It’s been exactly 1,895 days, or a little over five years, since we bid farewell to our corporate cubicles and embraced the FIRE lifestyle. Honestly, it feels like a lifetime ago—so much so that we barely remember what sitting in a cubicle feels like. But this post isn’t about reminiscing over office life; it’s about sharing what our early retirement journey has been like so far and how it’s reshaped our understanding of what “retirement” truly means.

What is FIRE?

Financial Independence, Retire Early (FIRE) isn’t just a catchy acronym for us—it’s become our way of life. For those new to the concept, FIRE is built on a simple principle: once your investments can cover 25 times your annual spending, you’ve achieved financial independence. This gives you the potential to retire early, following the famous 4% Rule.

In my experience, early retirement involves countless variables unique to each individual’s journey, and no one can fully predict life’s twists and turns along the way. But having investments that can support you for decades certainly takes a lot of pressure off when life throws its curveballs.

Our Version of “Retirement”

Let’s be clear: our version of “retirement” is far from the traditional image of idle days and leisurely pursuits—especially since we’re raising two small children. To be honest, it doesn’t even feel like we’re “retired” at all. We’ve traded corporate jobs for the freedom to raise our kids and manage our time, but the pace of life hasn’t slowed down as much as you’d think.

When we meet new people, the inevitable “What do you do?” question often leads to interesting conversations. My go-to response? “I manage investments and live off the returns.” It’s simple, honest, and avoids the misconceptions that often come with the word “retired.”

My wife takes a more direct approach, proudly stating, “We worked corporate jobs, retired early, and now live off our investments.” She doesn’t get asked as often, since most other moms just assume she’s a stay-at-home mom and that I’m the one working.

A Day in Our Lives

Our family-oriented community, rich in stay-at-home moms and dads who work in the service industry, provides a unique backdrop for our lifestyle. We’ve noticed the positive impact of having a parent at home full-time, particularly in their children’s behavior and their refreshing lack of attachment to electronics. The kids love to play outside, engage with traditional toys, or attend playdates without a digital distraction in sight.

Living in Florida close to Warm Mineral Springs has expanded our social circle, introducing us to visitors who often become friends. Our flexible schedule allows us to host these new acquaintances on weekdays, enjoying leisurely lunches, impromptu karaoke sessions, and casual home gatherings.

Our weeks are a blend of structure and spontaneity. Here’s a snapshot:

- Weekdays: While Tatiana coordinates playdates and homeschooling activities for our daughters, I’m often found managing our home construction project, tending to our fruit trees orchard, or tackling household chores. We also take advantage of off-peak time to do grocery shopping or any other errands. We barely get stuck in traffic as we avoid rush hour as much as possible.

- Family Day: We carve out one weekday for family adventures, taking advantage of less crowded attractions and weekday discounts—a delightful perk of early retirement.

- Mini-Vacations: Short trips to nearby cities like Tampa keep us energized and break up our routine. These one- or two-night getaways provide a change of scenery without the hassle of air travel.

- International Trips: While we haven’t taken many extended international trips due to the challenges of traveling with small children, we did enjoy a month-long stay in the Dominican Republic last May, visiting Santiago and the beautiful beaches of Puerto Plata. We look forward to more international travel as our children grow older and our new home is completed.

Major Life Changes Since Our 3-Year FIRE Update

Since our last FIRE update at the 3-year mark, we’ve experienced two significant changes:

- The Birth of Our Second Daughter: Welcoming Lina into our family has been a joyous and transformative experience.

- Land Purchase and Home Construction: We bought 5 acres of land in July 2022, kickstarting our dream of building our own home. We’re aiming to break ground this fall and move into our new home by next fall. This project represents a significant rebalancing of our assets and has already generated wealth through land appreciation. We’re excited about the various phases of development we have planned for this plot of land.

Key Financial Considerations for Early Retirement

Health Care

As early retirees, we must figure out how to cover healthcare expenses. We chose a family plan from the health exchange, primarily for emergencies. Our wellness spending focuses on integrative and alternative treatments, which are generally not covered by traditional insurance. This approach helps us treat root causes rather than just symptoms, but it does come with a price tag.

Here’s a breakdown of our wellness spending since retirement:

Year | Wellness Spending |

2020 | $4,491 |

2021 | $7,860 |

2022 | $12,772 |

2023 | $4,265 |

2024 | $4,150 (Projected) |

2021 and 2022 saw higher spending due to pregnancy-related costs and the birth of Lina. Excluding those outliers, we’ve averaged around $4,300 per year on wellness.

Family Planning

Being stay-at-home parents has allowed us to save significantly on daycare costs, which are often one of the most expensive line items for working families. We’ve found that kids can be as expensive as you allow them to be. While we spend on gifts for our children’s friends during birthday parties, the returns balance out when it’s our kids’ turn to celebrate.

Regarding future education costs, our approach differs from the traditional mindset of saving for college. Instead, we’re focused on helping our kids explore various paths to financial independence when they’re older. We believe there are many routes to success, and a traditional college education isn’t always necessary or the best choice for everyone.

Lifestyle Inflation

Are we gradually increasing our expenses beyond our initial projections? The short answer is that we are spending more than we intended, thanks in part to rising inflation—23.36% since July 2019. But we’ve adapted. The key takeaway here is that while we track our spending and make adjustments, we’re not overly rigid.

Fortunately, we’ve never relied solely on our investment portfolio for income. Rental properties have provided a steady source of additional cash flow, and we plan to continue this strategy by renting out our current home after we move into our newly-built house. We also have other real estate ventures on the horizon to further diversify our income streams.

Withdrawals in Early Retirement

Here’s a breakdown of our withdrawal amount compared to the traditional 4% Safe Withdrawal Rate (SWR):

Year | 4% SWR (inflation adjusted) | Actual Withdrawal Amount |

2020 | $48,587 | $39,499 |

2021 | $49,186 | $32,400 |

2022 | $51,497 | $41,102 |

2023 | $54,844 | $28,071 |

As you can see, in the first four years, we consistently withdrew far less than the recommended 4% from our portfolio. This conservative approach has helped our portfolio grow even as we’ve covered our living expenses.

Successful Financial Strategies

- Tracking Spending: We’ve stuck to tracking our spending and automating our finances. Using tools like Monarch (after migrating from Mint) helps keep everything organized.

- Cash Buffer: We’ve maintained a cash buffer to cover both living expenses and upcoming projects, like the construction of our new home. This strategy provides peace of mind and flexibility.

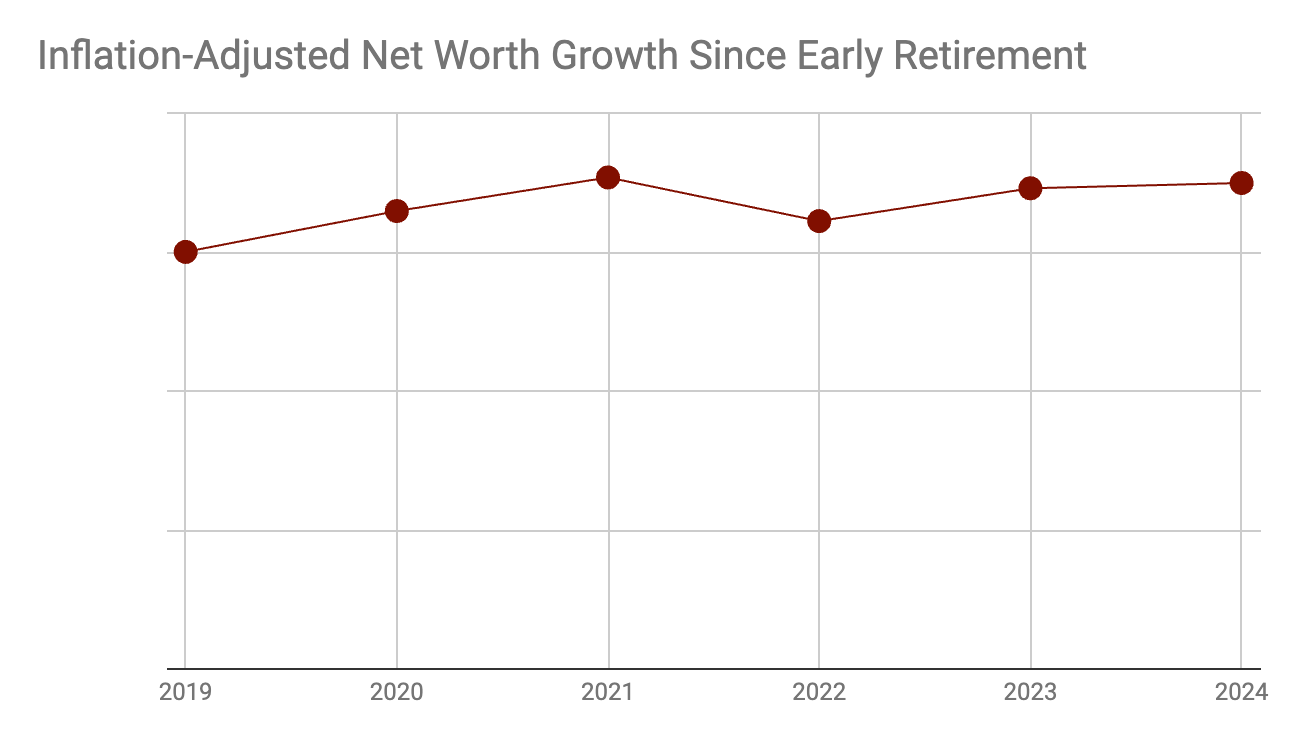

- Inflation-Adjusted Net Worth: Our net worth, adjusted for inflation, continues to grow—even as we spend a bit more than we initially projected. This steady growth, despite increased costs, is a major win for us. We make sure to adjust our current net worth for inflation. Our purchasing power is slightly higher than it was 5 years ago, which we consider a significant success. See the chart below.

Transportation in Early Retirement

We currently own just one vehicle, but last year we made the leap from our trusty 2007 Camry to a spacious 2021 Honda Pilot. This upgrade has been a game-changer for our family of four. The Pilot offers plenty of room for the kids in the back, and the third row comfortably accommodates friends when we have visitors.

Goodbye, good old Camry, and thank you for your service! I think it was approaching 200,000 miles when we turned it in.

With ample space on the Pilot, we can easily pack our beach gear and still have room to spare. It’s been a year and a half since we got it, and we couldn’t be happier with our decision. Having just one car has proven to be a practical and efficient choice for our lifestyle.

Final Thoughts

Five years into FIRE, we can confidently say that the journey has been transformative. Early retirement is about more than just quitting your job—it’s about reclaiming your time and reshaping your life around what truly matters to you. For us, that’s been spending quality time with our kids, exploring new places, and managing our finances on our own terms. The financial freedom we’ve achieved has opened doors to experiences and family time we never thought possible in our corporate days.

For those considering the FIRE path, we encourage you to take that first step. It’s not about retiring in the traditional sense—it’s about creating a life that aligns with your values and priorities.

What’s holding you back from pursuing financial independence? We’d love to hear your thoughts and answer any questions you might have about the FIRE lifestyle.

Remember, the best time to plant a tree was 20 years ago. The second-best time is now. The same goes for starting your journey to financial independence. Why not begin today?