Hello, everyone! Welcome to our latest One Life To Live (OLTL) update. We’re excited to share with you the highlights of our financial independence journey for the first half of 2020. Despite the unexpected challenges this year has brought, our FIRE journey continues to evolve and thrive.

A New Rhythm for OLTL

We’ve decided to shift our OLTL updates from quarterly to biannual. Why? It allows us to provide a more comprehensive view of our financial situation and frees up time for other engaging content. Don’t worry—you’ll still get all the juicy details, just in a more condensed format!

Our 2020 Journey So Far

Snowbirding in Florida

We kicked off 2020 in sunny Florida, embracing the snowbird lifestyle. Our days were filled with breathtaking sunsets by the Gulf Coast and quality family time. Our daughter, now old enough to play in the sand, enjoyed the beaches even more than before.

A Quick Trip to the Dominican Republic

I managed to squeeze in a visit to my dad in the Dominican Republic. While there, I indulged in some local cuisine and visited the iconic Santiago Monument. It’s always a treat to reconnect with my roots!

The COVID-19 Curveball

Like everyone else, our plans took an unexpected turn when the pandemic hit. We extended our stay in Florida until early April before returning to Pennsylvania. Since then, it’s been a mix of lockdowns, home-cooked meals, and carefully planned gatherings with close friends and family.

Financial Update

Portfolio Performance

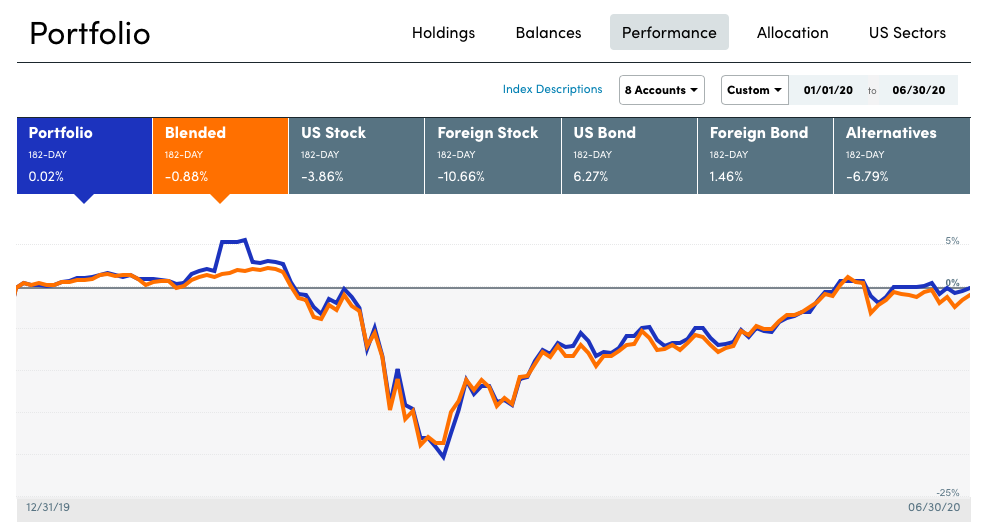

Despite the market turmoil, our portfolio has managed to stay afloat. Here are the key highlights:

- Portfolio return: 0.02% for the first two quarters

- Dividends received: $8,168

- Notable performer: Vanguard International Growth Fund (VWILX)—up 12.37% for the year

Household Spending

| Category | Amount ($) |

|---|---|

| Food & Dining | 7,595 |

| Home | 4,399 |

| Travel | 2,815 |

| Health & Fitness | 1,950 |

| Bills & Utilities | 1,357 |

| Gift & Donations | 831 |

| Shopping | 482 |

| Auto & Transport | 426 |

| Other | 79 |

| Kids | -1,794 |

| Total | 18,140 |

Our total spending for the first half of 2020 was $18,140. After factoring in rental income and tax credits, we only needed to withdraw $17,164 from our portfolio to cover living expenses.

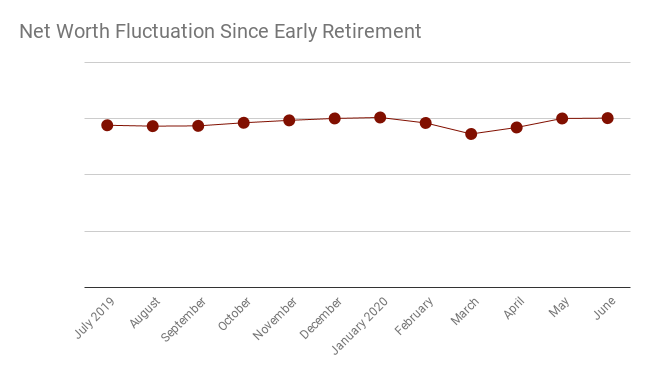

Net Worth Update

Despite the market volatility, our net worth has grown by $50-75k since retiring in July 2019. This growth, even as we’re withdrawing funds for living expenses, showcases the power of our investment strategy.

Reflections and Lessons Learned

- Market volatility is normal. The COVID-19 induced market crash was a reminder that downturns are part of the investment journey.

- Flexibility is key. Our ability to adjust our travel plans and spending habits helped us navigate uncertain times.

- The power of passive income: Our investments continue to work for us, even as we enjoy our retirement.

Looking Ahead

As we move into the second half of 2020, we’re focusing on:

- Continuing our Roth IRA conversion strategy

- Optimizing our withdrawal rate (currently set at 3.25%)

- Exploring new ways to generate passive income

This year has been a blessing of sorts. We made a good decision last year to go to cash and during the crash we took the opportunity to reinvest. Since we had to cancel international vacations and eating out, we also saved more money during the pandemic and yes, food prices are getting higher and higher and so is everything else. Inflation rate is actually misleading, because it doesn’t include food and gas costs…which are two major expenses in any household….

I always enjoy reading these updates. Our portfolio looks just like your chart, we took a big hit in March and it bounced back up in April. We are still at a negative for the year since it went down the first quarter but it looks like we might end the year with positive growth if it continues to go up. In regards to goals, we put a big dent on our debt since student loans have not been charging interest. Most of the money that we are saving on daycare is going straight to debt. Good year so far financially. I hope you guys are staying safe!

Hi! Taking unexpected savings from one category to pay off debt is a great strategy. Well done!