This month we’re visiting loved ones and vacationing in New England, primarily Providence, Cape Cod, and Boston. Last time we made it back here was on Labor Day weekend, and, as a result, we missed a few college graduations from my side of the family.

A great time to get on a solid financial footing is when you graduate and get your first job out of college. So, we want to take this opportunity to give a couple of tips to our nieces and nephews, who recently graduated, on how to reach financial freedom.

About three years ago, my wife and I started a college graduation reward system based on cumulative GPA for our nieces and nephews, and younger siblings, as follows:

GPA | Monetary Reward |

| Below 3.0 | $50 |

| 3.0 – 3.24 | $75 |

| 3.25 – 3.49 | $100 |

| 3.5 – 3.74 | $200 |

| 3.75 – 3.99 | $300 |

| 4.0 | $500 |

Why do we reward with money?

We do this to excite conversations about grades and reward hard work. Getting high grades is harder when you don’t have the bank of mom and dad supporting you. It’s even harder when you have to work different jobs to pay for your schooling, but it’s achievable, as long as you’re willing to put in the effort.

We also want to encourage the new generation of students in the family to pursue their college education. After all, that might be their best chance of reaching financial success.

The degree is an entry ticket to a better salary

If I wouldn’t have gotten a bachelor’s degree, it would’ve been a lot harder for me to reach financial success. That college degree was the entry ticket to a higher paycheck, and that goes for my wife as well. We hustled to get good jobs after graduation. Those nice paychecks allowed us to reach financial independence in just a few years after we started increasing our savings rate.

Want to learn how to calculate your personal savings rate? Check out this post.

We didn’t reach financial independence only because the paychecks got bigger, but also because our spending got smaller over time. Instead of upgrading our ’07 Camry, we bought more international stock fund index shares that included shares of Toyota.

A college degree means a lot in our family

We put a high value on a college degree in my family because it’s our way out of blue-collar jobs. We came to this country from the Dominican Republic with very little, and no one had college degrees. Most of my family worked in factory jobs. Ensuring that their children get an education to be able to get better jobs is a big deal.

My siblings sacrificed a lot for their kids to get to this point. Most of them came to the US as adults and focused on helping their children get as far as they could with their education by providing food, shelter, and necessities.

On my side of the family, we have about 20 nieces and nephews. Since we missed a few graduations over the past two years, about three graduates went unrewarded. So we decided to reach out to them during our trip and distribute the cash now.

We also had two more graduations this month: one with a bachelor of arts and another one with a master’s degree. These kids are going to get us bankrupt! 😕

In the end, we rewarded five family members, about $300-$500 total, but also wanted to give them some solid advice on how they can better prepare to reach financial freedom. I’m trying not to post exact amounts to avoid disclosing their GPAs for confidentiality purposes. 😆

A message to our nieces and nephews

Now that you’ve graduated, the ball is in your court. Some of you are already working, while others are starting to look for work.

Once you start making good money, you’ll be able to buy fancier cars, clothes, and even a house, if you wish, but I tell you one thing: the best shit money can buy is financial freedom.

And here are several reasons why:

- Financial freedom will give you the option to change jobs that you might dislike.

- It will allow you to help your parents in times of need.

- It will turn a job from mandatory to optional.

- Financial freedom provides you with peace of mind. You’ll be better prepared to raise your own kids and teach them valuable lessons without worrying about money.

- It sets you up so that you can live your life on your own terms. This might not mean a lot to you now, but it will as having a “nice corporate job” gets old.

How do you reach financial freedom?

You have to spend less than you earn and make your money work for you. It’s as simple as that. You invest the surplus and let it grow on its own. You build your wealth one dollar at a time. Don’t wait for a big sum of money to come your way before you start saving and investing. You can invest in different ways: through index funds, real estate, etc.

Pre-tax accounts are great investment vehicles

I’m not saying that this is the best route for you, but this is what has worked for us and many other people that have reached financial freedom. If you have a job that offers a 401(k) or other retirement vehicles, my best advice is to take full advantage of it by maxing it out. The maximum contribution in 2018 is $18,500. If you can’t do it right away, keep increasing your contributions until you reach the max.

Pre-tax accounts usually invest in index funds. By contributing to stock index funds you’re basically buying shares of stocks of the best companies in the world. Make it your business to own companies and not just their products. Shift your mindset from consumer to producer.

In addition to owning shares of companies, taking full advantage of pre-tax accounts is a great way to set yourself up for financial success, because you’d have a lower taxable income.

Let’s say you make an annual salary of $55,000. If you subtract the individual standard deduction for 2018, which is $12,000, your taxable income would be $43,000. If you contribute $18,500 to your 401(k), that would lower your taxable income to $24,500, effectively lowering your tax bracket from 22% to 12%. That’s right, anything you contribute pre-tax to your 401(k) is, in essence, invisible income to the government.

Another way to think about it is shielding money from taxes and letting a bigger base accumulate faster. With the $55,000 salary example, you’d effectively save $2,650 in taxes. See table below:

To save or not save in your 401(k) – (individual tax bracket) | ||

|---|---|---|

| Scenario 1: $0 pre-tax contribution to 401(k) | Scenario 2: $18,500 pre-tax contribution to 401(k) | |

| Annual gross income | $55,000 | $55,000 |

| Standard deduction | $12,000 | $12,000 |

| Pre-tax 401(k) deduction | $0 | $18,500 |

| Remaining income to be taxed | $43,000 | $24,500 |

| Tax bracket | *22% | *12% |

| Tax calculation* | $4,453.50 plus 22% of the excess over $38,700

$4,453.50 + $946 = $5,399.50 | $952.50 plus 12% of excess over $9,525

$952.50 + $1,797 = $2,749.50 |

| Federal tax | $5,399.50 | $2,749.50 |

| Money you save in taxes | $0 | $2,650 |

* 2018 tax brackets for unmarried individuals: 10% = Up to $9,525 12% = Over $9,525 but not over $38,700 22% = Over $38,700 but not over $82,500 |

By maxing out your 401(k), you’d look poorer to the government while becoming wealthier. 😉 Your investments would also grow tax-free until you withdraw them from your accounts decades later. If you follow the smart advice of Go Curry Cracker, you might never have to pay taxes on this money after you retire.

So, the moral of this example is: invest as much as possible pre-tax, shield your money from taxes, and accumulate wealth faster by delaying taxes.

Compounding is your friend

The sooner you start saving and investing, the less you’ll have to contribute to your accounts over your lifetime. That’s because your money will compound sooner and most of your balance will come from investment growth. At first, you won’t notice the accounts growing, but at some point, the return on your investments will be bigger than your paychecks. The compounding will be doing the heavy lifting for you.

Let’s see compounding in action

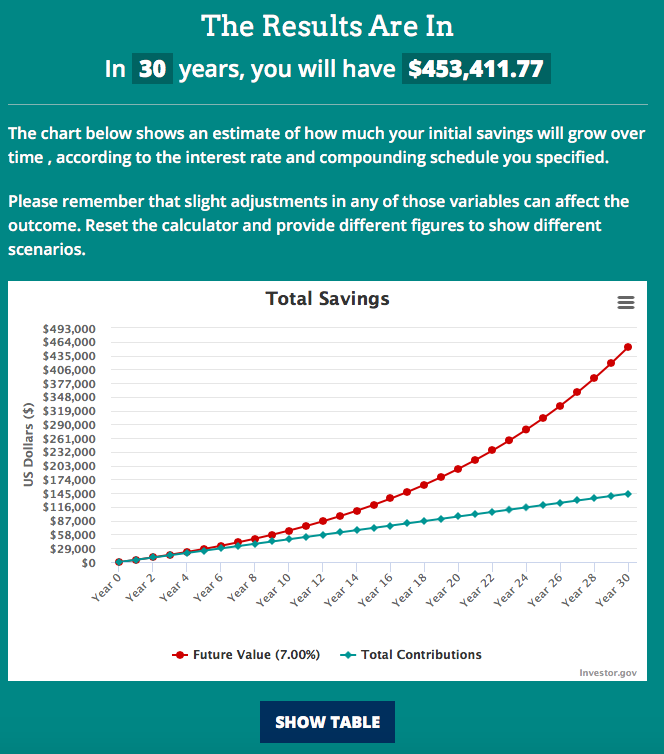

Example 1: So you start your first job out of college and decide to set aside $400 a month in your 401(k) for 30 years. If your money grows at a 7% annual rate, how much would you have in your account?

Notice how during the first three years compounding doesn’t represent much. Then it starts to take off after Year 3. By the end of the 30 years, your contributions are only $144,000 (below green dotted line), but your money growth or compounding is $309,411.77. That’s why the sooner you start saving, the more chances your money has to compound. The best time to save is today or yesterday! Let this compounding force work for you.

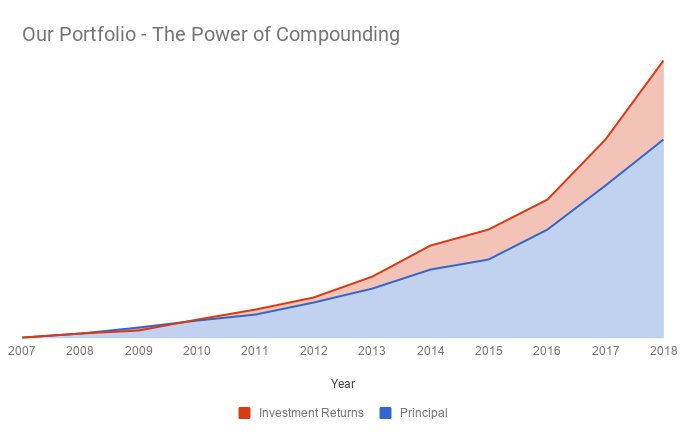

Our portfolio and the power of compounding

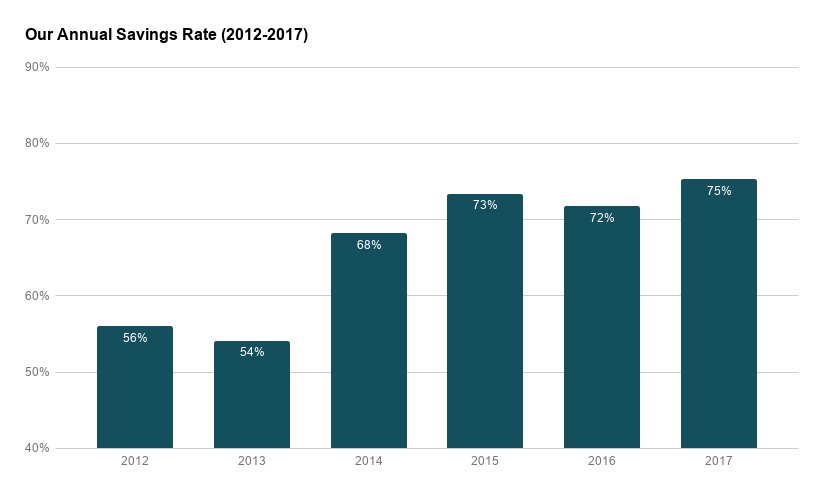

I only started saving the minimum to get the 401k match in 2006 when I was 32 years old. I didn’t get serious about saving as much as possible until 2012. Imagine if I would’ve tried to start saving right after college as my wife did? She’ll be retiring at 33. She started saving more right away and ramped up her savings once she got on the FI path!

Although, I’m still glad that I found my FI path while in my 30s, instead of continuing to live an average lifestyle of very little savings.

Since we started investing mostly at the beginning of a bull market and dumped as much as we could during the last six years into our accounts, our investment growth has become a big slice of our portfolio assets today. The gap between what we contribute and the returns keeps getting wider.

Investing during the Great Recession

From looking at the chart above everything looks rosy. 2008 looks like a minor hiccup.

Did our investments even get affected by the Great Recession?

It felt like the world was coming to an end back then. Didn’t it?

Big banks failed. Major auto companies filed for bankruptcy. People close to us lost their homes. Businesses of all sizes went out of business. It was Armageddon.

Our investments did go under in 2008, but we kept investing. We kept buying low (at a discount), while people were running for the door.

And here it’s how those years looked for our investments:

In 2008, our investments went under. We were losing money on paper but quickly recovered our losses because we stayed invested, kept saving more and the government rescued the economy. We were able to buy more mutual funds shares since they were cheaper.

By the end of 2009, we had positive returns. The longer your investment horizon, the longer your investments have to recover from bear markets.

Saving for 30 years?

Back to our first example, $453k is a nice chunk of money, but the readers of this blog don’t want to wait 30 years to accumulate wealth. That’s too much of a wait. I don’t want to have to save for 30 years. I want to see our investments grow for 30 years. To reach financial freedom sooner, you’ll need to accumulate many years of living expenses in your accounts at a faster rate.

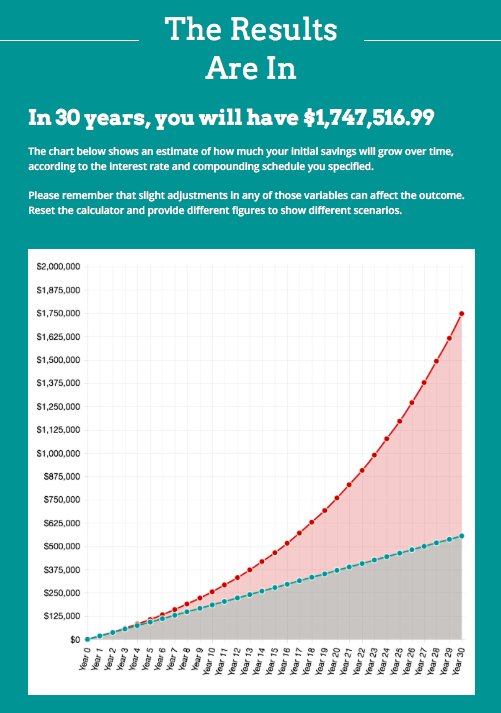

Let’s say that you contribute the maximum to your 401(k) of $18,500 for 30 years. Where would that take you? For reference, that’s about $1,541.66 per month in savings set aside.

By contributing $18,500 a year, you’d have over $1.7 million in investments in 30 years. 😯 By Year 16, you’d already have over half a million dollars. You could even stop saving for retirement at that point and still would end up with a higher balance than in example 1.

The pot gets even sweeter when you include any matching employer contributions and annual contribution limit increases by the IRS. When I started maxing out the 401(k) in 2012, the contribution limit was $16,500. It has already gone up by $2,000 in six years, mostly due to inflation.

But how can I afford to contribute the max of $18,500 per year?

First of all, that should be your goal, even if it’s not a reality on Day 1. That means that you shouldn’t start with a minimum amount to get your employer’s contribution match, which is often 1-4% of your pay. Instead, you should play with your paycheck, tax brackets and contribution amounts to see how close to $18,500 per year you could get.

As you earn more money and get promotions put all the extra money towards savings right away to avoid getting used to more money in your pocket. At some point, you’ll make enough that you’ll have to scale back on your 401(k) contributions to spread it out evenly during the year.

Second, embrace being a poor college grad. There is no shame in being poor or pretending to be to avoid inflating your lifestyle. You may have student debt too, which means you are starting with a negative net worth. Be responsible and pay that off ASAP instead of dragging it out. You’ll need to balance your budget to ensure you pay down your loans while still contributing as much as possible to your 401(k).

Third, live like responsible poor people do: try to minimize your fixed expenses, such as rent, car, food. If you can live with your parents, a roommate or a significant other to save on housing costs. While independence sounds great, it’ll eat away at your disposable income very quickly.

If you are lucky enough to live with parents who don’t charge you rent, pretend you pay rent to yourself. Take the $1,000 or whatever rent you think you’d pay in your area, and put it against your loans and into your 401(k). This way, you get used to living on your “future independence” budget, while at the same time stashing away savings in the interim.

Final thoughts

My dear nieces and nephews, it all boils down to this: Don’t spend all your money, minimize spending, and save big if you want to reach financial freedom. You got this!

Risk disclosure: All investing involves risk, including the possible loss of principal. The material contained on this website is for discussion purposes only and should not be misconstrued as financial advice.