It goes without saying that living in a great neighborhood and getting along with your neighbors can lead to unexpected opportunities. As financially independent individuals, we’re always on the lookout for unique investment prospects to further grow and diversify our portfolio. Little did we know that a casual conversation during a routine lawn-mowing session would lead to an exciting auction adventure, significantly boosting our assets and testing our investment acumen.

The Unexpected Discovery

It was just another Wednesday, and I was out mowing the lawn when I stopped to greet my neighbor. His mother had recently passed away, and I wanted to offer my condolences. As we chatted, he mentioned something that immediately piqued my interest: the 5.5-acre lot behind his property was going up for auction at a county sale the following week.

For context, this is an enormous piece of land for our area. To give you an idea, most lots in our neighborhood are about a quarter-acre. For our Dominican friends, we’re talking about 36 tareas de tierra! The county was holding a tax deed sale to recoup approximately $6,000 in back taxes and land maintenance fees.

I immediately stopped mowing and rushed to tell Tatiana the news. We immediately saw this as an excellent opportunity to expand our real estate holdings. We had just over a week to prepare for the auction—a perfect chance to put our investment skills to the test.

Due Diligence in a Time Crunch

Despite having family visiting from Thursday through Sunday, we cleared our schedules to thoroughly research the property and understand the online auction process. Here’s what we uncovered during our intensive investigation:

- Price Speculation: My neighbor mentioned that his brother-in-law, a real estate agent, believed the auction would settle around $18,000 per acre, totaling about $100,000. Given that a quarter-acre with infrastructure in our area typically sells for $30k-$35k, this seemed like a potential steal.

- Property Assessment: We contacted the city for additional information. They provided links to the auction website and crucial details about the lot. We learned it could potentially be divided into multiple parcels without much difficulty, significantly increasing its value and versatility within our portfolio. The possibility of building roads to add more lots was also discussed, though this would require a larger investment.

- Environmental Considerations: The land is rich in wildlife, including protected species like gopher tortoises and blue jays. While this didn’t deter us, we knew we’d need to factor in potential relocation costs for these animals in our development plans.

- Title Search: A preliminary title search revealed an unexpected hurdle—an outstanding mortgage of $190,000 from a now-defunct bank. This mortgage dates back to 2006, just before the real estate market began to decline. The original owner had passed away in 2011, and the bank had gone bankrupt during the 2008 financial collapse.

- Legal Solution: We discovered the concept of a “quiet title action lawsuit” to clear the outstanding mortgage. This legal process would cost about $2,000-$3,000 and take approximately three months, adding an interesting legal aspect to this investment.

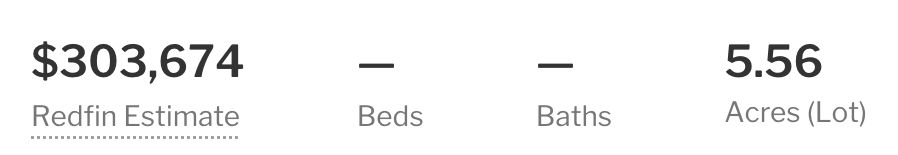

- True Value Assessment: Using local real estate data and tools like Redfin, we estimated the lot’s actual value at $303,674. This was significantly higher than our initial expectations and made the investment even more appealing.

Navigating the Online Auction

As the auction day arrived, we found ourselves facing an unexpected challenge—we couldn’t find the page on the auction site where the live bids were displayed! After a nerve-wracking 10 minutes, we finally discovered it under the misleading page title “Calendar.” Talk about an adrenaline rush!

We set our maximum bid at $200,000 and let the proxy bidding system do its work. The auction started at 9:12 AM, and what followed was 23 minutes of intense bidding warfare.

Four bidders entered the fray, with the opening bid at $6,641.12. The price quickly escalated, with two bidders dropping out at $97,400 and $133,000, respectively. The final battle was between two determined bidders, pushing the price above $150,000.

After 86 nail-biting bids, we emerged victorious at $166,300! The runner-up bidder had maxed out at $166,200, just $100 less than our bid. Talk about a close call!

| Bidder | Bid |

|---|---|

| Opening bid | $6,641.12 |

| A | $71,000.00 |

| B | $81,000.00 |

| A | $81,100.00 |

| C | $82,000.00 |

| A | $82,100.00 |

| D | $87,000.00 |

| A | $87,100.00 |

| B | $87,200.00 |

| A | $87,300.00 |

| C | $88,100.00 |

| A | $88,200.00 |

| B | $88,400.00 |

| A | $88,500.00 |

| D | $90,000.00 |

| A | $90,100.00 |

| D | $93,000.00 |

| A | $93,100.00 |

| C | $94,200.00 |

| A | $94,300.00 |

| D | $95,000.00 |

| A | $95,100.00 |

| C | $97,200.00 |

| A | $97,300.00 |

| B | $97,400.00 |

| A | $97,500.00 |

| D | $98,000.00 |

| A | $98,100.00 |

| C | $100,200.00 |

| A | $100,300.00 |

| D | $104,000.00 |

| A | $104,100.00 |

| C | $105,900.00 |

| A | $106,000.00 |

| D | $109,000.00 |

| A | $109,100.00 |

| D | $110,000.00 |

| A | $110,100.00 |

| C | $110,200.00 |

| A | $110,300.00 |

| D | $112,000.00 |

| A | $112,100.00 |

| C | $112,200.00 |

| A | $112,300.00 |

| D | $115,500.00 |

| A | $115,600.00 |

| C | $117,200.00 |

| A | $117,300.00 |

| D | $121,000.00 |

| A | $121,100.00 |

| C | $122,300.00 |

| A | $122,400.00 |

| D | $125,000.00 |

| A | $125,100.00 |

| D | $126,000.00 |

| A | $126,100.00 |

| C | $127,200.00 |

| A | $127,300.00 |

| C | $129,200.00 |

| A | $129,300.00 |

| C | $131,200.00 |

| A | $131,300.00 |

| D | $133,000.00 |

| A | $133,100.00 |

| C | $134,200.00 |

| A | $134,300.00 |

| C | $135,200.00 |

| A | $135,300.00 |

| C | $137,200.00 |

| A | $137,300.00 |

| C | $139,000.00 |

| A | $139,100.00 |

| C | $141,200.00 |

| A | $141,300.00 |

| C | $142,200.00 |

| A | $142,300.00 |

| C | $143,200.00 |

| A | $143,300.00 |

| C | $145,100.00 |

| A | $145,200.00 |

| C | $147,100.00 |

| A | $147,200.00 |

| C | $149,100.00 |

| A | $149,200.00 |

| C | $150,100.00 |

| A | $150,200.00 |

| C | $152,200.00 |

| A | $152,300.00 |

| C | $153,100.00 |

| A | $153,200.00 |

| C | $155,200.00 |

| A | $155,300.00 |

| C | $156,100.00 |

| A | $156,200.00 |

| C | $157,200.00 |

| A | $157,300.00 |

| C | $160,100.00 |

| A | $160,200.00 |

| C | $161,200.00 |

| A | $161,300.00 |

| C | $162,100.00 |

| A | $162,200.00 |

| C | $163,200.00 |

| A | $163,300.00 |

| C | $165,200.00 |

| A | $165,300.00 |

| C | $166,200.00 |

| A | $166,300.00 |

| Auction is over. |

Impact on Our Investment Portfolio

This purchase instantly added $136,182 to our net worth. Here’s the breakdown:

$303,674 (Redfin estimated value) – $167,492 (final price with fees) = $136,182 (instant equity)

We paid only 55% of the current market value, showcasing the potential of strategic real estate investments even after achieving financial independence. This addition to our portfolio has helped offset some of the recent declines in the stock and bond markets, further validating our decision to diversify into real estate.

Lessons Reinforced and Future Plans

- Local Market Knowledge is Crucial: Our deep understanding of the local real estate market helped us spot and act on this incredible opportunity. For instance, we knew that finding homes on oversized lots in our area was extremely rare, making this 5.5-acre lot exceptionally valuable.

- Continuous Learning: Even as financially independent investors, we’re always expanding our knowledge. This auction introduced us to new concepts like quiet title actions and the intricacies of online property auctions.

- Risk Management: By purchasing at a significant discount, we’ve built in a buffer against potential market fluctuations. Even in a worst-case scenario where we’d need to sell during a market downturn, we’d likely still break even or profit.

- Portfolio Diversification: This land purchase adds a unique element to our real estate holdings. We’re now exploring various options, from residential development to land conservation, each with its own set of challenges and potential returns.

- Inflation Hedge: In the current economic climate, with inflation rates significantly higher than in previous years, real estate investments like this can serve as an effective hedge against currency devaluation.

We’re currently working with a lawyer to quiet the title, a process that should take about three months. By year’s end, we’ll be ready to move forward with our plans for this property, whether that involves development, subdivision, or holding for future appreciation.

Sharing Our Experience

This auction adventure has been a thrilling addition to our post-FI journey. It’s reminded us that achieving financial independence doesn’t mean the end of smart investing or exciting opportunities.

Remember, staying curious, continuously learning, and being ready for unexpected opportunities can lead to significant wins, even after you’ve reached your initial financial goals.

You are a mean one, Mr. Grinch. Can’t wait to see the results! This post had me on my toes, I felt like I was the one bidding lol.

Mission accomplished! Hahaha