As we inch closer to our early retirement goal, our investment strategy continues to evolve. Our aim is simple: we want our retirement assets to cover our living expenses indefinitely, allowing us to focus on what truly matters to us. Let’s dive into how we’re adjusting our asset allocation to meet our future needs and address potential risks.

The Power of Purposeful Investing

For every year we work, we’re adding 4-5 years of living expenses to our assets, not accounting for future returns. This progress is exhilarating, but it also requires careful planning. Our asset allocation reflects our goals, giving us peace of mind regardless of market conditions.

Addressing Sequence of Returns Risk

As we approach early retirement, one of our primary concerns is the sequence of returns risk. This occurs when you start withdrawing from your portfolio and face lower or negative returns in the initial years of retirement, potentially depleting your funds prematurely.

We’re particularly mindful of this risk given the current extended bull market. While we can’t predict the future, we can prepare for various scenarios. Our approach includes:

- Maintaining five years of living expenses in bonds/cash

- Planning for a paid-off house (our “Nuestra Casa Fund”)

- Cultivating flexibility in our spending habits

- Staying open to meaningful work opportunities if needed

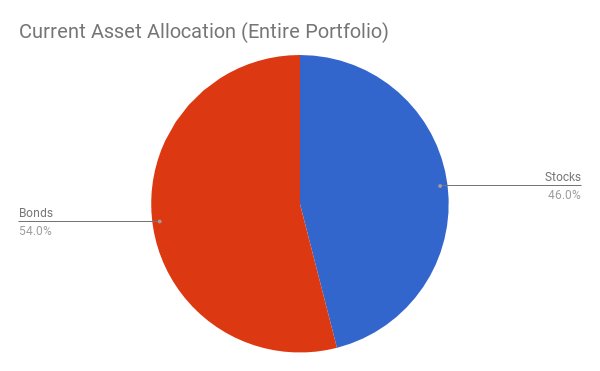

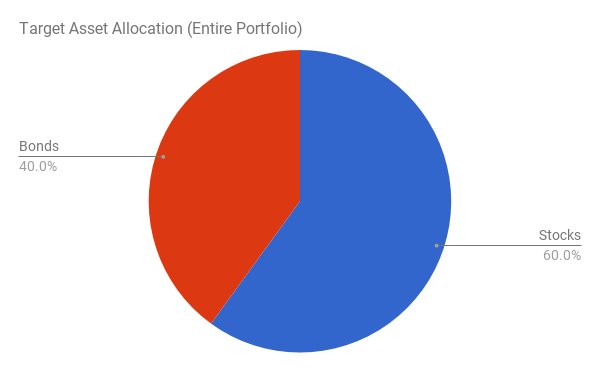

Our Current and Target Asset Allocations

As of October 2017, our portfolio is more heavily weighted towards bonds than our long-term target. This is due to our focus on saving for our future home and preparing for potential early retirement.

Our target allocation for early retirement is a 60/40 split between stocks and bonds/cash. This allocation allows us to have five years of living expenses and our house funds in less volatile assets while maintaining growth potential for the long term.

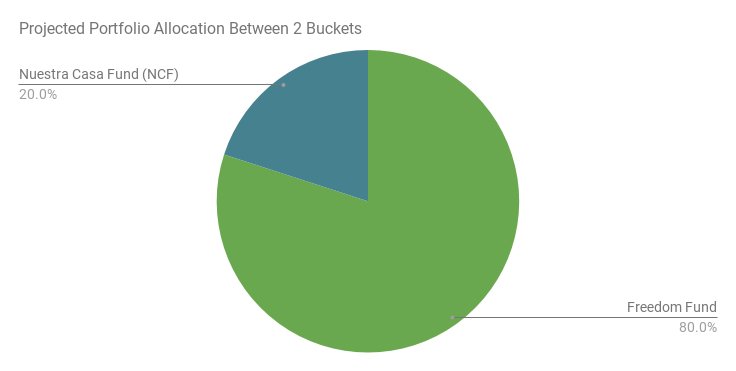

Breaking Down Our Investment Portfolio

Our portfolio consists of two main buckets:

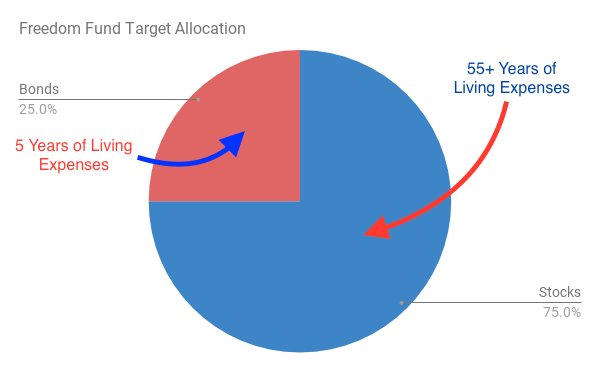

- The Freedom Fund (80% of portfolio): This fund will cover our living expenses in retirement. We aim for a 75/25 split between stocks and bonds/cash, with the latter covering five years of expenses.

- The Nuestra Casa Fund (20% of portfolio): Allocated entirely to bonds and cash, this fund is earmarked for purchasing our future home.

Long-Term Approach and Future Plans

We’re committed to maintaining five years of living expenses in bonds/cash, which will be close to a 75/25 allocation in our Freedom Fund at retirement. Our approach balances moderate growth with capital preservation.

While we currently own a rental property, we plan to sell it in the future and add the proceeds to our Freedom Fund. This decision aligns with our goal of complete freedom from active income activities and optimizing our happiness in early retirement.

Closing Thoughts

As we move full steam ahead towards early retirement, we remain flexible and open to adjusting our strategy as needed. Remember, there’s no such thing as a perfect asset allocation—it’s about finding what works best for your unique situation and goals.

What’s your approach to asset allocation? How does it align with your financial independence goals? Share your thoughts in the comments below!

Investing always carries risk, including the potential loss of principal. The strategies discussed here are for informational purposes only and should not be considered financial advice. Always consult with a financial professional before making investment decisions.

It’s always interesting to see what other people are doing with their investments! We just checked our allocation the other day and we’re coming in at around 20% bonds and 80% stocks. I think we’re happy with that for now.

I keep thinking about picking up a place to rent or flip, but I’m enjoying doing all the fun stuff too much to try making more money. Stocks and bonds are much easier to maintain 🙂

80/20 sounds like a good allocation for your situation. I think that after we retire and access our situation we’ll get closer to an 80/20 from a 75/25 (not including house funds).

I’ve been managing the property for so long that I want to know how it feels to not have the responsibility. RE is not 100% passive unless you hire a property manager. It hasn’t been that bad for us lately but every now and then you get the leak from hell that no matter how much you fix it, keeps coming back!

I’d like to try RE crowdfunding sites in the future but will wait until there’s a shakeout so that we can invest with solid companies. That’s at least 2-3 years down the line though. Thanks for stopping by!