Exciting times in our household as we now have a party of three! What have we been up to since June?

One Life To Live is our quarterly recap on how financial independence plays an integral part in fueling our true happiness. We have one life to live, but are we making the best of it? Are we living in the most fulfilling way possible? We hope that our lifestyle answers those questions as we continue to optimize for happiness. Carpe Diem!

Exploration

We didn’t go anywhere fancy during the third quarter and now we can tell you why! I love it. I love it. I love it. We were nesting! Travel is on pause as we started to raise our newborn girl during the last quarter.

She was born slightly under six pounds but is already weighing 12 pounds at 10 weeks, so she gained some serious ground. She got all the baby rolls, or Michelin Man rolls, as Tatiana calls them.

The first trimester with our newborn has consumed most of our time, but it’s all worth it! After a few weeks, she began to smile and that’s the biggest reward for our job.

It doesn’t matter how tired we are in the middle of the night. When we have to change her diaper and she smiles at us, while she’s wide awake, our tiredness goes away.

For me, it’s been hard at times going to work and leaving her behind. I don’t know how parents can do this for years. I guess going to work is a break from parenting for many. I’m away for a few hours and I already want to be back home with my family. I’m glad that we have a FIRE plan and this corporate work is just temporary.

After we retire, and that’s months away, there’ll be plenty of time to spend with our baby girl.

Parenting has been the most rewarding job so far and it sure keeps us grounded at home, cooking more awesome meals. Last quarter we ate out a few times, but increased our cooking at home, since going out to dinner together is now a big luxury.

What meals did we cook last quarter?

From the chef’s kitchen

Cooking your own meals is a great way to eat healthy and save money. A great advantage is that you can cook with better ingredients and know what’s going into your food.

Here are some of the meals that we cooked last quarter.

Now for the number lovers, we’ll proceed to discuss our basic spending, portfolio income and performance for the third quarter.

Passive income and expenses

The following is a streamlined spending report that takes very little time to produce, therefore, giving us time back to get back to living our lives. It stays within our theme of having one life to live and maximizing our time for happiness.

What’s included in these reports?

At the end of the day, people need food, shelter, mobility, the ability to pay the bills and take care of debt payments. So, these are the expenses that we concentrate on.

Bare-bones expenses

Bare-bones spending for Q3-2018

This is how we spent on the most basic needs during the third quarter.

| Category | Quarter Amount | YTD Amount | Comments |

| Auto & Transportation | $945.69 | $2,056.28 | |

| Bills & Utilities | $565.80 | $1,585.90 | |

| Debt Payments | $0 | $0 | |

| Groceries | $2,280.80 | $5,020.20 | |

| Home Supplies | $179.05 | $596.57 | |

| *Net Rent | $2,255.78 | $3,927.22 | |

Total | $6,227.12 | $13,186.17 |

Groceries

Our grocery spending has gone up this year and there some valid reasons for that:

- We now have a newer member in the family and she loves to eat! 🙂 Via mommy’s milk, of course, but mommy has a ravaging appetite now.

- We’re eating out less and that increases the grocery shopping by default. The food and dining expenses should even out when including restaurant spending or go lower. I say even out because we buy the best quality of food and it’s not cheap.

- With newborn responsibilities, we barely have time to go to other grocery stores. We shop mostly at Wegmans for convenience, which is a pricier supermarket for some of our regular staples. I stop by on the way home for some items and get right to cooking. It’s more important for me to have the ingredients to cook for the night right away, than drive far and get home late for cooking to save a couple of dollars on groceries. Not cooking for a few nights have a ripple effect because it also means having to buy lunch the next day. After we retire, we’ll have more time to do more bargain shopping, as long as the food quality is at least the same.

Home supplies

Tatiana realized that a few purchases that should have gone to the Home Furnishings category ended up in Home Supplies. I would have left it the same since I’m more interested in tracking our overall spending and a few hundred bucks going from furnishings to supplies is not going to rock my world, but Tatiana doesn’t feel the same.

[Editor’s note, AKA, Tatiana: “Really? You had to go there on the blog…Aish…”]

So, I conceded and she went through all the transactions to re-categorize. As a result, our home supplies spending is lower and it’s now reflected here.

What else is happening with our spending?

Since the arrival of our baby girl, we barely eat out and drink and that is saving us some money. We also haven’t traveled much this year, so our travel spending is pretty light. Travel hacking is helping with that as well.

That sums up our bare-bone spending for last quarter.

You can click here to see our latest annual spending.

Passive income

Dividends

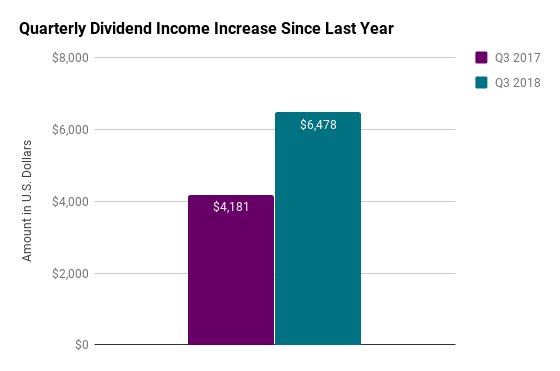

Our dividend income, from index-based investments (mutual funds and ETFs), continues to increase as we accumulate more assets. We received $6,478 in income and had a 54.9% increase from a year ago.

The truth is that we don’t really concentrate on increasing dividend income. We just invest according to our asset allocation and the dividends keep coming in. When it comes to investing, it’s important to see the whole picture and that includes the returns from the investments as well.

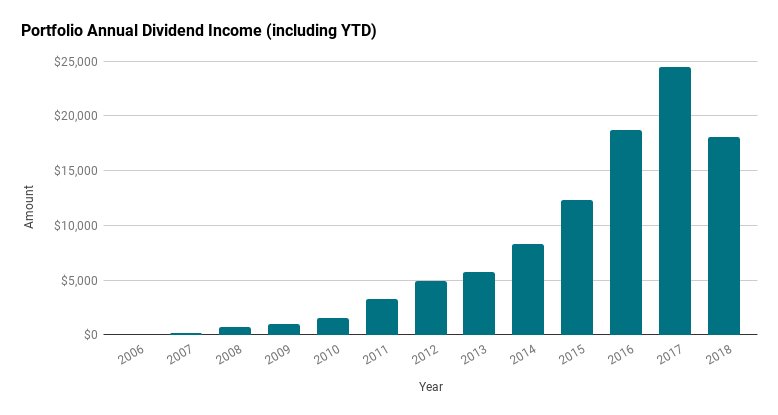

Dividend income over time

I love the following chart and want to include it in our report because it shows our humble beginnings and a transition to owning our time, once we got on the FIRE path in 2012.

I think we’re going to surpass $30,000 in dividends this year. The 4th quarter will come loaded with dividends as many funds pay dividends on an annual or bi-annual basis.

Freedom Fund Portfolio Returns

We currently have two goals for our entire portfolio:

- The Nuestra Casa Fund holds the funds for our future home, once we decide where to settle in early retirement.

- The Freedom Fund will provide the income needed to live life on our terms in retirement.

Since we’re nearing retirement, we opted for an allocation of 75% stocks (including REITs) and 25% bonds/cash in the FF Portfolio, which coincides with having the money we’ll need during the first 5 years of early retirement in bonds and cash.

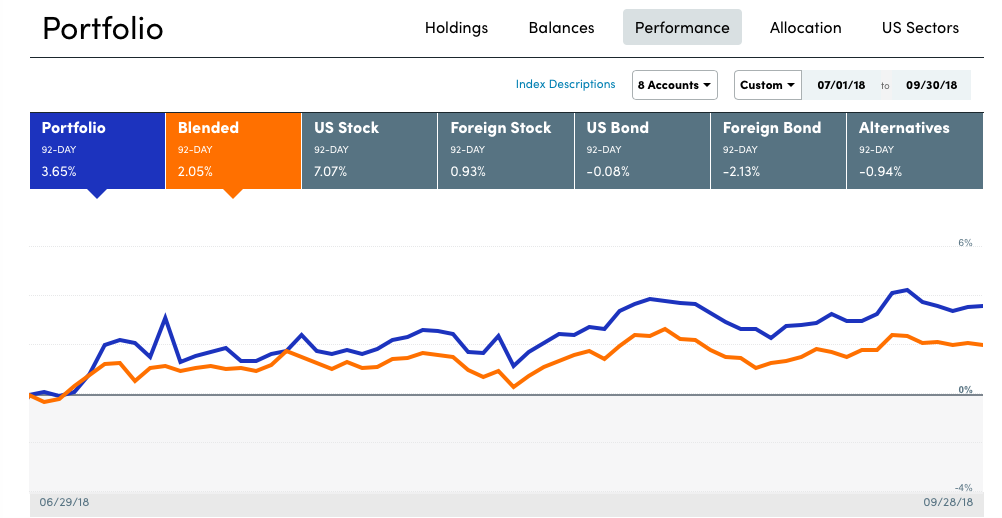

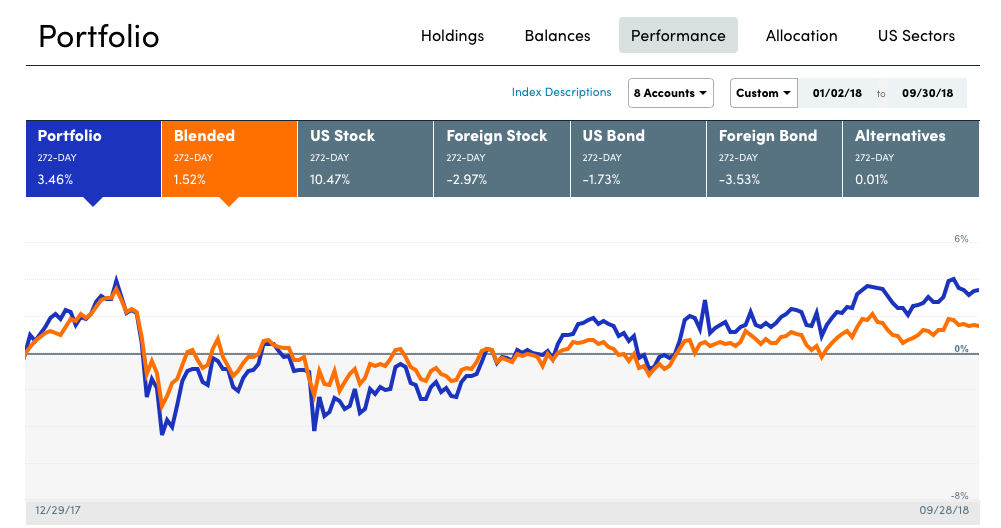

Q3 FF portfolio performance

Our FF Portfolio returned 3.65% for the quarter. We compared our portfolio to a blended mix of stocks and bonds. The blended recommendation from Capital One would’ve returned 2.05%.

Freedom Fund Portfolio YTD returns

Our YTD performance is 3.46% so far. It’s not as sexy as the 10.47% U.S. stock performance, but we’re okay with that, as we’re nearing retirement and need the cushion that bonds and cash provide for those early retirement years.

Net worth update

Our net worth did well for Q3. What’s refreshing about our net worth is that even if it was to go under for a while our plans remain the same. You’ve got to have that long-term perspective and invest accordingly, if you want to win the game. We already won the game, so investing is mostly on cruise control for us.

What makes up our net worth?

Only income-producing and real estate assets make the list.

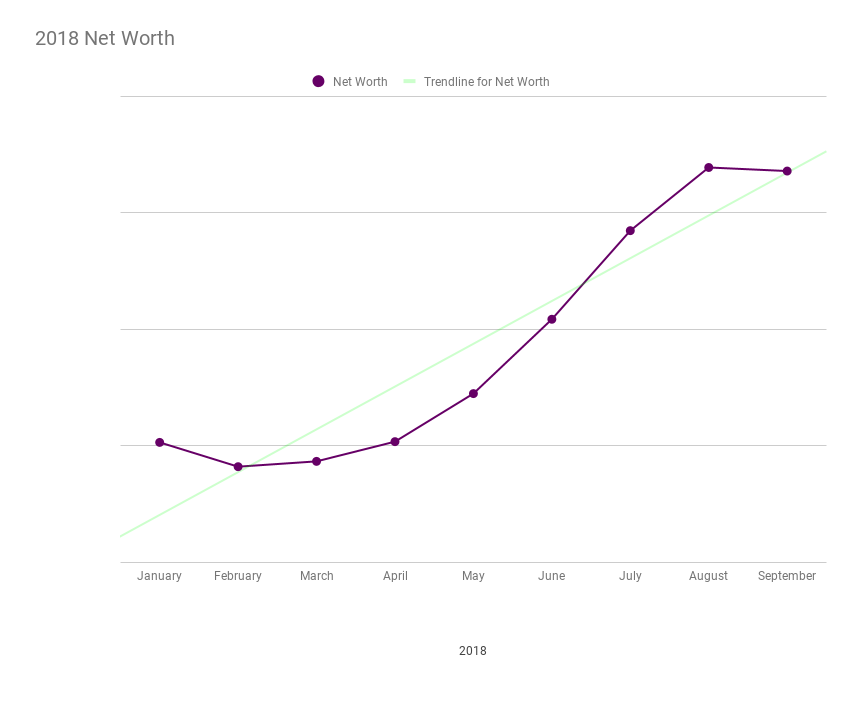

YTD net worth

We stayed above the trend line during Q3. July and August were great months and then it cooled off a bit in September. These fluctuations are mostly driven by our portfolio performance.

Our savings strategy hasn’t changed. We keep our spending low without sacrificing quality of life and invest the rest. As of now we’ve maxed out our 401(k)s, Roths, house fund, and keep putting money away that we’ll need once in retirement.

It’s been a great year so far and I don’t have a crystal ball to predict what happens next with the market, but I can tell you one thing: It doesn’t matter to us. FIRE is inevitable.

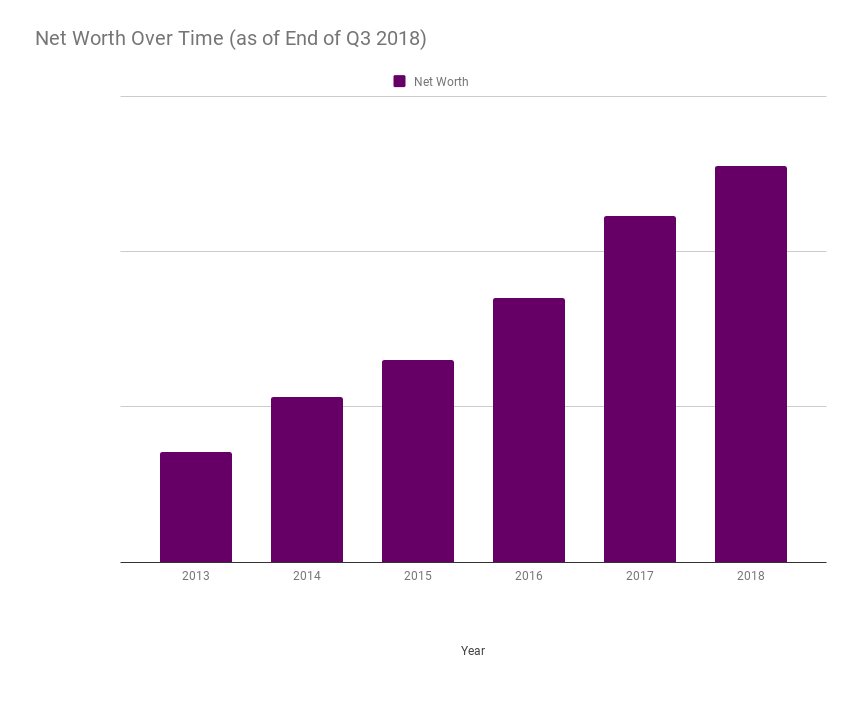

Net worth over time / Our ladder to wealth

We started tracking our net worth as a couple after we got married in 2014. It will be interesting to see how the following chart changes after we retire. Would it continue to trend up?

Road to retirement

We’re basically months away from early retirement, but there are a few things that we need to get done before that. First, we have to brace for another winter in PA! Oh no!!!

What’s helping us cope with this is that it is our last winter here and we’re also scheming to spend 5 weeks in Florida. We’ll spend time at my in-law’s house, do fun things that involve walking without freezing, go to the beach and the Warm Mineral Springs (AKA, Fountain of Youth – got to stay looking young in retirement), and carve out a little time to scope out the area of Sarasota and see some houses.

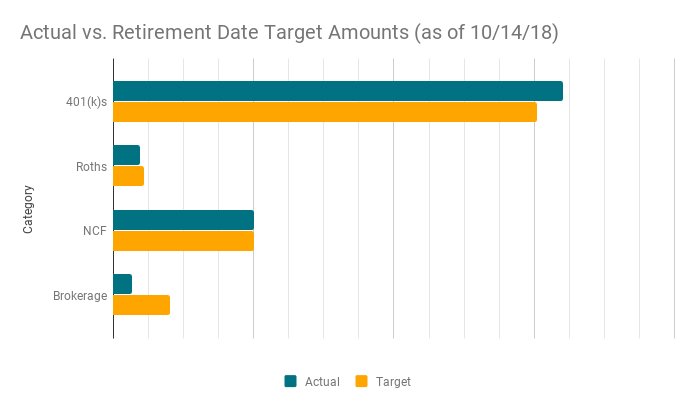

Funds for the next chapter in our lives

Here’s a snapshot of how our account balances are doing versus our targets.

We’ve been mentioning that we plan to keep about two years of savings in cash to fund our first years of early retirement. The savings for the first year will be kept outside of the brokerage account, so the target for the brokerage account has now been reduced by that amount.

Our 401(k)s balances are over our target, but a decline in the market could bring it back down or below our target.

We’ll be investing in the Roths as soon as January 2019 hits, so that’s the first financial goal of 2019. We have all of our REITs in the Roth accounts, so these accounts movements don’t correlate the equities market.

The brokerage account is where we’re putting most of our monetary efforts for the rest of the year. We won’t hit that target until we sell our rental property, as we’re counting on the proceeds to complete it.

What’s next?

Hopefully next time we update OLTL, we’ll be in Florida and our girl will be enjoying solid foods. We plan to drive to Florida and make lots of stops along the way. Who knows? If you’re on our path, maybe we can meet up! 🙂 Let us know.