As a self-proclaimed discount detective, I’ve spent years honing my skills to stretch every dollar. My husband José often jokes that I have a “savings sense” that tingles whenever there’s a deal nearby. Today, I’m excited to share my top five strategies for saving money on everyday purchases. These aren’t just theoretical tips; they’re battle-tested techniques that have helped us maintain our budget while still enjoying life’s little luxuries.

1. Discounted Gift Cards: Your Secret Weapon

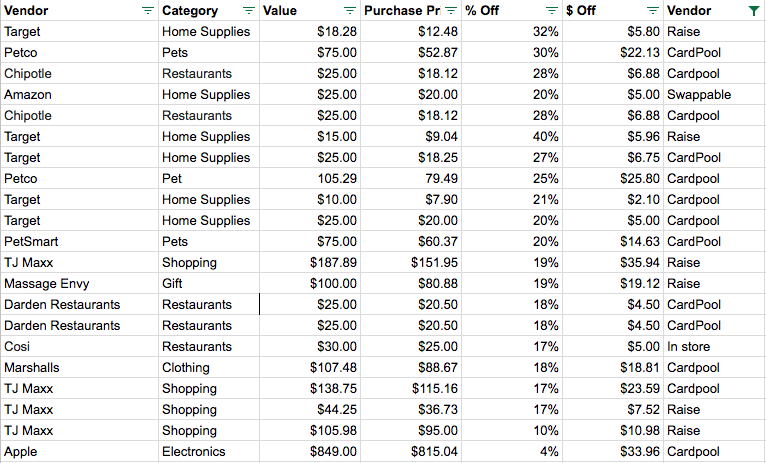

One of my favorite money-saving hacks is buying discounted gift cards. Sites like Raise offer gift cards at less than face value, which means instant savings before you even start shopping.

For example, we once scored a 30% discount on a pet store gift card. This allowed us to upgrade our cat Pushok’s food and litter without breaking our budget. José was thrilled that we could provide better-quality products without increasing our spending. It’s a win-win situation—for our wallets, for Pushok, and for our peace of mind!

Pro tip: Keep an eye out for gift card deals in January when people are selling their unwanted holiday gift cards.

2. Cashback Sites: Get Paid to Shop

Cashback sites like Rakuten) and Mr. Rebates are like finding money in your pocket. Simply click through these sites before making your online purchases, and you’ll earn a percentage of your spending back.

I’ve saved up to 12% on some retailers this way. It might not sound like much, but it adds up quickly. Last year, our cashback earnings covered a nice dinner out—it felt like we were eating for free!

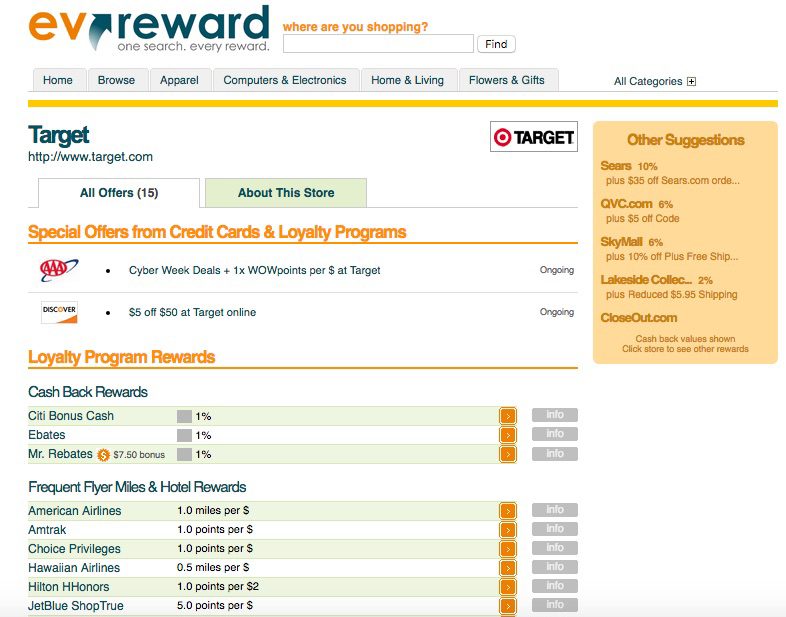

3. Online Shopping Portals: Maximize Your Rewards

If you have a credit card or are part of a loyalty program, check if they have an online shopping portal. These portals allow you to earn extra points or miles on your purchases.

I use ev reward to compare offers across different portals. It’s like being a rewards point sommelier, picking the perfect program to pair with each purchase.

4. Dining Rewards Programs: Eat Out, Earn Points

Most major airlines and hotel chains offer dining rewards programs. Link your credit card, and you’ll automatically earn points when you dine at participating restaurants.

José and I have turned date nights into point-earning opportunities. It adds a fun layer to choosing where to eat–we’re not just considering the menu, but also how many points we’ll earn!

5. Strategic Credit Card Use: Swipe Smarter, Not Harder

Different credit cards offer varying rewards for different categories. I use the Wallaby app to remind me which card to use where. It’s like having a tiny financial advisor in my pocket.

For instance, when booking hotels, I always use the card that gives the best travel rewards. It’s a small effort that translates into significant savings over time.

The Art of Double (and Triple) Dipping

The real magic happens when you combine these strategies. Let me walk you through a recent hotel booking:

- I went through Ebates to book on Hotels.com, earning 6% cashback.

- I used my Hotels.com account to earn credit towards a free night (worth 10% of the booking).

- I paid with my travel rewards card, earning an additional 2% in points.

Total savings: 18% off the listed price. Not too shabby for a few extra clicks!

The Catch (Because There’s Always a Catch)

Now, I won’t sugarcoat it–this approach takes time and effort. You need to set up accounts, compare offers, and be thoughtful about each purchase. But for me, it’s become a fun challenge. I get a little thrill every time I maximize our savings.

Remember, though, that time is money. These techniques really shine on big-ticket items but might not be worth the effort for small purchases. And most importantly, a discounted item is still a bad purchase if it’s not in your budget.

What are your favorite money-saving tricks? I’d love to hear them – after all, sharing knowledge is the best way to help each other grow financially savvier!

This post contains affiliate links, which means that if you click on one of them and sign up for a rewards program, we will receive a commission at no extra cost to you.