One Life To Live is our new quarterly update on how financial independence plays an integral part in fueling our true happiness. We all have one life to live, but the question is, are we making the best of it? Are we living in the richest way possible? We hope that our lifestyle answers those questions as we continue to optimize for happiness. Carpe Diem!

Welcome sexy souls,

We’re excited to bring this quarterly section where we drop a few lines and provide some essential FIRE updates. For our “numbers’ lover” readers, you can expect to see a high-level update on our main passive income streams and essential expenses in One Life To Live. By concentrating on these two categories, we’ll explore how our income would’ve covered those expenses if we were already retired. This way of thinking will give us a glance at how we’ll cover our bills with passive income after early retirement.

For the “lifestyle” readers that want to follow our journey beyond just numbers, we’ll provide updates on what we’ve been up to for the last quarter, including challenges, goals, fun stuff, and life adventures.

Adventures

We tend to stay low key during the summer, don’t go on exotic trips, and simply enjoy the local weather. Besides, it’s very expensive to travel due to the tourist season. So we went mostly on local trips and visited family and friends in New England.

Illuminated fountain performance at the Longwood Gardens

A close friend and her husband invited us to a light show in Longwood Gardens. The spectacle was phenomenal! If you are ever in the Philly area, this botanic garden has much more to offer than just pretty plants and flowers. There are restaurants, beer gardens, children’s play areas, and fountain shows.

A weekend in Philadelphia

We celebrated wifey’s birthday in the city of Philadelphia. Staying in the city for her birthday weekend has become a tradition. Our niece from Florida joined us as well. We showed her around and also discovered new places in the area.

Our visit to Rhode Island

We’ve visited New England during Labor Day in the past and have gotten lucky with the weather. This time it was a little chilly, so we didn’t go in the water of Misquamicut Beach. We rented a motel there for a few days.

Passive income and expenses

We’re streamlining these reports as much as possible, so that it takes very little time to produce, therefore, giving us time back to get back to living our lives. It stays within our theme of having one life to live and maximizing our time for happiness.

We enjoy blogging, but we also enjoy other things in life, and we want to continue keeping a nice balance between blogging and other life’s pleasures.

What’s included in these reports? At the end of the day, people need food, shelter, mobility, the ability to pay the bills and take care of debt payments. So, these are the expenses that we concentrate on.

Bare-bones expenses

Bare-bones spending for Q3-2017

This is how we spent on most basic needs during the third quarter.

Main Category | Quarter Amount | 2017 Monthly Average | Comments |

| *Net Rent | –$160.71 | $525.50 | We had a surplus of $160.71 for the quarter. This means that the net income before taxes from the rental property covered our entire rent for the quarter. |

| Bills & Utilities | $502.51 | $166.78 | |

| Debt Payments | $0 | $0 | |

| Groceries | $1,470.06 | $526.95 | |

| Auto & Transportation | $1,237.03 | $297.66 | We paid the auto insurance bill for one year. |

| Home Supplies | $172.30 | $64.74 | |

Total | $3,221.19 | $1,581.63 |

That’s it! It’s a very high-level, streamlined quarterly report of our most basic needs. You can click here to see our latest annual spending post.

Overall, it was a good quarter as far as spending goes. I don’t expect to see much change for the 4th quarter. With a monthly average bare-bones spending of $1,581.63, we can say that our bare-bones annual spending is around $19k. This creates a nice gap between what we need to get by and our overall spending budget.

Passive income

Dividends

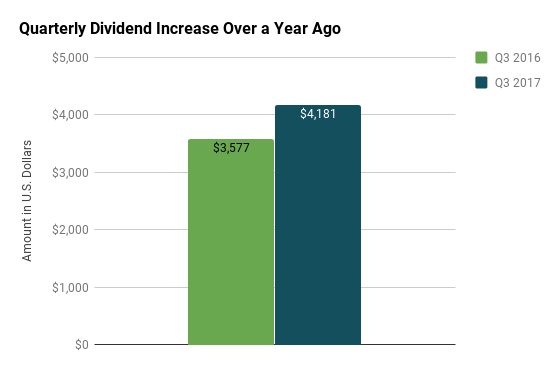

We received $4,180.75 in dividend income for the third quarter. Dividend income will be our main source of passive income in retirement.

Capital gains

We realized $3,588.24 in capital gains for the quarter. About $65 were for short-term gains as we needed to make an adjustment in one of the taxable accounts. The proceeds, along with the principal, were allocated to the NCF. We did some big repairs on the rental property and there’s still more to come, so at least we’ll show less profit on our taxes.

Selling some winners was also part of our plan to keep our stock exposure to no more than 50% of our net worth. We’re done selling and are continuing to move full steam ahead to early retirement.

Passive Income Main Categories

Main Category | Quarter Amount | 2017 Monthly Average | Comments |

| Dividends | $4,180.75 | $1,398.88 | |

| Capital Gains | $3,588.24 | $1,050.59 | |

Total | $7,768.99 | $2,449.47 |

Road to retirement

We continue to save for our future home but made major changes to our funds last month. The early retirement countdown is on!

From the chef’s kitchen

Cooking your own meals is a great way to eat healthily and save money. A great advantage is that you can cook with better ingredients and know what’s going into your food. Here are some of the dishes we cooked last quarter.

4th of July meal

We celebrated with family prior to the 4th of July holiday, so by the time the 4th came we decided to spend it at home.

Salmon egg benedict with homefries and avocado

Hibachi at our friend’s (aka brotha from anotha motha) house

A net worth milestone accompanied by a treat

Last July, we accomplished a significant financial milestone. I wanted a treat to commemorate and we decided on a cappuccino maker. We didn’t go with anything too fancy to begin with, just an entry-level pump expresso machine. I had an advanced birthday gift and put it to good use besides investing. Welcome home, Milly!

Oh wait, but this is an investment!

It’s an investment in our happiness.

Now we can enjoy delicious cappuccinos on the front porch or anywhere in our home and with the people we care about. We wanted to create a full European cafe experience as much as we could, so we got colorful cups and small spoons that Tatiana requested.

We spent about $140 after deducting the gift but what is important to us is to create these moments of sharing, while sipping an awesome drink inspired by our favorite cafes. And, just when you think it’s perfect already, we get organic coffee and milk to make these yummy cappuccinos, which means we have the best quality in town!

Optimizing happiness through efficiency

We finally got to closing the extra bank accounts we talked about last quarter. Now we’re back into organizing our photo libraries, deleting all the apps on the phones we don’t use, and continuing to simplify our lives. It’s a digital cleanse, baby!

Trying new things

Or not so new things…, but I finally carved out time during the week for self-taught piano lessons. With limited time due to a 9 to 5, something has to give. 🙁 With that in mind, I’ll be dedicating less time to blogging. All the activities associated with blogging, like answering emails and keeping up with social media, can consume a lot of time. As far as posting, we’ll try to get at least one article out a month.

Troubling times

It’s been sad and troubling times with all the catastrophes going on around the world. Our hearts are with the people that lost family members in those tragedies. Puerto Rico holds a dear place in our hearts and we feel so saddened by what the island is going through. We’re doing what we can to help and hope that the people can get the immediate necessities to survive and whatever aid they need to rebuild the island.

What’s next?

Aside from world events, we’re looking to finish the year with a bang, financially speaking. Our finances are mostly bulletproof at this point and our retirement plan is on cruise control. We’re hoping to take one last trip before the year is over and get ready to welcome 2018.