Welcome to our first-ever report on passive income! This report is intended to track our progress toward financial independence and early retirement.

Our ultimate financial goal is to retire early and live on passive income for the rest of our lives.

Our goal is to accumulate 25 times our projected annual spending in income-producing assets in order to achieve financial independence. Then, we can expect to withdraw 3-4 percent of those assets as passive income to cover our expenses.

These passive income streams will do the hard work for us. We’ll be able to leave our corporate jobs and focus more on living a happy life, one without alarm clocks and running from meeting to meeting all day. Our goal is to be able to reclaim our time, and each day that passes brings us closer to the finish line.

Aside from the fact that we are learning as we go, we hope that this can inspire you to achieve your financial independence goals and, if desired, to pursue early retirement.

We’ll reveal our figures, but remember that at the end of the day, it’s not about how much we make, but about how much we get to keep. We hope that by showing you how we make our “sauce,” you can get a sense of what might or might not work for you in your quest for financial independence.

Classifying Passive Income

Before we get into the numbers, the Internal Revenue Service divides income into three categories: active (earned) income, passive (unearned) income, and portfolio income. For the purposes of these reports, we will only look at passive and portfolio income as defined by the IRS.

We also excluded real estate income from our rental property from this report because we included it as part of our housing expenses last year.

A note on portfolio income

Types of portfolio income

Our portfolio generates income in two ways: through dividends and capital gains when we sell at a profit or when one of our funds distributes it.

We decided last year to sell some of our mutual funds and put the proceeds into short-term reserves because we are accumulating the funds required to fund our first five years of early retirement.

As a result, we made some capital gains and must pay taxes on them. We don’t believe in market timing, so we only sell when our plans change and we need to reallocate our assets to meet our investment strategy.

Taxes on portfolio income

Capital gains taxes are paid during the income tax year in which the investments are realized (sold). Dividend taxes, on the other hand, are reported and paid for in the income tax year in which they are distributed, even if they are reinvested.

Our Passive Income Streams

| Passive Income Stream | Amount | Comments |

| Credit Card Rewards | $395 | Tatiana manages the credit card rewards programs. |

| Dividends | $12,201 | Index fund investments (mostly 401(k)s) |

| Interest | $833 | Savings/CDs |

| Long-Term Capital Gains (realized) | $7,319 | Index fund investments |

| Short-Term Capital Gains (realized) | $330 | Index fund investments |

| Total PI for 2015 | $21,078 |

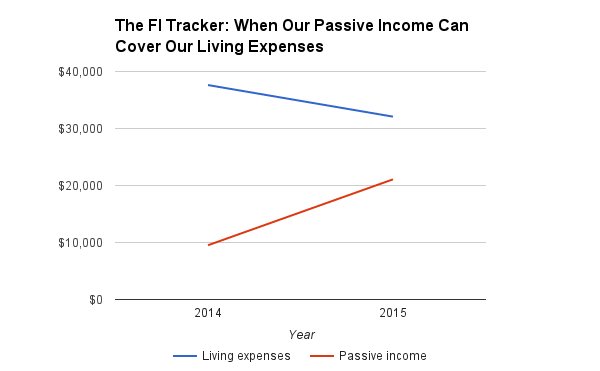

Last year, our passive income streams covered 66 percent of our living expenses. The ultimate goal is to reach 100%, which would mean that our passive income streams could cover all of our living expenses, and we would be financially independent!

If you want the freedom to spend your time however you want, creating passive income streams is the way to go. We’re looking for the most expensive luxury item money can buy: time

A closer look at our dividend income

One thing to remember about investing is that you must start somewhere. All it takes is the discipline to start saving, then to continue on that path and allow the snowball effect to occur.

When Tatiana and I first arrived in the United States, we didn’t have much. We arrived just before our adolescence, and I didn’t speak a word of English. To get to this point in our lives, we had to put in a lot of work.

We started investing around the same time before we met. After attempting the entrepreneurial path, I returned to the corporate world in 2006, and she began working a year later, right after college. This is the first time we have reviewed our investments in order to track all dividends since the beginning of time.

Hmmm

Hey, your plan sounds great, but how would you access your 401(k) funds after you retire early?

You know, you can’t touch that until you’re 59.5 years old!

There are ways to access your 401k assets without incurring penalties. Continue to follow our journey to see how it all plays out!