Welcome to part two of our Early Retirement Projections Series. In part one we estimated our expenses in early retirement. Now we want to dig deeper and figure out how much we’ll be able to withdraw from our portfolio to cover our retirement expenses. The time has come to unveil our withdrawal strategy!

Figuring out how and when you get paid when you have a job is easy: you show up to work and your paycheck gets deposited into your bank account, usually on a bi-weekly basis. Retiring early means that there’s no regular paycheck, but you have the freedom to design how often you want to get paid, with a fully funded retirement. You just no longer need to show up to get paid.

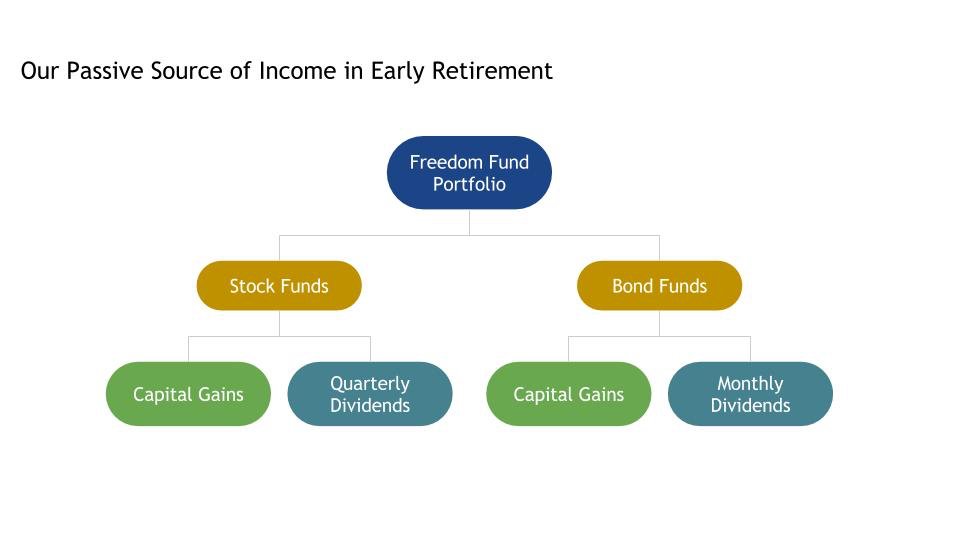

Our passive source of income in early retirement

Our Freedom Fund Portfolio will be our main source of income in early retirement. We’ll be able to withdraw dividends and long-term capital gains from our portfolio.

Our Freedom Fund Portfolio will provide us with quarterly dividends from the stock funds and monthly dividends from the bond funds.

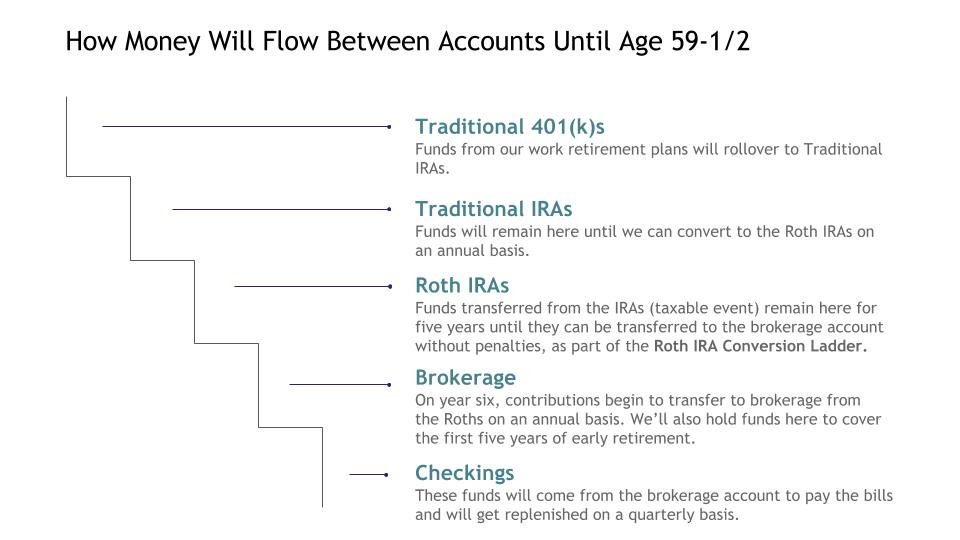

How money will flow between accounts

Since we are younger than 59-1/2, we can’t withdraw money from our 401(k)s without incurring any penalties. There are two ways to access money:

1) Rule 72(t)

2) The Roth IRA Conversion Ladder

We’re going to take advantage of the Roth IRA Conversion Ladder because it’s more flexible than the Rule 72(t) method. This means that each year in retirement we can transfer money from the 401(k)s to IRAs, and then to Roth IRAs. We’ll be able to access those funds after five years tax-free and without penalties.

We’ll need to live off the brokerage account for the first five years of early retirement. We also have some Roth contributions already that we can tap into. However, we’d like to withdraw only from the brokerage account during those years.

Withdrawal strategy criteria

Most retirement withdrawal rates are based on the 4% rule. It means that you can withdraw a fixed 4% from your portfolio, adjusted annually for inflation, and possibly not run out of money. This rule was based on a 30-year traditional retirement period. I did a whole bunch of calculations on CFIRESim and noticed that a longer retirement, like ours ~60 years, has a similar success rate.

There’s a lot of skepticism about the 4% rule out there, mainly due to the lower returns expectations on stocks and bonds over the next decade.

What’s driving the thoughts behind lower returns expectations?

Interest rates have been low for way too long, accompanied by a low inflation environment. Also, the price-to-earnings (P/E) ratio is high, so the expectation is for lower growth in stock prices.

I obviously don’t know when we’ll enter a lower growth cycle, but it’s good to have reasonable expectations. With a margin of safety at our disposal, there’s no need to worry. We can control many of the outcomes to make our portfolio last forever.

We want our withdrawal strategy to meet a certain criteria.

These are some words that come to mind when we think of our withdrawal strategy:

Flexibility

We want flexibility with the amount of money we’ll be withdrawing from our portfolio of stocks and bonds. In order to do this, we need to keep our spending flexible. We can do this because we have badass fixed expenses. Also, we don’t have any debt obligations to keep us tied to a certain level of income.

Flexibility will allow us to adjust our spending based on the current market environment. For example, if the market is down, then maybe we don’t plan that trip to Europe next year and head down to Latin America instead. If the market is up, then we can think about replacing our car or making some home improvements. Those are the kind of decisions that we can plan ahead based on market conditions and give our spending the ability to fluctuate over time.

We don’t have to spend a lot of money to have fun. Walks are free. Hobbies like learning new instruments, biking, reading, singing karaoke, and dancing are almost free. Exercising can also be free and for everything else, there’s YouTube for singing along to concerts at home.

By eliminating the stress of a 9-5, we’ll be more in tune with both our body and mind and will have less of a need for stress-killing entertainment.

Simplicity

I realize that withdrawing from accounts can become cumbersome, but we want to keep it as simple as possible. We can accomplish this by employing common sense and without the need for complicated formulas. I also don’t want to have to worry about money management bi-weekly anymore. I want to think about money only when needed and that is four times a year.

Why four times a year?

For one, we get dividends and 401(k) portfolio statements on a quarterly basis. We feel that at the beginning of a quarter it’s a good time to:

- Review spending,

- Review investments,

- Cash or re-invest dividends,

- Update net worth, and

- Withdraw money to pay the bills.

As seasons change (hopefully not too much in our future spot), we’ll get a chance to start fresh with new money (aka dividends and proceeds from investments sale).

After all, we got one life to live, baby, and an hour that I don’t need to spend worrying about the unnecessary is an hour that I can spend paying attention to Tatiana or taking a piano lesson. 🙂

Responsiveness

The 4% rule as it stands as a fixed withdrawal amount doesn’t respond to the market environment. It withdraws the same amount of money regardless of what happens in the market. Now, we wouldn’t blindly withdraw from our portfolio an annual fixed amount while disregarding investment performance, the same way we don’t start dancing at a funeral.

Our withdrawal method will be sensitive to the current environment. If we had a bad quarter, we’d withdraw less, and vice versa.

Limited risk

We also want to limit our sequence of return risk by not depleting our portfolio by a lot when the market is down. With our method, we address this issue.

An abundance, not scarcity, mindset

Before we dig further, I want to point out that we want to look at our situation from a point of abundance. We’re content with the way we spend our money, but we don’t have to restrict ourselves to live purely off the income from our portfolio. I want to see our portfolio as a tool that provides us with infinite money to pay for our living expenses, but it doesn’t have to be our only source of income for the rest of our lives.

We can go make more money if we want to, but making more money is not something that would make us happy in and out of itself. What we decide to do in retirement needs to result in more happiness and life satisfaction. More money is just that, more money if it’s not a byproduct of our happiness. Being happy is our main goal.

So by no means do I feel a sense of restraint to live only on what we make from our portfolio.

Bad times?

We’ll buckle down during the bad times. It’s what we’ve done in the past. We both immigrated to the U.S. with our families and had little in our pockets and very light suitcases. Doing a lot with very little is something that we’re good at. So we’re not afraid to keep things humble if it comes down to it. The most important thing is that we’ll be free from mandatory work, no matter the circumstances.

This is the power of financial independence.

We are buying our freedom. The freedom to spend our time the way we choose. The freedom to be more involved in things we deeply care about. The freedom to have breakfast at home every day and not needing to pack lunch to work anymore. The freedom to travel indefinitely.

This freedom from a 9 to 5, forever, will be our biggest achievement by far! Just because life should be filled with sunset-watching every day!

Our withdrawal strategy

So what withdrawal strategy are we planning to carry out? Based on our preferences, we’re leaning towards implementing a flexible withdrawal strategy. This means that we’ll withdraw around 3-4% of our portfolio based on two variables:

- Total market returns, and

- Our current monetary needs.

It took me weeks to figure out what we would do because my mind kept evolving the more I thought about this. We can’t just set this thing up and forget about it. No graph or chart can project the life curves that await on our path. What’s the point of setting up strategies with spending floors when we don’t know what our situation will be years from now?

Let’s say we put a spending floor of $30,000 and then we need more money for health reasons in one year? Are we going to stick to the floor spending or withdraw more? Of course, we’ll withdraw what we need. Life is not a fixed proposition.

We can’t eliminate all the risks, so we’ll monitor our portfolio as we go.

Our strategy means that income will vary. Some people don’t like to see their income fluctuate from year to year and would see this as a disadvantage. Our withdrawal amount will fluctuate from year to year, but so will our expenses. But the big advantage of withdrawing an amount depending on market returns is that there’ll always be savings left in our portfolio.

We also don’t have an issue with income fluctuating from year to year because we have created a nice gap between our essential and discretionary spending. We have the power to cut our super fancy budget in half in a bad economy and still truly enjoy life. It’s about reducing our discretionary expenses when times are tough.

If we have a prolonged period of drawdown and don’t feel like keeping reduced expenses for many years, we’ll go make more money. After all, there’s abundant wealth around us.

How much do we expect to withdraw in early retirement?

By the time we retire in two years we estimate to be able to withdraw between $40,000 to $42,000 a year, based on average market returns. That would more than cover our fancy projected budget of $38,000, not including health insurance and gift & donations categories. We also plan on having one year of living expenses in cash.

Putting our numbers to “the test”

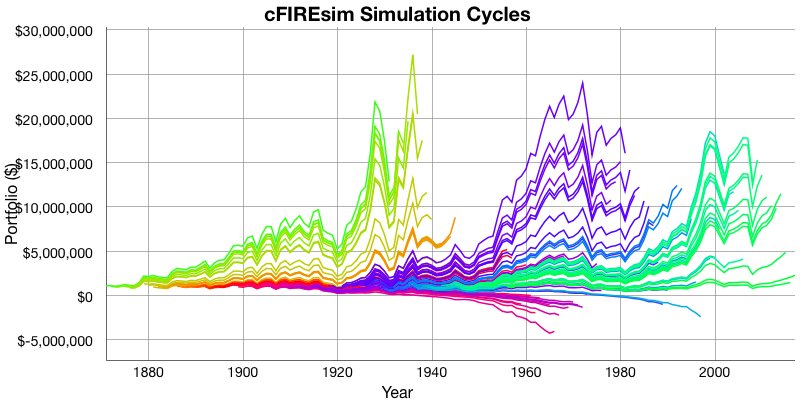

Now, let’s run a simulation to see how our strategy would fare.

Scenario: We retire by 2020 with a 75% stocks and 25% bonds portfolio allocation (Freedom Fund Portfolio). We plan for a 60-year retirement. Based on the initial 4% withdrawal rate, we’d set our withdrawal at $42,000.

Fees can be such a drag on portfolios, but not for us! Fortunately, we invest with one of the best in class and our fees are around .07%. But for the purpose of this exercise, we’ll set our fees at .10%.

I decided to use the Crowdsourced FIRE Simulator. I’m also using all historical data and adjusting for inflation. After inputting all the data, what’s the success rate of our portfolio, and are we good with it?

If we withdraw $42,000 annually from our portfolio consistently, we’d have an 86% success rate. Of course, this is based on past performance, which is no guarantee of future returns. However, that’s a very damn good rate considering that we haven’t added any additional income like social security. Only in a few instances would we run out of money.

We can increase our success rates by withdrawing less during poor market returns and adding income.

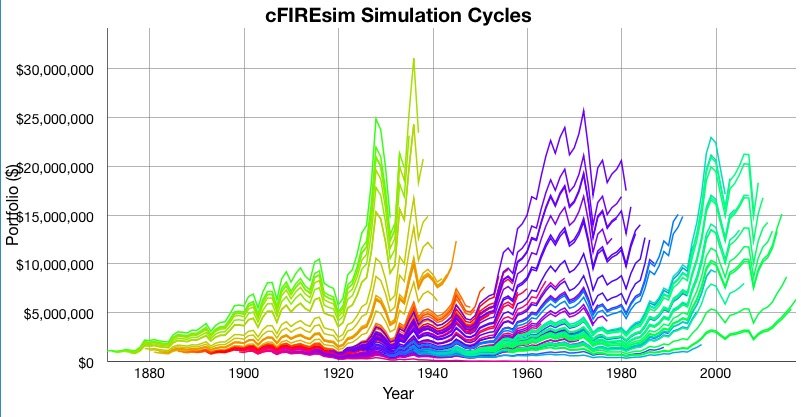

How about adding social security?

I went to the social security website and ran a quick calculation. Let’s add $1,300 for social security starting at age 67 for me and the same for wifey (using the same conservative amount for simplicity). How would $2,600 a month in social security impact our success rate?

100% success rate!

By adding a social security income estimate, our success rate goes up to 100%. That means we would end up with some money at the end of our retirement. We already felt pretty good at the 86% success rate because we can control our spending.

Nothing is 100% risk-free, but it’s good to see the numbers go up drastically just by adding some extra income. Also knowing that withdrawing less than 4% is really an option and not a must, makes early retirement feel even more stress-free.

A $42,000 annual income would more than take care of our super fancy $38,000 budget and leave some money for health care and gift & donations. If we have a lower initial portfolio balance to withdraw from, we’d find ways to cut our expenses.

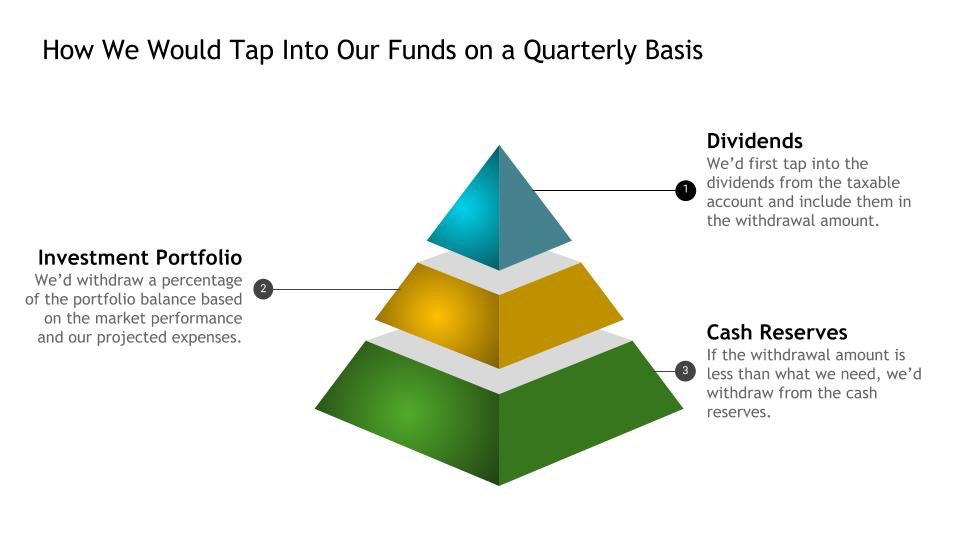

How we would tap into our funds

On a quarterly basis, we’d add up the dividend income, project expenses for the next quarter, and withdraw what we need from the portfolio.

If the quarterly returns were negative, we’d withdraw less and take from the cash reserves. We plan to have one year of expenses in cash reserves to help cushion any prolonged market downturns. We’d also try to lower our expenses for the following quarter based on total market returns.

If we had a really good quarter then we’ll withdraw up to 4%, spend what we need, and deposit what we won’t need in the cash reserve.

Estimating our retirement budget and going through our future withdrawal strategy process was a really good exercise. Even though we still have almost two years to go before we put our strategy into practice, we feel pretty confident about it. I’m sure things will continue to change before we get to our next stage in life.

However, it’s great to know that things are going to be alright. We got nothing left to prove here, my people. We can retire as projected. Let’s pull the plug without hesitation when we reach the end of our countdown.