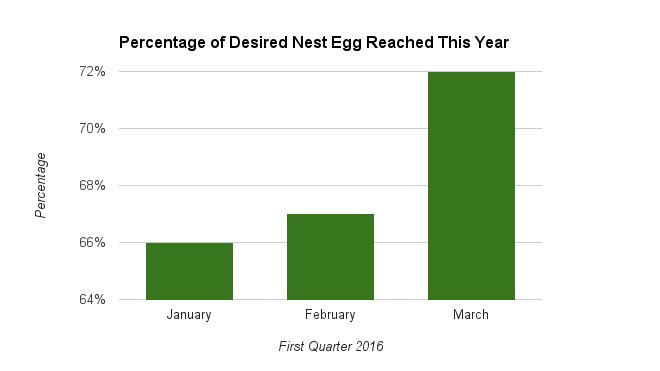

March was an exciting month for the stock market and those of us pursuing financial independence. Our equity portfolio suffered earlier in the year, but we were eventually able to reduce our losses. March restored what January and February had taken away. Of course, we don’t worry about these monthly fluctuations because our investments are in the market for the long term.

Staying the course is critical to the success of our investments. We bring it up because we have reached a significant milestone: we have accumulated 72 percent of our desired nest egg. Yay! The egg nest is nearly three-quarters of the way full. Let’s take a look back at our journey to see how we got here.

This is a very symbolic milestone. It’s like starting your senior year of high school. You’ve gotten over the hump, and your days as an inexperienced high school students are over.

Consider how you feel when you get in your car and see that your gas tank is only three-quarters full. You can drive for a long time without having to worry about running out of gas.

When you reach this point in your FI journey, you have FU money. I estimate it to be about 15 times your annual expenses, but it may be different for others. The point is that having FU money allows you to say no to nonsense.

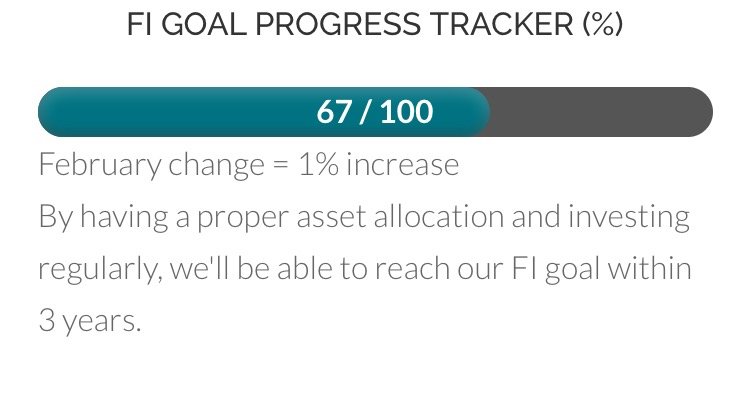

FI Goal Progress Tracker

If you’ve been paying attention, you’ve probably noticed that we update the FI Goal progress bar on the side navigation every month.

In February, our Progress Tracker showed that our nest egg had increased by 1%, bringing us to 67 percent overall. Since the stock market was down that month, we attributed the increase to our earnings.

While the market came back roaring in March, it was our consistent effort to spend less on unnecessary junk and save and invest that also helped us along the way.

Please keep in mind that we only include income-producing assets in our net worth.

What constitutes our nest egg?

Our nest egg is made up of mutual fund investments, short-term reserves, and a real estate property. We have a proper asset allocation based on our goals, and we rebalance as needed.

Looking in the rearview mirror

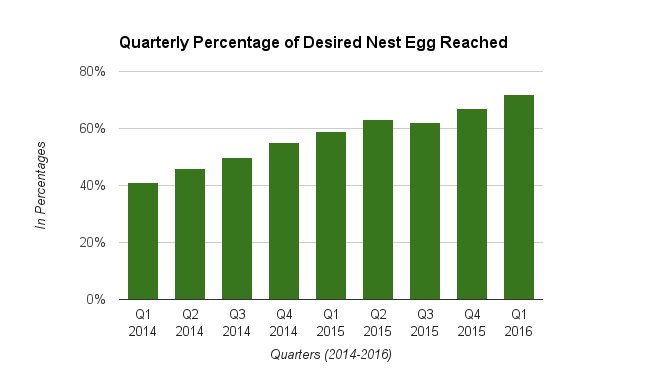

We’ve been married for over two years, and it’s been interesting to look back and reflect on how far we’ve come. We didn’t start thinking about what life could be like if we had complete financial control and the option to retire early from the rat race until May of 2012, when I bought the book Your Money Or Your Life.

When we married, our combined nest egg was approximately 35% of our goal. I had just finished paying off all of my debts a few months before and had gone into full savings mode. We were aware of financial independence and had similar goals.

Reading personal finance books helped us become better at cutting expenses, saving, and investing our money. While we continued to live our lives and educate ourselves, our investments grew on the sidelines. Gradually, our knowledge of this subject expanded far beyond what you learn in school.

The chart below illustrates the quarterly progress we made. For our non-financial readers, a quarter begins with the first three calendar months of the year. It is a very important metric in the financial sector. Most mutual funds, for example, pay out dividends quarterly.

Our timeline

For over a year, we’ve been documenting our FI journey on this blog. So far, it’s been an incredible journey, and we can’t wait to see what’s next. The table below shows how long it took us to get to this point, beginning a few months after we married.

Portion of nest egg filled | Time it took to reach new level | Comments |

| 40 – 50 percent | 6 months | The market was carrying a lot of the weight. |

| 50 – 60 percent | 7 months | The market started to slow down a bit. |

| 60 – 72 percent | 11 months | The market was a drag for the most part. |

What comes next

If nothing drastic changes in our daily lives and the stock market does not fall into bear market territory (a drop of more than 20%), we can say that we can reach 100 percent in less than 30 months. That’s in less than three years! We’re closer than ever to declaring financial independence and securing the funds to relocate abroad, but we’re not in a hurry because we want to make every moment of our lives count.

We already eat healthy foods by cooking the majority of our meals, travel frequently, and spend quality time with friends and family. We continue to enjoy the present moment, plan our next vacation, and get inspired by the image below of what life will be like once we have finished filling the tank with the remaining 28 percent of our nest egg and decide to retire early.

If nothing drastically changes in our daily lives and the stock market doesn’t fall into recessionary levels (a drop of more than 20 percent), conservatively speaking, we can say that we can get to 100 percent in less than 30 months. That’s less than 3 years away! We are closer than ever to declaring financial independence and securing the funds to move abroad, but we’re not rushing to get there, as we try to make every moment of our lives count. We already eat healthy foodcooking most of our meals, travel often, and spend quality time with friends and family. We continue to enjoy the present, plan our next getaway, and get inspired by the image below of what life will be like once we have filled the remaining 28 percent of our nest egg and decide to retire early. 🙂

What interests you about the prospect of a life free of financial worries?

Note: This article has been updated to reflect the fact that the Freedom Fund has been redefined and its sole purpose is to fund our living expenses. The percentages shown in the charts, in this post, are of our total net worth.