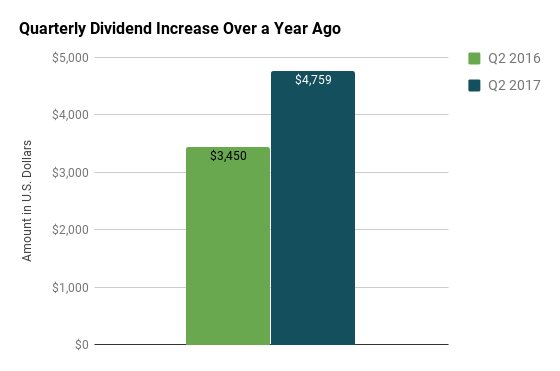

We’re thrilled to report that our dividend income for Q2 2017 reached $4,758.94, a 38% increase from the same period last year. This growth in passive income is a significant milestone on our path to financial independence.

In addition to dividends, we realized $2,087.79 in long-term capital gains this quarter. We made a strategic decision to sell some shares from a stock fund in our brokerage account, which earned us a 13% total return. This move aligns with our goal of maintaining no more than 50% of our net worth in stocks as we approach early retirement.

Essential Expenses and Financial Management

Our essential expenses for Q2 2017 totaled $8,032.67, averaging $1,828.44 per month. This includes categories like housing, utilities, groceries, and transportation. We experienced some unexpected costs with our rental property, which resulted in a net loss for the quarter. However, we’re viewing these repairs and upgrades as an investment in the property’s long-term value.

Main Category | Quarter Amount | 2017 Monthly Average | Comments |

| *Net Rent | $5,720.26 | $807.88 | Our rental property netted us $0 for the quarter. After accounting for taxes, insurance, and repair costs, we lost $2,270.26 for the quarter. |

| Bills & Utilities | $479.56 | $166.43 | |

| Debt Payments | $0 | $0 | |

| Groceries | $1,263.48 | $545.41 | |

| Auto & Transportation | $455.94 | $240.32 | |

| Home Supplies | $113.43 | $68.40 | |

Total | $8,032.67 | $1,828.44 |

We’re continuing to optimize our financial systems, closing unnecessary bank accounts, and simplifying our finances. This streamlining helps us stay focused on our FIRE goals while reducing financial stress.

Living Life to the Fullest

While we’re dedicated to reaching financial independence, we believe in enjoying the journey. Here are some highlights from our quarter:

- Dominican Republic Adventure: We spent 18 glorious days in the Dominican Republic, starting with a visit to family and indulging in some of the best pollo al carbon (charcoal-grilled chicken) in Santiago. We then drove to Punta Cana for two weeks of beach relaxation. This trip reminded us why we’re pursuing FIRE—to have the freedom to enjoy extended travel and quality time with loved ones.

- Culinary Explorations: We continued to hone our cooking skills, preparing delicious and cost-effective meals at home. From tuna fish meatballs with rice and beans to charcoal-grilled chicken and grilled salmon, we’re proving that eating well doesn’t have to break the bank.

- Concert Experiences: Music brings us joy, and we treated ourselves to some unforgettable concerts this quarter. We saw Latin legend Camilo Sesto in NYC and attended an energetic Ricky Martin concert in Maryland. These experiences remind us that it’s essential to allocate funds for activities that bring us happiness while still staying on track with our financial goals.

Balancing FIRE Goals and Lifestyle

Our approach to financial independence isn’t about extreme frugality or depriving ourselves of life’s pleasures. Instead, we focus on mindful spending, investing in experiences that truly matter to us, and continuously optimizing our finances to support our long-term goals.

We’re also exploring potential early retirement locations, keeping our options open as we near our FIRE target. This flexibility allows us to adapt our plans as our needs and desires evolve.

Looking Ahead and Your Turn

As we move into the second half of the year, we’re excited about the concerts we have lined up and the potential for more adventures. We’ll continue to work on establishing our miracle morning routine and finding new ways to optimize for happiness while steadily progressing towards our FIRE goals.

Our FIRE journey is teaching us valuable lessons about balance, priorities, and the importance of living in the present while planning for the future. We’re learning that financial independence isn’t just about the numbers; it’s about creating a life that’s truly rich in experiences and personal growth.

Now, we want to hear from you! How are you balancing your financial goals with living life to the fullest? What strategies have you found successful in your own journey towards financial independence?

Call to Action:

- Share your thoughts and experiences in the comments below. Your insights could inspire others in our community!

- If you found this post helpful, please share it with friends or family who might be interested in starting their own FIRE journey.

- Subscribe to our newsletter to stay updated on our progress and get more tips on balancing FIRE goals with an enjoyable lifestyle.

- Check out our resources page for tools and recommendations that have helped us on our path to financial independence.

Remember, we all have one life to live—let’s make it count! Whether you’re just starting out or well on your way to financial independence, every step you take towards your goals is a victory worth celebrating. Let’s support each other in creating lives of financial freedom and genuine happiness.

Join us next quarter for another update on our FIRE journey and lifestyle optimization. Until then, keep saving, keep investing, and most importantly, keep living life to the fullest!

All that food looks amazing! Plantains… yum. I’m big on rice + beans too. And plan on meal prepping such this weekend. Thanks for sharing your trip with us.

And nice job on the dividend income.

Hi!

Rice and beans meals prepping for the weekend sounds like a great plan. Enjoy!

It’s amazing how those dividends keep growing year over year but it’s definitely the result of disciplined investing. All our efforts have been going into the investment accounts after I paid off all my debt. Thanks for stopping by.