I can’t believe it’s been nearly a year since we last discussed our asset allocation. We were attempting to determine what kind of asset allocation we needed to have in order to enjoy our long retirement without depleting our funds at the time. After all, this investing journey is merely a means to an end.

We’ll be able to travel for months at a time, prepare most of our meals, pursue our hobbies, and do whatever the hell we want with our time once we’re financially independent and able to retire early. It’s liberating just thinking about it!

All of this will be possible thanks to our hard-earned money, which will be working for us while we lie down in a hammock. And those dollars must be allocated correctly in order to maximize returns while avoiding unnecessary risks.

After a year of additional research and analysis, I now feel confident in speaking about the asset allocation we should have as we approach early retirement and beyond. So, let’s take a look at how we’re putting our assets in place to enjoy the early retirement we just described.

A word about our portfolio and other assets

We typically invest in mutual funds and exchange-traded funds (ETFs). Our investment strategy is straightforward and requires little attention from us. We also have a rental property in our Freedom Fund portfolio. For the purposes of this article, we will only discuss asset allocation in our mutual fund and ETF portfolio.

Our current asset allocation

Asset class and current allocation

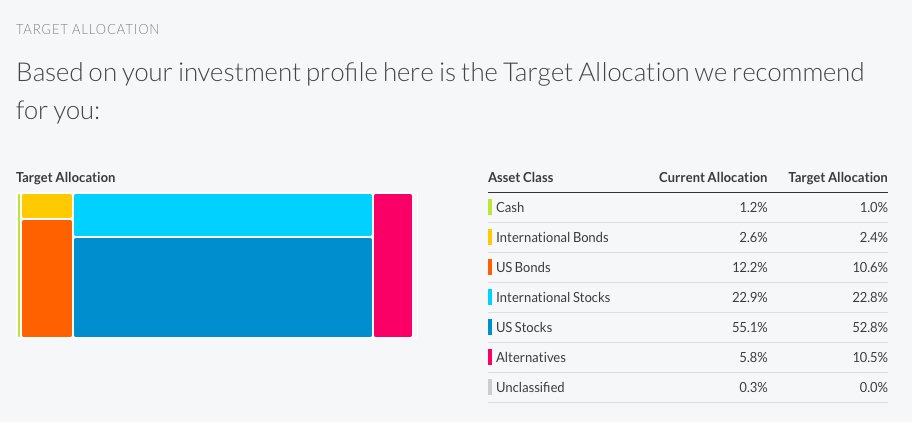

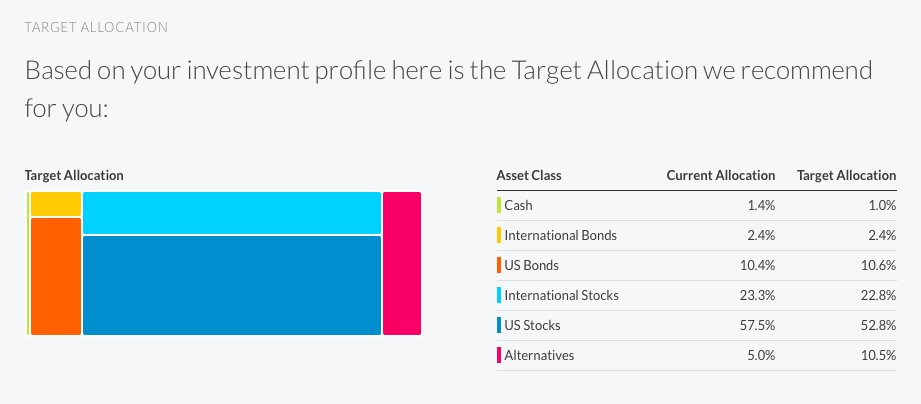

Target Allocation

After answering a few questions about our investment styles and risk tolerance, Personal Capital created an investment profile for us. Their asset allocation recommendations are very close to what we were looking for. We wanted to invest 10% in bonds, 10% in REITs, and anywhere between 20% and 25% in international stocks. We’ll closely follow the target allocation recommendation below because it serves our investment goal.

The Cash portion represents the cash held by index funds and ETFs. In general, we do not allocate cash in our portfolio on our own. The majority of the assets in Alternatives are REITs. Our goal is to invest up to 10% while decreasing our allocation to US stocks. It will take some time because we are allocating these investments to our Roth IRAs in order to reduce our tax bill.

We invest on a regular basis, and when deciding where to put our money, we usually look at this chart to see which category is underperforming and buy more into that. It’s that simple! We buy low.

Risk & returns

Why would we invest so little in bonds when we’re so close to retiring? Isn’t that a little too aggressive?

The truth is that we intend to stick to the safe withdrawal rate. On an annual basis, we plan to withdraw 3-4 percent of our investments. Dividends and income returns will account for 2% of that withdrawal. The remaining 2% will come from capital gains.

Our current allocation has an 8.9 percent historical return. That leaves 4.9 percent available for investment growth. Of course, these returns are not guaranteed because past performance is not indicative of future results.

An 8.9 percent return sounds nice, but we can’t always expect it from the market. Remember 2008?

That is correct; those returns are unattainable if you expect an 8.9 percent return year after year. The return is an average over a longer time period. For example, the market could give you a 30% return one year, then drop to a 10% return the next and provide negative returns the following years. This is why we base our estimates on average returns.

My 401(k) portfolio had negative returns in 2008 and did not show a positive return until the end of 2009. My 10-year rate of return has been 8.3%. Not bad considering that the first ten years of investing were a steep learning curve without the benefit of financial advice.

I have an investment rule that any money we need in the next five years does not go into stocks. That is one of the reasons we have bonds. If the market falls and we don’t want to sell low, the bond allocation should be enough to cover five years of expenses plus dividend income.

We use Personal Capital’s Efficient Frontier to see the historical risk and return for our allocation. It represents a set of efficient asset class mixes based on historical results.

Asset location and tax minimization

We’ve moved some assets around in our portfolio to ensure that they’re in the right place for tax purposes. We can reduce taxes by determining where each investment should be held. For example, we keep bonds in our 401(k)s to guard them from taxes because bond interest is taxed as ordinary income.

Also, we keep REITs in our Roth IRAs because they must distribute 90% of their earnings to shareholders and are taxed as ordinary income. Dividends and capital gains are taxed at a lower rate than interest income, which is taxed at the taxpayer’s highest marginal tax rate.

Future “home, sweet home” plan

After we retire and travel for a while, we intend to buy real estate again, whether it is a house, condo, or multi-family unit. This is a slight deviation from our previous plan to purchase real estate abroad as soon as possible. One reason is that we don’t know how things will change in a couple of years. The global economy can and will change.

Plus, who knows what new places we might fall in love with on our travels? It’s okay to be patient and perseverant if the path is not clear. Let us just see where this goes.

So we don’t want to rush into a purchase and lock ourselves in before we retire. We want to keep our options open, so the best strategy is to invest that money conservatively until we can make a decision.

How are we going to fund our home purchase?

Our plan is to sell our rental property and save the proceeds to help pay for our future home. We figured we could let the money grow because we’re keeping our plans flexible and don’t need to buy by a certain date.

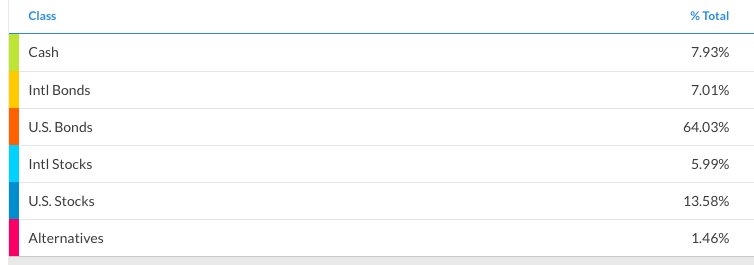

A 3-5 year investment time horizon is ideal for our goal. We did some research and decided on the Vanguard LifeStrategy Income Fund, which is composed of 80% bonds and 20% stocks.

When plugged into Personal Capital’s asset allocation models, this allocation has a historical return of 6%. If the investments provide a 3% return by the time we are ready to withdraw, we will have outperformed inflation.

Even if they only provide a 2% return, we’ll be fine because it’s still a better option than putting the money in CDs. It doesn’t take much to make us happy. After all, when you make a profit, you never lose money. 🙂

We could have saved this money in our current portfolio holdings to avoid paying taxes on the bond’s income returns, but the Lifestrategy Fund rebalances itself daily.

As a result, we won’t have to worry about rebalancing and can simply keep investing as we go.

Portfolio rebalancing entails buying or selling assets in a portfolio on a regular basis in order to maintain the original desired level of asset allocation. You should do this in tax-deferred accounts to avoid paying taxes.

This investment is not accounted for in the previously discussed portfolio asset allocation. We account for this asset separately because we don’t want LifeStrategy holdings to skew the asset allocation model we’re aiming for.

Personal Capital is great because we can choose which accounts to exclude from our calculations.

Home fund: Asset class and current allocation

“Hmmm, but if you add up the International and U.S. stocks holdings, you have a total of 20% of the money invested in stocks. Didn’t you say that you don’t invest any money that you need within 5 years in stocks?”

I did say that, but we don’t consider buying a home in three years a necessity. As a result, we’re keeping the purchase date open. That’s why we’re willing to take a small financial risk. A 20 percent stock allocation exposes us to very little volatility.

If there was a significant drop in the stock market and we saw an opportunity to buy real estate, we would consider the purchasing power of our funds before making a decision. Again, purchasing is a choice for us rather than a necessity. Why would we rush to buy if we could rent anywhere in the world while our money grows? 🙂

(Update: 3/4/17)

We’re extending our retirement date to our original retirement year of 2019, for personal reasons that we may discuss at some point. This means we’ll have a larger portfolio by retirement, and we’ve decided to save money for the home fund in cash while investing the rest in the market based on our asset allocation.

We sold the LifeStrategy investment at the end of 2016 and continued to rebalance our portfolio by investing new money.

What has been working for us on our FIRE journey

If we had to summarize the steps we took to get to this point in our lives over the last 5 years in a nutshell, it would be as follows: We track and minimize our spending, have paid off all of our debt, save aggressively, avoid a consuming lifestyle, spend on things and experiences that add value to our lives, and do not inflate our lifestyles.

Looking ahead

No one has a crystal ball to predict what the market will do, and we are no exception. We believe in long-term investing and are unconcerned about market fluctuations. I am completely confident that our portfolio will see us through retirement.

We’re not looking to outperform, but rather to consider an allocation that allows us to sleep well at night. We will continue to invest over the next few years in accordance with our allocation, which is in line with our FIRE plans.

Sign up to receive new posts by e-mail and our monthly FI updates.

I’d like to conclude with a quote that captures the essence of long-term investing:

“I never attempt to make money on the stock market. I buy on the assumption that they could close the market the next day and not reopen it for ten years.” –Warren Buffett

What would you do differently if you were planning an early retirement than we did? What asset allocation works best for you as an early retiree?

Risk disclosure: All investing involves risk, including the possible loss of principal. The material contained on this website is for discussion purposes only and should not be construed as financial advice.

Love those LifeStrategy funds. The simplicity of not having to rebalance is excellent.

I see the point made by earlyretirementnow and I’d caveat it with being positive you are ok with the potential downside. Even in a tough bond market a bond-heavy portfolio may still protect you from big drops as long as exposure to long term bonds is minimal. Just my 2 cents. Still agree with the logic just be mindful of the potential swings.

Very nice post and good asset allocation. I think for folks like us in the FIRE crowd we need a high equity allocation. Otherwise, the portfolio is not going to last for the 40 or even 50 years of projected retirement (given today’s low bond yields). Very different from the traditional retiree at age 65!

One thought on your home purchase fund: If I were to plan a home purchase in 3 years, I’d have more equity, less bond exposure. A home is a capital purchase (real estate is capital, included for example in REITs). So to hedge the future home price fluctuation, REITs wouldn’t be a bad choice. They might go down in value, but at the same time, you could buy your future home at a cheaper price. All the while getting higher yields than bonds. Nominal bonds would be the opposite of a hedge: an inflation shock would make the house more expensive but sink your bond portfolio. Or a bad recession would make the home cheaper but bonds will rally. Nominal bonds are an anti-hedge, they add unnecessary risk for this spending goal. Just a thought! 🙂

Thanks ERN for your thoughtful post! It certainly got us thinking. I agree on the high equity allocation for forks like us with a long retirement ahead of us. Equities make up around 68% of our net worth asset allocation and our long term goal will be to bring it down to about 35% of it by reinvesting in real estate. But in relations to the stock and bond allocation I don’t see us going beyond having 12-15% in bonds.

Adding REITs to our home purchase sounds like a good idea and we are definitely exploring it. Maybe we set aside 25% of the funds in REITs. That would bring the home fund asset allocation to 25% REITs, 15% stocks, 60% bonds. It definitely brings the risk level higher. I see this as if we were going with the VG Lifestrategy Conservative Growth Fund which has a 40% stocks/60% bonds asset allocation. https://investor.vanguard.com/mutual-funds/lifestrategy/#/ We just started investing in this “home fund” so we can make adjustments. That’s just an example of what we might do. One thing to keep in mind is that we might be buying abroad and the real estate market abroad doesn’t move in correlation with the U.S. market. We’ll let you and our readers know what we decide. This is the most thought-provoking comment I’ve seen on our site. I guess we should talk about asset allocation more often! 🙂 Thanks for stopping by.