As we sip our New Year’s Day coffee and pore over last year’s expenses, a tradition we’ve maintained since starting this blog, we’re reminded of the rollercoaster that was 2016. It was a year of financial stability, emotional challenges, and personal growth. Join us as we break down our spending, share our insights, and set new goals for the coming year.

The Year in Review: Triumphs and Tribulations

2016 brought us both financial success and emotional hardship. While our monetary situation remained stable, we faced a significant personal loss with the passing of my mother. This experience reinforced our belief in the importance of spending time with loved ones and pursuing financial independence to create more of those precious moments.

Breaking Down Our Expenses

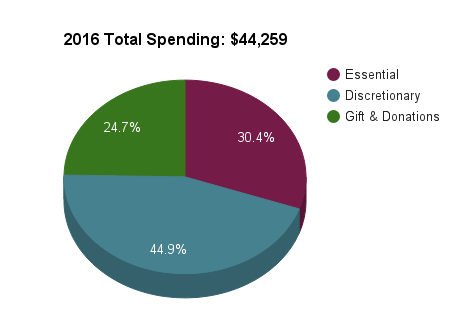

We categorize our spending into three main buckets: essentials, discretionary, and gifts/donations. Here’s how it all shook out:

Essential Expenses: $13,438

Our essential expenses covered the basics: housing, utilities, groceries, and transportation. One unique aspect of our approach is our “net rent” calculation. By offsetting our rental costs with income from our investment property, we’ve created a psychological win-win that makes renting feel more palatable.

| Category | 2016 | 2015 | Notes & Details |

|---|---|---|---|

| Net Rent | $2,358 | $2,798 | Annual gross rent ($13,800) less rental property expenses, resulting in net rental income. |

| Internet | $348 | $520 | Monthly high-speed internet service at $29/month. |

| Electricity | $717 | $634 | |

| Trash | $112 | $206 | Switched to pay-per-use trash collection ($4/32-gallon bin) with complimentary recycling service. |

| Groceries | $5,346 | $5,205 | Increased costs reflect transition to organic produce and non-GMO food options. |

| Home Supplies | $915 | $781 | |

| Mobile Phones | $840 | $840 | Cricket wireless plan, $35 monthly per device. |

| International Calls | $30 | N/A | International calling charges for family communication. |

| Auto Insurance | $647 | $1,039 | Reduced premium due to coverage for single vehicle. |

| Fuel | $975 | $844 | Increased fuel costs due to market fluctuations. |

| Auto Services, Parts, Registration, Other | $1,150 | $304 | Major service including alternator replacement and annual registration fees. |

| Total | $13,438 | $13,171 |

Discretionary Expenses: $19,888

This category is where the fun happens—and where we have the most control. From travel adventures to dining out, here’s where we splurged and where we saved:

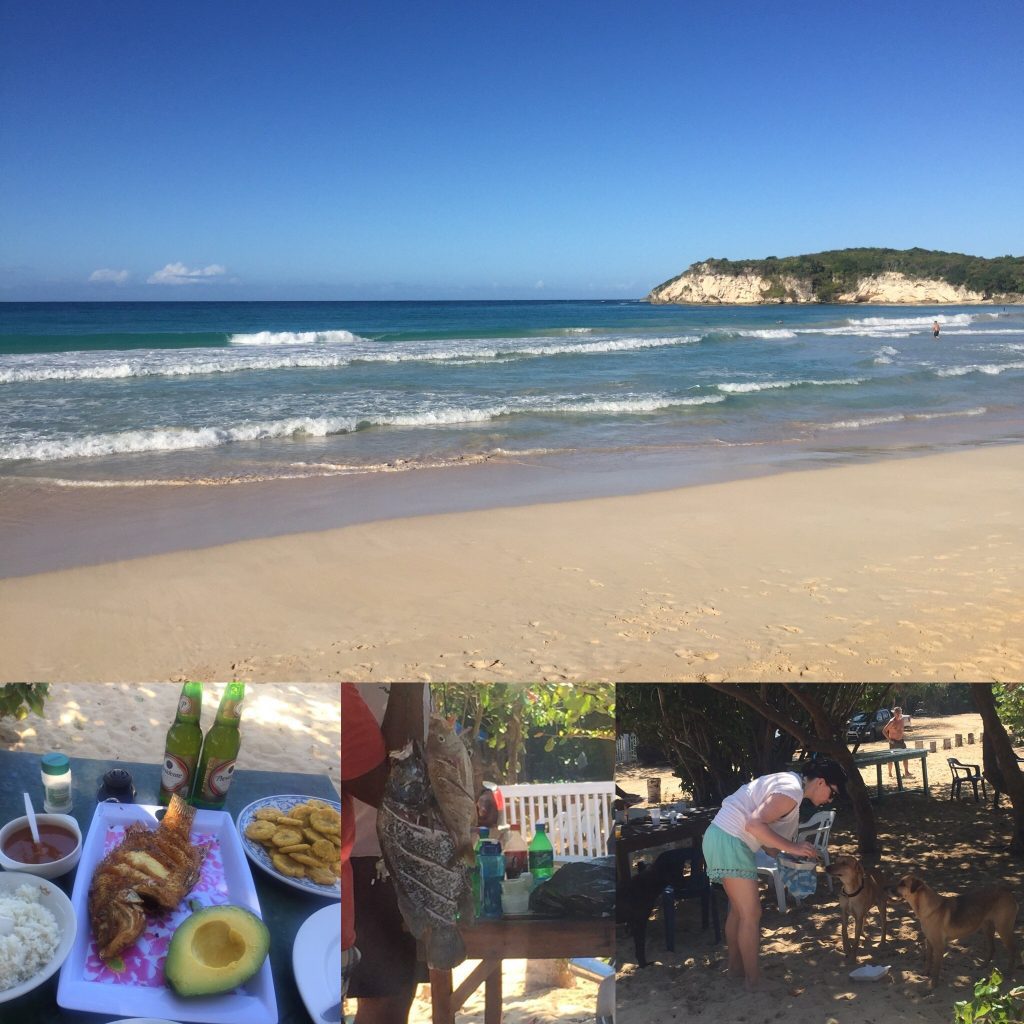

- Travel: We embarked on several memorable trips, including a 15-day stay in Punta Cana and an exploration of Colorado’s breathtaking landscapes.

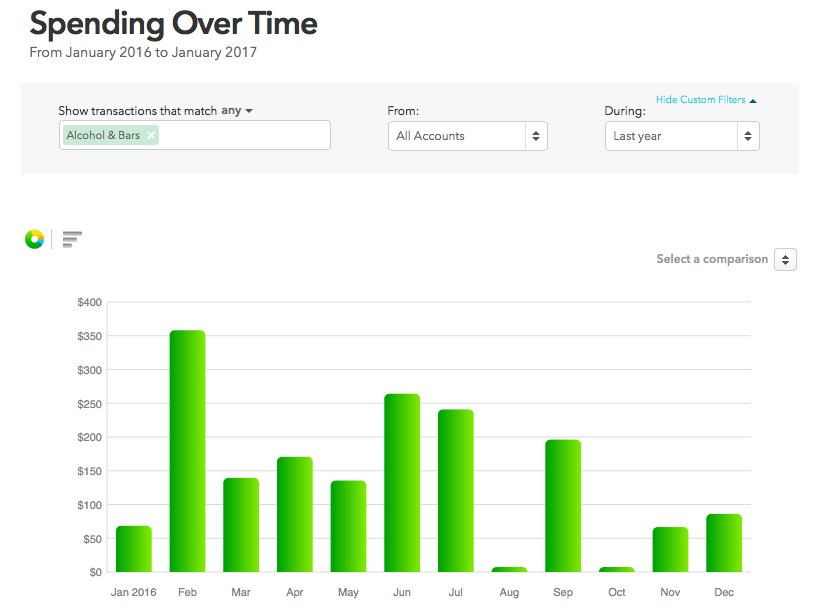

- Dining and Drinks: We spent $3,806 on restaurants and $1,726 on alcohol. More on that later!

- Shopping: We invested in some much-needed clothing updates and new tech gadgets.

| Category | 2016 | 2015 | Notes & Details |

|---|---|---|---|

| Health Insurance | $1,144 | $1,066 | Employer-provided Aetna insurance coverage. |

| Dental Insurance | $208 | $312 | |

| Vision Insurance | $164 | N/A | Biannual vision coverage plan. |

| Renter’s/Umbrella Insurance | $288 | $196 | Renter’s insurance reinstated as required by umbrella policy. |

| Toll Fees | $296 | $275 | |

| Parking | $63 | $49 | |

| Public Transportation | $168 | $157 | |

| Dry Cleaners | $60 | $69 | |

| Shipping/Office supplies | $6 | $37 | |

| Alcohol & Bars | $1,726 | $1,547 | Annual entertainment and social expenses. |

| Coffee Shops | $88 | $117 | Reduced spending on cafe visits. |

| Restaurants | $3,806 | $2,920 | |

| Lunch at Work | $231 | $530 | Reduced expenses due to increased meal preparation at home. |

| Entertainment | $798 | $914 | Annual concert and entertainment expenses. |

| Education | $0 | $0 | No direct educational expenses incurred. |

| Fees, Interest & Bank Charges | $0 | $0 | No banking fees or interest charges incurred. |

| Health & Fitness | $710 | $935 | Utilizing workplace fitness facilities. |

| Home Furnishings | $0 | $852 | |

| Personal Care | $778 | $689 | |

| Pets | $101 | $447 | Annual pet care expenses. |

| Clothing | $1,809 | $836 | Wardrobe update and replacement. |

| Electronics & Software | $1,535 | $308 | Technology upgrades and replacements. |

| Sporting Goods | $1,114 | $11 | Investment in fitness equipment. |

| Shopping (other) | $253 | $373 | Miscellaneous retail purchases. |

| Travel | $5,734 | $6,269 | |

| Miscellaneous | $305 | N/A | |

| Auto Sale | -$1,497 | N/A | Successfully sold second vehicle through Craigslist marketplace. |

| Total | $19,888 | $18,909 |

Gifts and Donations: $10,933

We believe in giving back, whether it’s supporting our parents or contributing to causes close to our hearts. This year, we allocated 25% of our total expenses to this category.

Lessons Learned and New Challenges

The Alcohol Awakening

Our deep dive into expenses revealed a surprising trend—we were spending nearly $5 per day on alcohol! This realization sparked a bold decision: we’re challenging ourselves to an alcohol-free 2017. It’ll be interesting to see how this impacts both our health and our wallet.

The Power of Mindful Spending

By categorizing our expenses, we’ve gained valuable insights into where our money goes. This awareness allows us to align our spending with our values, cutting back on areas that don’t bring us joy and redirecting funds to experiences and causes that truly matter.

Looking Ahead: Our Financial Independence Journey Continues

As we reflect on 2016 and look forward to 2017, we’re more committed than ever to our goal of financial independence. Our annual living expenses, not including gifts, of $33,326 serve as a benchmark for our “Freedom Fund,” the amount we’ll need to sustain our lifestyle in early retirement.

While we haven’t set a firm retirement date, we can feel it on the horizon. Until then, we’ll continue to optimize our spending, invest wisely, and make the most of every dollar—and every moment—along the way.

I’m impressed with your decision to cut out alcohol, especially since it was trending the opposite direction. Will be interested to hear if you are able to do it!

Hi PFK-

Yes, it feels kind of crazy to make such a commitment, but I’m up for the challenge and I’ll definitely report on it. Now I’m not saying it will be easy but we’ve been successful so far. I haven’t drank since mid December and the alcohol expenses are at $0 for the year. Now what to do with the newfound money? Keep investing! 🙂 Thanks for stopping by.