When my wife and I pulled the early retirement trigger in 2019, we faced a high-stakes question that keeps many would-be retirees working years longer than necessary: How much can we safely withdraw from our portfolio without running out of money?

The conventional wisdom pointed to the famous 4% rule—withdraw 4% of your initial portfolio in year one, adjust for inflation thereafter, and you’ll likely be fine for 30 years. But here’s the critical insight that changed everything for us: we weren’t planning for a 30-year retirement. We were looking at potentially 60+ years of freedom.

After months of research, countless spreadsheet iterations, and many late-night discussions, we discovered a withdrawal approach that’s given us both financial security and peace of mind: a CAPE-based variable withdrawal strategy. Five years later, the results speak for themselves—our portfolio has actually grown despite market volatility, while we’ve enjoyed the freedom of early retirement.

In this post, I’ll break down our exact formula, share the real numbers from our first five years, and give you the tools to implement a similar approach for your own retirement journey—whether you’re already retired or still in the planning stages.

What’s In This Article

- CAPE: Your New Best Friend in Retirement Planning

- Our Tailor-Made Withdrawal Strategy

- Putting It All Together: Try It Yourself

- Beyond the Numbers: Our Holistic Approach

- Five Years Later: How Our Strategy Has Performed

- The Reality of Retirement: Adapting to Life’s Changes

- Maintaining Purchasing Power: The True Measure of FIRE Success

- Lessons Learned and Looking Forward

- Your Turn: Finding Your Retirement Sweet Spot

CAPE: Your New Best Friend in Retirement Planning

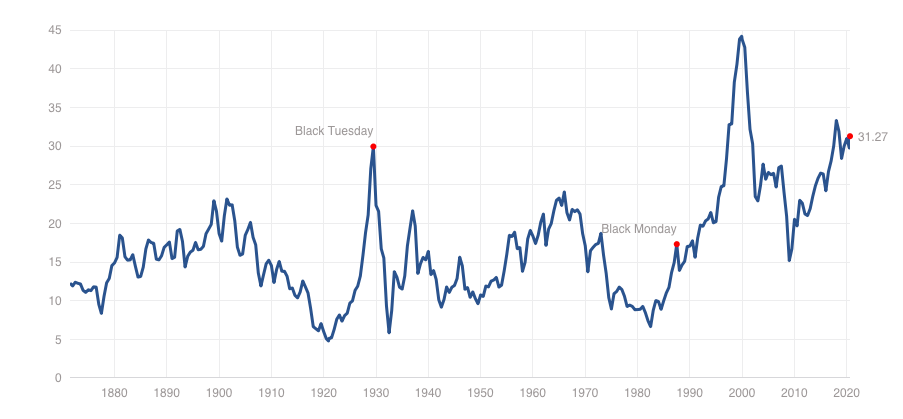

First things first: what the heck is CAPE? It stands for Cyclically Adjusted Price-to-Earnings ratio, a fancy term cooked up by economist Robert Shiller. In simple terms, it’s a way to gauge whether the stock market is overvalued or undervalued.

Here’s the gist:

- High CAPE = stocks might be overvalued = be cautious with withdrawals

- Low CAPE = stocks might be undervalued = you can potentially withdraw more

Think of CAPE as your financial weather forecast. It helps you decide whether to bring an umbrella (be conservative) or leave it at home (be a bit more generous with yourself).

CAPE ratio = price/average earnings for ten years, inflation-adjusted

Our Tailor-Made Withdrawal Strategy

After countless hours of research and number-crunching, we landed on a variation of the CAPE-based withdrawal method. Here’s how we put it into action:

- Using our interactive calculator, we enter two key pieces of information: our current portfolio balance and the latest CAPE ratio.

- The calculator instantly computes our suggested withdrawal rate using our formula: SWR = 1.5% + (0.5 × (1 ÷ CAPE))

- Based on this result, we know exactly how much we can withdraw for the year ahead.

For us, this typically results in a withdrawal rate between 2.5% and 3.5%, depending on market conditions. It’s more conservative than the traditional 4% rule, but it gives us peace of mind knowing we’re adjusting to market realities.

Putting It All Together: Try It Yourself

Want to see how our approach would work for your portfolio? Here’s how to use our calculator:

- Enter your current portfolio balance (e.g., $1,000,000)

- Input the current CAPE ratio (you can find this on multpl.com)

- Click “Calculate Safe Withdrawal Rate” to see your results

- The calculator will show you both your CAPE-based withdrawal rate and how much you can safely withdraw this year

When we kicked off our retirement in July 2019, we gave ourselves a few months to settle in before implementing our new strategy. Come January 2020, we were ready to roll:

- We entered our portfolio balance and the current CAPE ratio (30.99 at the time).

- Our formula suggested a withdrawal rate of about 3.11%.

- We rounded it up slightly to 3.25% because, hey, life’s too short to fret over decimal points!

This approach meant leaving thousands of dollars in our account compared to a traditional 4% withdrawal. But for us, that extra cushion is worth its weight in gold (or stocks and bonds, in this case) compared to a traditional 4% withdrawal.

Beyond the Numbers: Our Holistic Approach

While our CAPE-based strategy forms the backbone of our withdrawal plan, we’ve incorporated a few other elements to keep our financial ship steady:

- We keep dividends as cash instead of reinvesting, giving us a little extra liquidity.

- We’ve started a Roth IRA conversion ladder to access retirement funds before hitting 59½.

- We’re always mindful of the sequence of return risk (but that’s a story for another day).

Five Years Later: How Our Strategy Has Performed

It’s been five years since we implemented our CAPE-based withdrawal strategy, and I’m excited to share how it’s working out for us. Here’s a breakdown of our actual withdrawals compared to both the traditional 4% Safe Withdrawal Rate (SWR) and our CAPE-based SWR:

This data reveals some fascinating insights:

- Our CAPE-based SWR consistently suggests lower withdrawal amounts compared to the traditional 4% rule, reflecting a more conservative approach that’s better suited for a potentially 60+ year retirement horizon.

- For the first four years (2020-2023), we managed to keep our withdrawals well below the 4% rule, building a strong foundation for our long-term plan.

- In 2024, we significantly exceeded both our CAPE-based SWR and the 4% rule as we began building our dream home and transitioned away from using funds from our previous rental property sales.

Looking at our first four years (2020-2023), our performance was remarkable:

- Compared to the 4% rule: 18.7% less in 2020, 34.1% less in 2021, 20.2% less in 2022, and a whopping 48.8% less in 2023.

- Compared to our CAPE SWR: 4.4% more in 2020, 21.8% less in 2021, 0.7% less in 2022, and 36.3% less in 2023.

2024 represents a planned deviation from our strategy, with withdrawals 46.1% higher than the 4% rule and 76.6% higher than our CAPE-based recommendation. This illustrates an important reality of retirement planning: life happens, and flexibility is essential.

Traditional 4% Rule vs. CAPE-Based Withdrawals

Comparing the two retirement withdrawal strategies

- Simple to calculate and implement

- Consistent withdrawal amount each year (adjusted for inflation only)

- Works well for typical 30-year retirement horizons

- Doesn’t adapt to changing market conditions

- Higher risk of portfolio depletion for early retirees (40+ year horizons)

- May withdraw too little in favorable markets

- Adapts to market valuations and economic conditions

- More conservative in overvalued markets, more generous in undervalued ones

- Better suited for longer retirement horizons (40+ years)

- Reduces sequence of return risk

- Requires annual recalculation and adjustment

- Less predictable year-to-year income

The Reality of Retirement: Adapting to Life’s Changes

You might be wondering how we managed to withdraw significantly less than our conservative CAPE-based strategy suggested in those first four years—and what prompted the major increase in 2024. Here’s the full picture:

- Sale of Rental Property: Since 2023, we benefited from proceeds from our rental property sale, which provided additional funds to cover our living expenses without tapping our portfolio as heavily.

- Cash Cushion from New Home Mortgage: When we purchased our current home in 2020, we took out a mortgage instead of paying entirely in cash. This decision allowed us to maintain a healthy cash cushion, reducing our need for portfolio withdrawals.

- Portfolio Growth: Despite withdrawals, our investment portfolio actually grew over the first four years, creating an additional buffer against inflation.

- Home Building Project: In 2024, we began building our dream home, requiring significantly larger withdrawals. We anticipate at least one more year of higher-than-recommended withdrawals before returning to our normal strategy. We view this 2024 withdrawal less as a true “expense” and more as an asset reallocation—shifting investments from our stock portfolio into real estate, maintaining our overall net worth while changing the composition of our assets.

This five-year journey demonstrates that retirement planning involves managing multiple income streams and assets—not just investment portfolios. It also highlights that even the best strategies need to accommodate real-life goals and circumstances.

Looking at the totals over the five-year period:

- Total 4% Rule withdrawals would have been: $261,216

- Total CAPE-based SWR suggested: $211,946

- Our actual total withdrawals: $224,472

Despite the significant spike in 2024, our five-year total withdrawals are still $36,744 less than what the, inflation-adjusted, 4% rule would have suggested and only $12,526 (about 5.9%) more than our CAPE-based recommendation. This demonstrates the flexibility of our approach—we can temporarily exceed our guidelines when needed for important life goals while still maintaining a lower average withdrawal rate over time.

The beauty of our CAPE-based approach is that it provides a solid benchmark against which to measure these decisions. We know exactly how much we’re deviating from our long-term strategy and can make informed choices about when such deviations make sense for our overall financial wellbeing.

Maintaining Purchasing Power: The True Measure of FIRE Success

While our CAPE-based withdrawal strategy helps ensure we don’t deplete our portfolio, there’s another critical dimension to long-term retirement success: maintaining purchasing power.

Inflation is the silent threat that can erode even the most carefully planned retirement strategy. A dollar today simply doesn’t buy what it did when we retired in 2019, and this reality compounds over decades of retirement.

Our Five-Year Purchasing Power Results

We’ve tracked our purchasing power meticulously since retirement began, and the results validate our conservative withdrawal approach. Here’s what our data shows:

| Year | Inflation Rate | REAL Purchasing Power |

|---|---|---|

| 2019 | – | 1.00× (baseline) |

| 2020 | 1.2% | 1.10× (10% increase) |

| 2021 | 4.7% | 1.21× (21% increase) |

| 2022 | 6.5% | 1.06× (6% increase) |

| 2023 | 3.4% | 1.18× (18% increase) |

| 2024 | 2.9% | 1.18× (18% increase) |

Despite withdrawing funds for living expenses and facing significant inflation (particularly the 6.5% spike in 2022), our net worth’s real purchasing power has actually increased by 18% since retirement. This means we can buy more today than when we first retired, even after accounting for inflation. In simple terms, not only is our overall financial position holding steady, it’s actually growing stronger–like having a bigger slice of pie today than when we started, even though the cost of pie has gone up.

Notice how our purchasing power dipped slightly in 2022 during the highest inflation spike in decades (6.5%), but quickly recovered in 2023 as markets rebounded and inflation moderated.

This data confirms what we suspected: our conservative CAPE-based withdrawal strategy isn’t just about avoiding portfolio depletion—it’s creating a stronger financial position over time, giving us greater freedom and security as our retirement journey continues.

Lessons Learned and Looking Forward

Our five-year journey has taught us valuable lessons about sustainable retirement withdrawals. What began as a mathematical exercise has evolved into a practical philosophy that’s guided us through both typical retirement years and a major life event (building our dream home). Here are the key insights we’ve gained:

- CAPE-Based Guardrails Provide Peace of Mind: Our CAPE-based formula has consistently recommended 20-25% less than the traditional 4% rule, giving us confidence that our portfolio can withstand market cycles across a potentially 60+ year retirement. These are guardrails that help us sleep at night during market volatility.

- Flexibility Creates Financial Resilience: By viewing our withdrawal strategy as a guideline rather than a rigid rule, we’ve developed true financial resilience. This flexibility allowed us to withdraw 48.8% less than the 4% rule in 2023, building a cushion that made our 2024 home construction withdrawals less stressful.

- Portfolio Plus Strategy Beats Inflation: Despite inflation spikes as high as 6.5% during our retirement, our conservative approach has allowed our portfolio’s real purchasing power to grow by 18%. This means we can actually afford more today than when we first retired—the ultimate measure of a successful strategy.

- Building in Buffer Years Pays Dividends: The years we withdrew substantially less than our CAPE formula suggested (particularly 2021 and 2023) were strategic buffer-building years that made our 2024 dream home project possible without jeopardizing our long-term plan.

- Multiple Income Streams Create Optionality: Maintaining diverse income sources—rental property proceeds, portfolio dividends, and strategic mortgage decisions—gave us options beyond simply selling investments to fund our lifestyle. This optionality is particularly valuable during market downturns.

Looking ahead, we’ll continue using our CAPE-based approach while remaining open to refinements. We expect to return to our normal withdrawal pattern after completing our home construction, but we’re also prepared for whatever life brings next. If there’s one overarching lesson from these five years, it’s that the best retirement strategies combine mathematical rigor with real-world adaptability.

Your Turn: Finding Your Retirement Sweet Spot

Remember, there’s no one-size-fits-all solution when it comes to retirement planning. Our CAPE-based strategy works for us, but it might not be the perfect fit for everyone.

The key is to find an approach that aligns with your goals, risk tolerance, and sleep-easy factor. Whether you’re already enjoying retirement or still in the planning stages, take the time to explore different withdrawal strategies. Your future self will thank you!

Curious to play around with the numbers yourself? In addition to the calculator, I’ve created a read-only version of our spreadsheet that you can copy and customize.

Now, I’d love to hear from you: If you’re retired or planning to retire soon, what’s your game plan for withdrawals? Drop a comment below and let’s keep the conversation going!

This content is for informational and educational purposes only and should not be considered financial advice or a recommendation to follow any particular investment or withdrawal strategy. Before implementing any retirement withdrawal approach, please consult with a qualified financial professional who can provide personalized guidance based on your unique circumstances.

Thanks for this, very interesting. Would you adjust the actual withdrawal for inflation? I cannot see that in the spreadsheet, or am I missing something?