We had a lot of our investments locked up in our retirement accounts after we retired from our jobs. This was the result of us maxing out our 401(k)s in order to save money on taxes up front. While this was our best move, we were unable to easily diversify away from stocks and bonds as we desired. This is where opening a self-directed IRA comes into play.

What is a self-directed IRA?

A self-directed IRA is an individual retirement account that allows you to save for retirement with assets that traditional IRAs do not allow, such as precious metals and real estate.

You can invest in almost anything.

While the IRS doesn’t provide a list of approved investments, they do have a list of prohibited transactions such as life insurance, collectibles, and S-Corporations.

There are also “disqualified people” with whom you cannot conduct business, such as your parents and children.

We liked the idea of opening a self-directed IRA, or SDIRA, because we could have more control over where our money was invested and we could now invest more in real estate.

Why the switch? Weren’t we happy with our index funds?

Despite the fact that we had a good mix of stocks, bonds, and cash, I was uncomfortable. Perhaps it’s just that I’ve never been a fan of bonds. I don’t consider myself a money lender.

In addition, one of our long-term goals is to continue diversifying our net worth so that stocks represent a smaller portion of the pie. The SDIRA helps us achieve that.

We retired in 2019 and did not anticipate the stock growth we experienced two years into our retirement.

So we debated what to do with the extra funds in our accounts. And we decided to try something new early last year. Thus, the notion of investigating self-directed IRAs was born.

We still believe that the stock market is a great way to passively build wealth, if not the best. Stock funds continue to account for a sizable portion of our net worth. We’re just looking for further diversification.

For example, REITs are a great alternative to stocks, but they’re still different from investing in a residential property. In the past, five years or so, some REITs have begun to include real estate property management as part of their holdings, which is different from real estate ownership. It’s not that this is wrong; it’s just not the investment type that we’re looking for.

There are some REITs that invest only in residential properties, and we could have invested in those as well. But we don’t get to control these types of investments.

How much did we set aside for the SDIRA?

So we set aside about one-third of our portfolio, which was the equivalent of investment gains since we retired, as funding for our self-directed IRA, primarily to buy real estate.

However, because these were the equivalent of investment gains, we kept the majority of our original FI number target in our traditional IRAs.

In essence, we rebalanced our portfolio according to our goals.

The self-directed IRA provides us with options we didn’t even know we had.

Now that we have a self-directed IRA, we are ready to invest in more tangible assets. We can buy land and rental properties. However, finding good real estate opportunities has been the most difficult part of the process.

In June, we were finally able to close on a real estate transaction, and we’ll have more details in an upcoming post. We’re extremely excited about it!

Great real estate deals are hard to come by these days, but we have the patience to wait until we can hook the right fish. We can buy as soon as we see a good opportunity through the LLC, owned by our self-directed IRA. Yes, we formed an LLC to buy investments. We didn’t even know we could do this!

Are we fools for keeping cash on hand while we wait to make these investments?

Many inexperienced investors tend to “trash cash”. When the stock market is performing well, all you hear is “cash in a bank account is worthless.”

The truth is that cash has a place and time in our net worth. For example, in our SDIRA, cash allows us to act quickly on opportunities that may arise. We’re starting to get calls from our realtor whenever he sees a good deal before it even hits the market. He knows we mean business and have the cash to back up the deals if we so desire.

If we like a deal, we can literally write the check and purchase the property.

You’ll hear me say this often: If we need money in the next five years, we won’t put it in the stock market.

Of course, money is a tangible asset, so for other necessities besides our SDIRA, we can access cash in a different way: If we need $5,000 to cover an unexpected expense and have stock funds in a taxable brokerage account, we can sell them, even at a loss, and buy a comparable stock fund with cash in a tax-deferred account.

Unintended performance?

Right before we retired we explored what type of stock/bond allocation we should have. We decide that an equity glidepath was the right move for us.

Prior to opening the SDIRA, our stock/bond portfolio percentage was 63/37 (stocks/bonds) at the beginning of 2021. Since we were following the equity glidepath, we were shifting towards stocks.

When we opened our self-directed IRA, the exchange was mostly from bonds and some stock funds to cash.

While real estate is not a bond sector, it is an alternative investment that fits well with our plan to implement an equity glidepath and shift our portfolio to equities. In other words, we’re happy to increase our alternative investments for a higher long-term return than bonds.

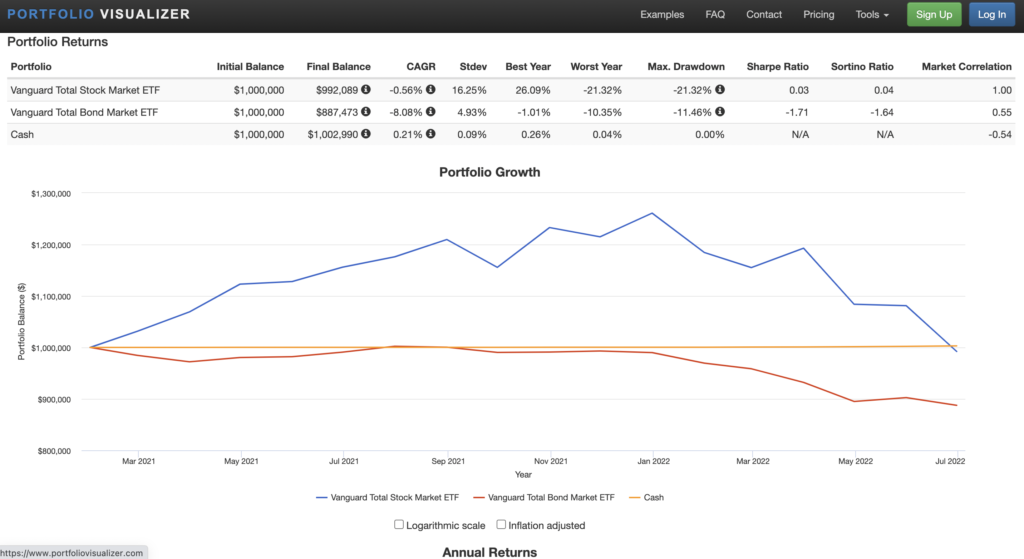

While we waited, this is how our cash fared in comparison to stocks and bonds. Cash doesn’t look so bad all of a sudden, huh?

Link to the inputs for table above

The graph above depicts how a hypothetical million dollars invested from February 2021 to June 2022 with income reinvested would have performed.

Vanguard Total Stock Market ETF (VTI) return: – 0.56%

Vanguard Total Bond Market ETF (BND) return: – 8.08%

Cash return = 0.21%

Although we had no intention of timing the market, things turned out well for us. Our cash is still returning a positive 0.21%. There are some valuable pennies there! Hahaha.

While looking to diversify, we sold at a good time when stocks were high and before bonds started to underperform.

“Wow, you call that a positive performance? You lost more to inflation.”

While inflation is a baitch, this is a much better performance than bonds, given that the majority of our money would’ve been invested in bonds. In any scenario, we are losing money to inflation.

Of course, even if bonds and equities did great during this timeframe, we’d be okay with our decision to go into cash to shift our investments. Hindsight is 20/20.

“What a great investor you are! You never make mistakes.”

We’re not great investors, to be sure. We simply use time to help us alleviate our investing mistakes. Again, hindsight is always 20/20. We don’t always get it right, which is why we always invest for the long term.

This is why I dislike statements such as, “If you’d bought Apple stocks in [fill in the year], you’d be a billionaire by now.” You never hear things like, “If you had bought Enron stock in [fill in the year], you’d be walking around in your underwear today.”

For example, in 2017, we started saving to pay for a house in cash. This money was mostly invested in bonds and cash while we saved. In 2020, we finally purchased our first home.

If we had invested in stocks during those years of waiting, we would have had a lot more money by the time we bought because the stock market increased from 2017 to 2020. So many ifs…

The risk of the money not being available when needed is not one we are willing to take. As investors, we must always know how much risk we can tolerate.

What is our benchmark?

Most of the money that is in our SDIRA would’ve been in a Total Bond Market Fund (BND) if we didn’t change our allocation and open a SDIRA. Life before the SDIRA involved us shifting to an equity glidepath and going from bonds to stocks in our portfolio.

So I’m betting my horses against a fund like BND.

As long as the SDIRA’s assets outperform a bond fund in terms of returns, we’re winning. And, perhaps most importantly, we will own more physical assets as part of our long-term investment strategy.

I am also aware that the risks and investment styles differ, but I am comfortable with real estate risk. We own a property that I purchased in 2004, so I’m well-versed in residential real estate investing.

But, I’m not trying to simply match a bond’s return. Based on the real estate industry, which performs much better than bonds, we should be able to generate good returns.

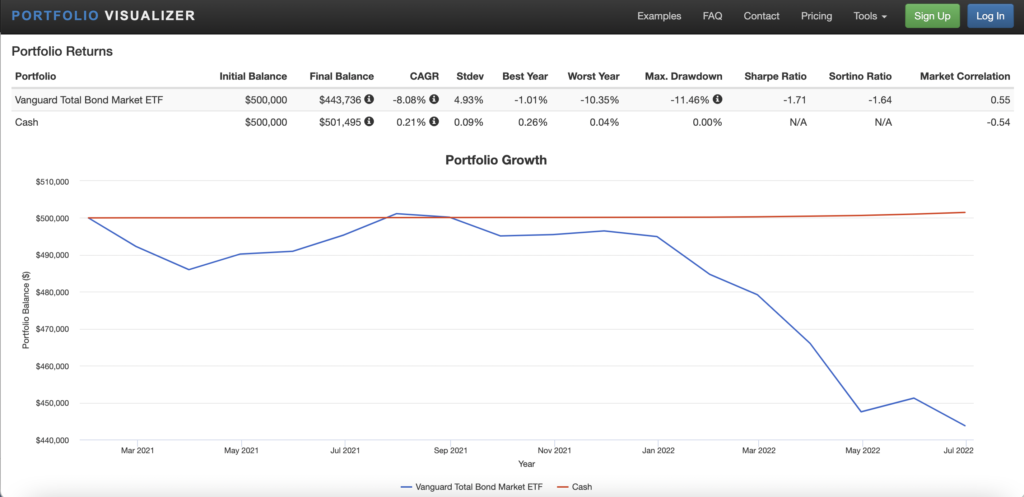

Let’s input other numbers to see how we would fare.

From February 2021 to June 2022, hypothetically, if we had kept $500,000 in BND for allocation purposes, we would have lost $56,264 as opposed to making $1,495 by keeping it in cash to invest in the SDIRA. Obviously, it’s not a gain to rave about, but when you’re losing your shirt, anything to cover your skin helps you sleep better on cold nights.

Link to the inputs for table above.

The question I must answer for my wife and I is therefore, to put it simply, “Are we doing better than BND in our SDIRA?”

Right now, even though we are mostly sitting in cash, the answer is an unequivocal “yes!”

Final thoughts

Financial freedom lovers, opening a self-directed IRA changes our game a bit. Besides real estate, we’ll get to explore other investments that were not available to us through our traditional IRAs.

They are available through taxable accounts, but we’re lacking capital there because we kept on maxing out 401(k)s while working. The main goals, following maxing out retirement accounts, were to save for a home purchase and have enough money saved up to cover our first five years of early retirement while the Roth conversions kick-in.

We’ll go into greater detail about self-directed IRAs and how we manage our own. For the time being, we wanted to share the news that we opened one and the reasons behind it.

Although we did not dive into it yet, there are advantages and disadvantages to holding real estate in tax-deferred accounts vs. holding stock funds in tax-deferred accounts, as well as the fees related to opening a self-directed IRA that owns an LLC. We’ll discuss these in more detail later.

So far, we’re pleased with our decision to establish a SDIRA. We now have financial control over what we had hoped. It’s not an all or nothing situation. We can still have the best of both worlds by investing via unconventional retirement accounts and traditional IRAs.

Why settle for one when we can have both? 😉