Every weekend, millions of Americans rush to buy lottery tickets, dreaming of instant wealth. They stand in lines at convenience stores, clutching their dollars and hoping for a miracle that has roughly the same odds as being struck by lightning while singing karaoke. Meanwhile, one-third of Americans have no retirement savings at all. This stark contrast reveals a fundamental truth about wealth building that rarely makes headlines: lasting financial success isn’t about luck—it’s about a fundamental shift in mindset from consumer to producer.

The Million-Dollar Reality Check

The meaning of “being a millionaire” has evolved significantly over the years. While inflation has certainly decreased the purchasing power of a million dollars, reaching this milestone still represents something powerful: financial freedom. The traditional financial advisory world often throws around numbers like $3 million as the minimum needed for retirement, but the FIRE community has repeatedly demonstrated that the real number can be much lower without sacrificing quality of life.

The secret lies in understanding what truly brings fulfillment. When you step back and examine your spending patterns, you often discover that many of the things you thought would bring happiness are actually just responding to social pressure or temporary desires. This realization becomes the first step in transforming your relationship with money.

The Producer Mindset: Your Path to Financial Freedom

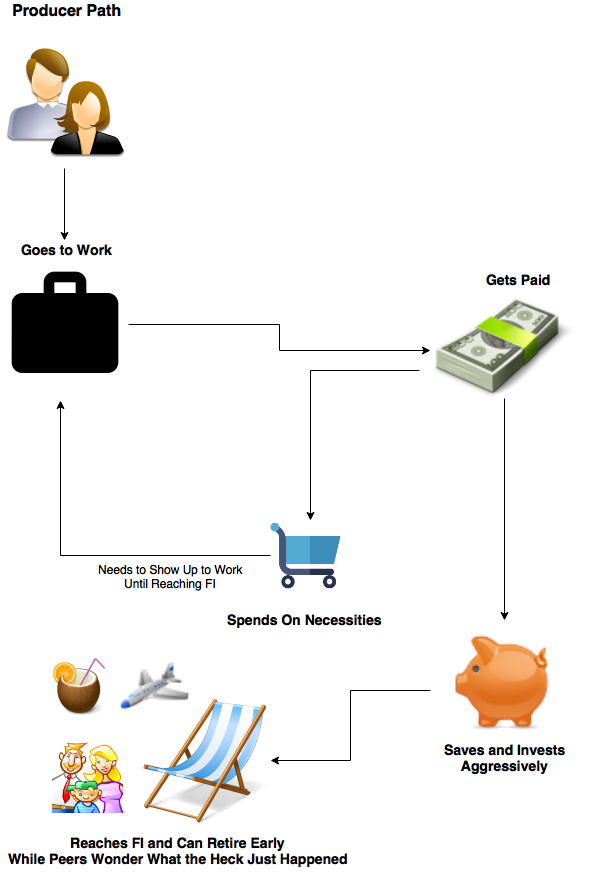

The distinction between building wealth and chasing it comes down to one crucial trait: becoming a producer rather than remaining a consumer. This shift goes far deeper than simply saving money or cutting expenses. It represents a fundamental change in how you interact with the world around you.

Producers are creators of value. They look at the world through the lens of opportunity and possibility. Whether through developing products, offering services, or making strategic investments, producers focus on generating value that outlasts their direct effort. A producer might write a book that continues to earn royalties for years, create a course that helps others while generating passive income, or invest in assets that appreciate over time.

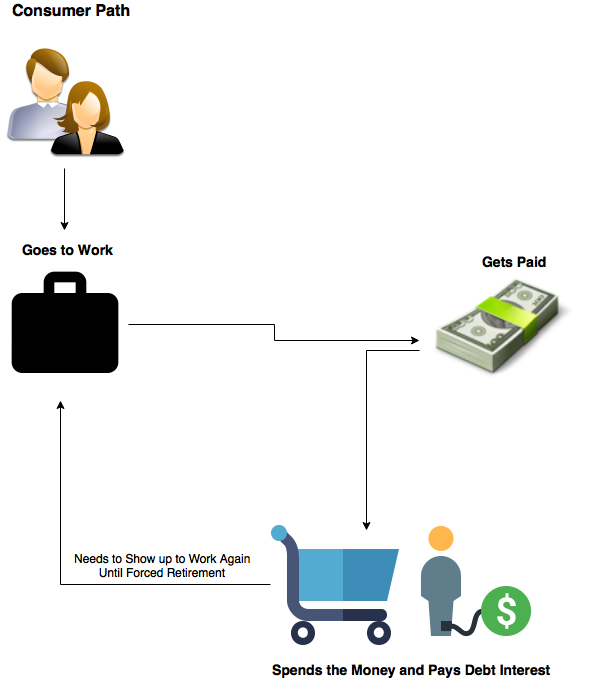

Consumers, on the other hand, focus primarily on using what others have created. There’s nothing inherently wrong with consumption—we all need to consume to live. The problem arises when consumption becomes our primary mode of interaction with the world. When we define ourselves by what we buy rather than what we create, we trap ourselves in a cycle that makes building wealth nearly impossible.

Breaking Free from the Consumer Trap

Our society has conditioned us to be consumers from an early age. Every day, we’re bombarded with thousands of advertisements, each carefully crafted to convince us that happiness lies in our next purchase. Social media has amplified this effect, creating an endless stream of carefully curated images that trigger our desire to spend and consume.

The typical consumer cycle is relentless and draining. You earn money, pay your bills, spend on wants that you’ve been convinced are needs, and then repeat the process all over again. Each paycheck becomes a tool for consumption rather than creation, and the possibility of building real wealth remains forever out of reach.

The Producer’s Pathway to Wealth

Producers view money through an entirely different lens. For them, each dollar represents potential energy—a seed that could grow into something much larger. When a producer receives a paycheck, their first thought isn’t about what they can buy but rather about how they can invest it to create more value.

This mindset transformation manifests in practical ways. A producer might look at their social media usage and ask how they could create content that generates income rather than just consuming others’ posts. They might consider buying a duplex instead of a single-family home, living in one unit while renting out the other to cover the mortgage. Even their approach to learning new skills is different—they focus on abilities that can generate income rather than just save money.

My Journey from Consumer to Producer

I intimately understand this transformation because I’ve lived it. Like many others, I started as a pure consumer. Money slipped through my fingers like water, leaving behind a trail of forgotten purchases and accumulating debt. The breaking point came when I realized that despite all my spending, I wasn’t any happier. In fact, the constant cycle of earning and spending was making me increasingly anxious about my future.

The shift didn’t happen overnight. It began with small changes—questioning my purchases, learning about investing, and looking for ways to create value rather than just consume it. Each step was challenging, but each success built momentum toward the next. Today, I view money as a tool for creating more value, not just as a means of consumption.

Embracing Your Producer Journey

The path to becoming a producer begins with awareness. Start by examining your relationship with money. Are you trapped in the consumer cycle, or are you building assets that generate value over time? Look for opportunities to create rather than consume. This might mean developing a side business, investing in income-generating assets, or building valuable skills that others will pay for.

Remember that this journey isn’t about completely eliminating consumption—that’s neither possible nor desirable. Instead, it’s about shifting the balance toward production. Every time you choose to create rather than consume, you take one step closer to financial independence.

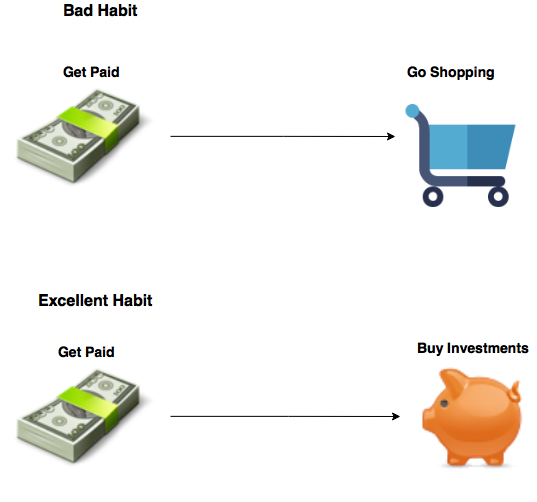

The choice between remaining a consumer and becoming a producer represents one of the most important financial decisions you’ll ever make. It’s not a choice you make once, but rather a series of small decisions that compound over time. Each time you choose to invest rather than spend, to create rather than consume, you build momentum toward your financial goals.

Join the Conversation

Take a moment to reflect on your financial journey. Where do you see yourself on the producer-consumer spectrum? Perhaps you’re already building a side hustle, investing in assets, or creating valuable content. Or maybe you’re just beginning to recognize patterns in your spending that you’d like to change.

Share your story below:

- What was your “aha moment” that made you question your relationship with money?

- Which producer habit are you most proud of developing?

- What’s the next creative or entrepreneurial project you’re excited to tackle?

Your experience might be exactly what another reader needs to hear to start their own producer journey. Let’s build a community of value creators who support each other’s growth toward financial independence.

This IS the best article ever! Thank you.

My new favorite article on this site. Time tested wisdom here, hard to calculate the true value of this content but I will start with priceless. Thanks for taking the time to share true wisdom with all of us who can use it. Keep it coming!!!

I guess it must be the favorite of many since it’s already the most viewed article of all time. I’m glad you find good use of it. Thanks for reading!

so refreshing to see your thoughts about consumerism. thanks for adding value by helping us see how we can do even better!!

Of course my friend! We can always do better and never let the guard down when it comes to consumerism. Bad habits never extinguish, they can only be replaced with good ones.