Hey there, fellow financial freedom lovers! It’s José here, and I’m excited to share the latest update on our journey towards financial independence (FI). Buckle up, because we’re getting close to our destination!

The Big News: FI is on the Horizon!

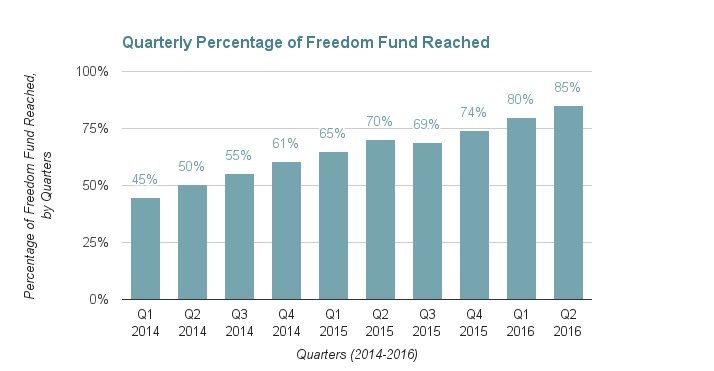

First things first, we have some thrilling news to share. Drum roll, please… We’re projecting to hit our FI target by July 2017! That’s right, in just about a year, we’ll have enough investments to cover our living expenses without ever needing to work again. It’s been a wild ride since we started this journey in 2011, and I can hardly believe we’re almost there.

Now, you might be wondering, “José, are you going to dramatically quit your job the moment you hit FI?” Well, not exactly. While the idea of handing in my resignation letter and jetting off to a tropical paradise is tempting, we’re planning a more gradual transition. We’ll likely keep working a bit longer, but with the freedom to take extended travels and start exploring the lifestyle we’ve been dreaming about.

Our FI Journey: A Walk Down Memory Lane

Looking back, it’s amazing how much our lives have changed since we embarked on this path. I remember the early days, devouring books on personal finance and debt-free living. (Fun fact: I just found an old screenshot of my Kindle purchases from 2011-2012, and it’s like a timeline of our financial awakening!)

We’ve come a long way since then. Our spending habits have done a complete 180—we’ve switched from impulse purchases to intentional spending, and our local library has become our best friend. It’s not about deprivation; it’s about aligning our money with what truly matters to us.

Redefining Our Freedom Fund

So, what exactly is our “Freedom Fund”? Simply put, it’s the investment portfolio we’re building to support our post-FI lifestyle. We’ve set our target at $35,000 per year, which might sound modest to some, but hear me out—when you’re debt-free and intentional with your spending, you’d be surprised how far your money can go!

Our Freedom Fund isn’t just about reaching a number; it’s about creating a portfolio built to last. We’re planning for at least 60 years (we’re aiming for a long, adventure-filled retirement!), with adjustments for inflation. Through careful asset allocation, we’ve designed a strategy with a 92% chance of success.

Life on $35,000 a Year: More Luxurious Than You Might Think

Now, I know what some of you might be thinking: “José, $35,000 a year? That sounds like a huge sacrifice!” But here’s the thing – when you strip away debt payments, unnecessary upgrades, and mindless consumption, your expenses drop dramatically. Last year, our basic living expenses in Pennsylvania were around $24,000, leaving plenty of room for fun and adventure.

Plus, we’re excited about the possibility of living abroad, where our money could stretch even further. Imagine fresh, perfectly ripe fruit picked at its peak, a more relaxed pace of life, and endless new experiences to discover. That’s the future we’re building towards!

Our Progress and Lessons Learned

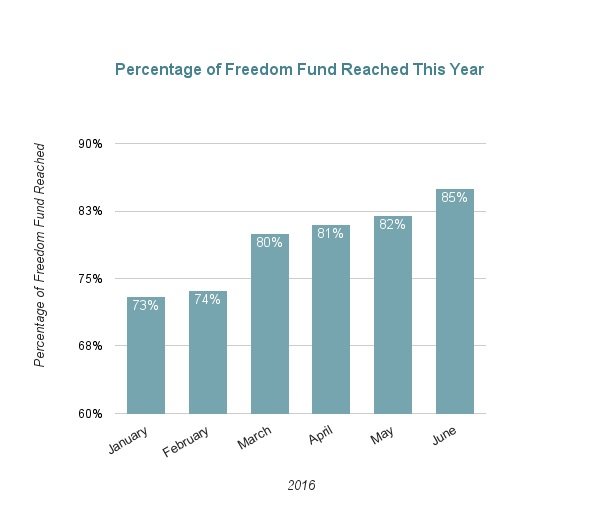

As of June, we’ve reached 85% of our Freedom Fund goal—a huge milestone! It hasn’t always been smooth sailing (I’m looking at you, Brexit-induced market dips), but we’ve stayed the course and kept our eyes on the prize.

The biggest factor in our success? Tracking our expenses and being intentional with our spending. It’s not about deprivation; it’s about aligning our money with our values and long-term goals. And contrary to what some might think, you don’t need a huge salary to pursue FI. It’s all about mindset and choices.

Dividend Income: A Key Piece of Our FI Puzzle

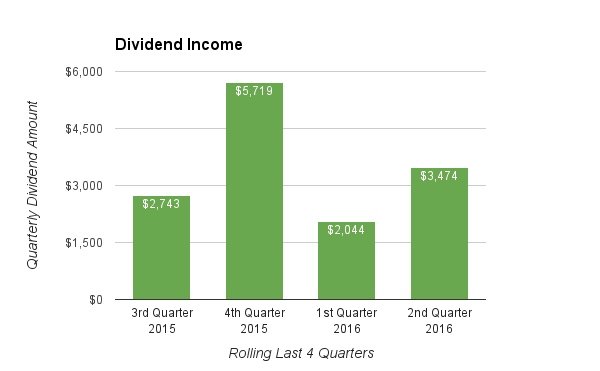

Now, let’s talk about an exciting component of our Freedom Fund: dividend income. We’re aiming for dividends to cover a significant portion of our annual expenses in retirement. Our target? $17,500 per year in dividend income.

I’m thrilled to report that we’re making solid progress towards this goal. In the second quarter of this year, we earned $3,474.09 in dividend income. Looking at the past four quarters, our total dividend income comes to $13,980. We’re just $3,520 shy of our annual target!

This steady stream of dividends is like a paycheck from our investments, and it’s incredibly motivating to watch it grow. We focus on mutual funds and ETFs rather than individual stock picking, which aligns with our strategy of building a diversified, low-maintenance portfolio.

Seeing these numbers makes all those years of saving and investing feel so worthwhile. It’s tangible proof that our Freedom Fund is doing exactly what we designed it to do—generating income to support our future lifestyle.

Looking Ahead: The Final Stretch

As we approach our target date of July 4th, 2017 (how’s that for Independence Day?), we’re filled with excitement and a touch of nervous energy. Will we hit our goal right on schedule? Only time will tell. But regardless of the exact date, we know we’re building a strong foundation for a life of freedom, adventure, and purpose.

So, to all of you out there working towards your own financial goals, keep pushing! Whether you’re aiming for early retirement or simply want more control over your finances, remember that every small step adds up to big changes over time.

Very inspirational! Congrats on getting this far in your journey. Are you able to share more details on how you were generating this level of income (what you’re invested in and/or a ballpark principle amount)?

Thank you! If you’re referring to our dividend income. We invest in index funds and are investing a large portion of our new non-retirement investment money in a high dividend yield index fund that generates over 3% in dividends. Large caps generate most of the dividend income but we’re diversified in different asset classes. The key here is to stick to an asset allocation that works for us.

As far as our job income, we work as project managers and have been with our current company for about 10 years. I didn’t save much during the first years, except for 4% of the salary to meet the company’s match. We don’t have 6 figure salaries but get paid decent salaries. As I paid off debt, we continued to increase our savings rate. We’d be able to share more details after we retire.

We’ll have an updated post on our asset allocation soon and will touch upon how we are invested. Thank you for reading!

Nice to see you guys make some progress on your well documented journey, truly inspiring. Happy 4th of July & Financial Independence Day!

Hi Blad,

It’s great to get a comment on the 4th of July. I didn’t think anyone would be reading. We’re glad to be an inspiration to others. Happy Independence Day to you as well.